Written by: Ma He, Foresight News

At the beginning of 2026, an app called "Are You Dead?" spread like a virus on social media. Developed by a team of three post-95s, this tool was launched with just over 1,000 yuan in costs and one month of development time, yet it topped the Apple App Store's paid app rankings within days, with paid downloads surging by 200 times and its valuation skyrocketing to 10 million yuan. The app's core function is simple yet hits a pain point: users must manually check in daily to confirm they are "alive," and if they fail to do so for two consecutive days, the system automatically sends an email notification to pre-set emergency contacts.

Developer Xiao Guo stated in an interview that user numbers were sparse at launch, but after a recent update, traffic suddenly exploded, even leading to imitators and competition. The official name has been changed to "Demumu" for global expansion, but the app's popularity goes beyond the product itself; it exposes a hidden yet widespread anxiety in contemporary society—"lonely death."

Living Alone Has Become a Trend, Especially in the Crypto Field

Behind the explosive popularity of "Are You Dead?" is the accelerated trend of living alone globally. According to data from 2026, the number of people living alone in China has exceeded 100 million, with young white-collar workers accounting for over 40%. These individuals often choose or are forced to live alone due to high work pressure, urbanization, and fragmented social interactions, facing the risk of sudden accidents going unnoticed. Undeniably, it reflects the social changes of the post-pandemic era. Globally, living alone has become a mainstream trend.

Data from Euromonitor International indicates that by 2030, single-person households will account for 30% of the total globally, especially in Asian and Western urban areas, where the younger generation's independence and diverse lifestyles continue to increase the proportion of those living alone. This is not just a lifestyle choice but also a psychological burden: Japan's "lonely death" has become a social issue, and similar news frequently appears in China. The popularity of the "Are You Dead?" app is a collective response to this hidden concern.

This trend of living alone is particularly pronounced in the cryptocurrency field. The crypto industry is inherently distributed and decentralized, with many practitioners being from the younger generation. According to a 2025 report by Coinbase, the average age of crypto users is between 25 and 35, with many being post-95s or post-00s. They often engage in high-intensity remote work, such as traders, developers, or community managers, making the concept of an office redundant due to 24/7 market monitoring, code debugging, and market analysis.

According to ZipDo's 2025 statistics, 68% of employees in the crypto industry prefer remote work, and 52% of startups report that remote models enhance productivity. LinkedIn's Crypto Work Culture report shows that 94% of crypto teams plan to permanently retain remote work, far exceeding the 22% in traditional industries.

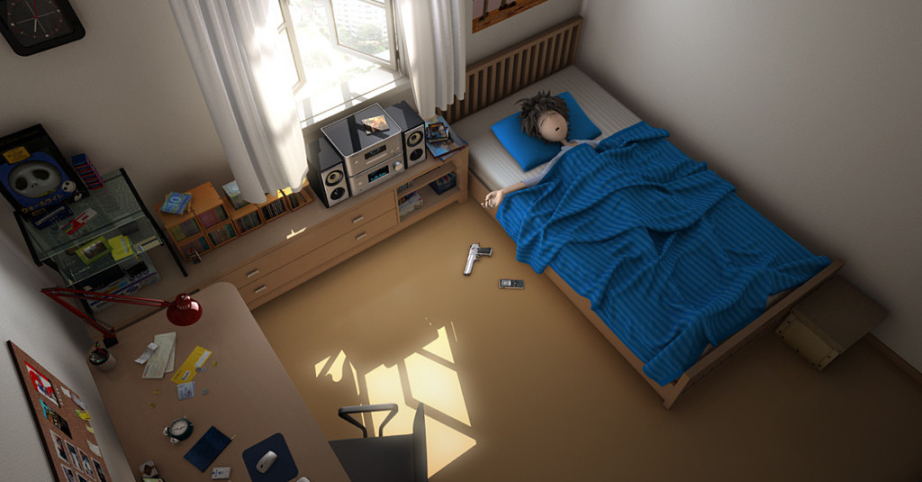

While this lifestyle is flexible, it amplifies the risks of living alone: practitioners may be scattered globally, lacking a fixed social circle, and the intensity of work leads to increased health risks. Imagine a solitary cryptocurrency trader experiencing a heart problem at home; what would happen to their crypto assets worth hundreds of thousands or even millions?

The explosive popularity of the "Are You Dead?" app has prompted many crypto investors to reflect: what should they do in case of an accident?

Crypto Practitioners Need to Prepare Adequately with Exchanges and On-Chain Wallets

In light of this reality, crypto practitioners need to make adequate insurance preparations regarding exchanges and on-chain wallets.

First, establishing an "inheritance mechanism" is key. Traditional bank accounts have will inheritance, but crypto's non-custodial wallets (like MetaMask or Ledger) rely on private keys, and once the holder passes away, the assets may be permanently lost. Therefore, using a multi-signature wallet is basic protection: for example, Gnosis Safe requires multiple keys to jointly authorize asset transfers. You can designate a trusted family member or friend to hold a backup key and specify the process in your will.

Secondly, introducing a "Dead Man's Switch" mechanism is an automated tool based on smart contracts. If the holder is inactive for an extended period (such as not logging in or confirming), the contract will automatically trigger asset transfer. Years ago, the Sarcophagus protocol was developed for this need; it is a decentralized "death switch" based on Base + Arweave that can publish files to any Ethereum address or public address at any time. Additionally, Dfinity's verifiable key launched in 2025 can also serve as its "disability switch."

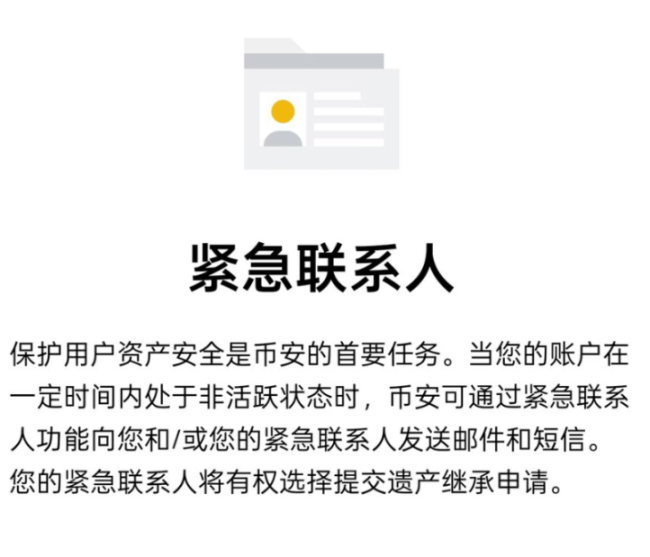

Some mainstream exchange platforms have already introduced policies for deceased users to prevent assets from "eternally sleeping." Binance and Coinbase require heirs to submit death certificates, identity verification, and court documents, typically taking 3-6 months to process. In 2026, Binance updated its "beneficiary designation" feature, allowing users to pre-set inheritance accounts, with the platform transferring assets after confirming death, avoiding previous legal disputes.

Kraken offers an "emergency access" option, allowing users to upload encrypted inheritance instructions. DeFi protocols like Aave or Uniswap, while more decentralized, are also beginning to integrate insurance modules: Nexus Mutual provides "smart contract coverage," including asset protection in the event of accidental death. A report from Global Wealth Protection emphasizes that using a trust structure is a high-level strategy—placing crypto assets in a "revocable living trust," controlled by the holder during their lifetime and automatically transferred to beneficiaries after death, without the need for probate.

Of course, these measures are not foolproof. A Dead Man's Switch could be exploited by hackers (requiring regular updates), and exchange policies rely on centralized trust, making it difficult to recover losses if a platform collapses or faces a crisis. However, compared to ignoring risks, this is one of the proactive protective measures crypto players can engage in. Crypto is not just an investment tool; it is a reflection of lifestyle.

In the era of living alone, protecting assets is protecting the future. As a crypto practitioner, why not start today by setting up your "proof of life"—not just an app check-in, but a legacy plan that exists on-chain. After all, in this distributed world, no one wants their wealth to vanish into thin air.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。