Selected News

Selected Articles

In today's world where quantitative trading is all the rage in the stock market, most people believe these cold algorithmic robots are the ruthless harvesters of Wall Street, continuously extracting the hard-earned money of retail investors who misjudge due to emotional biases or information asymmetry at millisecond speeds. However, in an emerging market over the past 48 hours, several top quantitative robots with nearly perfect profit curves collectively broke down, while a mysterious account named a4385 raked in $280,000 from it. This market is called the prediction market, and a trader named a4385 showcased a meticulously planned hunt against quantitative robots to the world.

In the past 24 hours, discussions in the crypto market have shifted from macro narratives to specific ecological events, with a clear focus and noticeable divergence. Mainstream topics center around the excitement brought by airdrops and DeFi governance upgrades, while the WLFI governance controversy and Trove's explosion have heightened market vigilance regarding transparency and fund security. In terms of ecological development, Ethereum strengthens institutional narratives and stablecoin imaginations, the Perp DEX track accelerates competition around incentive mechanisms and cost reduction optimization, and the competition for on-chain liquidity further intensifies.

On-chain Data

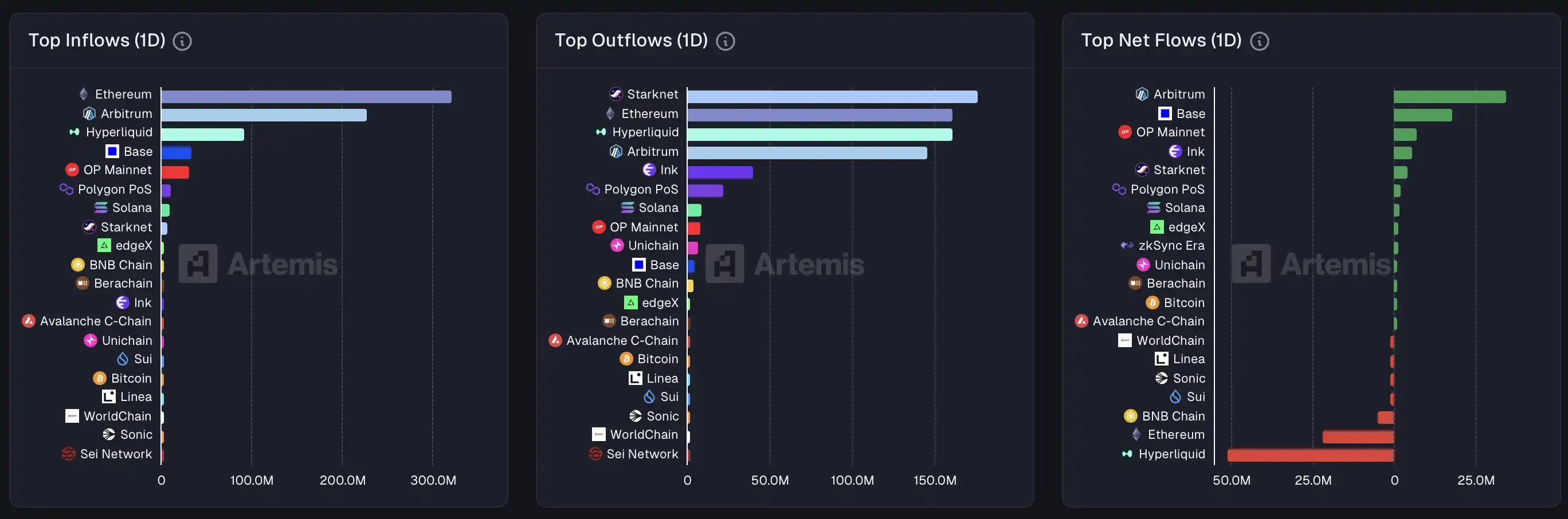

On-chain capital flow situation for the week of January 21

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。