The crypto world is evolving at an unprecedented speed, with its boundaries expanding from mere asset trading to reshaping the core of global financial infrastructure. The wave of institutionalization has arrived, and new competitive landscapes and business models are forming. Below is an in-depth analysis of key trends in the crypto market for 2026, based on cutting-edge industry insights.

1. The Rise of the AI Agent Economy: Autonomous Trading Becomes Reality

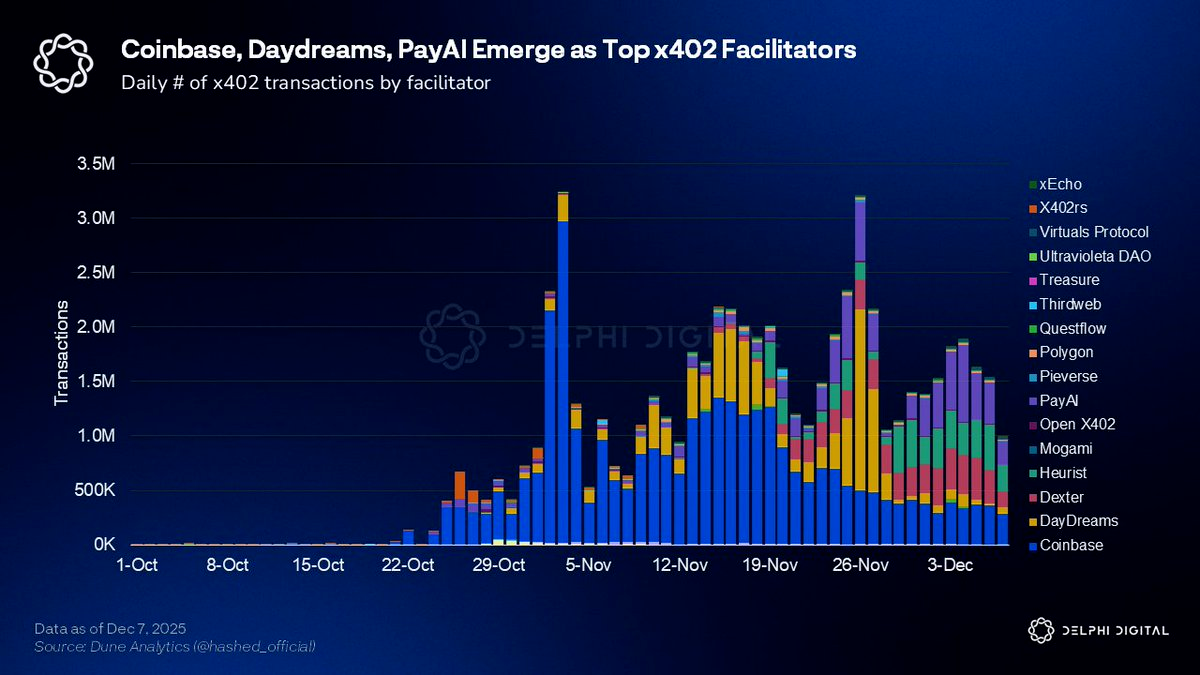

● The integration of technology is giving birth to a brand new autonomous agent economy. The core lies in two innovative protocols: the x402 protocol allows any API to access encrypted payments instantly, eliminating traditional subscription and payment barriers; the ERC-8004 protocol establishes an on-chain credit system for agents with performance history and collateral.

● This means that smart agents will be able to autonomously conduct value exchanges and collaborations in the on-chain world, just like humans. Imagine a scenario where a user entrusts a travel plan to an AI agent, which autonomously calls upon professional agent services for flight searches, hotel bookings, etc., pays data fees instantly through the x402 protocol, and ultimately completes all bookings and payments on-chain without any human intervention.

● In the financial sector, AI agents will be able to independently execute complex trading and asset management based on real-time data and preset strategies, becoming an automated force that cannot be ignored in the market.

2. Perpetual Contract DEX: The New Wall Street Integrating Traditional Finance

The traditional financial system is highly fragmented, with functions such as trading, clearing, settlement, and custody shared among different institutions, leading to inefficiencies and high costs. Blockchain technology, especially smart contracts, is integrating all of this into a single, programmable layer.

● Decentralized perpetual contract exchanges (Perp DEX), represented by Hyperliquid, are leading this transformation. They are no longer just trading venues but are building native lending, custody, and other functions, simultaneously playing multiple roles as brokers, exchanges, clearinghouses, and banks.

● This "one-stop" financial supermarket model significantly lowers user thresholds and overall costs. With projects like Aster Protocol, Lighter, and Paradex accelerating to catch up, a more efficient, transparent, and composable "New Wall Street" is forming on-chain.

3. Prediction Markets: Upgrading to Mainstream Financial Infrastructure

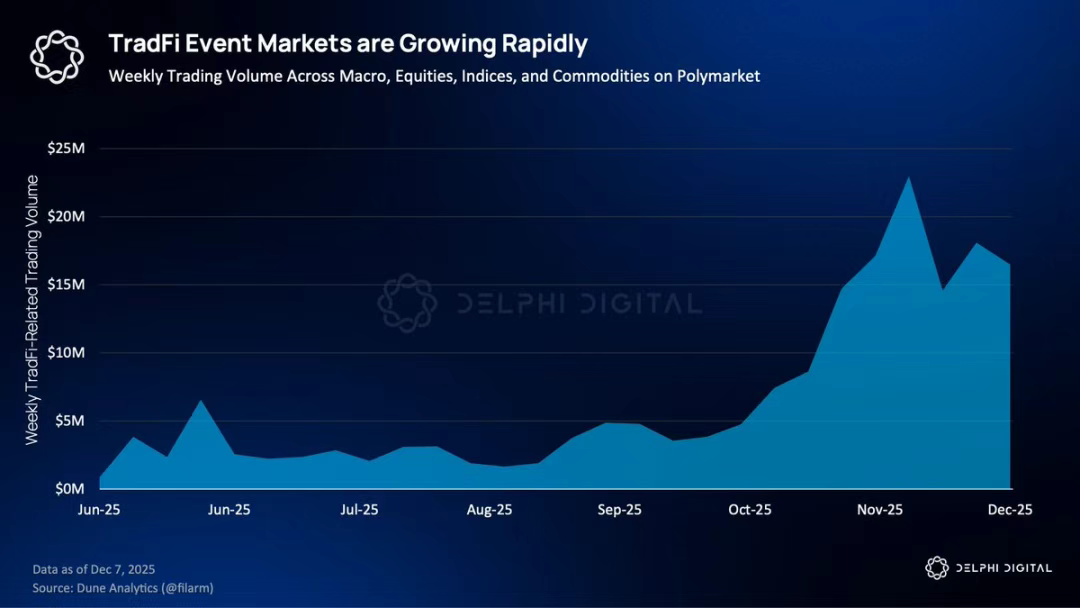

Prediction markets are transforming from marginalized gambling scenarios into real-time information and risk management layers serving traditional finance. This transformation has caught the attention of traditional financial giants; for example, the chairman of Interactive Brokers views them as valuable information sources for portfolios.

● By 2026, the application categories of prediction markets will significantly broaden: expanding from weather contracts relied upon by energy and agricultural insurance to earnings forecasts for publicly listed companies, macroeconomic indicators (such as CPI, Federal Reserve decisions), and even relative value comparisons between different assets.

● For instance, an investor holding tokenized Apple stock (AAPL) can hedge risks by purchasing a simple binary prediction contract for "Apple's quarterly earnings not meeting expectations," which is more convenient than operating traditional options. Thus, prediction markets are expected to become primary derivative tools, providing hedging and price discovery functions for broader financial activities.

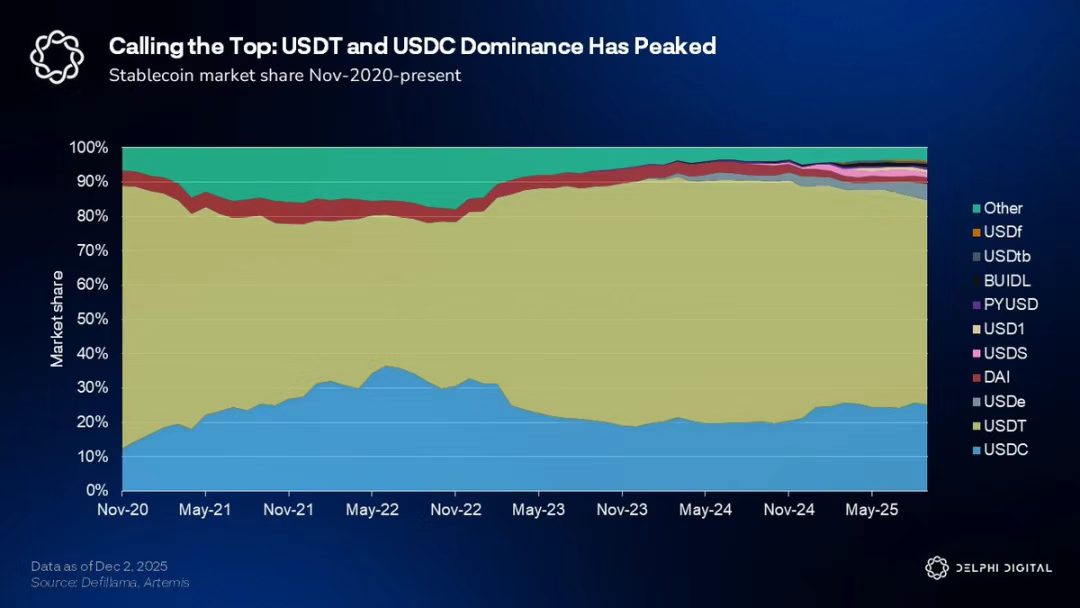

4. The Battle for Stablecoin Yields: Ecological Platforms Turn the Tables

Currently, stablecoin issuers (such as Circle and Tether) capture the vast majority of the yields from their stablecoin reserve assets, while the public chains and platforms that drive the widespread use of these stablecoins, despite creating huge demand, often receive nothing. For example, the total annual fee income of major public chains like Solana is far less than the interest income issuers gain from the stablecoin supply on these chains.

● This unreasonable value flow is being reversed. Hyperliquid captures and distributes part of the reserve yield to its ecosystem through its stablecoin USDH mechanism.

● More notably, Ethena Labs has launched a "stablecoin as a service" model, adopted by projects like Sui, MegaETH, and Jupiter, allowing these platforms to issue and manage yield-bearing stablecoins themselves, thus keeping the yields within the ecosystem.

● Platform providers are transitioning from passive conduits to active value capture entities.

5. DeFi Tackles the Holy Grail: Unsecured Credit Becomes Possible

For a long time, over-collateralization has been the cornerstone of DeFi lending protocols, severely limiting capital efficiency and practicality. The maturity of zero-knowledge proof technology (zkTLS) is opening the door to unsecured lending. This technology allows users to prove their creditworthiness to lenders without exposing all sensitive financial data (such as bank account details), for example, by showing that their asset balance exceeds a certain threshold.

● Based on this, protocols like JANE have begun to offer instant unsecured credit lines based on verified Web2 financial data (such as bank statements).

● Their algorithms can monitor borrower risk in real-time and dynamically adjust interest rates. This framework is also applicable to AI agents, where the on-chain performance history of the agent can serve as its "credit score" to obtain loans. Maple Finance, Centrifuge, and others are also advancing unsecured or partially secured loans in the fields of corporate credit and real-world assets (RWA).

● By 2026, on-chain credit will transition from concept to widespread infrastructure.

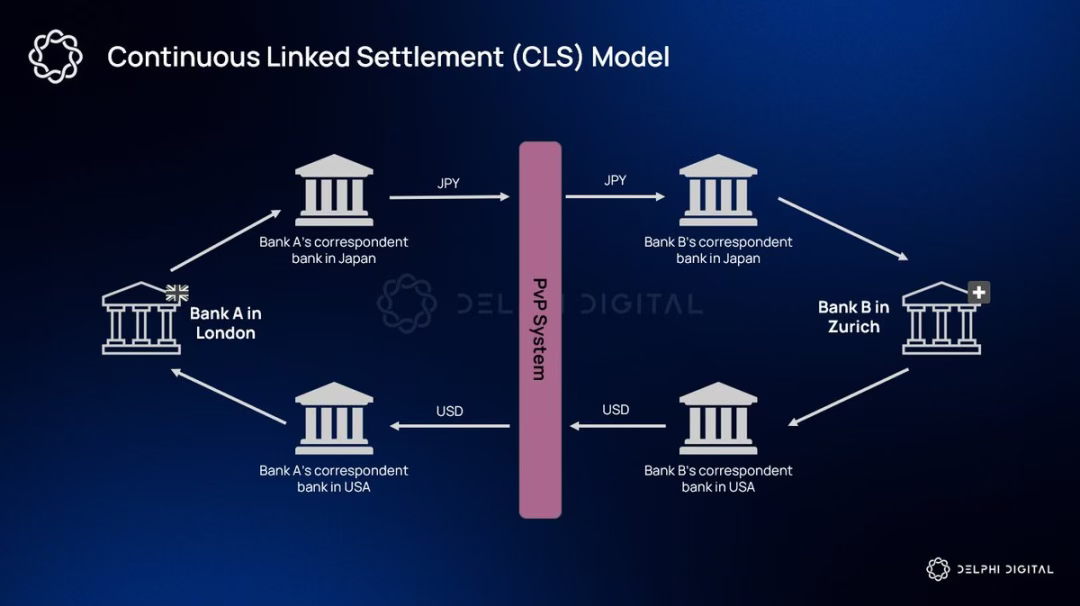

6. On-Chain Forex: Finding Breakthroughs in Emerging Markets

● Currently, the crypto market is almost monopolized by USD stablecoins, but the global forex market is a massive market worth trillions of dollars, characterized by inefficiencies due to numerous intermediaries. On-chain forex, by tokenizing various fiat currencies and placing them on the same settlement layer, is expected to significantly reduce costs and increase speed.

● Its initial product-market fit is likely to emerge in currency pairs from emerging markets where traditional financial services are lacking and remittance and exchange costs are extremely high, such as certain Southeast Asian, African, or Latin American currencies trading against the dollar or euro.

● For users in these regions, the fast, cheap, and traditional bank account-free exchange services provided by on-chain forex have a very clear value proposition. This will become another key battleground for cryptocurrency penetration into global finance.

7. Gold and Bitcoin: Dancing Together Against Currency Devaluation

In the context of the global macroeconomic landscape, long-term concerns about the value of fiat currencies are driving funds toward hard assets. Gold prices continue to strengthen against the backdrop of central banks' ongoing purchases (especially by China), the growth of global money supply, and expanding fiscal deficits, reaching historical highs.

● Historical data shows that the upward trend in gold prices often leads Bitcoin by several months. Together, they form a "narrative alliance" against currency devaluation.

● As major global economies enter a rate-cutting cycle, the end of the Federal Reserve's quantitative tightening (QT), and monetary issues heat up ahead of elections in multiple countries in 2026, it is expected that more funds seeking safe havens and value storage will flow into both the gold and Bitcoin markets, reinforcing their asset attributes.

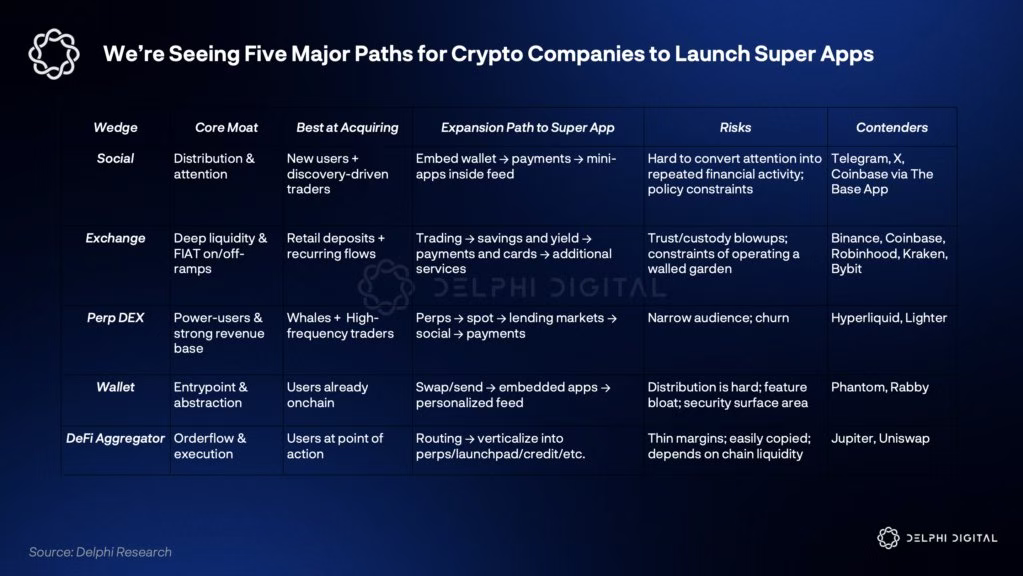

8. The Evolution of Exchanges: The Super App Competition Heats Up

Leading centralized exchanges (CEX) have long surpassed the positioning of mere trading platforms and are fully evolving into "financial super apps" that integrate multiple functions.

● Coinbase has built a complete ecosystem from the underlying operating system (Base L2), front-end interface (Base App), stablecoin yields (USDC), to derivatives (through the acquisition of Deribit). Robinhood has achieved high user stickiness and revenue diversification through its Gold membership subscription service.

● Binance, on the other hand, already has a large user base and payment scale of a super app. The core of the competition lies in who can acquire and retain users at the lowest cost while providing the most comprehensive services. By 2026, the leader in this all-in-one application race may further widen the gap with the followers.

9. Privacy Infrastructure: A Necessary Prerequisite for Mass Adoption

The global regulatory environment's pressure on financial privacy is becoming increasingly evident, as seen in the EU's "Chat Control Act," restrictions on cash transactions, and the design of central bank digital currencies (CBDCs), all reflecting a tendency to strengthen monitoring. Without effective privacy protection, the widespread adoption of crypto assets like stablecoins will inevitably face bottlenecks.

● Fortunately, privacy-enhancing technologies are rapidly developing.

○ PayLink offers privacy-protecting crypto payment cards;

○ Seismic provides protocol-level encryption services for fintech companies;

○ Keeta Network supports on-chain KYC without exposing personal data;

○ Canton Network offers interoperable privacy blockchain solutions for traditional financial institutions;

● The improvement of these infrastructures is key to whether crypto technology can truly become the foundation of global financial freedom and security.

10. Altcoin Differentiation: Value Returns to Fundamentals

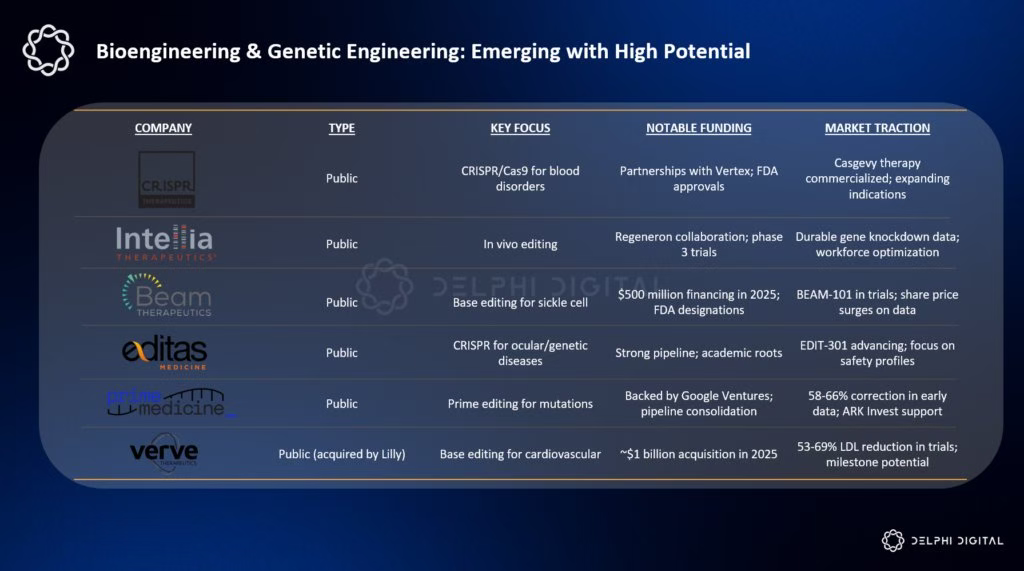

The era of market-wide surges and rising tides is over. In the future, massive token unlocks, capital competition from other tech sectors (such as AI and biotechnology), and the reality that ETF funds are primarily concentrated in Bitcoin and a few large-cap coins will force capital to make more stringent choices.

Funds will increasingly gather around structural advantages: assets with clear paths for ETF fund inflows; tokens that can generate real protocol revenue and conduct value buybacks (such as burning or dividends); and projects that have built solid moats in tracks with real demand and application scenarios, such as AI agents, prediction markets, and on-chain forex. Success will belong to those teams that can prove their economic models are sustainable and can deeply engage in real-world economic activities.

The crypto industry is undergoing a profound paradigm shift. It is no longer just about speculation and marginal innovation but about building the next generation of global financial settlement layers, information layers, and collaboration layers.

Prediction markets, on-chain credit, the autonomous agent economy, and stablecoins as programmable public utilities are vivid manifestations of this transformation. Understanding and engaging in the construction of these foundational changes will be the most promising way to define the financial landscape of the next decade.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。