TL;DR

- The landscape of crypto investment continues to expand, but the range of asset choices for capital is becoming increasingly narrow: Bitcoin's market dominance is on a sustained upward trend, while the growth of stablecoins and on-chain derivatives is continuously squeezing the market space for altcoins.

- The altcoin market is shrinking, with a significant increase in the concentration effect among leading assets: Currently, the top ten altcoins by market capitalization account for about 82% of the total market capitalization of the sector, a substantial increase from 70% five years ago.

- Since 2023, the performance of large-cap cryptocurrencies has significantly outperformed mid-cap and small-cap coins; the flow of funds after market fluctuations has further reinforced investors' preference for high liquidity and mature leading assets.

The landscape of crypto investment is still expanding. Hundreds of new tokens are launched each year, the number of stocks related to digital asset businesses is continuously increasing, and tokenization technology is gradually bringing traditional assets like stocks and commodities onto the blockchain. However, as investment choices become more abundant, market capital has become increasingly selective.

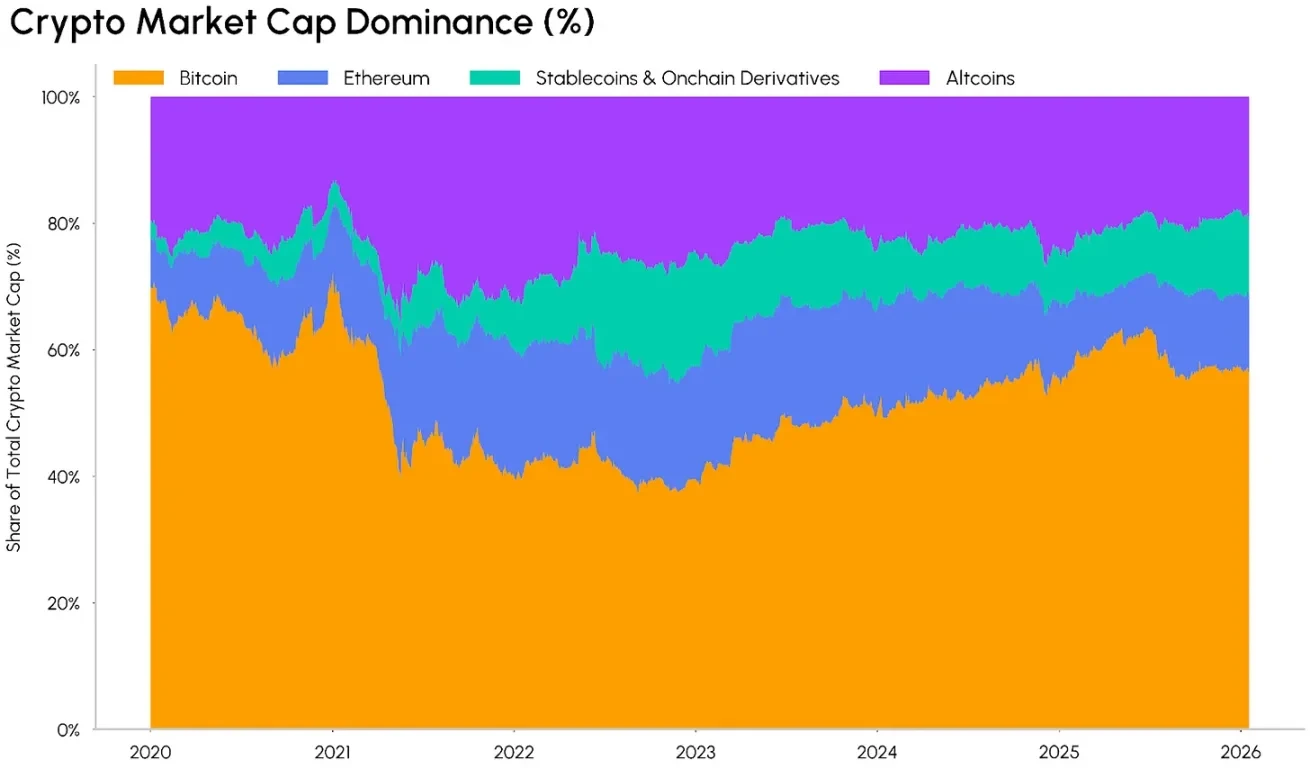

Bitcoin's market dominance has rebounded to around 65%, reaching its highest level since early 2021; at the same time, the market capitalization of stablecoins and on-chain derivatives (such as wrapped tokens, staked tokens, cross-chain bridge tokens, etc.) now accounts for nearly 12.5% of the total crypto market capitalization. Therefore, altcoins are facing dual pressure; despite the increasing number of tokens, their total market share is shrinking.

This issue of the "Current State of the Network Market" report will explore whether the crypto market is undergoing a structural shift towards capital concentration. We will analyze the trends in market dominance and return performance of assets across different market capitalization tiers and sectors to investigate whether capital is continuously gathering towards fewer, larger, and more mature tokens, or if investment opportunities are still widely distributed.

Trends in Market Dominance

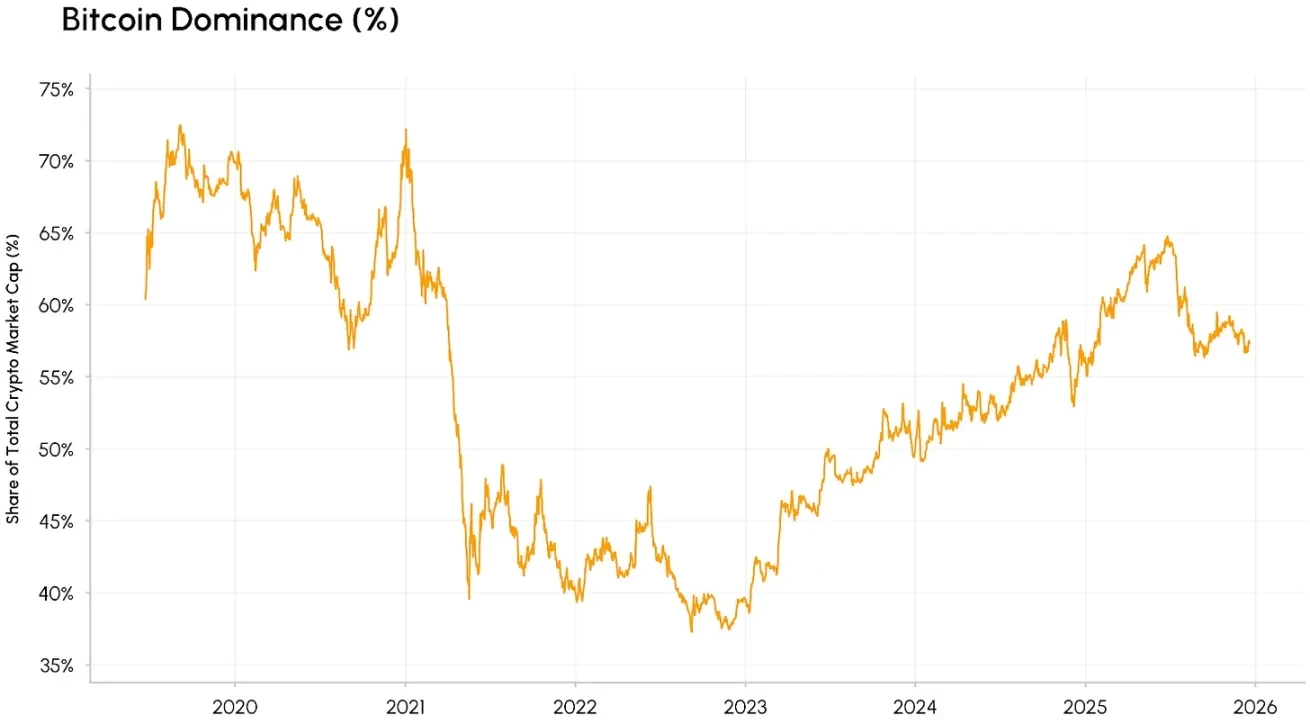

First, we will analyze the trends in market dominance. Bitcoin's market dominance (i.e., the proportion of Bitcoin's market capitalization relative to the total market capitalization of the crypto market) climbed to 65% in 2025, marking a new high since 2021. Notably, this growth is not a short-term spike but has shown a long-term steady increase since hitting a low in 2022.

The launch of Bitcoin spot ETFs has deepened the institutionalization process, attracting over $150 billion in long-term capital, which has further propelled its market dominance. This trend solidifies Bitcoin's position as a "safe-haven asset" in the crypto market and makes it a high liquidity, regulated entry point for traditional institutional investors. Compared to previous bull markets where "altcoin seasons" quickly diluted Bitcoin's market share, this round of Bitcoin's dominance appears more sustainable.

Bitcoin Dominance, Data Source: Coin Metrics

The structure of other assets in the crypto market is also changing. Currently, stablecoins with a market capitalization exceeding $300 billion and on-chain derivatives are continuously increasing their share of the total market capitalization. These tokens serve different functions in the crypto ecosystem: stablecoins are the primary medium of exchange in the market, while on-chain derivatives provide investors with rights to claim returns on underlying assets or create income-generating channels.

Distribution of Market Dominance in the Crypto Market, Data Source: Coin Metrics

As a result, the altcoin market is facing a dilemma. The range of investable assets is continuously narrowing, and the concentration effect among leading assets is becoming more pronounced: market value is increasingly concentrating on assets with higher liquidity and more mature development, which often have clear application scenarios, defined regulatory development paths, and can fully benefit from the development trends of stablecoins, decentralized finance (DeFi), and asset tokenization.

Unlike previous market cycles, the speed of capital rotation from mainstream coins to altcoins has significantly slowed in this round, with ETFs and various institutional investment tools firmly locking market liquidity into leading assets. However, with the implementation of universal listing standards and the introduction of altcoins and multi-asset ETFs broadening investment channels for more large-cap altcoins, combined with the advancement of market structure-related legislation, this market landscape may undergo a transformation.

The "Monopoly of Giants" Trend Within the Altcoin Sector

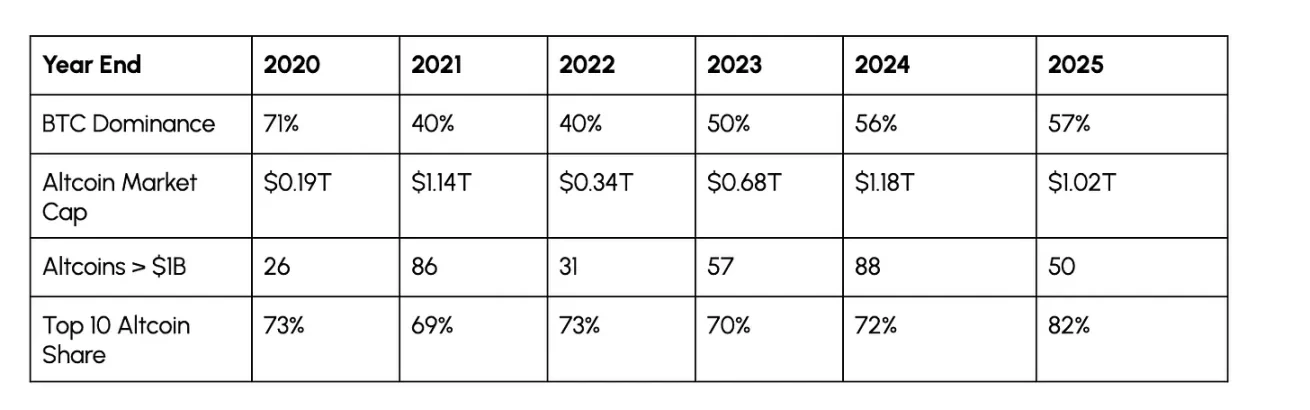

Even within the altcoin sector, the trend of capital concentration is intensifying. Currently, the top ten altcoins by market capitalization (excluding Bitcoin) account for about 82% of the total market capitalization of the sector, a significant increase from 64% during the 2021 bull market. In the last bull market, a large number of small-cap altcoins that briefly created value gradually exited the market, replaced by a sector structure with a stronger concentration effect, and the lifecycle of various short-term market narratives has continuously shortened, making it difficult to sustain rising asset values.

Proportion of Market Capitalization of the Top 10 Altcoins, Data Source: Coin Metrics

We can also observe this concentration trend by looking at the number of tokens that break through specific market capitalization thresholds. Although the total market capitalization of the crypto market has repeatedly set historical highs, the number of altcoins with a market capitalization exceeding $1 billion has decreased from about 105 at the peak in 2021 to about 58 currently. This means that even though the total number of assets in the market is increasing, the number of truly "investable" altcoins is continuously decreasing. While this does not mean that the altcoin sector is heading towards decline, the focus of market capital may further concentrate on assets with solid fundamentals and stronger risk resistance.

Number of Altcoins with Market Capitalization Exceeding $1 Billion, Data Source: Coin Metrics

The table below summarizes the annual evolution characteristics of the aforementioned market trends. Some indicators still exhibit cyclical characteristics, such as Bitcoin's market dominance falling during bull markets and rising during bear markets, but the market share of the top ten altcoins has shown a different trend: from 2020 to 2024, regardless of market conditions, this proportion has remained stable at 69%-73%, while in 2025, it surged to 82%. This change indicates that the market is undergoing a structural shift towards mature leading assets, rather than merely a short-term behavior of "chasing quality assets."

Data Source: Coin Metrics

Capital Flow to Mainstream Coins

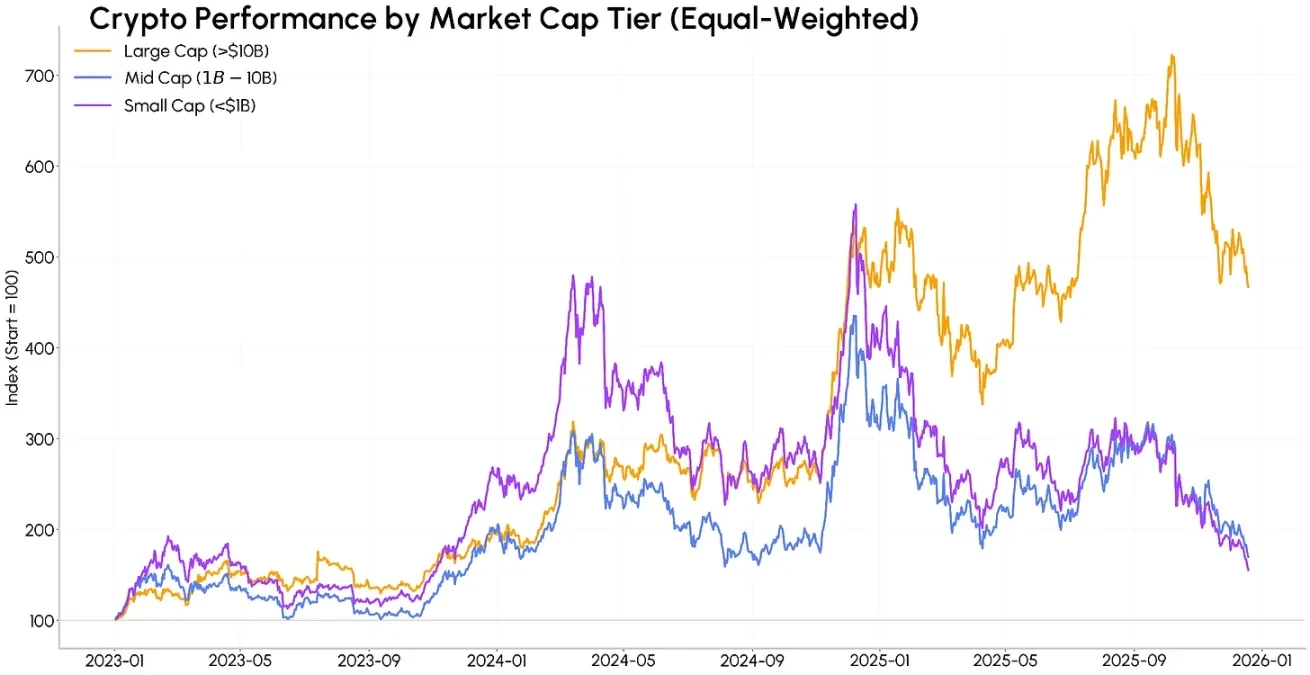

This trend of capital concentration is also reflected in asset return performance. Since 2023, mid-cap coins (market capitalization of $1 billion - $10 billion), especially small-cap coins (market capitalization below $1 billion), outperformed large-cap coins (market capitalization over $10 billion) in both early and late stages of 2024, but this trend experienced a sharp reversal in 2025, driven by the rapid decline of market sentiment towards meme coins and other short-term narrative rotations.

On a weighted basis, from January 2023 to the present, the overall return rate of large-cap cryptocurrencies is about 365%, while the return rates for mid-cap and small-cap coins are only about 70% and 55%, respectively, with most of the earlier gains being given back. This phenomenon of return differentiation fully illustrates that market performance is increasingly leaning towards mature, liquid assets, making it difficult for small-cap tokens to replicate the sustainability of gains seen in previous cycles.

Market Performance of Tokens of Different Market Capitalization Sizes, Data Source: Coin Metrics

On October 10, 2025, the market experienced a large-scale liquidation event triggered by high-leverage positions and liquidity exhaustion. This event may further reinforce the trend of capital leaning towards defensive assets, with investors increasingly favoring high liquidity assets rather than significantly more volatile small-cap assets.

Conclusion

All data indicate that the crypto market is in a phase of structural change, gradually maturing and moving towards consolidation. Although the number of assets in the crypto market continues to increase, and the types of traditional assets it supports as underlying infrastructure are becoming more diverse, the overall liquidity in the market remains limited. At the same time, in multi-asset investment portfolios, crypto assets must compete for space with popular investment themes in the stock market and traditional safe-haven assets like gold.

Currently, capital is continuously gathering towards large-cap cryptocurrencies, as well as the infrastructure sector that supports stablecoins, tokenized assets, and decentralized finance. The importance of liquidity and scale has further increased compared to the past, raising the threshold for altcoins to attract long-term capital significantly.

Of course, if market structure-related rules become clearer, and altcoins and multi-asset ETFs continue to gain popularity, along with improvements in the market liquidity environment, there is still a possibility of a new round of altcoin seasons. However, it can be anticipated that the beneficiaries of this round of altcoins will be more concentrated, and the choices of capital will be more selective than in any previous cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。