Written by: Kolten, Aave Labs

Translated by: Golden Finance

The CLARITY Act has sparked a debate about the future direction of the U.S. monetary and banking system. One of its core provisions would prohibit digital asset service providers (such as cryptocurrency exchanges) from paying yields to customers simply for holding "payment stablecoins."

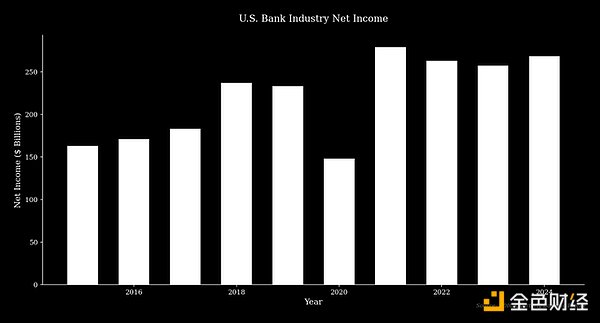

This proposed ban on third-party platforms follows the 2025 GENIUS Act, which has already prohibited stablecoin issuers from paying interest. The banking industry supports these measures, aiming to protect their profits, which are a lucrative part of their business model.

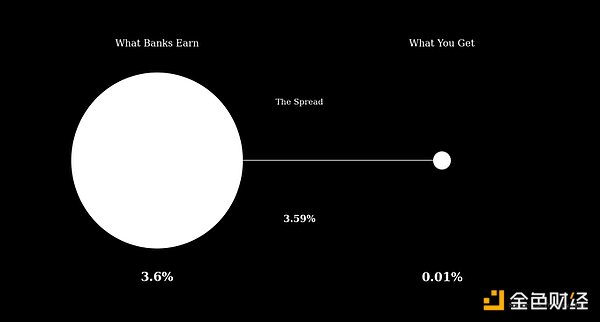

In simple terms, the banking model operates by absorbing customer deposits and paying lower interest rates, then lending those deposits at higher rates or investing in assets like government bonds. The bank's net interest margin, or spread, is the difference between the interest earned and the interest paid.

This model can be very profitable. JPMorgan reported a record net profit of $58.5 billion in 2024. Revenue reached $180.6 billion, with net interest income of $92.6 billion, which is its main source.

New fintech solutions provide savers with a more direct way to achieve higher yields while also introducing competition that the industry has historically avoided. It is not surprising that some large traditional banks use regulatory means to protect their business models, as this strategy is reasonable and has precedents.

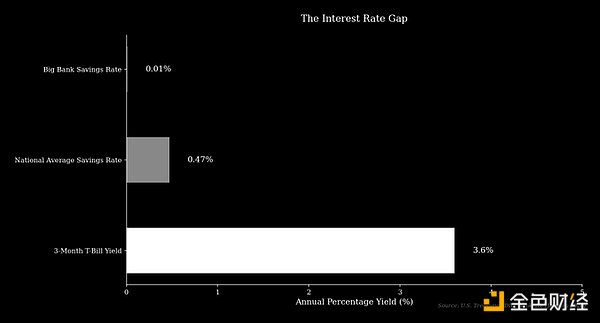

Dual-Mode Banking

As of early 2026, the average annual interest rate for national savings accounts is 0.47%. Meanwhile, some of the largest banks in the U.S., including JPMorgan and Bank of America, offer a standard interest rate of 0.01% APY on basic savings accounts. During the same period, the yield on risk-free investments, such as the 3-month U.S. Treasury yield, is about 3.6%. Therefore, a large bank can absorb customer deposits, purchase government bonds, and earn a spread of over 3.5% with minimal risk.

JPMorgan has approximately $2.4 trillion in deposits, theoretically generating over $85 billion in income solely from the deposit spread. While this is an overly simplified estimate, the logic still holds.

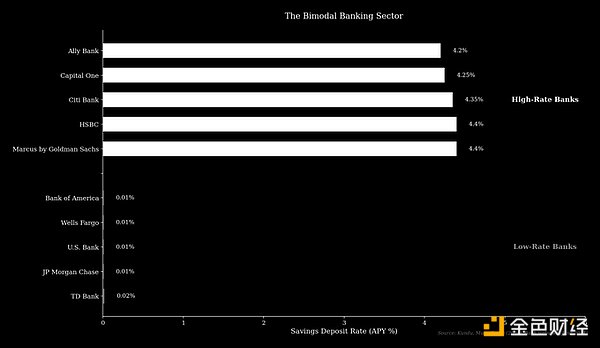

Since the global financial crisis, the banking industry has diverged into two distinct types of institutions: low-interest banks and high-interest banks. Low-interest banks are large traditional banks that attract deposits from customers who are insensitive to interest rates, leveraging their extensive branch networks and brand recognition.

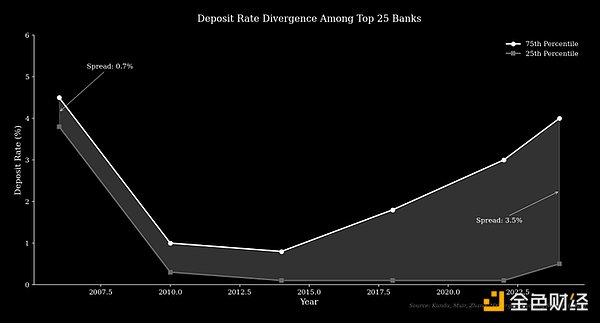

High-interest banks, such as Marcus by Goldman Sachs or Ally Bank, typically operate online and engage in price competition by offering deposit rates closer to market rates. Research by Kundu, Muir, and Zhang shows that the gap between the 75th percentile and the 25th percentile of deposit rates among the top 25 banks has widened from 0.70% in 2006 to over 3.5% today.

The profitability of the low-interest bank model relies on a group of depositors who are not actively seeking higher yields.

"$6 Trillion Deposit Flight"

Banking groups argue that allowing stablecoins to generate yields could lead to a "deposit flight" amounting to $6.6 trillion. They claim this would result in a credit drought in the economy. Bank of America CEO Brian Moynihan expressed this concern at an investor meeting in January 2026, warning that "deposits are not just a pipeline; they are funds. If deposits flow out of banks, lending capacity shrinks, and banks may have to rely more on wholesale financing, which comes with costs."

He also added that Bank of America itself would be fine, but small and medium-sized enterprises would feel the impact first. This argument views deposits flowing into stablecoins as leaving the commercial banking system. However, this is not always the case.

When customers purchase stablecoins, dollars are transferred to the stablecoin issuer, which holds them as reserves. For example, the reserves for the major stablecoin USDC, issued by Circle, are managed by BlackRock, and these assets are held in a combination of cash and short-term U.S. Treasury securities. They remain within the traditional financial system, meaning the total amount of deposits may not change; they are simply reallocated from customer accounts to the accounts of stablecoin issuers.

What is the Real Issue?

What the banking industry is truly concerned about is the flow of deposits from low-interest accounts to other investment products that offer higher yields. For instance, the USDC rewards from Coinbase and DeFi products, such as the yields offered by the Aave App, far exceed those of most banks. For customers, the choice is between earning 0.01% on every dollar held at a large bank or holding the same dollar in stablecoin form to earn over 4%, a difference of more than 400 times.

This dynamic challenges the low-interest bank model, prompting customers to shift funds from transaction accounts to interest-bearing accounts and making depositors more sensitive to interest rates.

In a world with yield-bearing stablecoins, customers can achieve market rates without changing their primary bank accounts, intensifying existing competition among banks. As fintech analyst Scott Johnson stated, "Banks are not actually competing for deposits with stablecoins; they are competing with each other. Stablecoins are merely accelerating this dynamic change, ultimately benefiting consumers."

Research by Kundu, Muir, and Zhang supports this view, finding that when market interest rates rise, deposits tend to flow from low-interest banks to high-interest banks. This flow of funds promotes the issuance of personal and commercial loans, with high-interest banks increasingly issuing such loans. Yield-bearing stablecoins are likely to replicate this effect, directing funds to more competitive institutions.

Historical Parallels

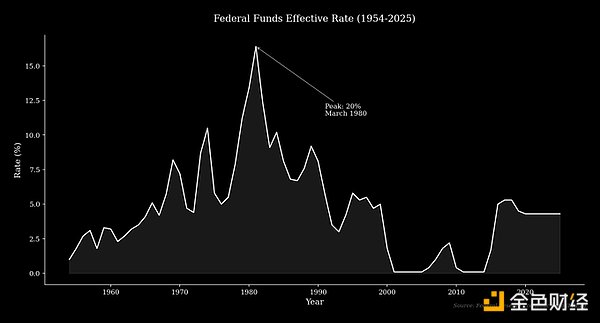

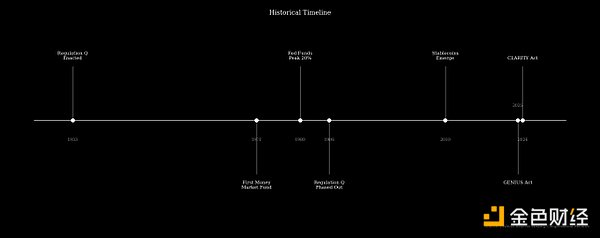

The current conflict surrounding stablecoin yields is reminiscent of historical conflicts over interest rates. The Q Regulation was a rule enacted during the Great Depression aimed at limiting the interest banks could pay on deposits to prevent "excessive competition." For decades, this regulation had little impact as market interest rates remained below the statutory limits. However, by the 1970s, inflation and rising interest rates made these limits binding. For most of the 1960s, the federal funds rate was below 5%, but it surged sharply, peaking at 20% in March 1980, while the law prohibited banks from offering competitive rates.

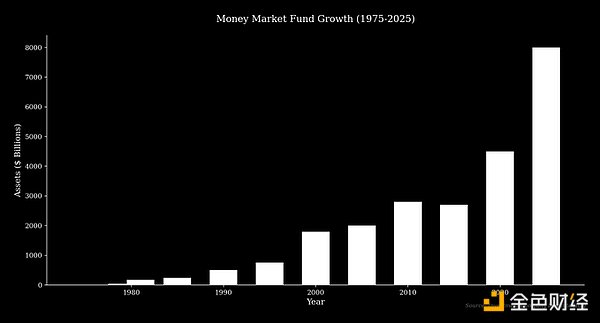

In 1971, Bruce Bent and Henry Brown created the first money market mutual fund, the Reserve Fund, which offered savers market-rate returns along with check-writing capabilities. Today, such protocols are emerging in abundance. Aave's functionality is similar, allowing users to earn deposit yields without a bank intermediary. These funds grew from 76 funds with $45 billion in assets in 1979 to 159 funds with a total size exceeding $180 billion just two years later, now managing over $8 trillion in assets.

Initially, banks and regulators opposed this initiative. These regulations were ultimately deemed unfair to savers, prompting Congress to pass legislation in 1980 and 1982 to gradually eliminate interest rate ceilings.

The Rise of Stablecoins

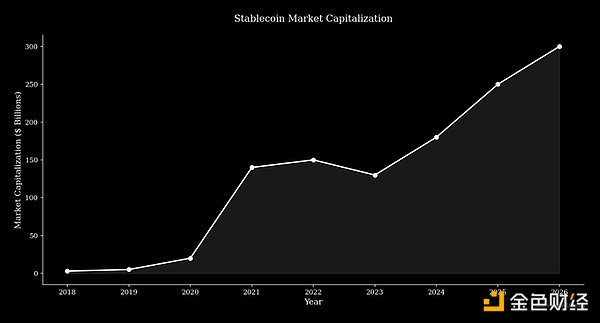

The stablecoin market has also expanded at a similar pace, with a total market capitalization growing from just over $4 billion at the beginning of 2020 to over $300 billion by 2026. The largest stablecoin, Tether (USDT), is projected to reach a market cap of $186 billion in 2026. This expansion indicates a demand for digital dollars that can circulate freely and potentially earn competitive yields.

The debate over stablecoin yields is a modern version of the money market fund debate. Banks opposing stablecoin yields are primarily those vested interests benefiting from the existing low-interest system. Their goal is to protect their business models from a technology that could provide greater value to consumers.

Markets tend to adopt technologies that offer better solutions over time, while the role of regulators is to decide whether to facilitate or delay this transition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。