Author: Brian, Guatian Laboratory W Labs

In early August 2025, Hong Kong's RWA and stablecoin sector reached its hottest peak in nearly five years. At that moment, the entire city was filled with a passion not seen since 2017-2018: executives from traditional financial institutions, AI entrepreneurs, and even leaders of industrial capital flocked to Hong Kong in search of pathways to integrate Web3. Dinner gatherings and hotel lobbies buzzed with discussions about tokenized government bonds, cash management tools, and stablecoin legislation. A Wall Street banker who had just moved from New York to Hong Kong candidly stated that, in terms of the density of crypto topics and the breadth of participation, Hong Kong had replaced New York as the hottest blockchain city in the world.

However, just over two months later, the market temperature plummeted sharply. There were clear signs of tightening policies from mainland regulators regarding the RWA transformation of financial institutions and assets heading to Hong Kong. Several tokenization projects for mainland physical assets, which were previously on the verge of launch, were postponed or shelved, and trading volumes for some RWA platforms with Chinese backgrounds dropped by 70%-90%. The once "number one in the world" heat of Hong Kong's RWA seemed to slide from the height of summer into the depths of autumn, raising temporary doubts about Hong Kong's status as an international Web3 center. On November 28, 2025, the People's Bank of China led a meeting with 13 national-level departments, including the Central Financial Office, the National Development and Reform Commission, and the Ministry of Justice, to establish a "Coordination Mechanism for Combating Speculation in Virtual Currency Transactions." For the first time, the meeting included stablecoins in the regulatory scope of virtual currencies, clarifying that activities related to virtual currencies are illegal financial activities, emphasizing that they do not have legal tender status and cannot be used for currency circulation.

The tightening of mainland regulations, while affecting Chinese clients to some extent in the short term, limited the outflow of mainland funds, and some mainland institutions would suspend their RWA business in Hong Kong. However, Hong Kong's unique "one country, two systems" framework, with its independent regulatory structure, theoretically should not be affected by mainland policies. This does not represent a fundamental shift in Hong Kong's RWA policies but rather another manifestation of the "high-temperature cooling - structural repositioning" cycle that has repeatedly occurred in Hong Kong's RWA sector over the past two years. Looking back at 2023-2025, three stages of evolutionary paths can be clearly outlined:

2023 - H1 2024: Regulatory Opening and Sandbox Experimentation

The HKMA launched Project Ensemble, and the SFC continuously approved multiple tokenized money market ETFs and bond funds. Local licensed platforms like HashKey and OSL obtained virtual asset VA licenses, officially establishing Hong Kong as a "regulated RWA testing ground."

H2 2024 - July 2025: Explosive Growth Period of Internal and External Resonance

The passage of the U.S. "GENIUS Stablecoin Act," the onset of the Federal Reserve's interest rate cuts, and the Trump administration's pro-crypto stance, combined with the release of Hong Kong's local stablecoin legislative consultation documents, triggered a surge of global funds and projects. The BoShi - HashKey tokenized money market ETF, XSGD, and several tokenized private credit funds saw their AUM skyrocket from tens of millions to billions of dollars within just a few months, making Hong Kong briefly the fastest-growing RWA market in the world.

August 2025 to Present: Limited Participation and Risk Isolation Period

Mainland regulators adopted a more cautious attitude towards cross-border asset tokenization, clearly restricting the deep involvement of mainland institutions and individuals in the Hong Kong RWA ecosystem, objectively cutting off the previously main sources of incremental funds and assets. Local and international capital in Hong Kong continued to be allowed to participate fully, but the growth momentum shifted from "mainland assets on-chain" to "local + global compliant funds allocated to U.S.-led on-chain assets."

The underlying logic of this cyclical cooling is the dynamic balance that decision-makers maintain between "participating in the new order of the global digital economy" and "preventing systemic financial risks." Hong Kong's role has been re-anchored to: fully connect with the U.S.-led blockchain economic network, limited by local resources, while building a firewall to prevent risks from transmitting to the mainland.

This means that the Hong Kong RWA market has not entered a recession but has instead entered a clearer and more sustainable third phase: shifting from the previous "barbaric growth" to a new pattern of "compliance-led, DeFi integration, and global funds connecting to U.S. on-chain assets." Purely on-chain, high transparency, low-risk cash management-type RWAs (money market funds, tokenized government bonds) will continue to grow rapidly, while the path of physical RWA that heavily relies on mainland assets and funds will be significantly compressed.

For practitioners, the short-term pain brought about by policy fluctuations is inevitable, but the compliance space remains ample. Especially, the brief window of tolerance from U.S. regulators towards DeFi, combined with the rare overlapping advantages of on-chain services that licensed platforms in Hong Kong can legally provide, offers a valuable strategic runway for further deepening on-chain liquidity, structured products, and cross-chain asset allocation within a regulated framework.

The story of Hong Kong RWA is far from over; it has merely transitioned from a noisy public fervor to a more calm and professional deepening phase. This article will further elaborate on the Hong Kong RWA market and related representative projects.

Hong Kong RWA Market Landscape

As a frontier for the integration of global blockchain and traditional finance, Hong Kong's RWA market has established itself as the most regulatory mature ecological hub in Asia by 2025. This market is driven by the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC), focusing on tokenized money market instruments, government bonds, green bonds, and emerging physical assets (such as charging pile revenues and international shipping rents) through the Project Ensemble sandbox project and the "Digital Asset Policy 2.0" framework. The overall landscape presents characteristics of "institution-led, compliance-first, and gradual DeFi integration": shifting from experimental issuance in 2024 to large-scale infrastructure construction in 2025, emphasizing cross-chain settlement, stablecoin integration, and global liquidity connection. The Hong Kong RWA ecosystem has transformed from a "financing window" to an "innovation platform," deeply connecting with the U.S.-led on-chain network while solidifying risk isolation walls to prevent cross-border transmission.

Types of Participants: Institutional Capital Dominates, Tech Companies and Startups Coexist

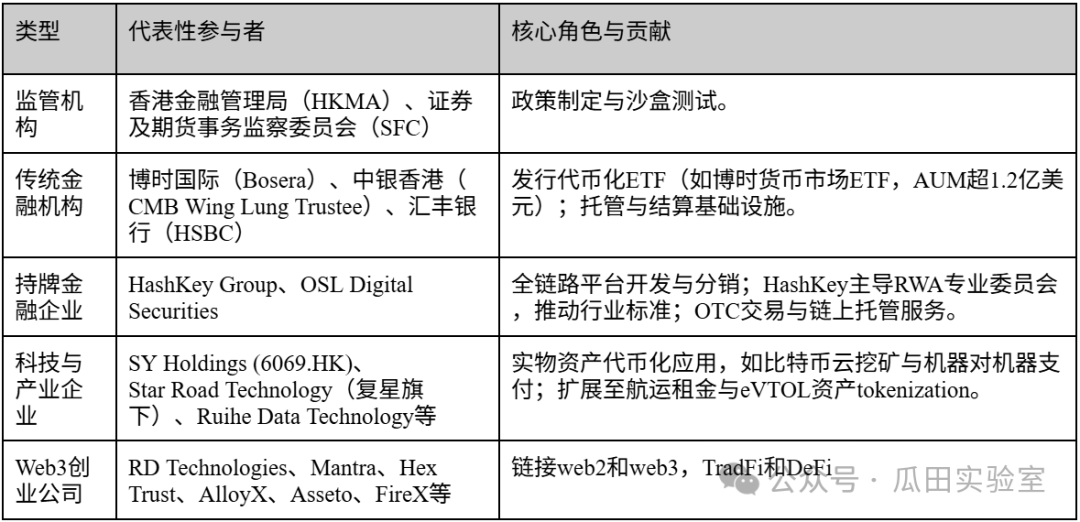

Participants in the Hong Kong RWA market are highly stratified, dominated by institutional capital, supplemented by local tech companies and emerging Web3 startups, forming a closed-loop ecosystem. The following table summarizes the main types (based on active entities in 2025):

It can be seen that the Hong Kong market is primarily composed of institutional players, accounting for about 70%, dominating the issuance of high-threshold products; enterprises and startups fill the technological and application gaps, benefiting from the SFC's expansion of VA licenses.

Overall Scale and Growth Trends

In 2025, the Hong Kong RWA market size was embedded within the global $26.59B - $35.8B on-chain TVL framework, with AUM soaring from tens of millions at the beginning of the year to billions. The growth momentum stems from the cumulative effects of policies—the 2025 policy report called for RWA infrastructure investment, and stablecoin regulations are set to take effect in 2026, expected to reduce cross-border payment costs by 90% and settlement times to 10 seconds. The annual growth rate exceeds 200%, with TVL expanding 58 times within three years, but high compliance costs (over $820,000 for a single product issuance) limit retail penetration, with institutional inflows accounting for over 80%.

Future Development Potential Assessment

The potential for Hong Kong RWA is vast, with the market size expected to reach trillions of dollars from 2025 to 2030, ranking among the top three globally (only behind the U.S. and Singapore). The advantages lie in the iterative speed of the regulatory sandbox and alignment with international standards: the SFC is about to open global order book sharing to enhance liquidity; the Ensemble project will build a tokenized deposit settlement system, radiating to emerging trade chains in Brazil/Thailand. The DeFi tolerance window and the integration of AI + blockchain (such as the tokenization of shipping rents, unlocking a $200 billion market) will drive diversified scenarios, with the startup ecosystem expected to add over 50 new projects. Challenges include cost barriers and isolation from mainland funds, but this instead reinforces Hong Kong's positioning as a "global neutral hub": attracting European and American institutions to allocate U.S. Treasuries/MMFs while local enterprises deepen their engagement with Asian physical assets. Overall, Hong Kong RWA is transitioning from "heat-driven" to "sustainable growth," with the key being policy continuity and infrastructure maturity.

Hong Kong RWA Related Platforms

1. HashKey Group — The "Full-Stack" Cornerstone of the Compliant Ecosystem

In the grand narrative of Hong Kong's ambition to become a global Web3 center, HashKey Group is undoubtedly the most representative "flagship" entity at present. As Asia's leading end-to-end digital asset financial services group, HashKey is not only a pioneer in Hong Kong's compliant trading market but also a key builder of the infrastructure for RWA asset issuance and trading. Its strategic layout spans from the underlying blockchain technology to the upper-level asset management and trading, forming a complete compliance loop.

HashKey Group was established in 2018 and is headquartered in Hong Kong, with deep ties to Wanxiang Blockchain Labs. At the outset of the SFC's implementation of the virtual asset trading platform licensing system, HashKey established a route of embracing regulation.

In August 2023, HashKey Exchange became one of the first exchanges in Hong Kong to upgrade to Class 1 (securities trading) and Class 7 (providing automated trading services) licenses, allowing it to provide services to retail investors. This milestone not only established its legal monopoly advantage in the Hong Kong market (one of the two oligopolies) but also provided an effective channel for the future secondary market circulation of compliant RWA products (such as STOs, security token offerings).

On December 1, 2025, HashKey Group passed the Hong Kong Stock Exchange hearing and is set to list on the main board of Hong Kong, expected to become the "first licensed virtual asset stock in Hong Kong." There are several industry experts who have analyzed HashKey's prospectus and listing outlook; I believe HashKey's listing is a landmark event that will help Hong Kong compete for pricing power and discourse in the global Web3 field (especially relative to Singapore and the U.S.), establishing Hong Kong's position as a "compliant digital asset center."

HashKey's structure is not a single exchange model but rather has built an ecosystem that serves the entire lifecycle of RWA:

HashKey Exchange (Trading Layer): The largest licensed virtual asset exchange in Hong Kong, providing fiat (HKD/USD) deposit and withdrawal channels. For RWA, this is the future liquidity destination after asset tokenization.

HashKey Tokenisation (Issuance Service Layer): This is the core engine of its RWA business. This department focuses on assisting institutions in tokenizing physical assets (such as bonds, real estate, artworks, etc.), providing a one-stop STO solution from consulting and technical implementation to legal compliance.

HashKey Capital (Asset Management Layer): A top global blockchain investment institution with assets under management (AUM) exceeding $1 billion. Its role in the RWA field is more about supporting the funding side and building products (such as ETFs).

HashKey Cloud (Infrastructure Layer): Provides node validation and underlying blockchain technology support, ensuring the security and stability of asset on-chain.

In the Hong Kong RWA market, HashKey's core competitiveness is reflected in two dimensions: "compliance" and "ecological linkage":

Regulatory Moat: The core of RWA lies in mapping regulated offline assets onto the chain. HashKey possesses complete compliance licenses, allowing it to legally handle tokens that are of a "securities" nature (Security Tokens), which is a threshold that most unlicensed DeFi platforms cannot surpass.

"Consolidated" Ecological Capability: It can connect the asset side, funding side, and trading side. For example, a real estate project can be tokenized by HashKey Tokenisation, subscribed to early by HashKey Capital, and finally listed and traded on HashKey Exchange.

Institutional-Level Connector: HashKey has established fiat settlement cooperation with traditional financial institutions such as ZA Bank and Bank of Communications (Hong Kong), solving the most critical issues of "deposit and withdrawal" and fiat settlement for RWA.

HashKey's practices in the RWA field mainly reflect two directions: "traditional financial assets on-chain" and "compliant issuance." The following is a summary of its typical cases:

HashKey Group is not just an exchange; it is the operating system of the Hong Kong RWA market. By holding scarce compliance licenses and building a full-stack technical infrastructure, HashKey is transforming "asset tokenization" from a concept into executable financial business. For any institution wishing to issue or invest in RWA in Hong Kong, HashKey is currently an indispensable partner.

2. OSL Exchange — The "Digital Arms Dealer" and Infrastructure Expert of Traditional Finance

In the chess game of Hong Kong RWA, if HashKey is the "flagship" charging ahead to build a complete ecosystem, then OSL Group (formerly BC Technology Group, 863.HK) is the "arms dealer" working behind the scenes, providing technology for traditional financial institutions.

As the only publicly listed company in Hong Kong focused on digital assets, OSL possesses the financial transparency and auditing standards of a listed company. This makes OSL the preferred "safe passage" for traditional banks and sovereign funds that are extremely risk-averse to enter the RWA market.

Unlike HashKey, which actively expands retail users and builds a public chain ecosystem, OSL's strategic focus is extremely concentrated on institutional business. Its structure is not designed to "build an exchange," but rather to "help banks build their products":

Unique "Public Company" Moat:

The core of RWA lies in compliance review through traditional finance (TradFi). For large banks, the compliance costs of collaborating with a public company are far lower than with private enterprises. OSL's financial statements are audited by the Big Four, and this "institutional trust" is its biggest trump card in the B-end market.

Technology Provider (SaaS Model):

OSL is not fixated on having all assets traded on the OSL platform but is willing to provide technology (OSL Tokenworks) to help banks build their own tokenization platforms. This is a "selling shovels" strategy—whoever issues RWA, as long as they use OSL's underlying technology or liquidity pool, OSL can profit.

Monopolistic Position in Custody:

In the issuance of Hong Kong's first Bitcoin/Ethereum spot ETFs, Harvest and ChinaAMC both chose OSL as the virtual asset custodian. This means that over half of the underlying assets in the Hong Kong ETF market are securely controlled by OSL. For RWA, "whoever controls custody controls the lifeblood of the assets."

In the RWA industry chain, OSL defines itself as a precise pipeline connecting traditional assets with the Web3 world:

RWA Structuring and Distribution (Structurer & Distributor):

Utilizing its identity as a licensed broker, OSL excels at handling complex financial product structuring. It is not just about simple "asset on-chain," but focuses on the tokenization of investment-grade products, such as bank notes and structured products.

Cross-Border Compliance Liquidity Network:

OSL has deep collaborations with Zodia Markets, a subsidiary of Standard Chartered Bank, and financial giants in Japan. In terms of RWA liquidity, OSL follows an "institution-to-institution" dark pool and over-the-counter (OTC) route, rather than a retail order book model.

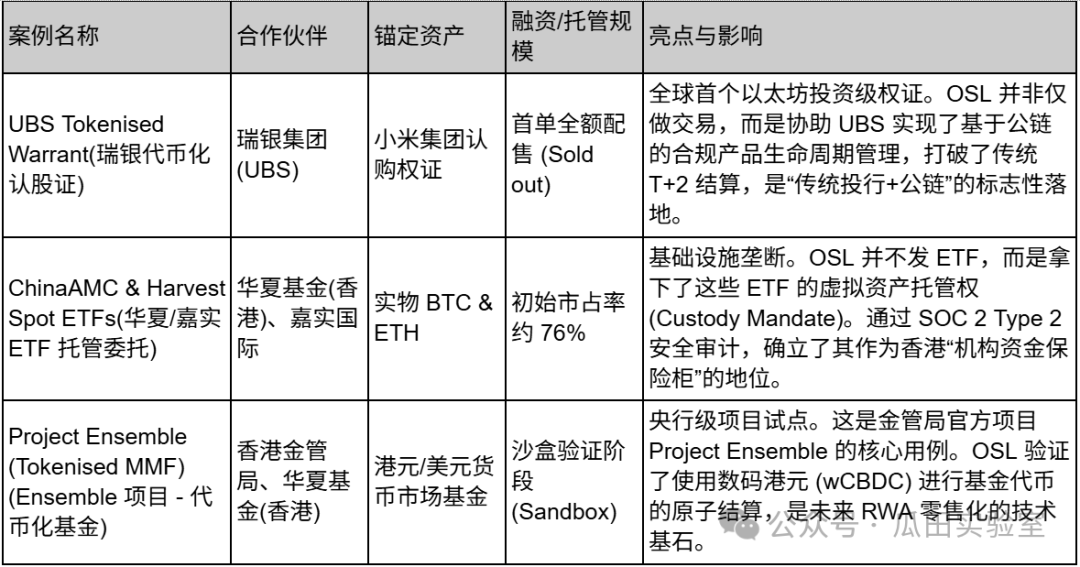

OSL's cases are often not limited to Hong Kong but have strong international demonstration effects, with partners being top TradFi giants. Due to its B2B nature, financing scales are generally not disclosed:

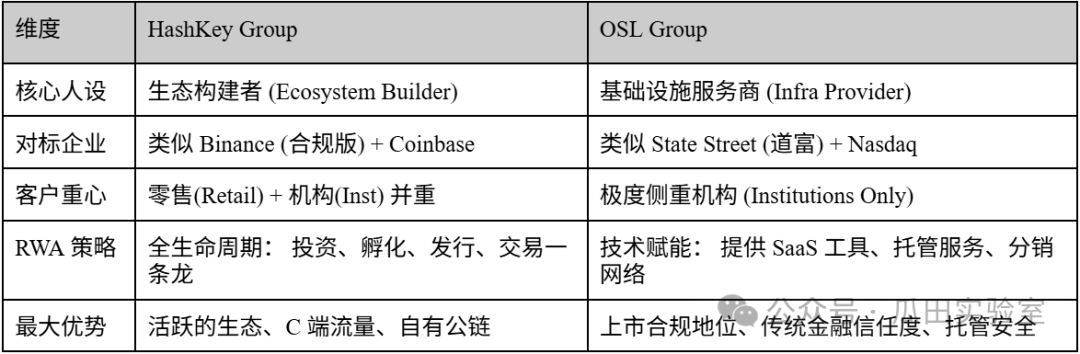

To better understand the differences between the two, a comparison table of HashKey vs. OSL has been summarized:

If HashKey is building a prosperous "Web3 commercial metropolis" in Hong Kong, then OSL is like the chief engineer responsible for the underground pipelines, vault security, and power supply of this city. In the RWA market, OSL does not pursue the loudest "issuance" but is committed to becoming the safest "warehouse" and the most compliant "passage" for all RWA assets.

3. Ant Digital — The "Trusted Bridge" for Physical Asset Tokenization

In the landscape of Hong Kong RWA, Ant Digital (and its Web3 brand ZAN) represents a dimensional strike from internet giants. Unlike financial institutions that focus on "licenses" and "trading," Ant Digital's core competitiveness lies in solving the fundamental pain points of RWA: how to prove that the tokens on the chain correspond to the physical assets off the chain?

Ant Digital's strategic path is very clear: leveraging the high-performance technology of AntChain, which has been deeply cultivated in China for many years, combined with Trusted IoT, to provide "asset digitization" technical standards and verification services for global RWA projects in Hong Kong, this international window.

Ant Digital does not exist as a "trading venue" in the Hong Kong RWA market but is positioned as a Web3 technology service provider. Its business logic can be summarized as "two ends and one cloud":

Asset Side: By implanting IoT modules (Trusted Modules) into physical devices such as solar panels, charging piles, and engineering machinery, real-time data is collected and directly put on-chain. This transforms RWA from "credit-based on the issuer" (trusting the issuer) to "credit-based on the asset" (trusting the real-time cash flow generated by the device).

Capital Side: Through the ZAN brand, it provides institutional investors with KYC/KYT (Know Your Customer/Know Your Transaction), smart contract auditing, and node services to ensure the compliance of fund inflows and outflows.

Privacy Protection: It is one of the few vendors capable of providing zero-knowledge proof (ZKP) technology in the Hong Kong Monetary Authority's Project Ensemble (sandbox), solving the deadlock of banks needing to verify transactions on public chains while not leaking commercial secrets.

While HashKey and OSL handle "securitized assets" (such as bonds and funds), Ant Digital excels at handling "non-standardized physical assets":

Source Trustworthiness: Traditional RWA relies on auditors to inventory warehouses, while Ant Digital uses implanted chips to allow the operational data (power generation, mileage) of new energy vehicles, batteries, and even biological assets (such as cattle) to be put on-chain in real-time.

Large-Scale Concurrent Processing: Inheriting the technical genes of Alipay's "Double Eleven" level, Ant Digital's blockchain can support the concurrent on-chain of hundreds of millions of asset data, which is difficult for most public chains to achieve.

Internationalization of the ZAN Brand: From 2024 to 2025, ZAN rapidly rose in Hong Kong, becoming a key middleware platform connecting Web2 developers and the Web3 world, especially occupying a place in the compliance technology field.

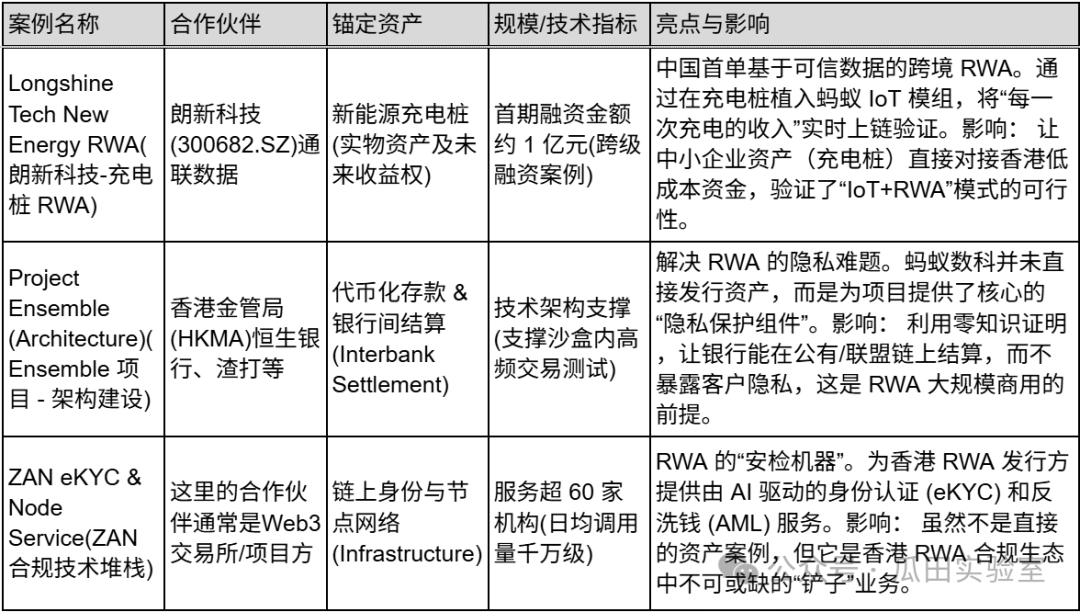

Ant Digital's cases mainly reflect "real economy on-chain" and "interbank settlement architecture."

If HashKey is "Taobao," building a platform for everyone to buy and sell RWA products; OSL is the "vault," providing the safest warehouse to help institutions safeguard RWA assets, then Ant Digital is the "smart factory + quality inspector," delving into the production process (charging piles, batteries), giving each asset a "qualified label" (IoT verification), and providing technology to ensure these assets can circulate smoothly. Ant Digital focuses on data in the Hong Kong RWA market, aiming to become the "customs" and "translator" for physical world assets transitioning to the Web3 world.

4. Conflux Network — The "Compliant Public Chain" Base Connecting the Mainland and Hong Kong

In the Hong Kong RWA market, the vast majority of platforms (such as HashKey and OSL) primarily address the issue of "how assets are traded locally in Hong Kong," while Conflux solves the problems of "how mainland assets can compliantly exit" and "what currency to use for settlement."

As "China's only compliant public chain," Conflux leverages its background from the Shanghai Tree Graph Blockchain Research Institute, deeply binding itself with "national team" resources such as China Telecom and the Belt and Road Initiative. In the 2025 Hong Kong market, Conflux has evolved from merely a technical public chain to the core issuance layer for offshore RMB/HKD stablecoins.

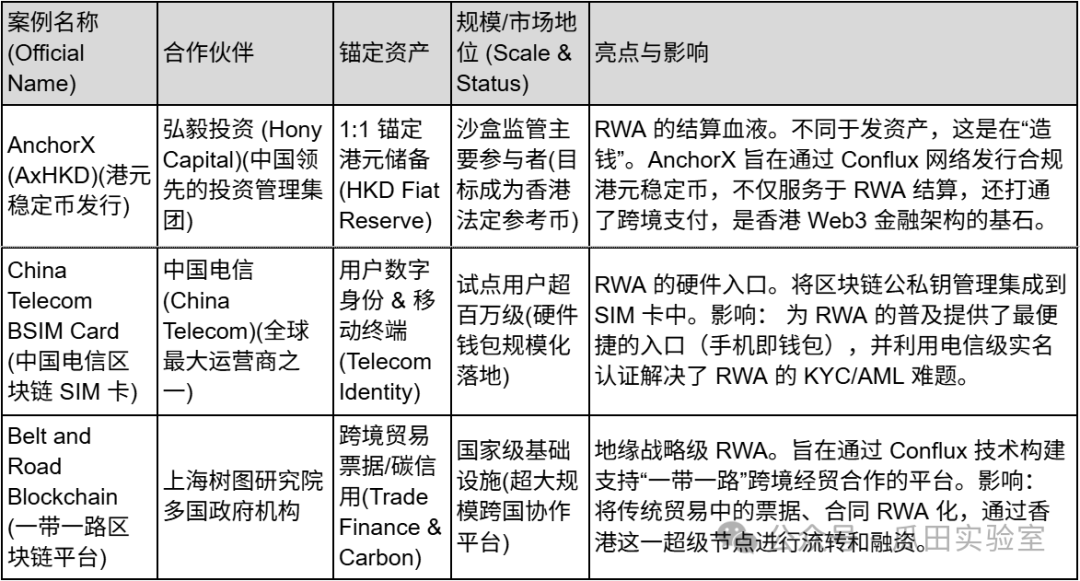

Conflux's RWA strategy is distinctly different from others; it avoids the crowded asset management track and focuses on the foundational infrastructure:

The Lifeblood of RWA (Stablecoins): Conflux has incubated and supported AnchorX (with major investment from Hony Capital), dedicated to issuing compliant HKD stablecoins (AxHKD). In RWA trading, putting assets on-chain is the first step, but "what to buy with" is the second step. Conflux aims to make AxHKD the settlement currency for the Hong Kong RWA market, comparable to USDT/USDC.

Physical Entry (BSIM Card): In collaboration with China Telecom, the BSIM card embeds blockchain private keys directly into mobile SIM cards. For RWA, this means that future asset rights confirmation (for example, if you buy a tokenized property on your phone) can be bound to the telecom operator's real-name identity, solving the most challenging "identity authentication (DID)" issue in RWA.

Mainland-Hong Kong Connector: Utilizing its R&D center in Shanghai (Tree Graph), Conflux can meet the overseas needs of mainland enterprises, using technical means to compliantly map mainland physical assets (such as photovoltaics and supply chains) onto the Conflux public chain in Hong Kong for financing.

In the RWA space, Conflux's moat lies in its geopolitical advantages:

"Desensitized" Interoperability: Conflux has achieved a unique technical architecture that complies with mainland regulations (non-coin blockchain technology applications) while enabling tokenized trading in Hong Kong through cross-chain bridges. This makes it the most "politically correct" choice for state-owned and central enterprises in mainland China attempting to venture into RWA.

Closed Loop for Payments and Settlements: Through the AnchorX project, Conflux is effectively participating in the Hong Kong Monetary Authority's "sandbox regulation." Once the HKD stablecoin is launched, Conflux will transform from a mere "road" into a financial network with "toll pricing power."

High-Performance Throughput: RWA (especially high-frequency notes or retail assets) requires extremely high TPS (transactions per second). Conflux's Tree Graph structure claims to achieve 3000-6000 TPS, which offers advantages over Ethereum's mainnet when handling traditional financial high-concurrency transactions.

Conflux's cases focus on "currency infrastructure" and "national-level cooperation."

Conflux Network is the only "public chain-level" player in the Hong Kong RWA market. It does not directly earn money through trading fees but aims to become the "digital silk road" connecting Chinese manufacturing with global capital by setting underlying standards (stablecoin standards, SIM card standards).

5. Star Road Technology — Customized First Class for "Old Money" to Web3

Amidst the clamor of the Hong Kong RWA market, Star Road Technology (also known as Xinglu Technology, with some overseas promotional brands as Finloop) may not be the loudest "disruptor," but it is likely the most stable "successor."

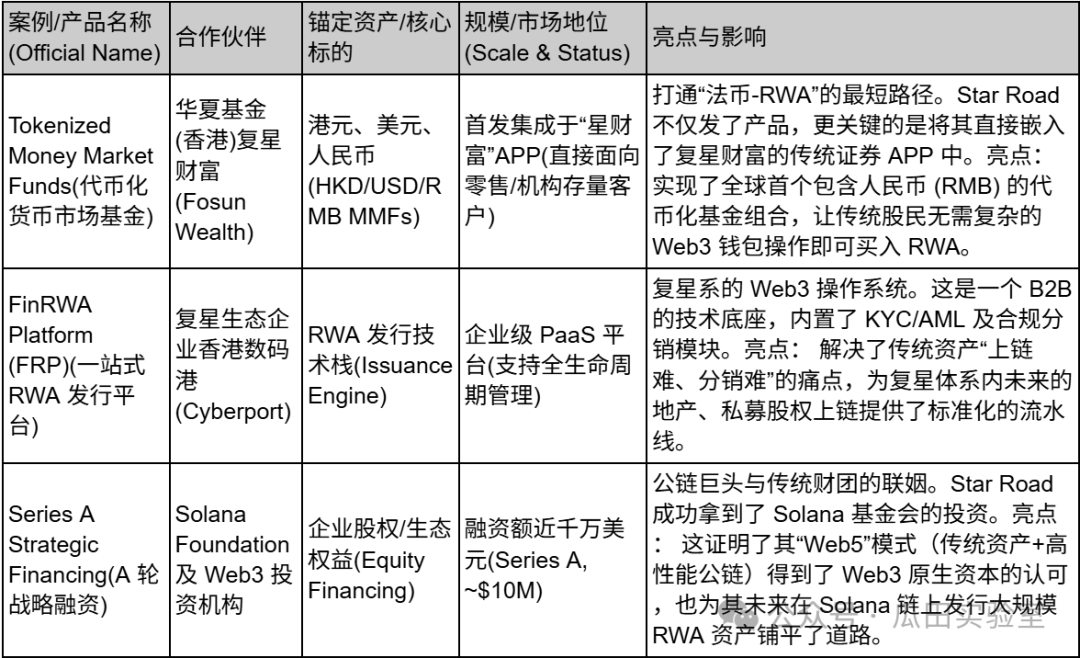

Rather than viewing Star Road as an independent Web3 startup, it is better seen as an "official landing craft" sent by a large comprehensive private enterprise—Fosun International—into the digital asset world. Independently incubated by Fosun Wealth, the birth of Star Road carries a distinct group will: it is not committed to building a new financial order from scratch but aims to smoothly and compliantly "ferry" the vast stock assets and high-net-worth clients of traditional finance into the blockchain world.

Strategically, Star Road has proposed a unique "Web5" concept. Unlike the purely decentralized idealism of Web3, Star Road's Web5 strategy resembles a pragmatic compromise—it seeks to integrate the mature user experience and traffic entry of the Web2 era (the client base of Fosun Wealth) with the value interconnection technology of the Web3 era.

In this narrative, Star Road has built its core infrastructure — the FinRWA Platform (FRP). This is an enterprise-level RWA issuance engine, but its design is not intended to serve anonymous on-chain geeks; rather, it is meant to serve institutions and high-net-worth individuals within the Fosun system. It acts as a precise converter, connecting the real estate, consumer, and cultural tourism assets that Fosun has cultivated for years on one end, and a compliant digital asset distribution network on the other. For Star Road, RWA is not the goal but a means to activate the liquidity of the group's stock assets.

Unlike other platforms that are keen to explore high-risk, high-return DeFi plays, Star Road has chosen the most stable entry path: currency fund tokenization.

Through deep alliances with China Asset Management (Hong Kong) and its parent company Fosun Wealth, Star Road's flagship product focuses on tokenized money market funds in HKD, USD, and RMB. This choice is strategically insightful—money market funds are the most familiar and lowest-threshold financial products for traditional investors. By tokenizing these funds with its technology, Star Road is effectively providing the safest entry ticket for "old money" that is cautious about crypto.

More importantly, Star Road has opened the RWA channel for RMB. Against the backdrop of Hong Kong as an offshore RMB center, this capability allows Star Road to precisely capture mainland capital that holds large amounts of offshore RMB and seeks compliant overseas value enhancement.

Star Road's business landscape resembles a "boutique digital investment bank" rather than an exchange. Its cases demonstrate a complete closed loop from "underlying technology" to "asset issuance" to "ecological capital":

Star Road Technology represents the understanding and transformation of Web3 by the elite class of traditional finance: not pursuing radical decentralization but striving for extreme compliance, security, and experience. For institutions and high-net-worth individuals looking to allocate digital assets while retaining the traditional financial service experience, Star Road is the most harmonious and convenient entry point.

6. MANTRA — The RWA "Compliance Highway" Connecting the Middle East and Asia

In the Warring States era of RWA, MANTRA represents the rise of the "infrastructure faction." It is not satisfied with merely issuing a certain type of asset but attempts to define the underlying standards for RWA assets operating on-chain.

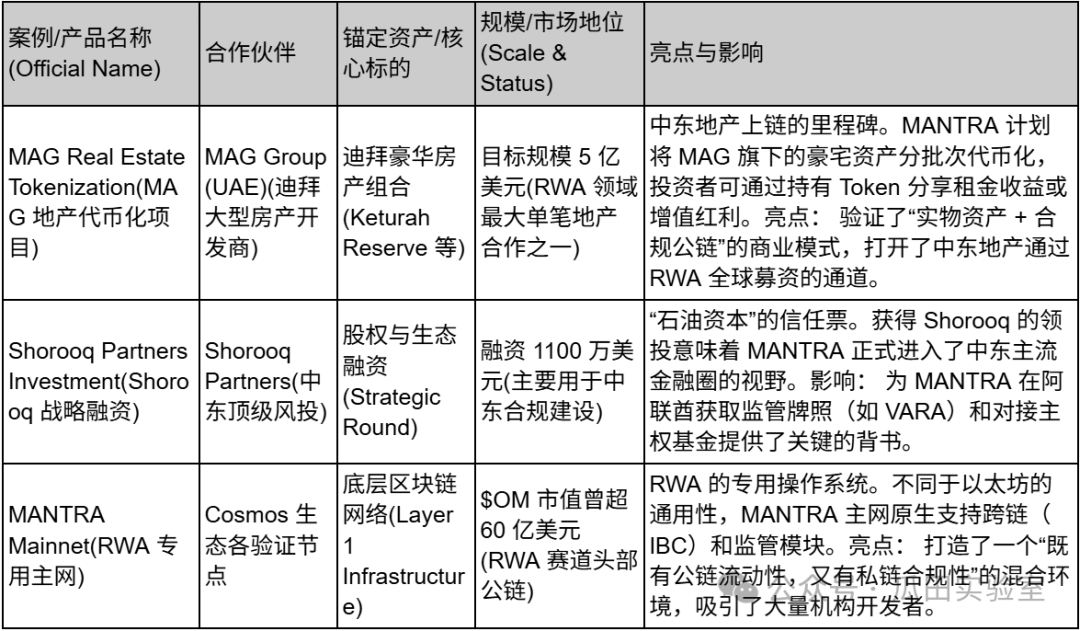

MANTRA's predecessor was MANTRA DAO, which has evolved over several years into a public chain focused on regulatory compliance for RWA. Its strategic focus is quite unique—it avoids the fiercely competitive U.S. market and does not rely entirely on Hong Kong but instead heavily invests in the UAE, leveraging Dubai's extremely friendly virtual asset regulatory framework (VARA) to build a corridor connecting Middle Eastern capital with Asian liquidity.

MANTRA addresses a core pain point at the strategic level: the contradiction between the "permissionless" nature of public chains and the "strong regulation" of finance.

Native Compliance Layer: MANTRA Chain has built-in identity authentication (DID), KYC/AML modules, and compliance whitelist mechanisms in its underlying protocol. This means that developers do not need to write complex compliance code themselves; they can directly call MANTRA's modules to issue real estate tokens or bonds that meet regulatory requirements.

Connecting Middle Eastern "Oil Capital": MANTRA has secured investment from top Middle Eastern venture capital Shorooq Partners and established deep cooperation with Dubai real estate giant MAG. This not only brings funding but, more importantly, opens up the vast real estate and sovereign wealth resources in the Middle East, a unique advantage that other platforms relying on USD or HKD assets do not possess.

Mainnet Incentives and Token Economy: MANTRA has constructed a tight economic closed loop through its native token $OM's buyback and staking mechanism. It uses token incentives to attract institutional validators and asset issuers, attempting to leverage Web3's incentive model to drive the on-chain presence of TradFi assets.

On the asset side, MANTRA has chosen a heavy but also attractive track: real estate. Unlike government bond RWAs (which are also strengths of platforms like Star Road), real estate RWAs require handling complex offline rights confirmation and legal structures. MANTRA is directly collaborating with Dubai developer MAG to tokenize a $500 million luxury real estate portfolio. This approach is highly ambitious—if it can turn Dubai's luxury homes into on-chain liquid tokens, then MANTRA will have proven its ability to handle "non-standard, large, physical assets," which is a much deeper moat than simple government bond tokenization.

Additionally, MANTRA launched a large-scale $OM token buyback plan in 2025 (committing to at least $25 million), a behavior similar to a public company's "stock buyback," which greatly enhances institutional investors' confidence in its token economic model.

MANTRA's business landscape exhibits clear characteristics of "Middle Eastern assets + Asian technology + global compliance":

Although MANTRA started in Hong Kong, it has shifted its focus to the Middle East to align with its RWA compliance strategy. MANTRA represents another possibility in the RWA market: not just moving assets on-chain but specifically building a chain for assets. For investors optimistic about the rise of Middle Eastern capital and the prospects of real estate on-chain, MANTRA is currently the most representative infrastructure target.

Note: The remaining parts of the nine major platforms, the comparison between the Hong Kong and U.S. RWA markets, and the three major trends in the future of the Hong Kong market. Please refer to the follow-up second part "Hong Kong RWA Storm (Part II): Bipolar Narrative, Regulatory Red Lines, and Future Chessboard."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。