It has indeed come to an end, and Trump's TACO has appeared once again.

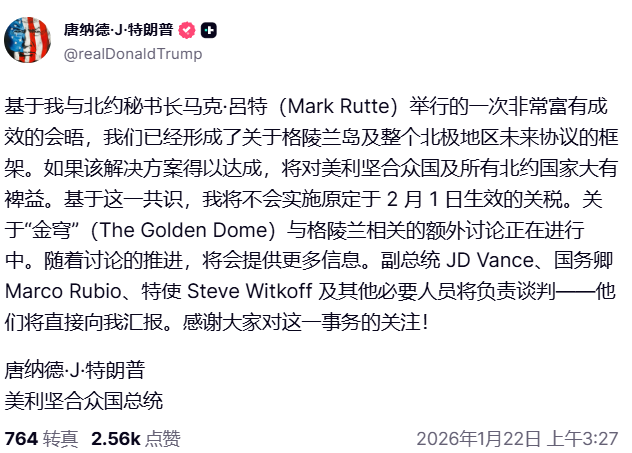

Just now, Trump publicly stated on Truth Social that he will not implement the Greenland tariff on February 1.

The heated trade war between Europe and the U.S. should be over. Following the announcement, both the U.S. stock market and $BTC experienced a rapid rebound, which once again proves the direct correlation between Bitcoin and the U.S. stock market. When the U.S. stock market, especially tech stocks, rebounds, BTC at least does not perform poorly.

From the current situation, the U.S. stock market has completely recovered from Tuesday's decline. Although Bitcoin's rebound is not as strong as that of the U.S. stock market, it is also sprinting towards $90,000. If nothing unexpected happens, it shouldn't be a problem for it to return above $90,000 tomorrow in the Asian time zone.

This can be seen as a unity of knowledge and action. I bought one BTC at $90,000. Unlike my usual principle of only buying and not selling, I plan to try short-term trading with this BTC. I have made a contract, so I will use one BTC for an experiment. I am prepared for losses when buying this $BTC, and if the price drops, I will hold onto it. If the price starts to rise, I will consider short-term trading.

Let’s treat it as an attempt.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。