Week 3 of 2026 Bitcoin On-Chain Data Changes — Trump’s Ballots and Investors’ Pockets

Actually, this tweet was supposed to be written yesterday, but I spent a lot of energy writing about the impact of Trump's Greenland tariffs on the market, so I decided to save it for today. I initially thought it would be a heavy topic to write about, but unexpectedly, Trump's TACO in the early morning eased the pressure.

In fact, over the past week, investors' enthusiasm for cryptocurrencies has been quite good, which also validates the performance we've been tracking with data. Although there was a decline due to negative expectations regarding inflation, the price of $BTC has remained relatively strong around $90,000, which is currently seen as a support area.

The events in Venezuela two weeks ago and Greenland last week point to one conclusion: Trump is starting to worry about ballots, especially as his tariff policies may be challenged by the Supreme Court. Trump urgently needs actions to reverse his disadvantage and regain votes. While the challenges in Venezuela are significant, he has indeed found some success, and regarding Greenland, although it has been a long-standing wish of the U.S., it seems he may have mishandled it.

Back to the data level.

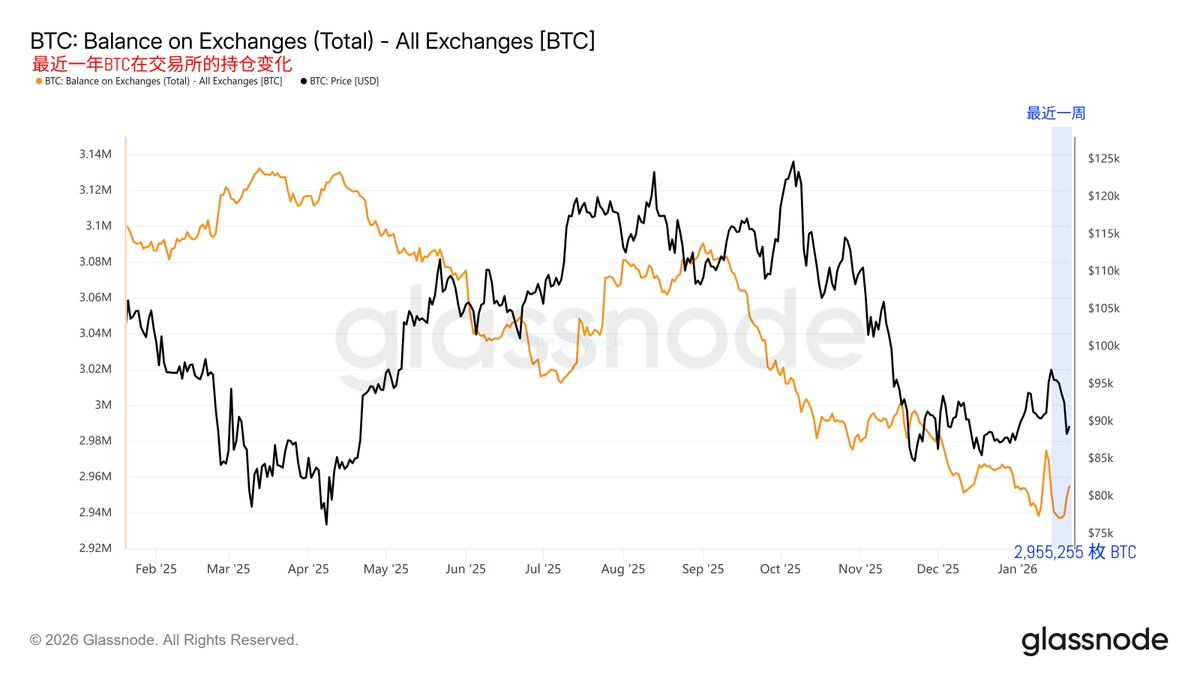

Recent Year’s Bitcoin Inventory on Exchanges

The inventory on exchanges is one of the data points I pay the most attention to, and it has been consistent for a long time because this data represents the sentiment of Bitcoin holders. As I mentioned earlier, investors' sentiment towards $BTC has been quite good over the past week. Although there have been slight fluctuations due to price volatility, the overall trend has not triggered panic among investors.

Even when Trump announced tariffs on Greenland-related countries last Sunday, causing a drop in Bitcoin prices, there were still no signs of mass selling. Instead, as BTC prices fell, the inventory on exchanges reached its lowest point in the past year.

From this data, it can be seen that the majority of BTC holders have very stable sentiment; short-term price fluctuations will not make them give up their holdings. Instead, lower prices may encourage investors to buy the dip.

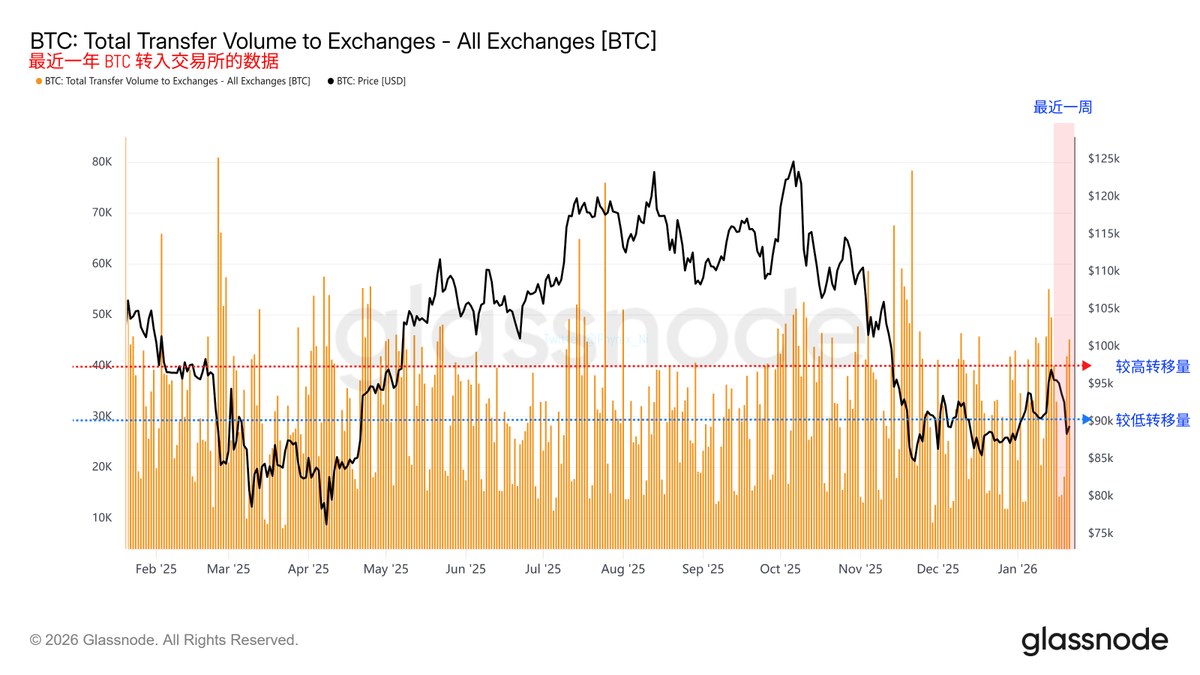

Recent Year’s Bitcoin Transferred to Exchanges

Last week, we mentioned that the events in Venezuela led to a rise in Bitcoin prices. Although buying pressure was strong, selling pressure was also relatively high. A week later, it is clear that investors' selling has decreased. Moreover, this trend is not only observed when prices rise; even when prices fall, the selling pressure transferring to exchanges is decreasing.

The data from the past year clearly shows that when $BTC prices are relatively low, investor selling decreases, unless triggered by independent events. If it is a natural price fluctuation, it has become difficult for investors to part with their holdings at lower prices.

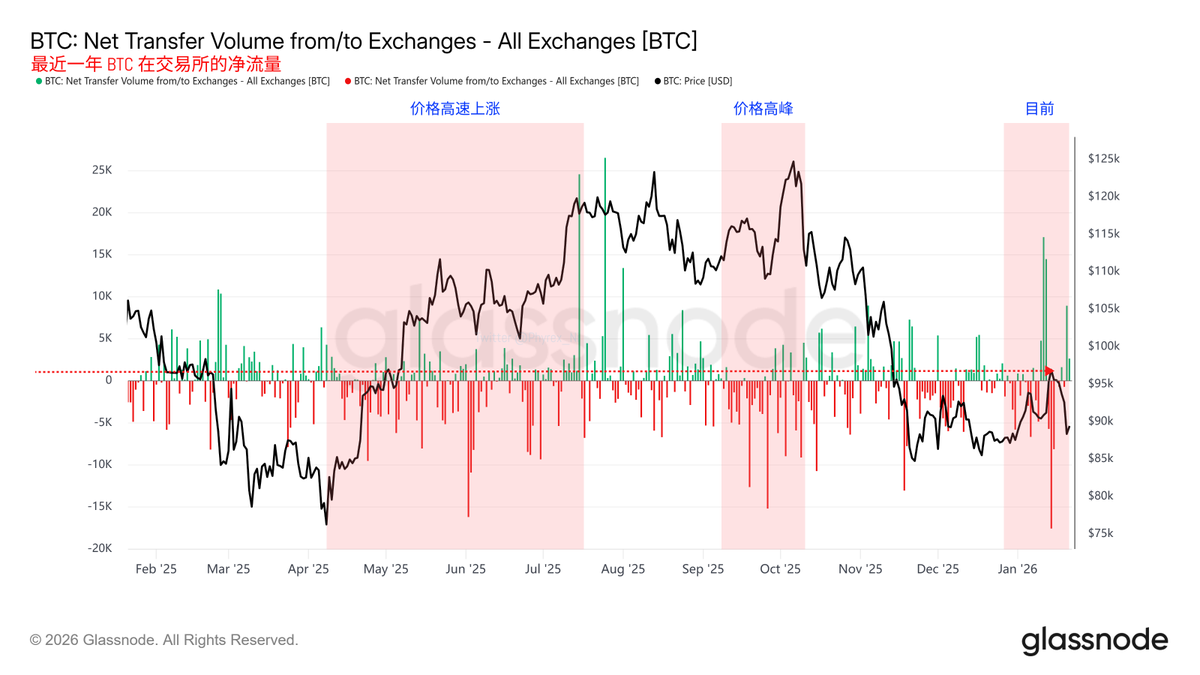

Recent Year’s Net Flow of Bitcoin on Exchanges

Although events may lead to concentrated selling by a few investors, it can be seen that buying pressure remains very strong in this case. From this data, even though the price of $BTC is still fluctuating around $90,000, it is evident that investor sentiment has not entered a bearish trend. Whenever there is significant selling, there is also corresponding significant buying.

In the tweet from the day before yesterday, I mentioned that if the European tariffs are implemented, the consequences would be greater than the impact of the Chinese tariffs. However, the current decline in sentiment appears to be much lighter than in April. Investors' confidence in 2026 is clearly greater than in 2025.

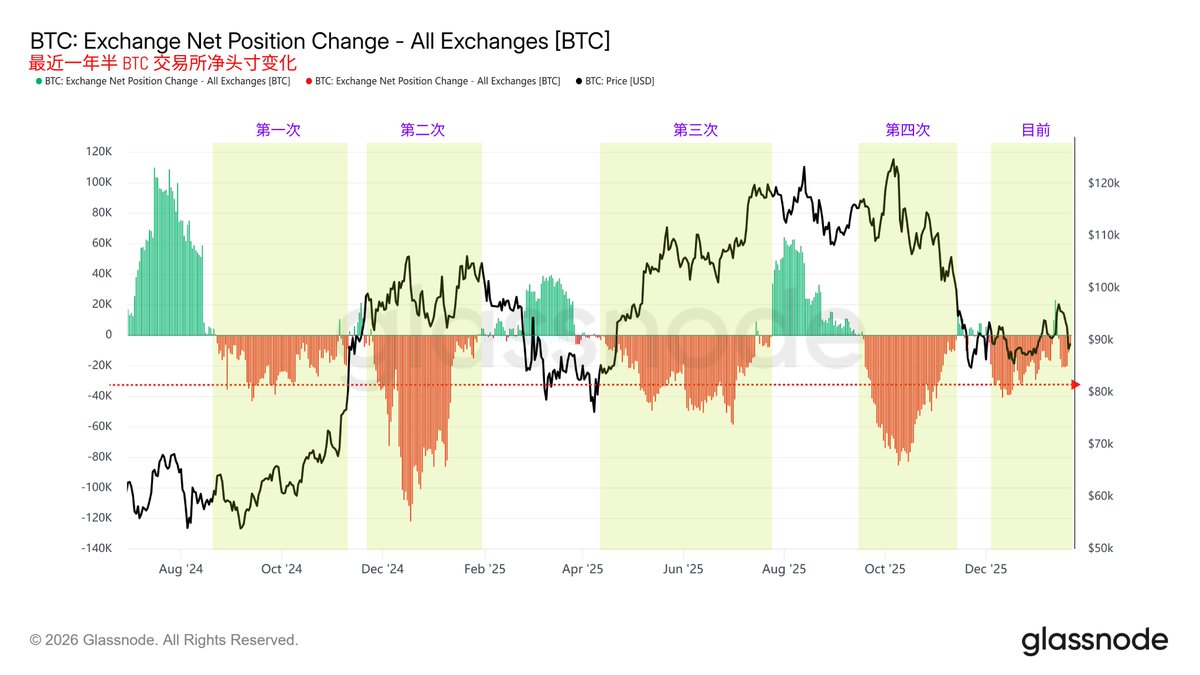

Recent Year and a Half Bitcoin 30-Day Average Inventory Data on Exchanges

Of course, some friends may ask, when can we expect an explosive rise? Unfortunately, from the current data, although investor stability is strong and sentiment is good, with even strong buying power, it cannot be denied that the overall level of buying power is still in a very low range compared to the past year.

On one hand, Trump is causing disruptions, preventing the market from settling down; on the other hand, U.S. stocks are indeed performing better, with more funds starting to shift to U.S. stocks. Therefore, $BTC is still just a little brother to tech stocks, without a significant influx of funds. Last week’s events in Venezuela barely brought in funds, but unfortunately, Greenland’s situation extinguished that trend.

The main reason remains the Federal Reserve's monetary policy, as we have yet to see a real trend towards rapid interest rate cuts. Even if investors choose U.S. stocks, it is due to the strength of AI. As a safe-haven asset, only when the Federal Reserve truly enters a rapid rate-cutting cycle and investors' risk appetite increases will more funds flow into the cryptocurrency space.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。