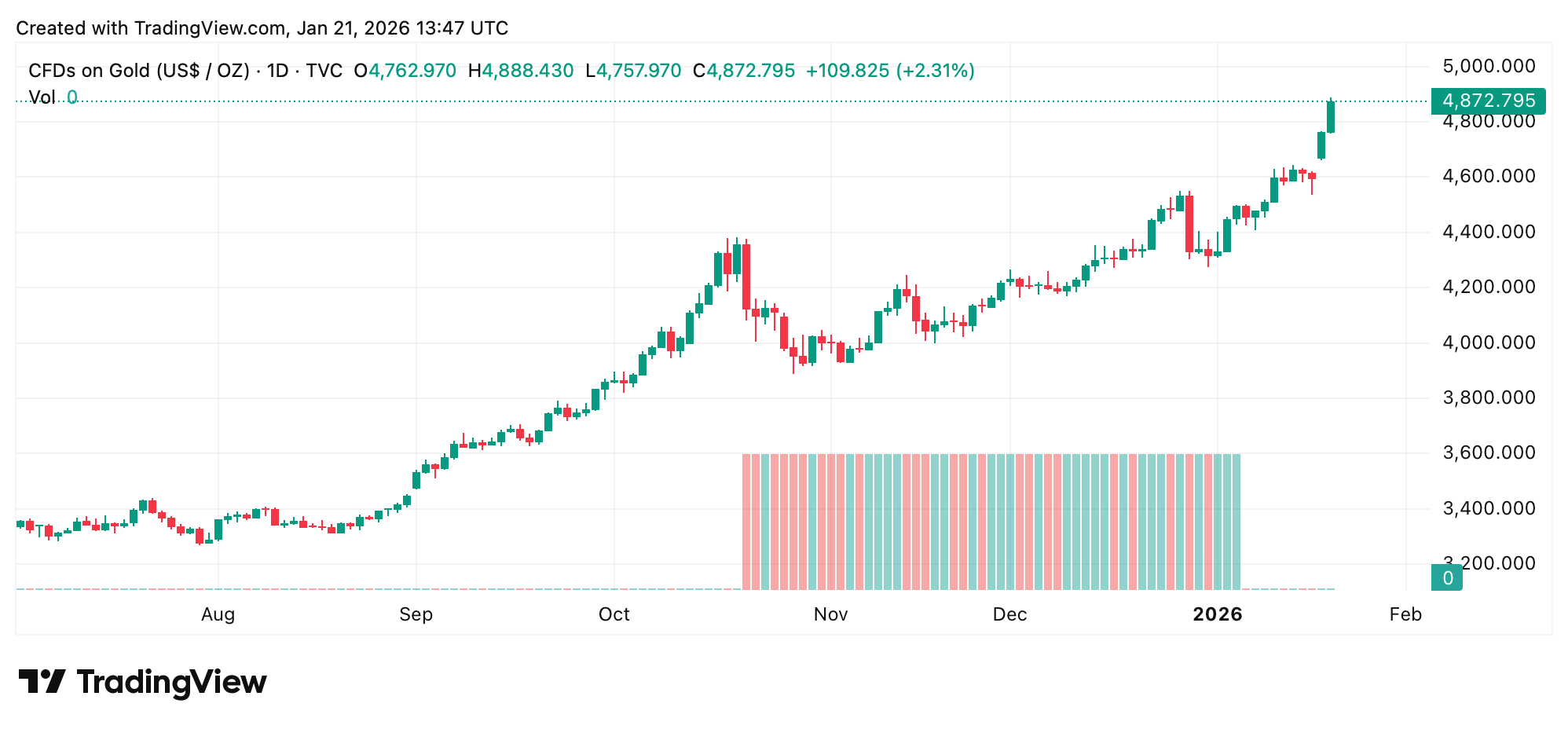

At 8:50 a.m. Eastern time, gold is changing hands at $4,872, while silver is flirting with triple digits at $94.91. The move has been fueled by geopolitical turmoil, trade-war jitters, and growing chatter that the fiat monetary regime may be cracking at the seams.

With those pressures piling up, analysts and market watchers expect precious metals to keep climbing as investors rush toward hard assets. Wednesday shows gold still pressing higher, while silver—fresh off last week’s eye-popping run—appears to be catching its breath.

Bloomberg’s lead commodity analyst Mike McGlone says silver is behaving exactly as it always does—dramatic, unruly, and deeply allergic to moderation. In his view, the metal’s face-melting sprint has effectively hit the brakes on its own supply squeeze, with a near-historic breakdown in the gold-to-silver ratio suggesting things moved a bit too far, a bit too fast.

McGlone argues silver’s infamous nickname as the “devil’s metal” is earning its keep once again. According to a report from the London Bullion Market Association (LBMA), experts think gold could “average 38% above last year’s levels.” LBMA researchers add that expectations are being driven by U.S. central bank easing and a steady drift by central banks away from the dominant greenback.

LBMA’s report laid out a wide-ranging outlook, with a bearish call of $3,450 an ounce for gold and an extremely bullish target of $7,150. “Geopolitical tension continues to cement gold’s role as the world’s premier safe haven,” the LBMA annual Precious Metals Analyst Survey noted this week.

Also read: Bitcoin Teeters at $88K as Bulls and Bears Lock Horns in a Volatile Showdown

In short, gold and silver are still being treated as sturdy bets for 2026, even after punching through record levels above $4,850 for gold and $95 for silver, largely because geopolitical tensions refuse to cool. Pressure from U.S. tariff threats aimed at Greenland and Europe, the risk of flare-ups involving Iran and Venezuela, and President Trump’s jabs at Federal Reserve independence are all feeding safe-haven demand.

Whatever the angle, gold and silver are acting less like quick-hit trades and more like barometers for global anxiety. With geopolitical risks humming, central banks loosening policy, and faith in fiat systems wearing thin, hard assets remain front and center.

Even after sharp rallies and pauses to catch their breath, precious metals keep commanding attention as investors hedge uncertainty, hinting that 2026 could continue to favor those looking for shelter beyond traditional monetary channels.

- Why are gold and silver prices hitting record levels in 2026?

Geopolitical tensions, trade disputes, and central bank easing are pushing investors toward hard assets as confidence in fiat currencies weakens. - What is driving silver’s move toward $100 an ounce?

Strong investment demand and a sharp shift in the gold-to-silver ratio have lifted silver, even as short-term consolidation suggests a pause. - How high could gold prices go next, according to analysts?

The London Bullion Market Association outlines a wide range, with forecasts stretching from $3,450 to as high as $7,150 an ounce. - Why are investors favoring precious metals over fiat assets?

Ongoing geopolitical risk, tariff threats, and doubts about central bank independence are reinforcing gold and silver’s role as safe havens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。