On January 15, 2026, the JST token officially completed its second large-scale buyback and burn. This destruction action not only reflects the project's firm commitment to a deflationary mechanism but also demonstrates the profitability and financial health of the JUST ecosystem to the entire cryptocurrency market with a burn scale of 525,000,000 JST (accounting for 5.3% of the total supply).

According to the official announcement from JustLend DAO, the estimated value of this burn exceeds 21 million USD. Combined with the amount from the first round of JST burns, the total amount of JST tokens burned has reached 1,084,890,753, accounting for 10.96% of the total supply. This means that in less than three months, JST has achieved a permanent removal of more than one-tenth of the total supply, showcasing an astonishing deflation rate.

From a broader perspective, this burn marks a fundamental evolution in the value narrative of JST. It is transforming from a governance token into an equity asset anchored to the growth of ecosystem cash flow. This process not only enhances the scarcity and value foundation of the JST token but also provides a clear and practical path driven by real earnings to support token value in the decentralized finance space, showcasing a new paradigm of transparent and sustainable deflation.

JustLend DAO Ecosystem Performs Strongly, Establishing the Financial Foundation for Large-Scale Buybacks

Such a large-scale buyback and burn inevitably require a solid financial foundation for support. The announcement clearly reveals the dual pillars of funding sources: up to 10,192,875 USD from JustLend DAO's net income in the fourth quarter of 2025, while another 10,340,249 USD comes from the project's accumulated reserve earnings. These two figures are themselves the strongest proof of performance, pointing to a core fact: the JustLend DAO ecosystem not only possesses strong immediate profitability but also has a robust financial structure and sustainable cash flow.

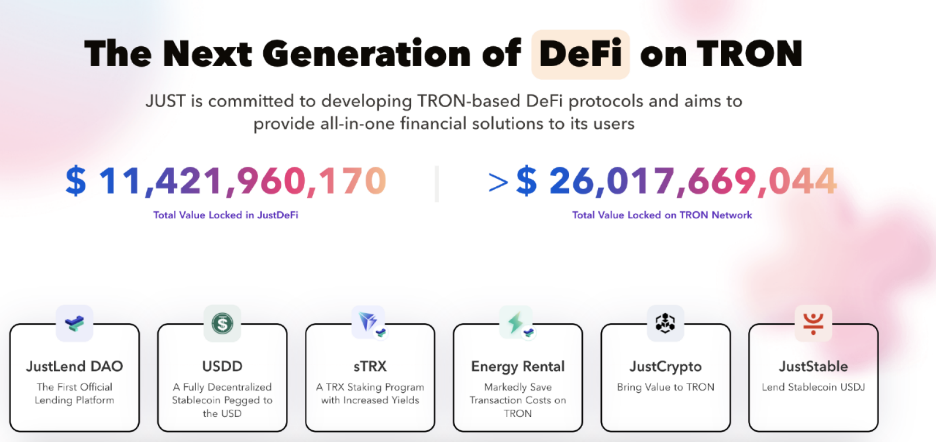

A deeper analysis of JustLend DAO's performance in the fourth quarter of 2025 reveals several clear growth trends. First, as the flagship lending protocol of the JUST ecosystem, JustLend DAO benefits from the continuous improvement of the TRON infrastructure, with its total locked value (TVL) surpassing 7.08 billion USD in the fourth quarter, consistently ranking among the top three in the lending market, and the lending activity in its SBM market has also reached a new cyclical high.

Notably, the 10,340,249 USD in reserve earnings that constitute an important part of the buyback funds can be traced back to the reserve earnings deposited in the SBM USDT market during the first buyback of JST. The appreciation process of these funds is itself the most direct proof of the strong profitability of the SBM market. It demonstrates JustLend DAO's ingenious financial operation model: strategically recycling ecosystem profits to continue "self-generating" within the protocol, thus providing an endogenous and sustainable source of funds for subsequent value returns.

On this basis, JustLend DAO's revenue structure is also showing a trend of diversification. In addition to the solid growth of the traditional lending market, JustLend DAO has innovatively constructed a product matrix including sTRX (Staked TRX) and Energy Rental, greatly expanding the boundaries and depth of its value capture.

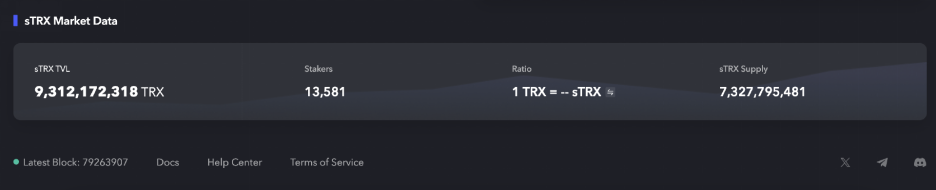

Among them, the sTRX service allows users to earn rewards while staking TRX, while still flexibly participating in other DeFi activities. This innovative design significantly enhances capital efficiency and user stickiness. As of January 15, the platform's TRX staking volume has surpassed 9.3 billion, a remarkable figure that not only reflects the community's high recognition of the sTRX product but also brings considerable and sustainable service revenue.

At the same time, the "Energy Rental" service, aimed at reducing users' on-chain operation costs, has also demonstrated strong market appeal through proactive rate optimization. Since September 2025, the basic rate of this service has been significantly reduced from 15% to a more competitive 8%. The rate optimization has directly stimulated market demand and transaction frequency, thereby creating robust incremental revenue for the protocol through more active rental business.

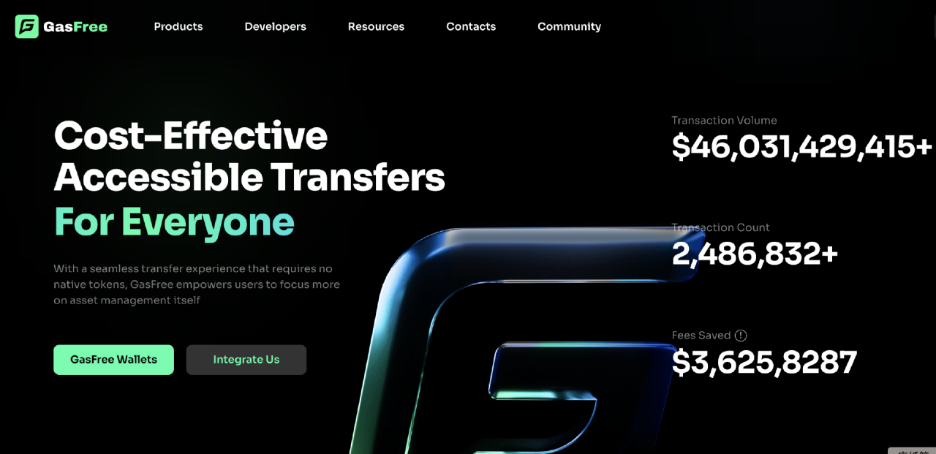

While the core product matrix continues to gain momentum, JustLend DAO is focused on lowering the participation threshold for the general public. In March 2025, it innovatively launched the GasFree smart wallet, which completely breaks the long-standing barrier that required users to hold native tokens (TRX) in advance to pay transaction fees, allowing users to deduct and pay the required network fees directly from their transferred token assets (such as USDT). This design not only achieves extreme operational convenience but also fundamentally broadens the accessibility of blockchain finance.

To accelerate the popularization of this innovative feature, JustLend DAO simultaneously launched an attractive 90% transfer fee subsidy campaign. With the support of this campaign, users using the GasFree feature for USDT transfers only need to pay a minimal fee of about 1 USDT. This combined strategy quickly ignited market demand. **As of January 15, the total transaction volume driven by the GasFree smart wallet has exceeded 46 billion USD, a staggering scale that not only validates the market's strong desire for a frictionless trading experience but also directly *saved users over 36.25 million USD in network fee costs*. This innovation, by significantly reducing actual usage costs and cognitive barriers, has introduced a massive influx of new users and capital flow into the ecosystem, forming another strong growth pole for the platform's network effect and revenue potential.

Meanwhile, another funding channel in the buyback and burn plan, namely the incremental earnings from the USDD multi-chain ecosystem (over 10 million USD), also constitutes a significant source of value. As the core decentralized stablecoin of the TRON ecosystem, USDD has achieved remarkable results in its multi-chain expansion strategy, successfully deploying on mainstream public chains such as Ethereum and BNB Chain, broadening its application scenarios and user base.

Its ecosystem value recently achieved a milestone leap, on January 14, the TVL of USDD surpassed 1 billion USD. This means that in less than two months, the TVL of USDD has achieved an astonishing 100% growth, and its expansion speed and market acceptance fully confirm the strong momentum and deep asset appeal of this stablecoin in the multi-chain ecosystem. The rapid growth of its TVL and the continued prosperity of the ecosystem significantly enhance the potential scale of this funding channel in the future, providing a predictable source of value for JST's subsequent quarterly buyback and burn plans.

Through deep integration with different DeFi protocols, USDD not only consolidates its stability but also creates a continuous flow of value for the entire ecosystem. The JST buyback and burn plan incorporates the excess income from the USDD ecosystem, constructing a value closed loop of "stablecoin + lending protocol + governance token." In this model, the expansion and prosperity of USDD and JustLend DAO directly drive the deflation of JST, while the increase in JST's value, in turn, enhances the attractiveness and cohesion of the entire TRON DeFi ecosystem, forming a powerful internal synergy and value feedback effect.

Deepening the Deflationary Mechanism: Reshaping the Value Foundation of JST

In summary, this buyback and burn is triggering a series of profound structural changes. At its core, it has completed the reshaping of the value support logic of JST. JST is no longer merely a "utility token" used for paying network fees or participating in governance votes; it has evolved into an "equity asset" directly anchored to the cash flow performance of JustLend DAO, USDD, and related ecosystems.

Through the buyback and burn mechanism, the ecosystem's profit growth is continuously injected into the value foundation of the JST token, making holding JST equivalent to holding a certificate of rights to share in the future profit growth of the ecosystem. On January 8, CoinMarketCap data showed that the market capitalization of JST historically surpassed 400 million USD, which is not only a numerical leap but also a substantial recognition of its new positioning by the market. Accompanying the rise in market capitalization is an increase in capital activity; on January 8, its 24-hour trading volume significantly increased by 21.92%, reaching 31.49 million USD, and the price has also steadily risen by 10.82% over the past month, with a daily increase of 3.1%.

The simultaneous expansion of trading volume and market capitalization at critical junctures is not a coincidence of market fluctuations but a clear "vote of confidence" from capital in response to the positive fundamentals of the JUST ecosystem, especially the profitability and value return mechanisms highlighted by the buyback and burn.

Secondly, the JST buyback and burn has also brought substantial appreciation of governance power. As the total supply of tokens irreversibly decreases, the governance weight represented by each JST remaining in the market will correspondingly increase. This means that long-term holders not only enjoy the economic benefits of value appreciation but also amplify their voice in key community decisions (such as parameter adjustments, new product launches, treasury fund usage, etc.). This design deeply binds the interests of core community members with the long-term success of the protocol, greatly enhancing community stability and participation.

From a broader industry perspective, the buyback and burn practice of JST provides a clear and exemplary new paradigm for token economics in the DeFi space. In a very short time, through two rounds of burns, 10.96% of the total supply has been removed. This action not only demonstrates efficient execution but also signifies a deep binding of the protocol's financial success with the interests of token holders, establishing a model of "value creation - value return" in a virtuous cycle.

This model fundamentally reverses the old logic of token value relying on speculative narratives, shifting towards a sustainable path driven by the cash flow of the protocol's fundamentals, providing a solid and credible case for the industry on how to construct an economic model with substantial value support.

Looking ahead, as JST's quarterly buyback and burn becomes the norm, a clear and predictable deflationary path has already been laid out, and the scarcity of JST will be a narrative that strengthens over time. Each quarterly report disclosure and the subsequent burn will become a catalyst for reassessing its intrinsic value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。