Markets reacted negatively to President Trump’s statements on Greenland on early Tuesday, when the American leader reaffirmed his intention to annex the world’s largest island and make it part of U.S. territory.

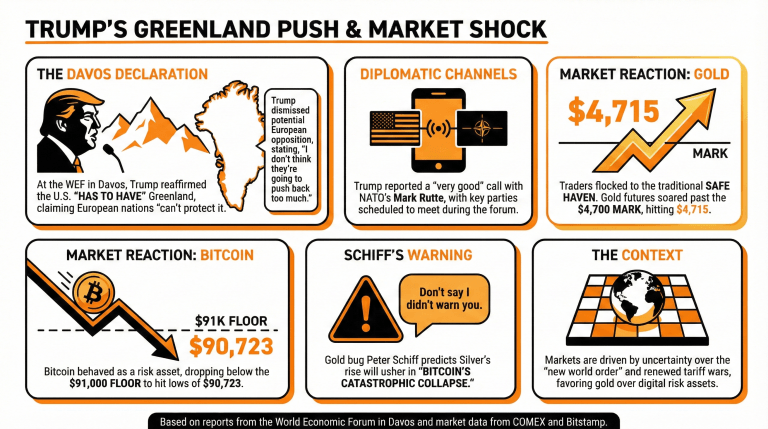

At his arrival in Davos, where he will be part of the World Economic Forum (WEF) Annual meeting, Trump reiterated that the U.S. “had to have” Greenland and disregarded a possible opposition from European leaders toward this action.

He stated:

I don’t think they’re going to push back too much. Look, we have to have it. They have to have this done. They can’t protect it.

On Truth Social, Trump also revealed that he had a “very good” telephone call with NATO’s Mark Rutte regarding Greenland’s issue, and that various parties involved would meet in Davos.

Gold was favored by the news, as traders shifted to the traditional safe-haven asset. Gold’s COMEX futures for February soared past the $4,700 mark, reaching $4,715.

The precious metal has started 2026 with an outstanding performance, surging due to the uncertainty regarding the renewed tariff war and the ongoing reconfiguration of the international chessboard, which Canada’s Prime Minister Mark Carney referred to as a “new world order.”

Bitcoin, on the other hand, experienced a downturn, behaving as a risk asset amidst a de-risking operation by financial operators. The prime cryptocurrency fell as low as $90,723 on Bitstamp, losing the $91K floor.

Gold bug Peter Schiff anticipated this behavior, predicting that silver’s rise could precede bitcoin’s price drops. On January 19, he stated:

What’s happening with silver is about to happen with Bitcoin, only in reverse. Silver’s spectacular rise will usher in Bitcoin’s catastrophic collapse. Don’t say I didn’t warn you.

Read more: Trump Threatens Nations Opposing Greenland Annexation With Tariffs

What recent statements did President Trump make about Greenland? Trump reaffirmed his desire to annex Greenland, stating that the U.S. “had to have” the territory, dismissing potential European opposition.

How did markets react to Trump’s comments on Greenland? Following his remarks, gold prices surged past $4,700, signaling a shift toward safe-haven assets, while bitcoin fell below $91,000 amidst market uncertainty.

What does Peter Schiff anticipate regarding bitcoin and silver? Schiff predicts that silver’s rise will lead to a significant downturn in bitcoin, suggesting a reversal of their current market behaviors.

What context surrounds these market movements? The reactions are influenced by ongoing tensions from a renewed tariff war and the evolving international landscape, termed a “new world order” by Canadian Prime Minister Mark Carney.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。