Author: CoinGecko

Compiled by: Deep Tide TechFlow

In the last quarter of 2025, the cryptocurrency market experienced a severe adjustment, with the total market capitalization plummeting by 23.7%, closing at $3 trillion. This marked the first annual decline in the cryptocurrency market since 2022, down 10.4% year-on-year. Although the quarter once reached a historic high of $4.4 trillion, a historic $19 billion liquidation event in October led to a significant price drop. Despite the price correction, market volatility drove the average daily trading volume to an annual high of $161.8 billion, while the stablecoin market grew by 48.9% year-on-year, reaching a historic high of $311 billion.

This year, the cryptocurrency market showed a decoupling trend from traditional assets, with gold rising by 62.6% and the U.S. stock market performing well, while Bitcoin fell by 6.4%. However, institutional adoption deepened further, with Digital Asset Treasury Companies (DATCos) deploying at least $49.7 billion in 2025 to acquire over 5% of the total supply of Bitcoin and Ethereum. Other highlights include a 302.7% surge in prediction market trading volume and centralized exchange annual perpetual contract trading volume reaching a historic high of $86.2 trillion. These data indicate that even with falling prices, market infrastructure and utility continue to expand.

Our "2025 Annual Cryptocurrency Industry Report" comprehensively covers everything from the cryptocurrency market landscape to in-depth analyses of Bitcoin and Ethereum, as well as a deep dive into the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and reviews the performance of centralized exchanges (CEX) and decentralized exchanges (DEX).

Here are the key highlights from the report, but be sure to read the full 60-page report for more details.

CoinGecko's Seven Highlights from the "2025 Annual Cryptocurrency Industry Report"

- The total market capitalization of the cryptocurrency market decreased by 10.4% in 2025, closing at $3 trillion.

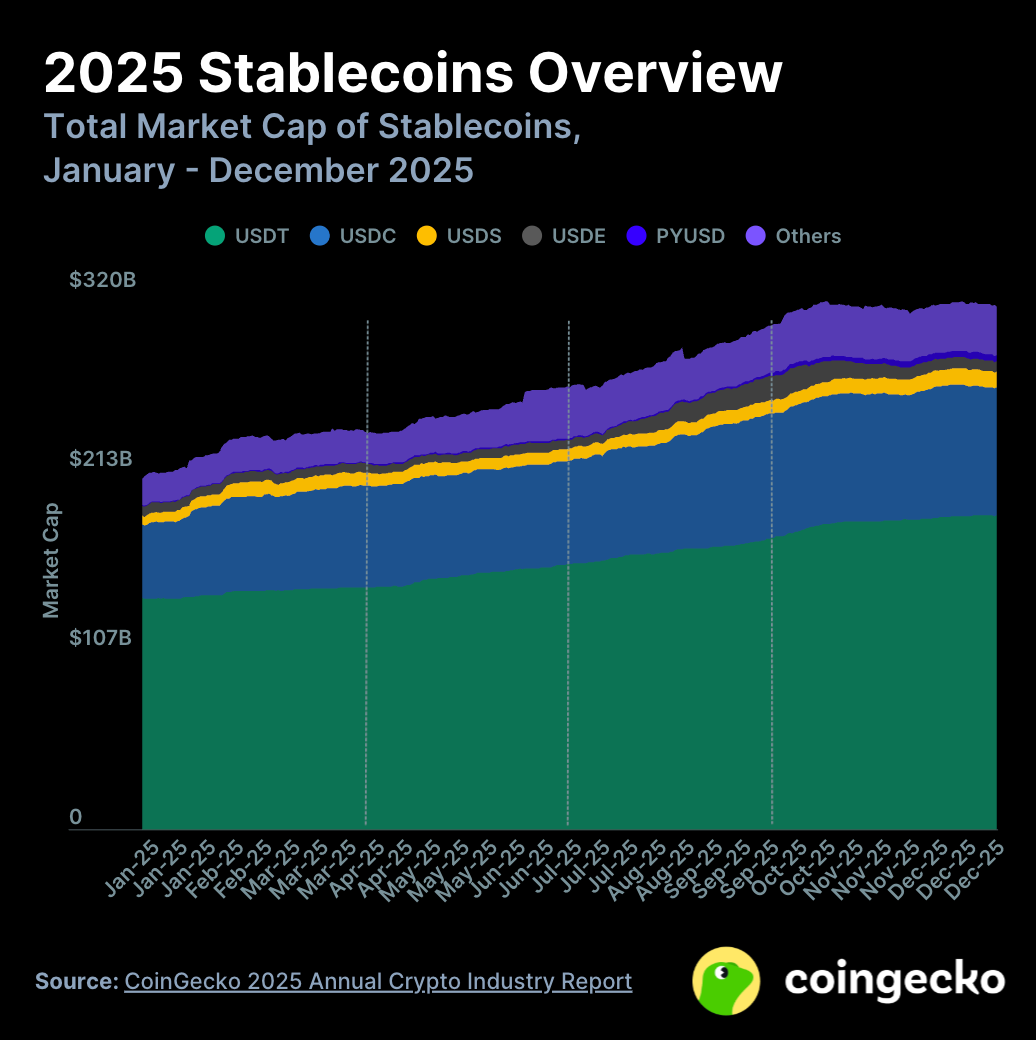

- The market capitalization of stablecoins surged by $10.21 billion (+48.9%) in 2025, reaching a historic high of $311 billion.

- Gold performed exceptionally well in 2025, rising by 62.6%, while Bitcoin lagged behind, falling by 6.4%, with the U.S. dollar and oil also performing poorly.

- Digital Asset Treasury Companies (DATCos) invested at least $49.7 billion in 2025, with about 50% concentrated in the third quarter.

- Prediction market trading volume grew by 302.7% in 2025, reaching $63.5 billion.

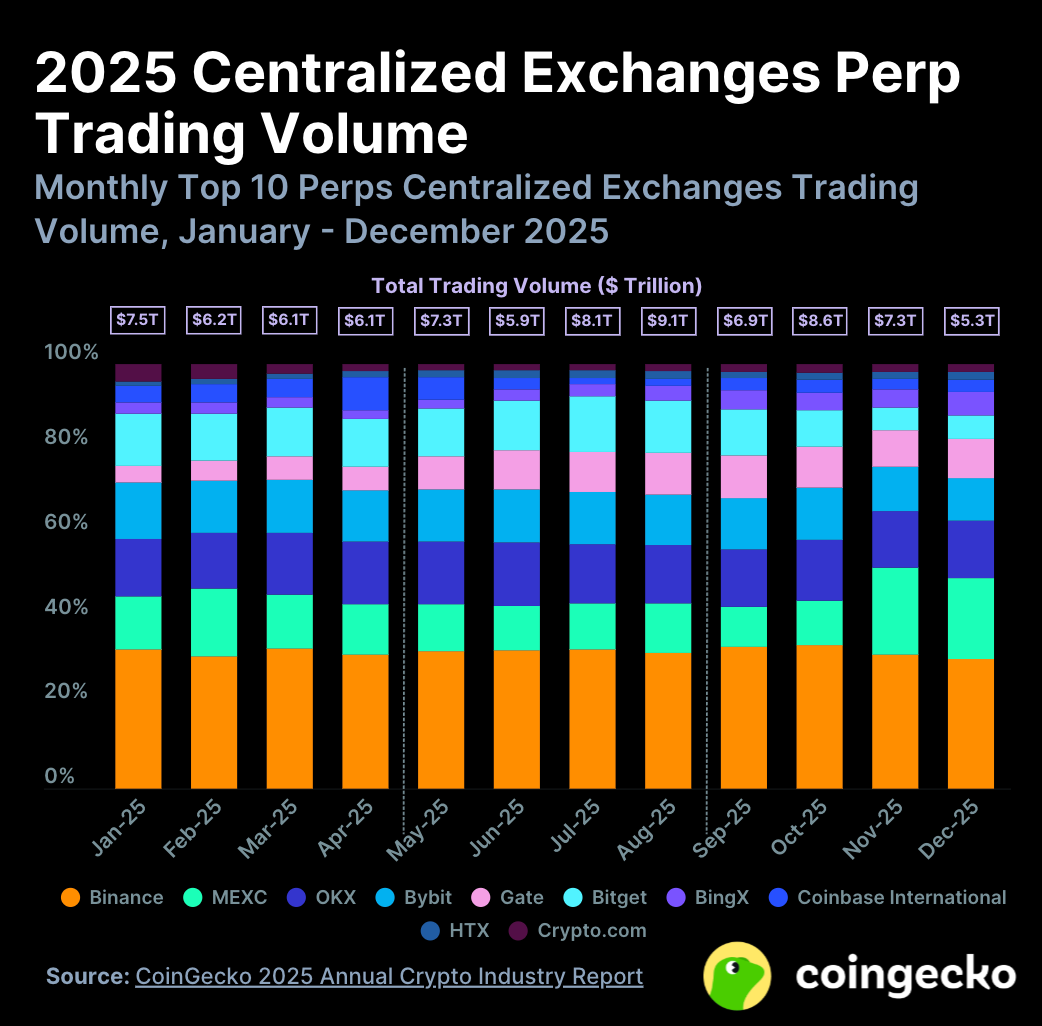

- Centralized exchange perpetual contract trading volume increased by 47.4% in 2025, reaching a historic high of $86.2 trillion.

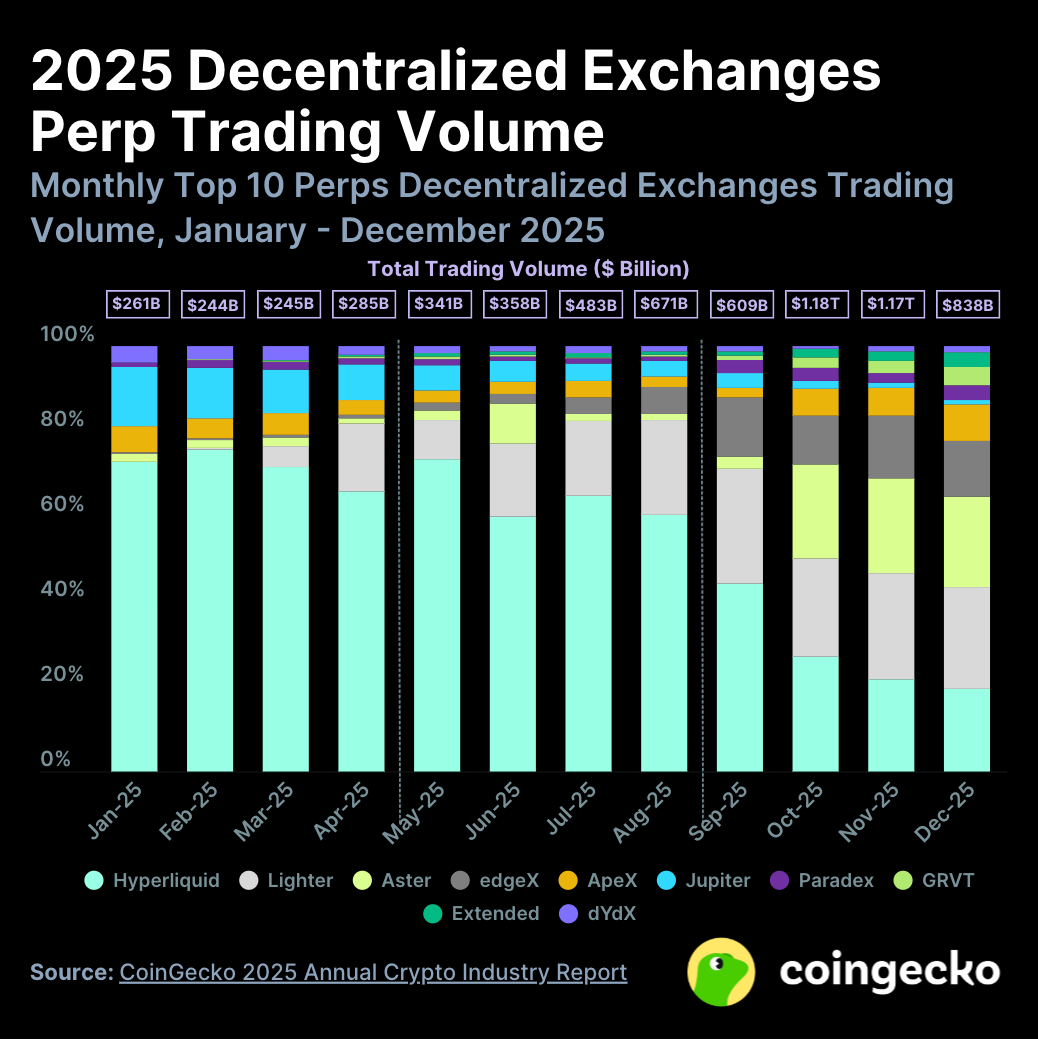

- Decentralized exchange perpetual contract trading volume grew by 346% in 2025, reaching $6.7 trillion, setting a new historic high.

1. The total market capitalization of the cryptocurrency market plummeted by 23.7% in Q4 2025 (a decrease of $94.6 billion), closing the year at $3 trillion

The total market capitalization of the cryptocurrency market declined by 23.7% in the fourth quarter, decreasing by $94.6 billion, and closed the year at $3 trillion, down 10.4% year-on-year. This is the first annual decline in the cryptocurrency market since 2022.

At the beginning of Q4 2025, the cryptocurrency market performed strongly, reaching a historic high of $4.4 trillion. However, this peak did not last, as prices continued to decline until the end of November, followed by a period of consolidation until the end of the year. The trigger for this round of decline was the historic $19 billion liquidation event triggered by the U.S. announcement of a 100% tariff on China on October 10.

Meanwhile, the average daily trading volume in Q4 grew to $161.8 billion, setting an annual high, with a quarter-on-quarter increase of 4.4%. This growth was mainly due to the liquidation event and the subsequent high volatility. However, as the market entered a consolidation phase, trading volume gradually declined.

2. The market capitalization of stablecoins surged by $10.21 billion (+48.9%) in 2025, reaching a historic high of $311 billion

In Q4 2025, the total market capitalization of stablecoins grew by $6.3 billion, reaching a historic high of $311 billion by the end of the quarter. The stablecoin market grew by 48.9% year-on-year, increasing by $10.21 billion.

The biggest change in Q4 came from the Ethereum ecosystem stablecoin Ethena's USDe, which plummeted by 57.3% (a decrease of $8.4 billion) after a rapid deleveraging in mid-October. Due to the de-pegging event on the Binance platform, the supply of USDe fell from a peak of nearly $15 billion to $6.3 billion, severely undermining investor confidence in high-yield circular strategies.

At the same time, PayPal's stablecoin PYUSD emerged, with its market capitalization surging by 48.4% (an increase of $1.2 billion) to $3.6 billion, successfully becoming the fifth-largest stablecoin, replacing World Liberty Financial's USD1. Its growth was aided by YouTube's launch of a creator earnings payment feature and the approximately 4.25% yield offered by Spark Savings Vault.

3. Gold leads in 2025: up 62.6%, while Bitcoin lags behind, down 6.4%, with the U.S. dollar and oil also weak

In 2025, gold emerged as the best-performing asset, with an annual increase of 62.6%. In contrast, Bitcoin performed poorly, falling by 6.4%, echoing the weak performance of the U.S. dollar and oil.

Gold's performance in 2025 was particularly outstanding, rising by 62.6% over the year. In Q4 alone, gold increased by 11.4%, primarily driven by continued central bank purchases and uncertainties related to tariffs. Following gold, the U.S. stock market performed well, with the Nasdaq index rising by 20.5% and the S&P 500 index rising by 16.6%, benefiting from the ongoing AI narrative.

In contrast, commodities and stocks performed strongly, while Bitcoin (BTC) underperformed, falling by 6.4% over the year. Assets that performed worse than Bitcoin included the U.S. dollar index (down 10.0%, affected by interest rate cuts and political changes) and crude oil (down 21.5%, due to global oversupply and record production from non-OPEC countries).

4. Digital Asset Treasury Companies (DATCos) invested at least $49.7 billion in 2025, with about 50% concentrated in the third quarter

Digital Asset Treasury Companies (DATCos) became significant players in the market in 2025, investing at least $49.7 billion in cryptocurrency purchases throughout the year. The third quarter was the peak of investment, accounting for half of the total annual investment, mainly due to a wave of emerging altcoin DATCos.

However, investment pace significantly slowed in Q4, with only $5.8 billion invested. The crash in the cryptocurrency market weighed on DATCos' stock prices, causing many DATCos' adjusted net asset values (mNAV) to fall below 1.0. This forced them to use funds for stock buybacks rather than continue accumulating cryptocurrencies.

As of January 1, 2026, DATCos held a total of $134 billion in crypto assets, a 137.2% increase from $56.5 billion on January 1, 2025. DATCos currently hold over 1 million Bitcoins and 6 million Ethers, accounting for over 5% of their total supply.

5. Prediction market trading volume surged by 302.7% in 2025, reaching $63.5 billion

In 2025, the prediction market experienced explosive growth, with trading volume increasing by 302.7% year-on-year, reaching a historic high of $63.5 billion.

The nominal trading volume of the prediction market surged from $15.8 billion in 2024 to $63.5 billion in 2025, a year-on-year increase of 302.7%.

At the beginning of 2025, Polymarket held an 85.6% market share in the first quarter but was overtaken by Kalshi in the fourth quarter. In Q4, Kalshi's market share reached 39.6%, while Polymarket ranked second with 32.4%. Meanwhile, Opinion, supported by Yzi Labs and based on the BNB chain, launched in November, becoming a strong competitor to the existing market. Opinion's trading volume in December reached $7 billion, matching Kalshi, but the current trading volume may be influenced by airdrop activities.

6. Centralized exchange perpetual contract trading volume increased by 47.4% in 2025, reaching $86.2 trillion, setting a historic high

In Q4 2025, the top ten centralized perpetual contract exchanges (Perp CEXes) recorded a trading volume of $21.2 trillion, down 12.0% from $24.0 trillion in Q3. The total annual trading volume reached $86.2 trillion, a year-on-year increase of 47.4%, setting a historic high.

October 2025 became the second-highest trading month in history, only behind August, when Bitcoin reached its latest historic high. In contrast, December was the quietest trading month of the year, with a trading volume of only $5.3 trillion.

In 2025, the market share of the top ten centralized perpetual contract exchanges remained relatively stable throughout the year. The only significant change was the surge in trading volume for MEXC in November and December, which jumped ahead of OKX, Bybit, and Bitget to claim the second position. Outside the top ten, KuCoin performed impressively in 2025, becoming the only non-top ten perpetual contract exchange with a trading volume exceeding $1 trillion.

7. Decentralized exchange perpetual contract trading volume grew by 346% in 2025, reaching $6.7 trillion, setting a historic high

The trading volume of decentralized perpetual contract exchanges (Perp DEXes) increased by 80.8% in Q4 2025, rising from $1.8 trillion in Q3 to $3.2 trillion in Q4.

In 2025, the total trading volume of the top ten decentralized perpetual contract exchanges reached $6.7 trillion, a significant increase of 346% compared to $1.5 trillion in 2024. The trading volume ratio of Perp DEX to centralized perpetual contract exchanges (CEX) surged from 2.5% a year ago to 7.8%.

The growth in trading volume was primarily driven by incentives and airdrop activities provided by exchanges such as Lighter, Aster, edgeX, GRVT, and Paradex. Hyperliquid remained the most active decentralized perpetual contract exchange overall in 2025, but was surpassed by Lighter in Q4. Hyperliquid and Lighter have now entered the top ten annual trading volume for perpetual contract exchanges, recording trading volumes of $2.9 trillion and $1.3 trillion, respectively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。