🧐 RWA has been on-chain for two years, but what really gets the money moving might be TermMax | Basic Introduction and Latest Activity Guide for Earning Points——

@xhunt_ai now has a real-time hot topics section that allows us to see the discussion intensity of many projects:

TermMax @TermMax has consistently been at the forefront of activities;

Activity entrance: https://leaderboard.termmax.ts.finance/smart-earn

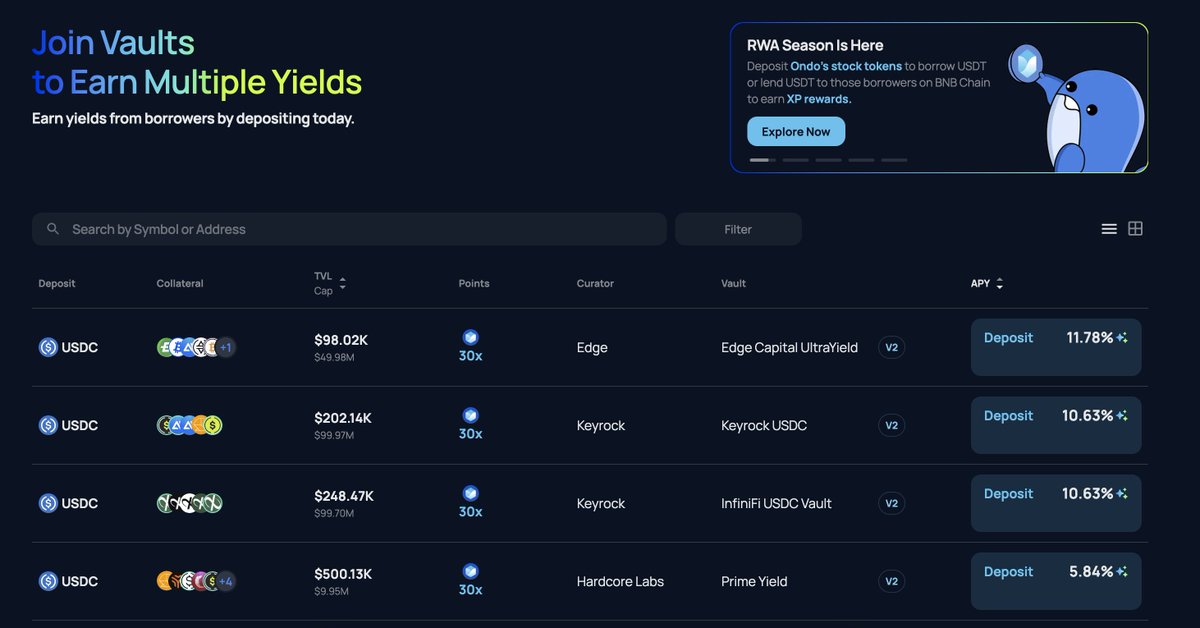

Currently, you can earn XP points through check-ins, Vault deposits, and lending; earn AP points by engaging in futures leveraged trading in the Alpha market; create tweets related to TermMax to earn MP points;

Check-in creation is a zero-risk way to earn points, highly recommended for participation;

Lending and Alpha market futures leveraged trading carry risks and volatility, so please choose to participate at your own discretion. I will clarify the relevant principles and risk points below.

Let’s also discuss what TermMax does and why its activities are so popular?

1️⃣ Why I increasingly feel that TermMax is very important for the long-term development of RWA.

Yesterday, I shared a piece of news about NYSE stocks being systematically tokenized.

Many people might think: moving US stocks on-chain is just basic operation, and it has been popular for a long time, but there are many directions that people have not seen:

For the past two years, the narrative of RWA has been stuck in an awkward position: assets are on-chain, but the money lacks the DeFi link, making it impossible to move efficiently.

TermMax can actually fill this gap; it is the liquidity infrastructure of the RWA era, an important link.

In simple terms, it brings fixed interest rates from traditional finance into DeFi, solving the problems of fragmented liquidity, interest rate volatility, and the inability to combine strategies.

Currently, TermMax has deeply integrated with Ondo Finance @OndoFinance, supporting a batch of designated Ondo tokenized US stock / ETF assets as collateral (specifics are subject to the official current support list),

Lending out USDT or other stablecoins.

The most critical point here is: fixed interest rates mean that borrowing costs are locked in from the start, without worrying about market fluctuations causing interest rates to soar.

This is super scarce in the current DeFi: floating rate protocols like Aave and Compound cannot compare, especially for institutional-level RWA assets, where certainty is key.

Why do I say this?

2️⃣ The real difficulty of RWA may never lie in compliance;

When many people talk about RWA, their first reaction is: regulation, licenses, compliance paths, legal structures.

These are certainly important, but if you really think from the perspective of institutions, family offices, and finance departments, what are they most afraid of?

Not volatility, but uncertainty.

Especially: uncertain financing costs, which is why I have always felt that trillion-level RWA assets cannot stay long-term in a floating rate DeFi system.

In simple terms: if you let someone holding US stocks, ETFs, or US Treasuries use Aave or Compound, where the interest rates fluctuate with sentiment, you are essentially increasing the type of risk they dislike the most, because they are risk-averse.

To put it bluntly: what DeFi players find exciting is exactly what RWA funds avoid at all costs.

3️⃣ What TermMax is doing:

What it is doing is something that is completely normal in TradFi but extremely scarce on-chain: seriously bringing the concept of "fixed interest rates" back on-chain.

Without banks, without central matching, without balance sheets, how to achieve “fixed interest rates”? It is actually very counterintuitive; TermMax uses a three-token structure.

AMM pricing + quasi-zero interest bond design; the final result can be summed up in one sentence: when you borrow money, you already know what the cost is.

This sentence is very common for DeFi, but extremely important for RWA. This is why the combination of TermMax × Ondo is crucial; before Ondo appeared, RWA was more like a "showpiece."

After Ondo, RWA truly began to change: assets that can be collateralized, combined, and used in DeFi.

But the problem immediately arises: holding $NVDA, $AAPL, ETFs, what happens after going on-chain? If you can only borrow money at a floating rate, then essentially you are just replaying the problems of TradFi in a different place.

TermMax collateralizes Ondo's tokenized US stocks / ETFs, lending out USDT, and in this process, the interest rate is locked in from the start, without worrying about waking up to find costs doubled.

4️⃣ From two perspectives, who exactly does TermMax solve problems for?

For borrowers:

You are no longer betting on interest rates, not betting on liquidity, nor betting on when the system will act up.

What you are doing is making a very clear judgment:

Am I willing to hold or hedge US stocks for a period of time at a certain cost of X%?

This is very familiar to many US stock traders and hedge strategy players. But TermMax allows it to happen on-chain.

For lenders:

TermMax's Ondo-only Vault is also very straightforward: your USDT is lent to people who are collateralizing real stocks, not relying on token inflation, not relying on new incentives, but coming from real-world financing needs.

At this stage, this kind of yield structure is rare in DeFi.

5️⃣ Why is its emergence important?

I think three backgrounds are overlapping:

1) The world has entered a phase of "preventive easing";

2) The speed of RWA assets going on-chain has significantly accelerated;

3) Institutions are seriously looking for "fixed income on-chain."

In this environment: floating rates are not friendly to risk assets, while fixed rates have become the entry threshold.

So I prefer to see TermMax as a foundational protocol rather than a project chasing trends.

6️⃣ About recent earning activities:

Finally, let’s talk about the hottest activity recently in the Xhunt discussion area:

Activity entrance: https://leaderboard.termmax.ts.finance/smart-earn

TermMax has launched the “DeFi Renaissance” activity (code-named The Great Awakening), releasing incentives in phases; we are currently in Phase 1 early bird period, with a very low threshold.

Phase 1: Renaissance Passport (1/13 - 1/25)

Core: Complete 2/3 tasks (Task 3 is mandatory):

Task 1: Screenshot floating rate fluctuations/liquidation alerts, post on X with #TermMax #DeFiRenaissance

Task 2: Use the official template to compare TermMax vs Aave/Morpho, post on X with an explanation.

Task 3: Nominate DeFi KOL.

Submit through the form to earn the “Initiate” role + 60,000 XP + additional voting rights for Phase 2. Purpose: community consensus, early bird entry ticket.

Phase 2: KOL Strategy Simulation (1/26 - 2/8)

20-30 KOLs simulate strategies, users vote + post on X to share. Rewards based on participation.

Phase 3: Community Game - Chaos vs Order (running in parallel until 2/8)

Team Chaos: floating rates;

Team Order: fixed rates.

Decisions based on interactions (likes/shares/views/comments), winners share a pool of 100,000 MP + 1.5x XP multiplier.

Debates and confrontations revolve around liquidation, risk, and order, essentially using gamification to help everyone understand: which is more suitable for RWA, the "disorder" or "order" of DeFi.

7️⃣ Personal judgment

The next phase of DeFi that truly emerges will not rely on higher APYs, but on lower uncertainty.

If RWA is really to become a part of DeFi, then fixed rates are probably an unavoidable hurdle.

TermMax may not be the only answer, but at least it has placed the problem in the right direction.

Let’s continue to complete the tasks; for those who can participate, let’s get the XP running first, as it is relatively simple now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。