Brian Armstrong, chief executive officer of crypto exchange Coinbase (Nasdaq: COIN), shared on social media platform X on Jan. 17, that he disputed claims of White House hostility toward crypto negotiations, emphasizing cooperation with administration officials amid ongoing discussions over a crypto market structure bill and banking-related yield issues.

His comments were directed at a Jan. 16 post on X by journalist Eleanor Terrett, who reported that the White House was considering pulling support for the crypto market structure legislation if Coinbase failed to return with a yield agreement acceptable to banks. “In general, love your posts, but this is not accurate,” Armstrong responded directly to that reporting. The Coinbase chief added:

“The White House has been super constructive here. They did ask us to see if we can go figure out a deal with the banks, which we’re currently working on.”

Expanding on Coinbase’s approach, the CEO explained: “Actually, we’ve been cooking up some good ideas on how we can help the community banks specifically in this bill, since that’s what this is about…..the community banks, right? More coming soon.” Terrett’s original post cited a source close to the Trump administration describing frustration over what was characterized as a unilateral move by Coinbase and stressing that no single company speaks for the entire crypto industry.

Read more:

Terrett pushed back publicly after Armstrong challenged her reporting, writing: “My reporting was airtight and accurate.” She continued:

“You also just cited the central point of my story as correct: that the White House asked Coinbase to go secure a deal on yield. My reporting is that WH support now appears to be contingent on that outcome.”

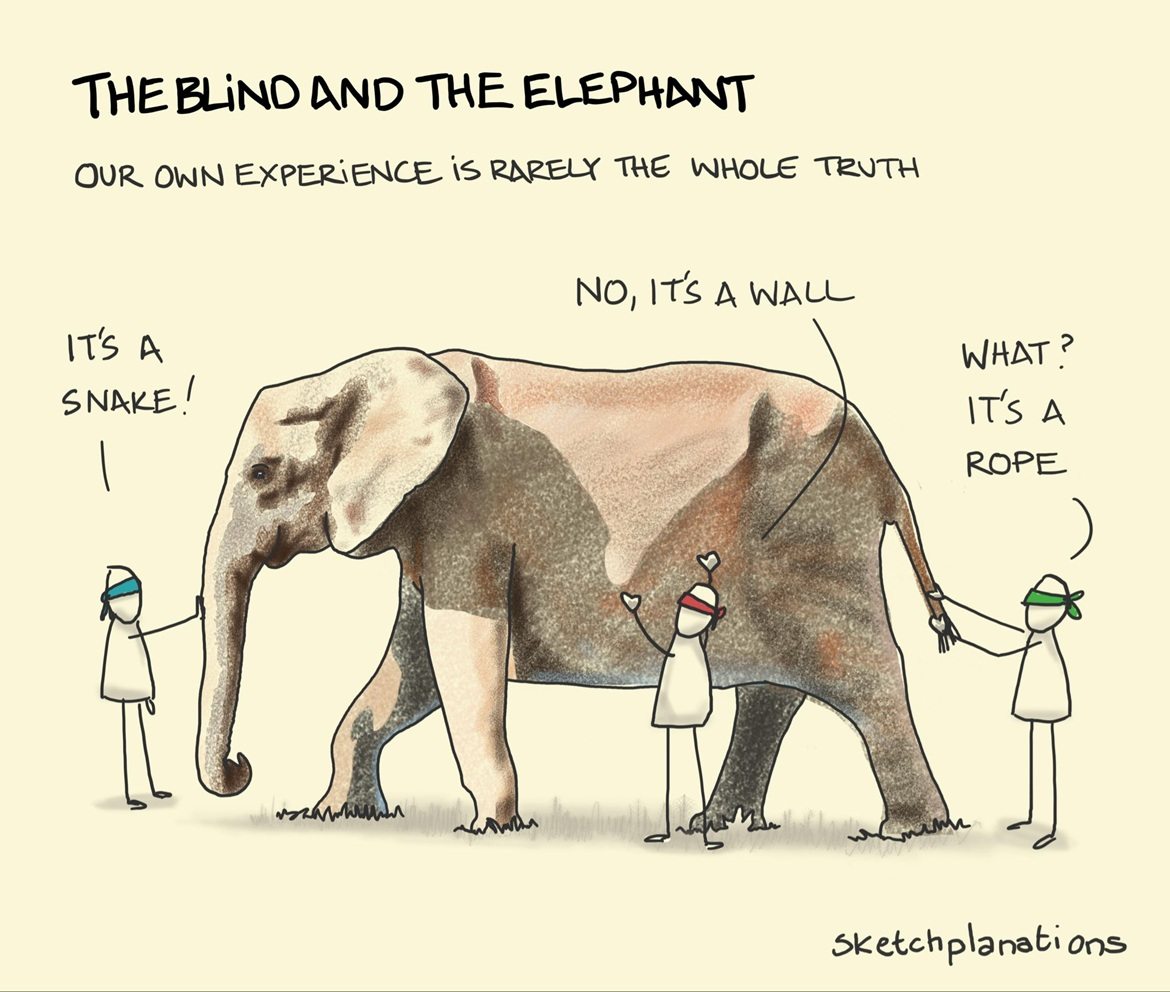

Armstrong responded by posting an educational illustration titled “The Blind and the Elephant” with the subtitle “Our own experience is rarely the whole truth.” It visually represents an ancient parable about subjective perception and limited experience, suggesting multiple perspectives on the same issue.

The exchange sparked wider industry reaction, including commentary from entrepreneur Mike Dudas, who opined: “Big banks stalling crypto regulation. They want zero competition for deposits while paying you less than 0.1% on your hard-earned money in checking accounts. Meanwhile, innovators like Coinbase and Paypal offer 3.5% on *fully backed* deposits. You don’t hate the banks enough.” The debate highlighted ongoing friction between crypto firms, community banks, and large financial institutions as policymakers weigh how yield-bearing digital assets could reshape competition, consumer choice, and regulatory priorities in the U.S. financial system.

- What did Brian Armstrong say about White House crypto talks?

He said the White House has been constructive and is actively working with Coinbase on banking yield issues. - Why is Coinbase negotiating with banks?

The White House asked Coinbase to seek a yield agreement with banks tied to crypto market structure legislation. - What was Eleanor Terrett’s reporting about?

She reported that White House support could depend on Coinbase securing an acceptable deal with banks. - Why are banks critical in the crypto yield debate?

Banks fear competition from crypto firms offering higher yields on fully backed deposits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。