Market attention intensified after a bold downside projection for bitcoin circulated among traders. Veteran commodity and foreign exchange trader Peter Brandt, who has traded since 1975, shared on social media platform X on Jan. 19, 2026, that bitcoin could move toward a $58,000–$62,000 range amid ongoing technical weakness.

He explained:

“$58K to $62K is where I think it is going $ BTC.”

However, he noted: “If it does not go there, I will NOT be ashamed, so I do not need to see you trolls screen shot this in the future. I am wrong 50% of the time. It does not bother me to be wrong.”

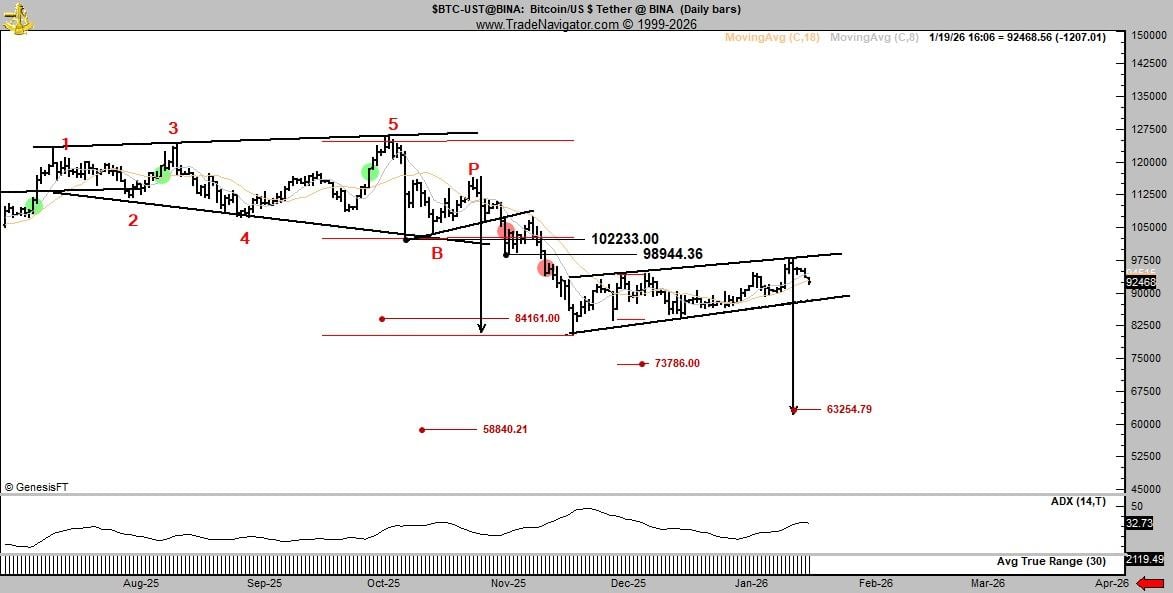

The post included a daily bitcoin chart showing price trading within a modestly rising channel following a sharp selloff. The chart illustrated repeated failures near the upper boundary below $100,000, while the lower channel support clustered in the low-$80,000 area. Momentum indicators on the chart suggested a market lacking strong directional conviction, reinforcing Brandt’s emphasis on probability rather than certainty when outlining price scenarios.

Bitcoin chart shared by Peter Brandt.

Read more: The Destruction of Fiat Has Begun — Peter Brandt Warns Altcoins Will Become More Worthless Than USDs

On Jan. 20, Brandt shifted attention away from a specific price target and toward structural risk. He stated on X:

“ Bitcoin has now become a diagonal pattern. I do NOT trade diagonal patterns. I leave these for the Elliott Wave guys who without fail after the next big move will tell us how they had it all figured out $ BTC.”

That post was accompanied by another daily bitcoin chart showing price compressing inside a rising diagonal after a decline from prior highs. The chart marked resistance near the $100,000 area and identified multiple downside reference levels extending through the $80,000s and $70,000s, with a projected move pointing toward the low-$60,000 zone. The visual reinforced Brandt’s caution toward diagonal formations, which he views as technically complex and prone to sharp, difficult-to-trade resolutions.

- Why are investors closely watching Peter Brandt’s bitcoin downside projection?

Investors are paying attention because Brandt’s call for a potential move toward $58,000–$62,000 highlights elevated downside risk amid weakening technical momentum in bitcoin. - What technical factors support the possibility of bitcoin falling toward the low-$60,000 range?

Repeated failures below $100,000, weakening momentum indicators, and a rising diagonal pattern suggest a fragile market structure vulnerable to sharp downside moves. - How does Brandt’s probability-based approach impact investor sentiment?

By emphasizing probabilities rather than certainty and acknowledging a 50% error rate, Brandt reinforces the need for risk management and scenario planning among bitcoin investors. - What does Brandt’s warning about diagonal patterns mean for bitcoin traders and investors?

Brandt’s avoidance of diagonal patterns signals increased volatility and technical complexity, which can lead long-term investors to adopt a more cautious or defensive positioning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。