The market on Tuesday was exactly as expected. From the start of the Asian time zone, U.S. stock futures continued to be sold off, with a decline of around 1%. The price of $BTC dropped directly to around $90,000, and after the market opened, the decline in U.S. stocks continued to increase. Before the market closed, the average drop for the Nasdaq and S&P 500 exceeded 2%, marking the largest single-day drop in the past three months.

The reason for this has been discussed for three days: Trump's increase in tariffs on Greenland-related countries has led to market panic. Since tariffs have been used as a weapon by Trump, they have had a significant impact on risk markets intermittently. The most direct effect is that changes in tariffs directly undermine the Federal Reserve's interest rate cut path and negatively impact the U.S. economy.

However, from the current situation, the tariffs initiated by Trump and the EU's retaliation have not ended, and there is even a possibility of further escalation. The Prime Minister of Greenland has even stated that preparations are being made for a possible military invasion. Additionally, in response to Europe potentially using tariffs for retaliation, Lunik stated that if Europe retaliates with tariffs, the U.S. will revert to a tit-for-tat situation. This means an escalation of the tariff war, the last occurrence of which was with China.

Although there are other events today, such as the U.S. acquiring 50 million barrels of oil from Venezuela, Trump's warning to the Supreme Court that if it rules the IEEPA tariffs illegal, the U.S. will not have enough funds for refunds, and Coinbase CEO's continued optimism about U.S. cryptocurrency legislation, these are insignificant in the context of the larger tariffs and inflation.

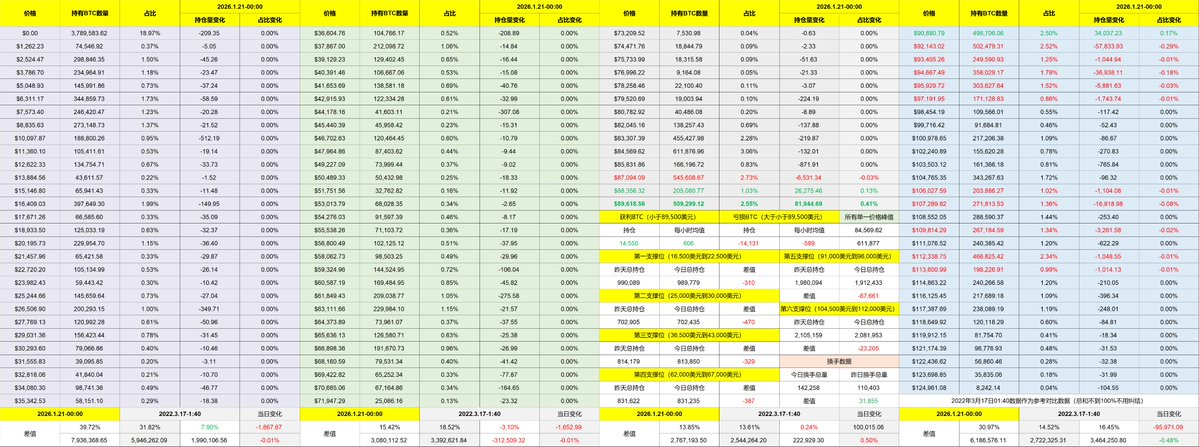

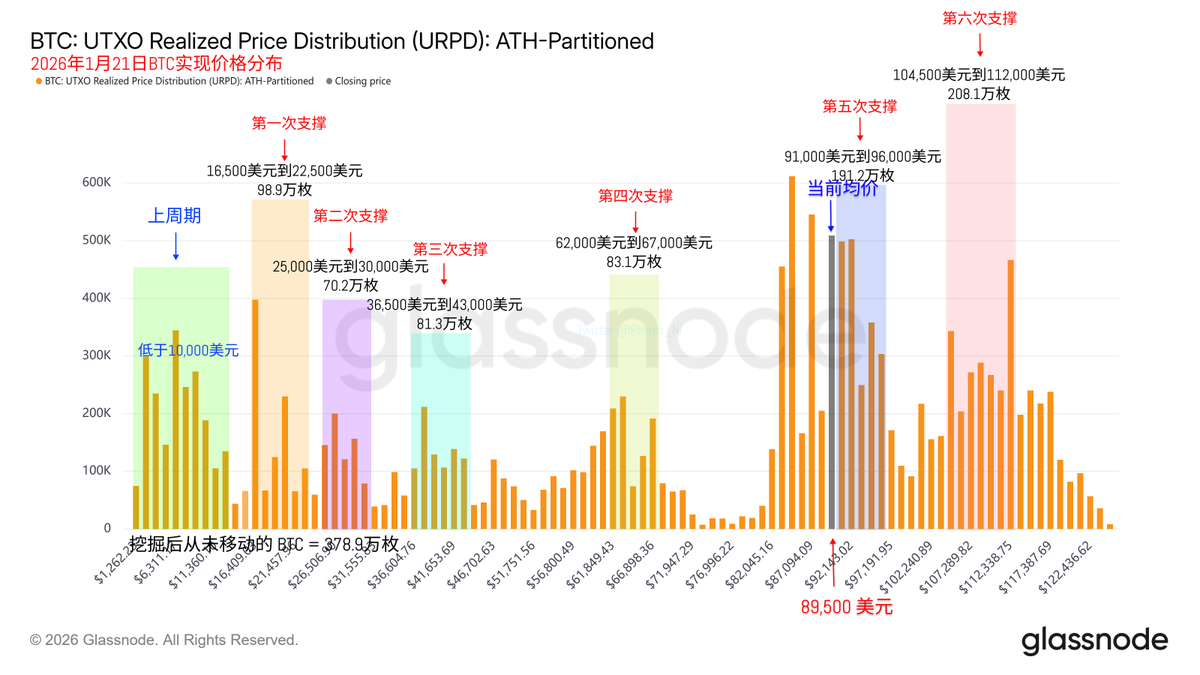

Looking back at Bitcoin's data, although the price of $BTC has seen a significant drop today, the market has not entered a state of full panic; at most, it is in the early stages of panic. The turnover rate has not yet exploded, and the main participants in trading are still short-term investors who bought in the past week, while earlier investors who made profits or losses have not participated significantly in trading.

However, with Trump's hardline stance and Europe's resistance, this tariff war may not end here, and the market's response may not stop at this point. The biggest hope currently is that the U.S. Supreme Court can rule on or before February 1 whether Trump's IEEPA tariffs are illegal, or that both sides will voluntarily back down.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。