Global markets turned broadly positive this week, with bitcoin climbing above $95,000 and touching $97,000 as investors embraced risk assets. The rally has coincided with softer U.S. inflation signals, steady job market data, and robust inflows into crypto exchange-traded funds (ETFs), reinforcing optimism across equities, precious metals, and digital assets.

Bitcoin’s recent upswing reflects a return of risk appetite after weeks of consolidation. Spot bitcoin ETFs logged substantial inflows this week, with over $840 million in a single session, the biggest daily bounce in months. This helped support the price break above key resistance and lifted market sentiment.

Macro factors are playing a substantial role. U.S. inflation data came in softer than expected, easing pressure on the Federal Reserve and strengthening the case for continued accommodative policy, which typically benefits risk-oriented assets. At the same time, geopolitical developments have yet to spook markets, with gold and silver also rallying alongside BTC.

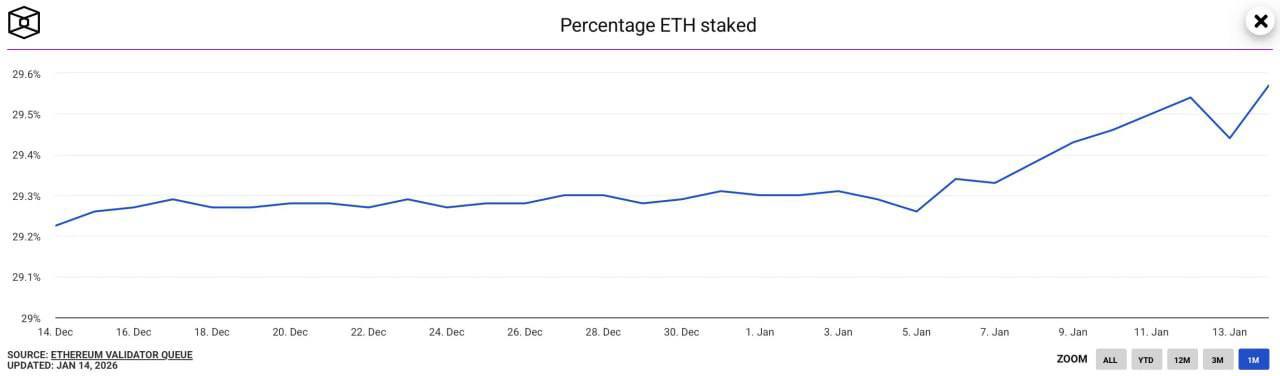

On the ethereum side, staking activity has surged, reaching a new all-time high. Over 36 million ETH, nearly 30 % of the circulating supply is now locked in staking contracts, a milestone driven by increased institutional participation and sustained confidence in the network’s proof-of- stake model.

Despite the upbeat backdrop, risks remain. QCP’s Jan. 14 market update notes that markets are watching key forthcoming events, including U.S. inflation data, producer price figures, and influential Supreme Court decisions on tariffs that could sway cross-asset positioning and investor sentiment. While the current trajectory favors risk assets, unexpected geopolitical escalations or harsher macro readings could trigger pullbacks.

Read more: Bitcoin ETFs Surge With $754 Million Inflow as Crypto ETFs Register Broad Gains

For now, bitcoin’s resurgence above $95,000 and strong ETF demand signal renewed interest from both retail and institutional investors. With ethereum staking participation also climbing, the crypto market appears to be stabilizing and potentially laying the groundwork for further gains, provided major economic and political catalysts don’t upset the current equilibrium.

- Why did bitcoin climb above $95,000?

Strong spot ETF inflows, softer U.S. inflation data, and renewed risk appetite pushed BTC through key resistance. - How are macro conditions supporting crypto markets?

Cooling inflation and stable jobs data eased Fed pressure, favoring risk assets like bitcoin and equities. - What’s driving ethereum’s record staking levels?

Growing institutional participation has locked nearly 30% of ETH supply into staking contracts. - What risks could disrupt the current bullish trend?

Upcoming U.S. data releases or geopolitical shocks could quickly reverse market sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。