Article edited on January 21, 2026, at 17:30. All opinions do not constitute any investment advice! For learning and communication purposes only.

Self-discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the farther they go. I am Fuzhu, deeply analyzing mainstream coin trends, breaking down market logic with professional accumulation, and providing pragmatic trading ideas.

Market Overview

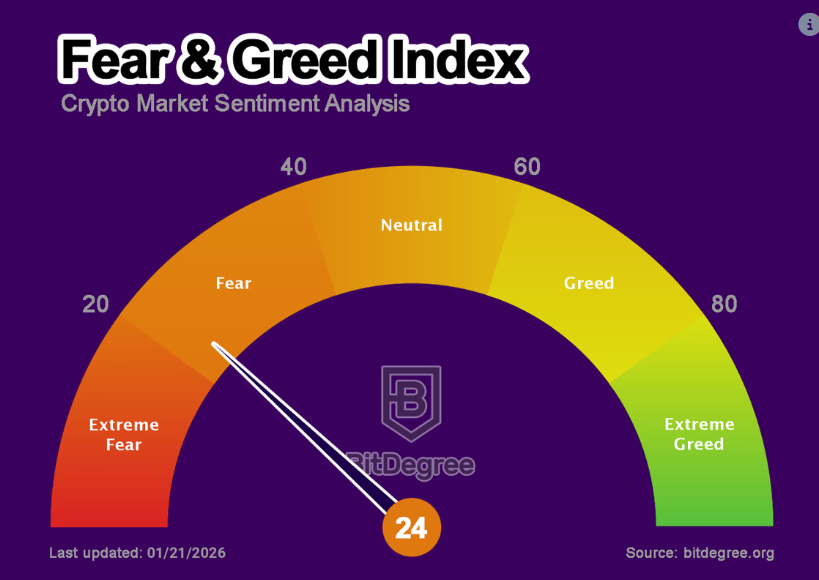

Today, the cryptocurrency market is under overall pressure, with the total market capitalization shrinking to about $3.1 trillion, a decrease of about 3.4%-3.8% in 24 hours, and a trading volume of about $120 billion. Bitcoin has fallen below the $90,000 mark, down 3%-3.2% in 24 hours; Ethereum has slid to around $3,000, down about 4%-6.6% in 24 hours. Market sentiment has turned to extreme fear (the Fear and Greed Index has dropped to 24), triggered by Trump's "Greenland Tariff" threat (a 10% tariff on the EU, effective from February 1), leading to a global risk aversion that wiped out about $120-150 billion in market value. Altcoins like Solana (SOL) and XRP have seen even sharper declines (6%-8%), with the GameFi sector leading the drop.

Fundamentals

Although today was hit hard by the tariff turmoil, institutional giants are swooping in like hungry wolves! Last week, net inflows into digital asset investment products reached a record $2.17 billion, with Bitcoin ETFs being the main draw. Despite some recent outflows, overall institutional inflows have exceeded $87 billion. The fundamentals of BTC face short-term pressure, but long-term support remains relatively strong.

Policy Aspect

Today, Trump's "Greenland Fantasia" has turned things upside down! The President threatened to impose a 10% tariff on Denmark and seven other European countries (increasing to 25% in June), triggering panic over a trade war, causing hundreds of billions in crypto market value to evaporate. The EU is poised to retaliate with a potential €93 billion tariff, leading to a global flight from risk assets, exacerbated by quantitative tightening. Japanese bonds plummeted, and the VIX soared above 20, with crypto assets being the first to bear the brunt.

But there is a silver lining behind the clouds! Although the CLARITY Act has been delayed, the GENIUS Act, aimed at limiting stablecoin yields, is pushing for clearer regulations. China is strengthening legislation on virtual currencies, with institutions accelerating adoption; Harvard and the Abu Dhabi sovereign fund have already entered the market. In the short term, the "tariff nuclear bomb" dominates, while mid-term regulatory improvements act as a catalyst—crypto is moving from "wilderness" to "mainstream fortress"!

Technical Analysis

BTC is currently consolidating around $89,000. Last night, it experienced a downward fluctuation, quickly dropping to around $87,700 in the early session, then rebounding to near $90,000 before retracing again. The market's focus has shifted to whether it can reclaim this position. Technically, if it cannot return above the $91,000-$92,800 range, weakness may continue. Key support is around $85,000.

On the daily level: MACD shows a death cross but is accompanied by whale accumulation, with a reversal probability of 65%. KDJ continues its death cross, and the lower Bollinger band support is effective. Support is at $87,000; if it breaks, it could drop to $86,000-$85,000. Resistance is at $90,000. For short-term operations, we consider setting up short positions near $90,000, targeting $89,000-$86,000. Ethereum: $3,000 has transformed from support to a strong resistance level. If it breaks below $2,900, it may further test down to $2,600. In terms of operations, we set up short positions near $3,000, targeting $2,900-$2,800. (Remember to control contract positions within 10% and set stop-losses.)

Disclaimer: The above content is personal opinion, and strategies are for reference only, not as investment basis. Any risks taken are at your own discretion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。