Original Title: "Does Leveraging BTC Dollar-Cost Averaging Really Make More Money?"

Original Author: CryptoPunk

Five-Year Backtest Tells You: 3x Leverage Has Almost No Cost-Effectiveness

Conclusion First:

In the past five years of backtesting, the final return of BTC with 3x leverage dollar-cost averaging is only 3.5% higher than that of 2x leverage, but it comes with the risk of nearly going to zero.

Considering risk, return, and feasibility comprehensively—spot dollar-cost averaging is actually the optimal long-term solution; 2x is the limit; 3x is not worth it.

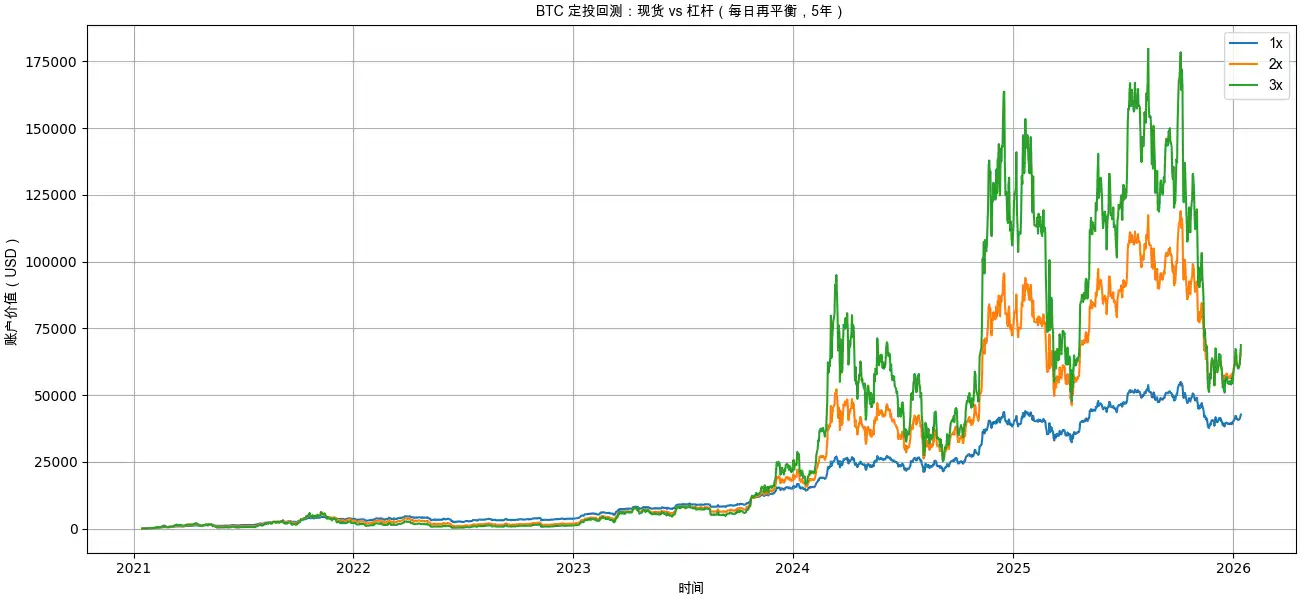

I | Five-Year Dollar-Cost Averaging Net Value Curve: 3x Has Not "Opened the Gap"

From the net value trend, we can see directly:

· Spot (1x): The curve rises smoothly, with controllable drawdowns.

· 2x Leverage: Significantly amplifies returns during bull market phases.

· 3x Leverage: Experiences multiple "ground-hugging" phases, long-term consumed by volatility.

Although in the rebound of 2025-2026, 3x slightly outperformed 2x,

the net value of 3x has always lagged behind 2x for several years.

Note: In this backtest, the leverage part is tested using a daily rebalancing method, which will incur volatility loss.

This means:

The final victory of 3x heavily relies on "the last segment of the market."

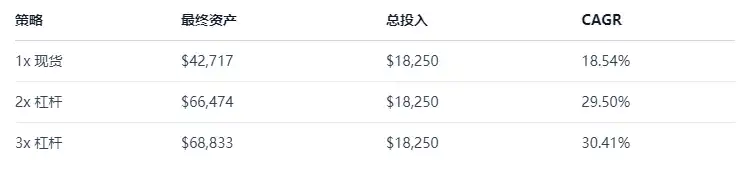

II | Final Return Comparison: The Marginal Returns of Leverage Diminish Rapidly

The key is not "who earns the most," but how much more:

· 1x → 2x: Earns approximately $23,700 more.

· 2x → 3x: Only earns approximately $2,300 more.

Returns hardly grow anymore, but risks increase exponentially.

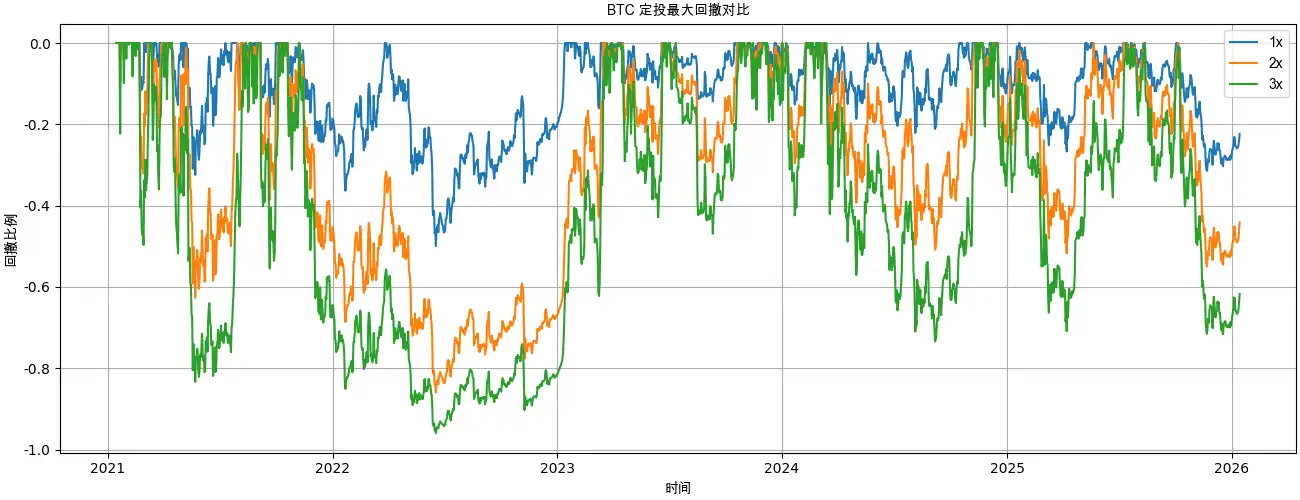

III | Maximum Drawdown: 3x Is Close to "Structural Failure"

There is a very critical real-world issue here:

· -50%: Psychologically bearable.

· -86%: Requires +614% to break even.

· -96%: Requires +2400% to break even.

3x leverage essentially "mathematically bankrupted" during the bear market of 2022,

with subsequent profits almost entirely coming from new funds invested after the bear market bottom.

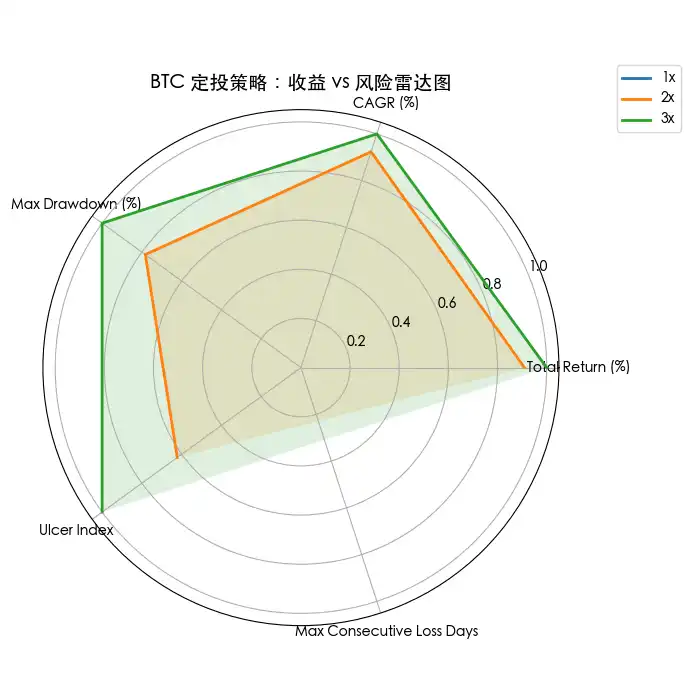

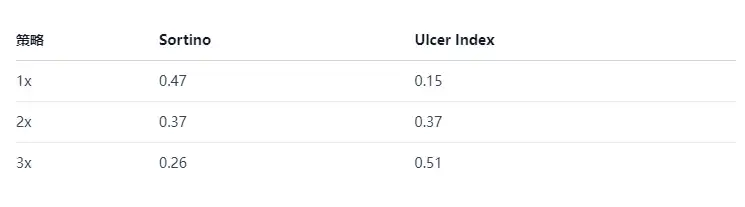

IV | Risk-Adjusted Returns: Spot Is Actually Optimal

This set of data indicates three things:

1. Spot has the highest risk-return ratio.

The higher the leverage, the worse the "cost-effectiveness" of downside risk.

3x is in a deep drawdown zone for a long time, causing significant psychological pressure.

What does an Ulcer Index of 0.51 mean?

The account is "staying underwater" for a long time, providing almost no positive feedback.

Why Does 3x Leverage Perform So Poorly in the Long Term?

The reason can be summed up in one sentence:

"Daily rebalancing + high volatility = continuous loss."

In a volatile market:

· Price rises → Increase position.

· Price falls → Decrease position.

· No price movement → Account continues to shrink.

This is a typical case of volatility drag.

And its destructive power is proportional to the square of the leverage multiplier.

In a high-volatility asset like BTC,

3x leverage bears a 9-fold volatility penalty.

Final Conclusion: BTC Itself Is Already a "High-Risk Asset"

The answer given by this five-year backtest is very clear:

· Spot Dollar-Cost Averaging: Optimal risk-return ratio, feasible for long-term execution.

· 2x Leverage: Aggressive upper limit, suitable only for a few people.

· 3x Leverage: Extremely low cost-effectiveness in the long term, not suitable as a dollar-cost averaging tool.

If you believe in the long-term value of BTC,

then the most rational choice is often not to "add another layer of leverage,"

but to let time work in your favor, rather than become your enemy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。