| Hot News |

1: [The Federal Reserve's Independence Faces a "Century Trial": Credibility at Risk]

2: [India's Central Bank Proposes Interconnectivity of BRICS Digital Currencies for Cross-Border Payments]

What do we think about Bitcoin and Ethereum today? The recent pullback on Saturday is not just a simple decline, as Bitcoin has just retraced to the critical line on the 12-hour chart. The current real-time price of Bitcoin is at 93,000, and Ethereum's real-time price is 3,211. To conclude, we won't speculate on the strength of the rebound or the bottom-fishing position today. If it holds, it will be a rebound; if it doesn't, it will continue to drop. The overall market rebound is still far from the anticipated bull market. Currently, market sentiment remains very poor. Bitcoin faces significant resistance at 98,000-100,000, unless there is extremely strong buying power to force a rally, or the downward trend will continue. Data from the options market confirms this, with implied volatility (IV) continuing to decline, and skew remaining negatively biased. The bearish sentiment in the futures market continues to dominate trading volume, all signals of a weakening market.

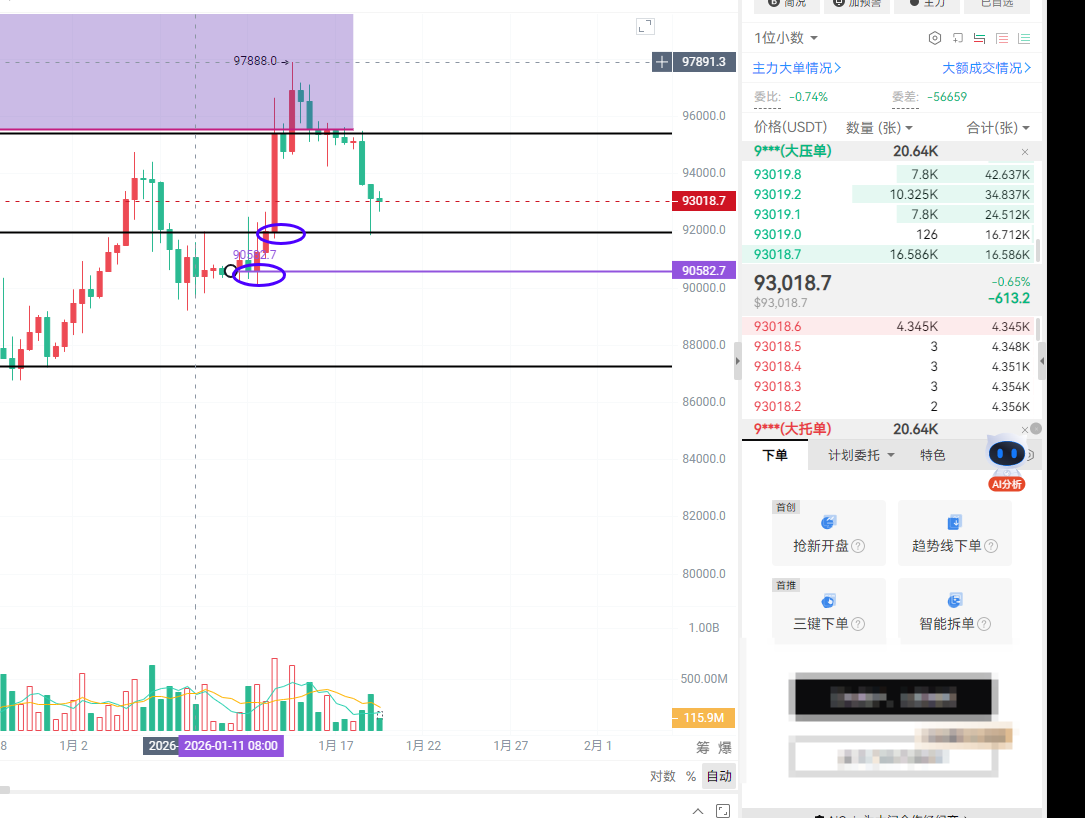

BTC: From the current 12-hour perspective, the secondary high platform around 95,400 has failed to convert between support and resistance. The strong bullish buying pressure that entered on the 13th of last week is now facing selling pressure at high levels, continuing to retrace to the previous concentrated trading area. 91900-90500. This position is in the weekly concentrated trading area. The upper resistance is at 94,800-95,400. This week, we need to focus on confirming support around 92,000 before considering entering long positions. If there is no retracement and the price rises without volume, we will patiently wait, observing more and acting less. If Bitcoin retraces and does not break 91,900, then if the 12-hour closes above this level, this wave will be a washout, and we will first look for a rebound at 94,800, then at 95,400. If Bitcoin 📉 breaks 91,900 and cannot close above it, then we should not stubbornly pursue long positions today, as the market will continue to weaken. Bottom-fishing will be a lesson not to be misled by smoke screens.

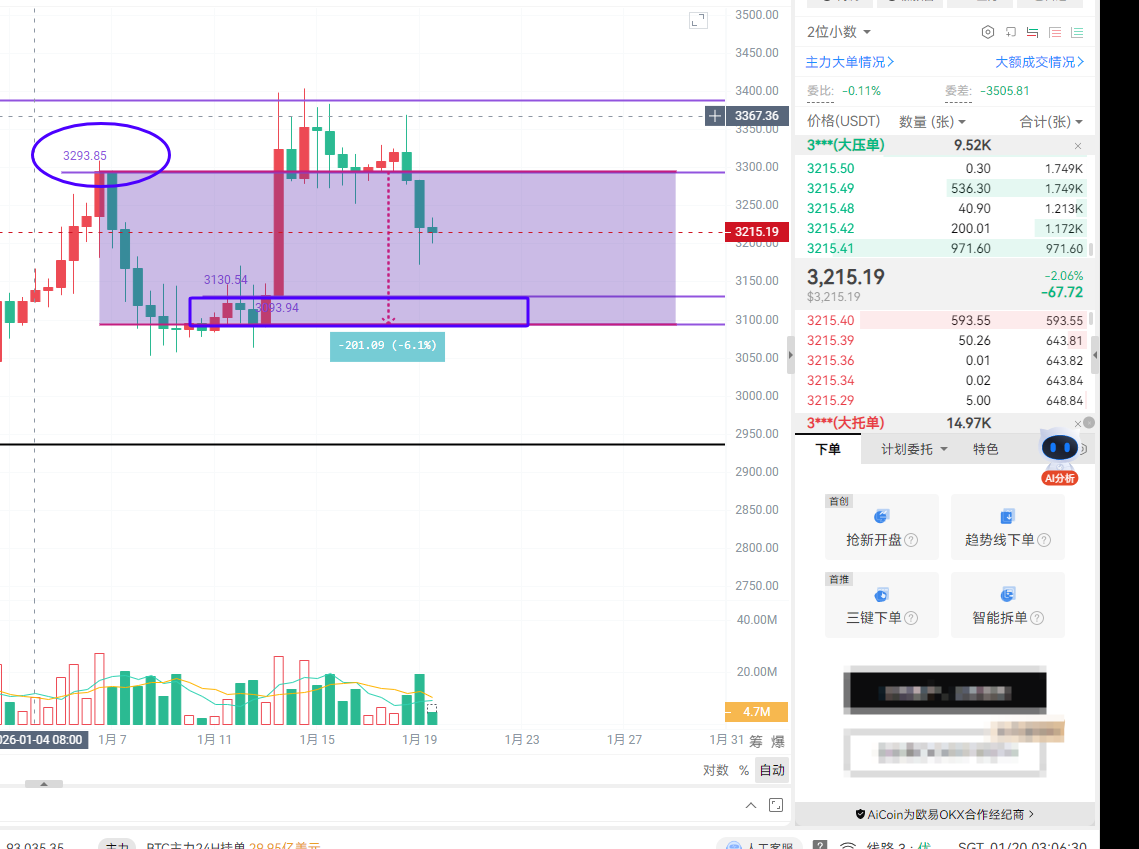

ETH: Ethereum is even simpler, with support at 3,130-3,090 and resistance at 3,300-3,370. The operation should sync with Bitcoin's rhythm.

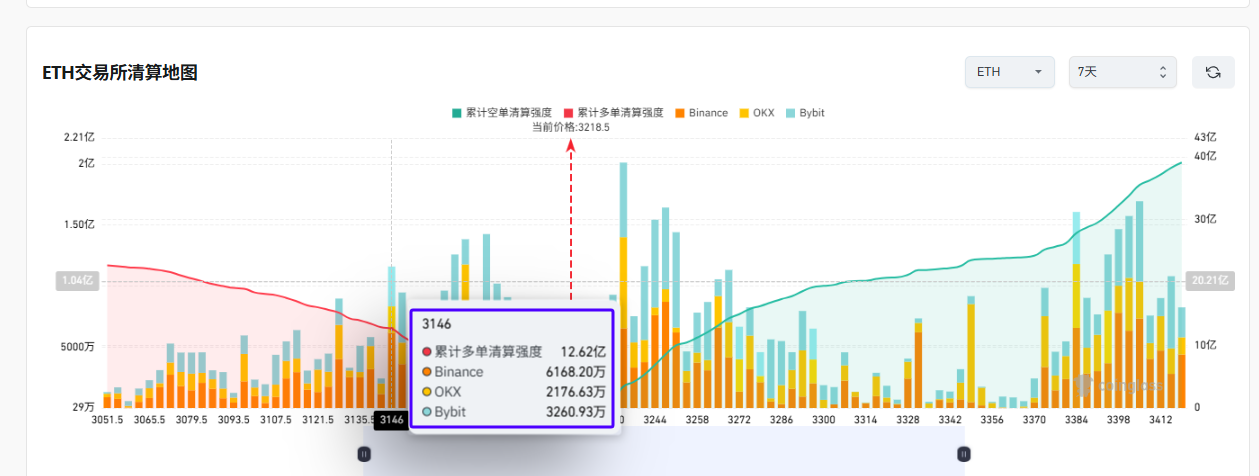

This Week's Liquidation Map:

We must remember that those who truly make money are not the ones who react the fastest, but those who are already on board when others are in doubt. Following the market trend allows one to go further in the market, and these are the people who truly achieve results.

In this recent bull market, I have repeatedly emphasized that I believe the underlying logic of the crypto market has changed. The factors determining market trends are now more complex than before, and this complexity is something investors have not experienced in previous bull and bear markets. I am Tommy, a companion in the crypto space who trades and practices simultaneously. If you want real-time entry points and personalized strategies, click on my profile to join the community. We have professional trading instructors available around the clock to help you maintain your mindset; you don't have to bear it alone.

Points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Lastly, everyone should remember the two key points I mentioned in my last article: focus on trial positions in the short term, and once we move away from our target range, it will be the last opportunity to get in before a significant profit by the end of the year. I am Tommy from K-line Life, your real-time crypto steward, mainly focusing on spot and futures trading for BTC/ETH/ETC.

Specializing in style: K-line Trading

Original Volume Trading Strategy.

Short-term swing highs and lows, medium to long-term trend trades, daily extreme retracements, weekly top predictions, monthly head predictions.

WeChat Official Account QR Code (K-line Life Tommy)

Warm Reminder: The only WeChat Official Account at the end of the article is created by the author!!

Please be cautious in distinguishing between true and false, thank you for reading!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。