Finance apps and neobanks are turning to Latam, seeking growth opportunities in regions often overlooked.

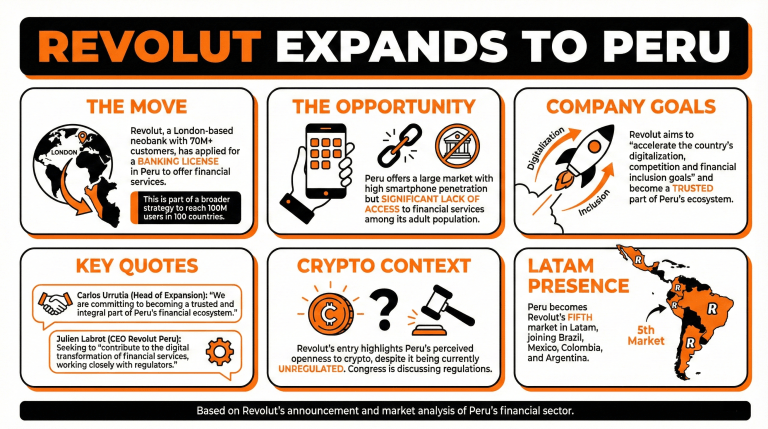

Revolut, a financial neobank based in London with over 70 million customers, has recently announced its expansion plans into Peru, disclosing that it has applied to receive a banking license to offer financial services in the country.

The move is focused on establishing a foothold in Peru, which has a large level of smartphone penetration, but whose adult population still lacks access to financial services in a significant proportion.

Convinced that it can help offer improved access to financial tools to more Peruvians, the company stated that its entrance into the country will “accelerate the country’s digitalization, competition and financial inclusion goals.”

“By pursuing a full banking licence, we are not just entering a new market – we are committing to becoming a trusted and integral part of Peru’s financial ecosystem,” said Carlos Urrutia, Head of Expansion at Revolut.

Julien Labrot, who was appointed CEO of Revolut Peru, stressed that the firm sought to “contribute to the digital transformation of financial services, working closely with regulators to offer a long-term, trusted world-class banking solution for individuals and businesses alike.”

Revolut’s move to enter Peru’s financial market highlights the perceived openness of the Peruvian market to the crypto industry. While cryptocurrencies are still unregulated in Peru, the Peruvian Congress is discussing regulations to solve this gray area issue.

Peru would be the fifth market in Latin America (Latam) with Revolut’s presence, serving customers in Brazil, Mexico, Colombia, and Argentina already. Latam markets are relevant to the company’s goal of reaching 100 million users in 100 countries.

Read more: Peru Issues VASP Regulation, Strengthens AML/TF Requirements

What are Revolut’s recent expansion plans in Latam? Revolut aims to enter the Peruvian market by applying for a banking license to offer financial services, targeting improved access for underserved populations.

Why is Peru a strategic choice for Revolut? With high smartphone penetration but significant gaps in financial service access, Peru presents an opportunity for Revolut to enhance digitalization and financial inclusion.

What commitments did Revolut make upon entering Peru? Carlos Urrutia, Revolut’s Head of Expansion, emphasized their commitment to becoming a trusted part of Peru’s financial ecosystem by pursuing a full banking license.

How does Peru fit into Revolut’s broader Latam strategy? Peru will become the fifth market in Latam for Revolut, which already operates in Brazil, Mexico, Colombia, and Argentina, as part of its goal to reach 100 million users globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。