Written by: Xu Qian, Jin Weilin

Introduction

In recent years, more and more people have gained considerable profits through cryptocurrency trading, but many are still wondering: Do the earnings made in anonymous wallets or decentralized exchanges need to be taxed?

To get straight to the conclusion: If you are a tax resident of China, you should, in principle, declare and pay taxes to the Chinese tax authorities on any cryptocurrency earnings obtained through any channel.

How is "Chinese Tax Resident" Defined?

According to the Individual Income Tax Law of the People's Republic of China, individuals who meet any of the following conditions are considered tax residents of China:

1. Have a domicile in China

A domicile refers to individuals who habitually reside in China due to reasons such as household registration, family, or primary economic interests.

If your household registration or family center is in China, or if your main life, work, and economic connections are in China, you may be recognized as a tax resident even if you frequently stay overseas.

2. Reside in China for a cumulative total of 183 days within a tax year

This is a clear time standard. Even if you are a foreign national, as long as you reside in China for a cumulative total of 183 days within a year, you are considered a tax resident of China.

Mankun Reminder:

Whether you are recognized as a tax resident due to "domicile" or "residence time," once you meet the conditions, you are required to declare and pay taxes on your global income (including both domestic and foreign income) to China in accordance with the law.

Why Do Cryptocurrency Earnings Also Need to Be Taxed?

Many people believe that since cryptocurrency is restricted in China, related earnings are "not taxable," which is a common misconception. Tax authorities are concerned with whether you have earnings, not whether those earnings come from an encouraged industry.

1. What is the nature of cryptocurrency?

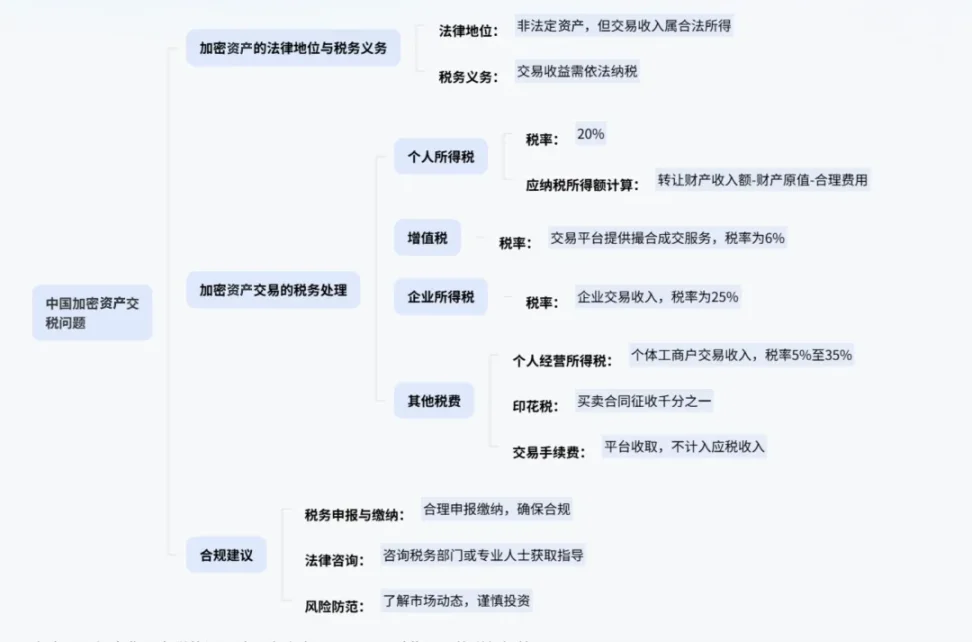

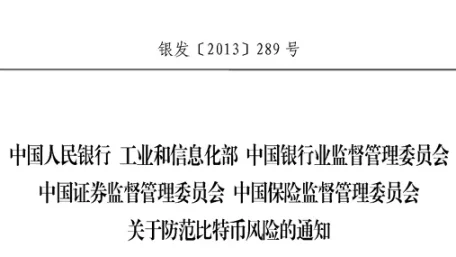

According to the Notice on Preventing Bitcoin Risks issued by the People's Bank of China and other five ministries (Yin Fa [2013] No. 289), the Announcement on Preventing Risks of Token Issuance Financing issued by the People's Bank of China and other seven ministries on September 4, 2017, and the Notice on Further Preventing and Dealing with Risks of Virtual Currency Trading Speculation issued by the People's Bank of China and other ten ministries on September 24, 2021, virtual currencies cannot circulate as currency, but their property attributes as "virtual goods" are not denied. In other words, the law recognizes it as a tradable asset.

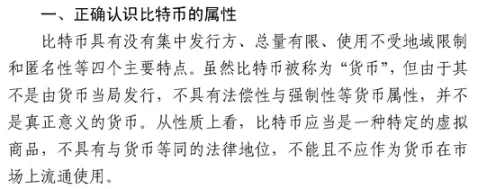

2. What are the corresponding tax regulations?

The State Administration of Taxation's reply on the issue of individual income tax for income obtained from buying and selling virtual currencies online (Guo Shui Han [2008] No. 818) clearly states: Income obtained by individuals from buying and selling virtual currencies online is classified as "income from property transfer" and is subject to individual income tax in accordance with the law.

3. Conclusion and Tax Rate

Therefore, regardless of which cryptocurrency you buy or sell, as long as the transaction generates profits, this portion of the earnings is classified as "income from property transfer" and is subject to individual income tax at a rate of 20%.

In short: Tax authorities do not differentiate by industry; they only look at earnings. Profits from cryptocurrency trading are classified as income from property transfer and must be declared and taxed at 20%.

Do You Need to Declare Earnings from Anonymous Wallets and DEX Trading?

Some investors believe that using decentralized wallets (like MetaMask) or trading on decentralized exchanges (like Uniswap) is anonymous, making it impossible for tax authorities to track. However, in the current regulatory and technological environment, this belief carries significant risks.

1. Fund flows can still be tracked

The vast majority of investors will ultimately convert their cryptocurrency into fiat currency through OTC or compliant platforms and transfer it to domestic bank accounts.

Once the funds enter the banking system, they come under the supervision of tax authorities. Especially for large amounts and frequent transactions, it is easy to trigger the bank's risk control system, which may attract the attention of tax departments.

2. International tax information exchange mechanisms have become normalized

China has joined the CRS (Common Reporting Standard for Automatic Exchange of Financial Account Information) and has implemented automatic tax information exchange with hundreds of countries worldwide. If you have accounts at overseas exchanges or banks, the relevant account information may have already been exchanged back to the Chinese tax authorities.

3. The "Golden Tax Phase IV" has strengthened data supervision capabilities

The "Golden Tax Phase IV" system utilizes big data, AI, and other technologies to achieve data networking among multiple departments, including taxation, banking, customs, and industry and commerce. The system can automatically compare individual declared income with actual consumption and asset situations, and once significant discrepancies are found, it will trigger tax alerts.

Therefore, even if trading occurs on-chain or overseas, as long as the final earnings enter your name or are used for living expenses in some form, there is a risk of being discovered by tax authorities and being required to pay back taxes.

What Are the Consequences of Not Declaring Cryptocurrency Earnings?

If the tax authorities discover that you have not declared overseas cryptocurrency earnings, you may face the following legal consequences:

1. Payment of back taxes and late fees

The tax authorities will order you to pay the taxes owed but not paid, and according to Article 32 of the Tax Collection and Administration Law of the People's Republic of China, a late fee of 0.05% per day will be charged (approximately 18.25% annualized), with the accumulated amount increasing over time.

2. Facing tax penalties

- If deemed "not having filed a tax declaration," a fine of up to 2,000 yuan may be imposed; for more serious cases, a fine of between 2,000 yuan and 10,000 yuan may be imposed.

- If deemed "tax evasion" (refusing to declare or making false declarations after being notified), a fine of up to five times the amount of unpaid or underpaid taxes may be imposed.

3. Possible criminal liability

If the amount of tax evasion is large and exceeds 10% of the taxable amount, and you still do not pay after the tax authorities issue a collection notice, it may constitute the crime of tax evasion, leading to criminal liability.

Mankun Reminder:

Not declaring cryptocurrency earnings may seem "concealed," but it actually carries multiple risks. From high late fees and substantial fines to potential criminal liability. It is advisable to proactively comply with declarations to avoid subsequent legal and financial risks.

Mankun Suggestions

If you have ever gained profits from trading cryptocurrencies, especially if funds have already flowed back to domestic accounts, Mankun lawyers suggest that you:

1. Proactively organize transaction records

It is recommended that you try to compile a clear transaction history, including the time, quantity, and price of purchases and sales, and retain key evidence that can prove the "cost" of the assets, such as bank transfer records, exchange transaction details, on-chain transaction hashes, etc.

The more complete the cost evidence, the more accurate the calculation of taxable income will be, and the tax burden will be more reasonable.

2. Consider proactive declaration or self-inspection

If you have not yet received a notification from the tax authorities, you can declare through the "Individual Income Tax" APP or on the Natural Person Electronic Tax Bureau website.

According to regulations, declarations should be submitted to the tax authority in charge of the location of your employment; if you do not have an employment unit, you can handle it with the tax authority at your household registration location, habitual residence, or primary income source.

If you have received reminders from the tax authorities via SMS, phone calls, etc., please cooperate actively, truthfully explain the source of funds, and prepare transaction records and other relevant supporting materials.

3. Retain all transaction vouchers

Develop the habit of long-term preservation of transaction screenshots, wallet addresses, transfer records, exchange bills, and other materials. These are not only the basis for calculating taxes but also key evidence for explaining and proving the authenticity of transactions during tax audits.

4. Plan reasonably within compliance

If you trade frequently and in large amounts, consider tax planning within the legal framework, such as managing assets through compliant structures or legally applying tax treaties. It is advisable to consult professional tax lawyers or accountants during this process to ensure that the plan is sound and feasible.

Conclusion

In today's world, where the digital economy and globalization intertwine, tax compliance has become a necessary course for every investor. Although the world of cryptocurrency carries a "decentralized" flavor, tax obligations do not disappear as a result.

Proactively understanding regulations, truthfully declaring income, and properly preserving evidence is not only a respect for the law but also a long-term protection of your assets and credit safety.

If you have questions or need assistance regarding cryptocurrency taxation, seek professional support as early as possible to ensure steady progress on the path of compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。