Good evening everyone, I am Xin Ya. The volatility yesterday was particularly good. After each round of unilateral movement, there was such good volatility due to the struggle between the scavenger team and the trapped positions, and good volatility will attract new positions to enter. So, we will continue to have a good time. I just want to say, I hope you all paid close attention to the tendencies and the several important positions given yesterday. This way, you might be able to make a profit on the back and forth.

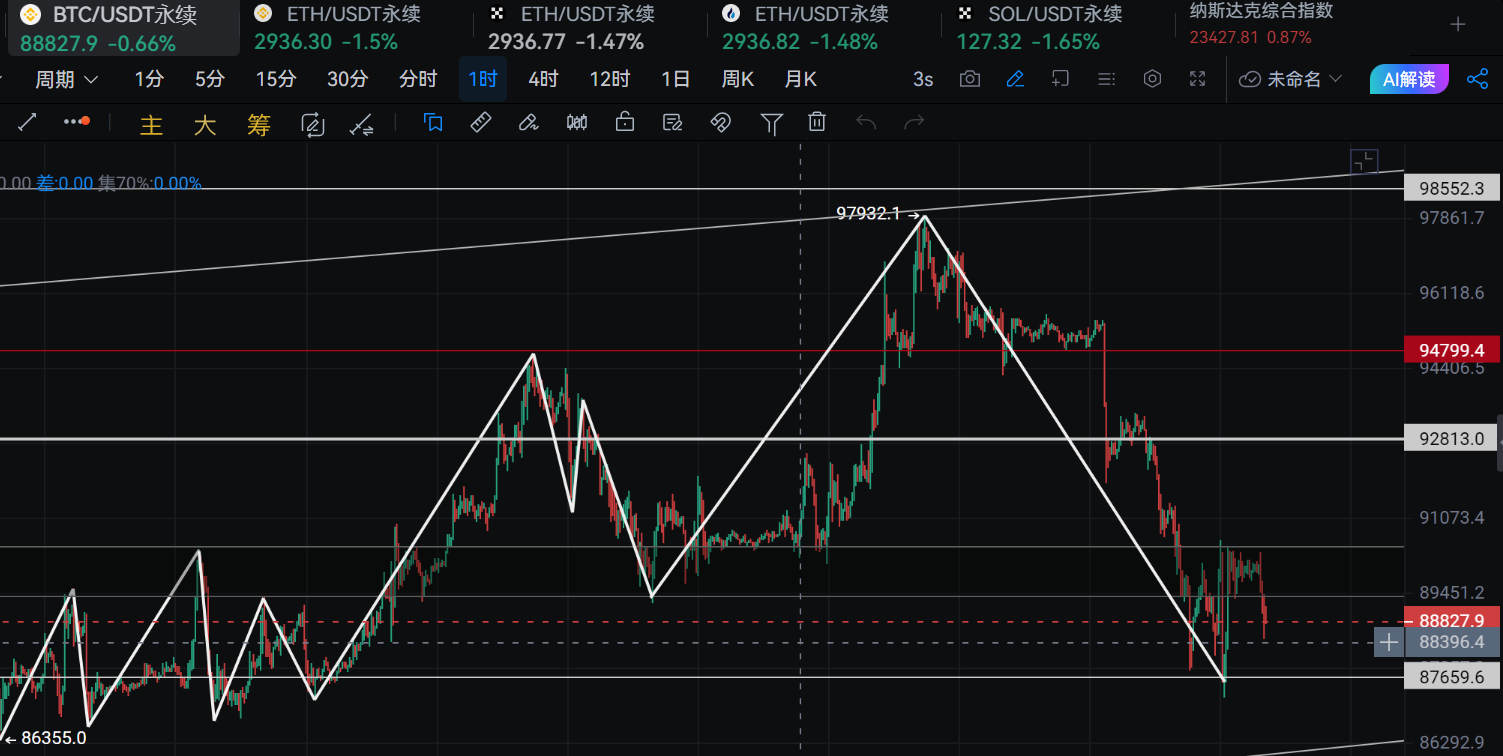

Let's briefly review. On January 21st, at 10 PM, Bitcoin's buying pressure surged to 90,500, where it faced resistance from the upper edge of the previous market. The next bearish candle refreshed the low, dropping to around 87,200. Short sellers took profits, and three one-hour bullish candles brought the price back to around 90,500, continuing until 8 PM tonight. Bitcoin has been closely following the one-hour EMA30, with narrow consolidation around 90,000. After 9 PM, three waves of selling pressure pulled the price back to around 87,500, returning to the previous day's starting point.

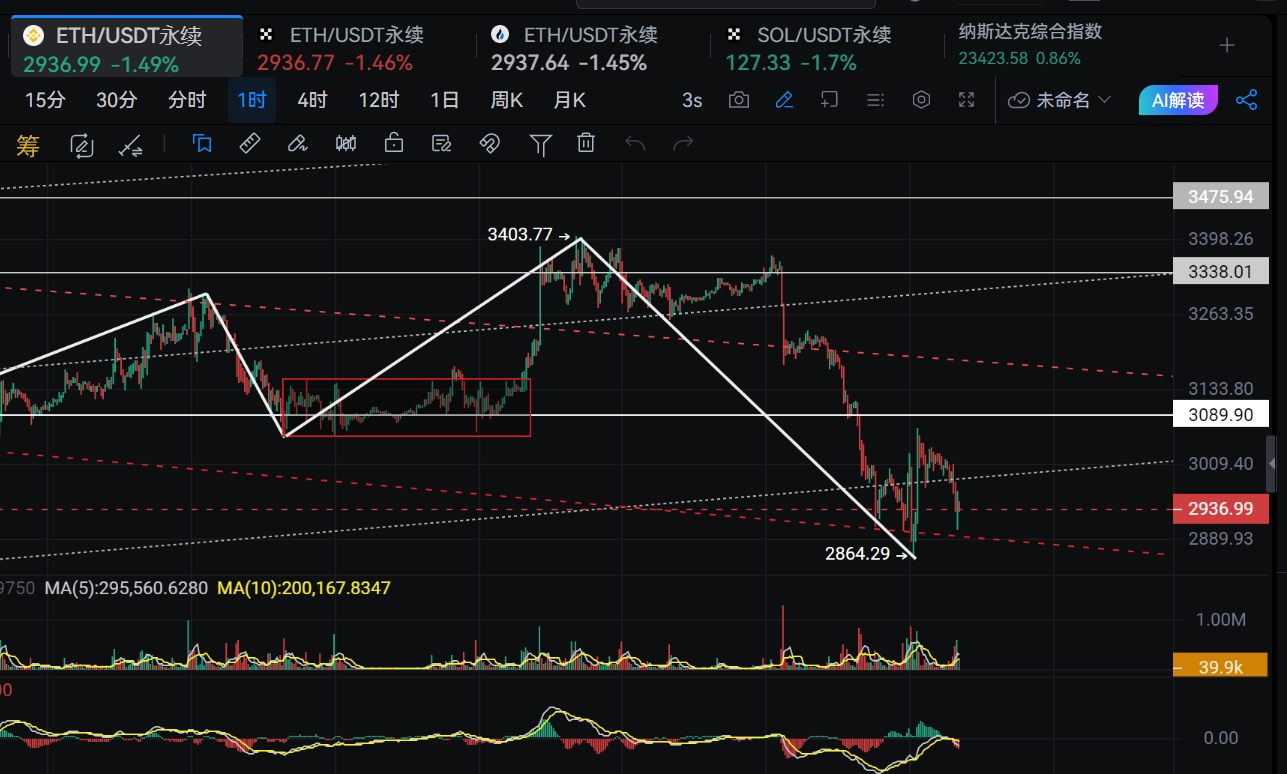

Ethereum's pattern is very similar, still showing its old nature, dropping deep and bouncing hard. The first resistance level was at the one-hour EMA30, at the 3,000 round number. After dipping to around 2,850, it bounced back to around 3,070 and then fell back to consolidate in the 2,980-3,030 range. After breaking the EMA30 at 9 PM, it dipped to 2,900, and has currently closed bullish. Looking at the four-hour chart, the buying support is still quite strong. However, you cannot deny that the cost and price of this strong phase are very high, so it is advisable to focus on going long, with a wide stop loss to allow for some margin of error.

It is recommended to pay attention to the upper level of Bitcoin around 89,500, and the lower level around 97,800. You can consider entering around 88,500, adding to your position at 87,500 with a stop loss set below 86,800. For Ethereum, focus on the lower level of 2,886 and the upper level of 3,008, as well as around 3,050. The market is inclined to consolidate and oscillate upwards. You can start making some trades in the range of 2,930 to 3,000, which is expected to become a high-frequency oscillation zone. We cannot rule out 90,000 and 3,050 becoming pressure points, but taking positions on the left side always has the highest risk-reward ratio.

Moving forward together: Public account, Xin Ya talks about trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。