The information, opinions, and judgments regarding the market, projects, cryptocurrencies, etc., mentioned in this report are for reference only and do not constitute any investment advice.

This week, BTC opened at $91,499.04 and closed at $90,872.01, a decrease of 0.68%, with a volatility of 6.15% and a significant increase in trading volume compared to last week.

As previously reported, BTC attempted to reach $94,000 this week, driven by the continued improvement in Federal Reserve liquidity and the "soft landing" expectations brought about by U.S. employment data meeting expectations.

However, with no hope for a rate cut in January, the risk appetite of market participants continues to deteriorate. After reaching the resistance level of $94,000, BTC ETFs and long-term holders increased their selling, causing the rebound to falter, and BTC had to retreat to the $90,000 level again.

Currently, BTC and the crypto market remain in a dilemma where buying power is weak and selling pressure is increasing at highs. New buying sentiment, or an overall increase in risk appetite, may allow BTC to break through the $94,000 resistance and further expand the rebound space.

From a technical perspective, BTC is in a favorable situation where the retracement bottom price is continuously rising, and the 60-day moving average is also stabilizing. If there are no negative external shocks, the price may break through $94,000 in the short term, challenging the $95,000 indicated by the 90-day moving average.

Policy, Macroeconomic Finance, and Economic Data

Considering the government shutdown, the monthly economic data released by the U.S. this week is the first batch since the normalization of data, making it very important, but the final results did not exceed market expectations.

On January 8, the initial jobless claims data showed that the number of applicants for the week was 208,000, slightly below expectations and the previous value. This mildly benefits risk assets but aligns with the "soft landing" expectations, indicating strong economic resilience.

On January 9, the U.S. December seasonally adjusted non-farm payrolls were reported at 50,000, lower than the expected 60,000 and the previous value of 56,000, but the unemployment rate was only 4.4%, slightly below the expected 4.5%. Meanwhile, hourly wage growth was 3.8%, higher than the expected 3.6%. The seemingly "conflicting" employment data indicates that the crisis level in the job market is lower than expected, which has caused the probability of a rate cut in January, as shown by FedWatch, to drop to single digits.

This week's data reinforced this consensus— the economy is soft landing, with employment cooling but not as bad as feared. As the main battleground for global capital, U.S. stocks continue to remain strong, with the S&P 500 and Dow Jones indices both reaching historical highs. The Nasdaq, which has faced skepticism over excessive AI investments, also rose by 1.88%, approaching its historical peak. There are signs of capital shifting from tech stocks to consumer stocks, value stocks, and small-cap stocks.

The 10-year U.S. Treasury yield closed at 4.173%, with real yields reaching 1.91%, which continues to exert significant pressure on tech stocks and high-duration assets like BTC.

Crypto Market

Macroeconomic liquidity is improving but has not yet reached a level of abundance, and high-risk assets remain under pressure. AI tech stocks are still under pressure, and BTC is no exception.

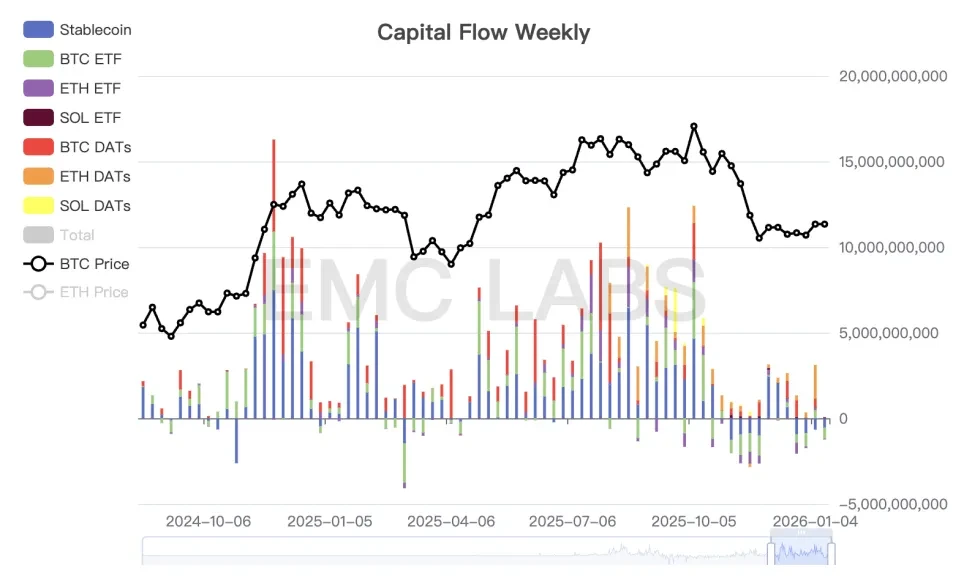

From a funding perspective, cyclical and short-term funds are still exiting at highs, while long-term allocation funds are buying at low levels, currently entering a fragile balance state.

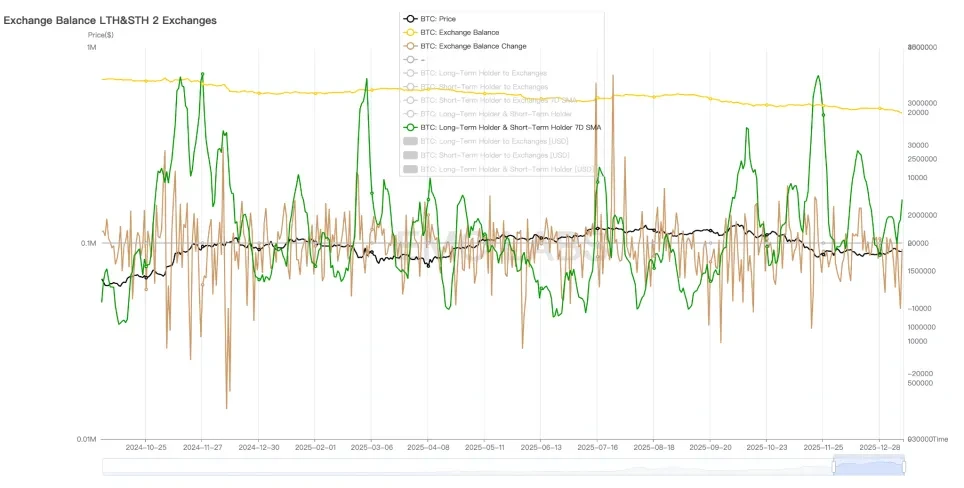

This week, as prices rebounded to previous highs, a wave of selling re-emerged before the release of significant economic and employment data.

Central Exchange Long and Short Selling Statistics (Daily)

The destructiveness of this sell-off triggered by risk appetite is not persistent, and the current scale is gradually decreasing. The continued selling by long-term holders remains the biggest threat to the mid-term crypto market.

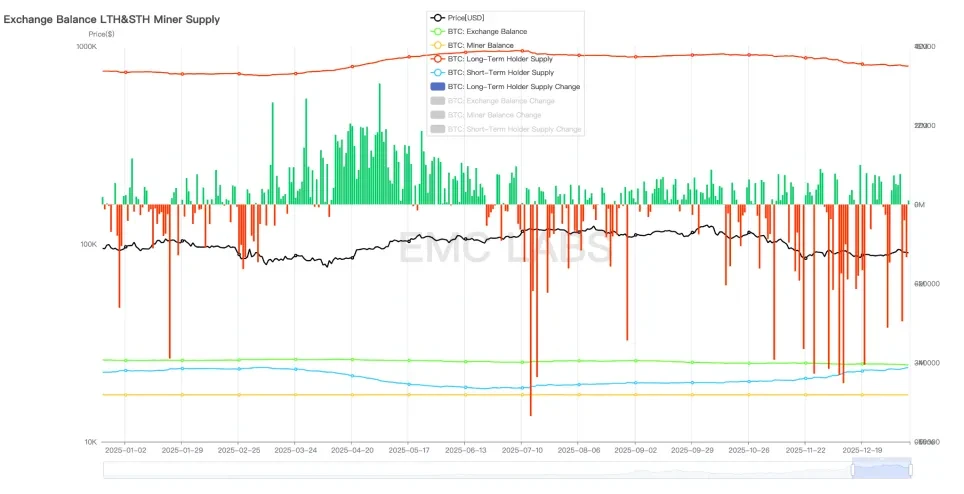

Long Position Changes Statistics (Daily)

Last week, the degree of continuous reduction in long positions weakened but continued, which also caused BTC to turn down after rebounding to $94,000.

The funding aspect also confirms this. The largest inflow occurred on January 5, followed by continuous outflows, resulting in a net outflow for the week, with BTC ETFs recording $647 million and stablecoins $539 million.

Crypto Market Fund Inflow and Outflow Statistics (Weekly)

Last week, centralized exchanges saw a net outflow of nearly 25,000 BTC. The support for the market still comes from the "whale group," which has been increasing its holdings over the past week. However, this group is currently adopting a "holding without lifting" strategy, only accumulating at low levels and not forming upward buying power.

Cyclical Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, entering a "downward phase" (bear market).

About Us

EMC Labs was founded in April 2023 by cryptocurrency asset investors and data scientists. It focuses on blockchain industry research and crypto secondary market investment, with industry foresight, insights, and data mining as core competencies, dedicated to participating in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。