According to Cryptoquant, new whales—large-scale investors who entered the market within the last five months—now command a larger share of bitcoin’s realized cap than the “OG” whales who have held through multiple market cycles. This milestone marks a fundamental shift in the digital asset landscape: The market’s direction is no longer dictated by the “diamond hands” of the past, but by the nervous capital of the present.

Realized cap, which calculates the aggregate cost basis of all bitcoin ( BTC) based on when it last moved, shows that a massive volume of BTC has recently changed hands at premium prices. These new whales—entities holding more than 1,000 BTC with coins younger than 155 days—now represent the dominant force in the market’s capital structure.

Read more: The Supply Sink: Why Bitcoin Exchange Reserves No Longer Dictate the Price Trend

However, this dominance comes with a catch, the Cryptoquant report notes. While old whales enjoy an average cost basis of roughly $40,000, these new market leaders entered the fray much higher.

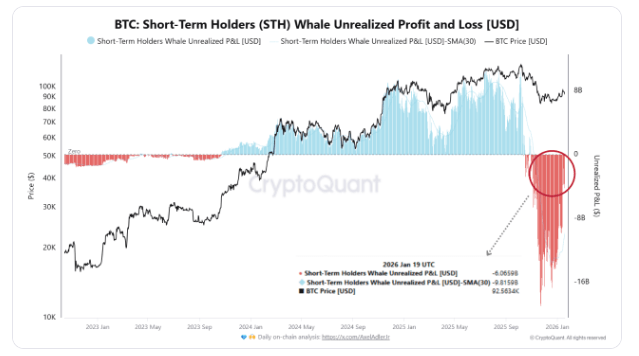

The report asserts that current market volatility is a direct reflection of this new cohort’s financial stress. Data shows the realized price for these new whales sits at approximately $98,000. With the spot price currently trading below that mark, this group is sitting on nearly $6 billion in unrealized losses.

Unlike the OG whales who are accustomed to bitcoin’s characteristic volatility, these newer institutional and high-net-worth players are showing signs of weak hands. Pointing to on-chain data, the report argues that new whales have been the primary source of realized losses since the recent market peak.

Rather than holding through the dip, they are using short-lived price rebounds to exit positions, choosing risk management over long-term conviction. Because this cohort holds the most realized capital and exhibits the highest turnover, its behavior creates a distribution regime that stalls upward momentum.

The disparity between the two whale classes has never been more stark. While the new whales are scrambling to mitigate losses, the old guard remains largely unfazed. The report asserts that the marginal supply—the bitcoin most likely to be traded at any given moment—is now firmly in the hands of the most emotionally and financially exposed group in the ecosystem.

Until the market can either absorb these $6 billion in losses or see this cohort reach a point of total capitulation, bitcoin’s price action will likely remain tethered to the defensive maneuvers of its newest big players, the report concludes.

- What changed in bitcoin’s whale landscape? New whales now hold more realized cap than OG whales.

- Who are the new whales? Investors with 1,000+ BTC acquired within the last 155 days.

- Why is the market under pressure? New whales face nearly $6B in unrealized losses at ~$98K cost basis.

- How does this affect bitcoin’s price? Their defensive selling stalls upward momentum and drives volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。