Today's homework is a bit uncomfortable. In the early hours, Trump directly TACO'd, and I also bought the dip. I originally thought that since Trump had TACO'd, Europe would start to communicate properly, but that wasn't the case. I don't know if it's because Trump's words are too hard. I mean, you could have just found a way to step down, but instead, you insisted on trying to regain it verbally. As a result, Europe began to sell off American assets, and the head of the Nordic pension fund directly stated that the risk premium for holding U.S. assets has increased.

This has made the market continue to feel uneasy. Although the pressure from tariffs has temporarily eased, if Europe withdraws investments from the U.S., the impact on the market will be significant. Once European funds switch U.S. assets from a low-risk preference to requiring a higher risk premium, the three anchors—U.S. stocks, U.S. bonds, and the U.S. dollar—will be pulled simultaneously.

More critically, this will turn the tariff issue from a one-time shock into a longer narrative. Europe is starting to factor geopolitical and policy uncertainties into the pricing model for U.S. assets. Once this is written into the investment committee's framework, it won't be something that can be resolved in just a couple of days. Therefore, the market's pain point moving forward is not whether the tariffs have been lifted, but whether funds are willing to accept a higher capital cost for the U.S. If Europe really is reducing allocations, the rebound in risk assets will resemble a technical correction rather than a trend-based inflow.

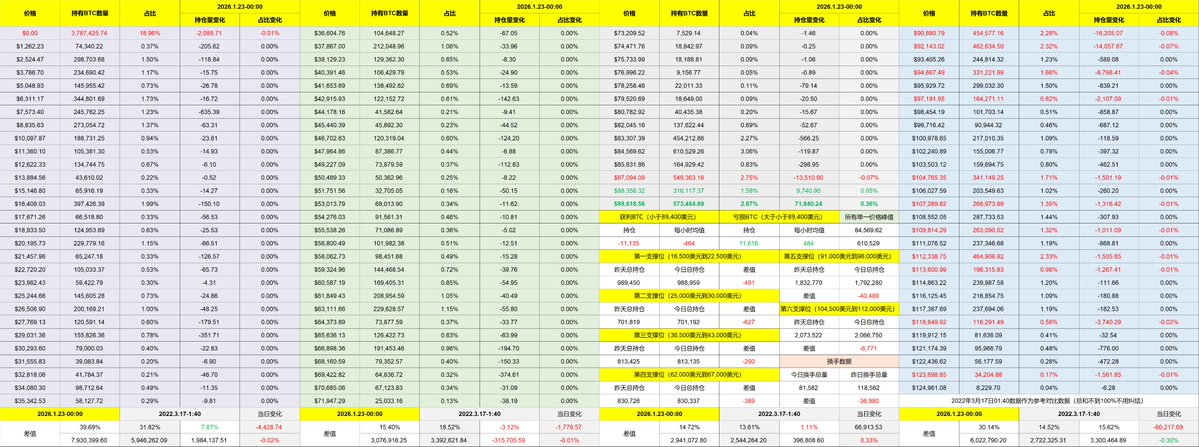

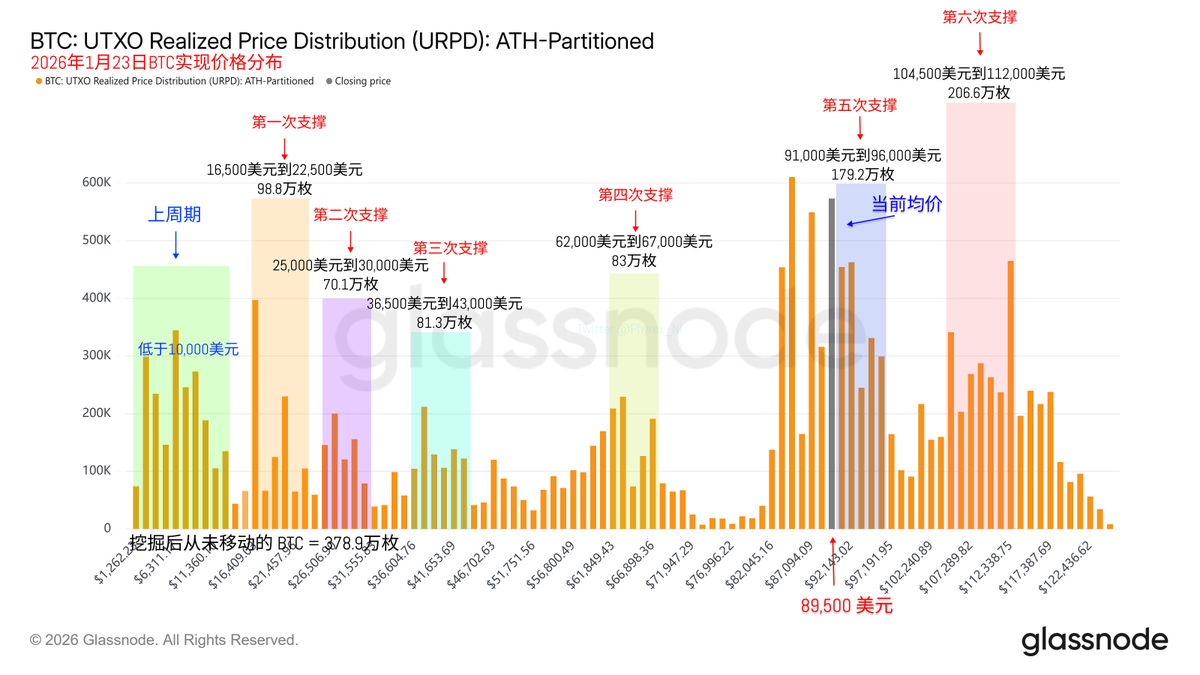

Looking back at Bitcoin's data, the turnover rate is still quite low, with the main sell-off still coming from short-term investors. Investor sentiment remains relatively stable, and there are no signs of deepening panic. After all, from the current situation, the tariff crisis has been resolved, and now it seems to be a strong retaliation against Trump, hoping for a quick resolution.

The chip structure remains very stable, and there are no signs of collapse. Moreover, more chips are gathering around the $90,000 mark. Currently, the accumulation between $83,000 and $92,000 is a bit excessive, and it is also evident that the willingness of holders to sell is relatively low.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。