Global digital asset markets appear set for powerful, sustained growth as blockchain adoption gains momentum worldwide. That bullish outlook is outlined by Ark Investment Management in its Big Ideas 2026 report released this week, which forecasts sweeping expansion across cryptocurrencies and smart contract platforms over the next decade.

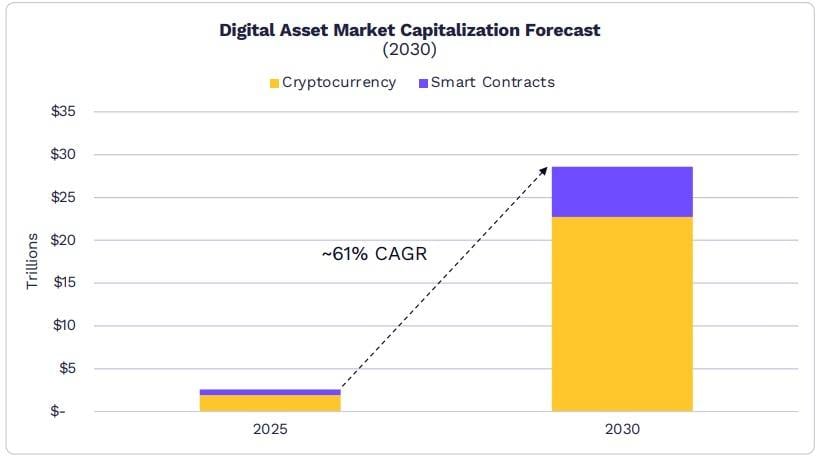

“Digital assets could reach $28 trillion in market value in 2030,” Ark wrote. The report details a base-case scenario in which total digital asset market capitalization rises from roughly $2 trillion in 2025 to approximately $28 trillion by 2030, implying an estimated compound annual growth rate of about 61%, as shown in Ark’s market capitalization forecast chart. The company explained:

“The market for smart contract networks and pure-play digital currencies—the latter which serve as stores of value, mediums of exchange, and units of account on public blockchains—could grow at an annual rate of ~61% to $28 trillion in 2030.

“We believe bitcoin could account for 70% of the market, the balance dominated by smart contract networks like Ethereum and Solana,” the company added.

Ark Invest’s digital asset market cap forecast from Big Ideas 2026.

The chart visually breaks down this projection, showing cryptocurrencies expanding to roughly $22 trillion to $23 trillion by 2030, while smart contract platforms grow to an estimated $5 trillion to $6 trillion. The steep upward trajectory between 2025 and 2030 underscores Ark’s view that digital assets are entering a period of rapid, compounding adoption.

Read more: Ark’s Cathie Wood: Bitcoin’s Calm Is Misread as ‘Coiled Spring’ Economy Prepares to Snap

The analysis connects this projected expansion to structural shifts across the digital asset ecosystem. Bitcoin is modeled as the dominant component of the cryptocurrency segment, supported by institutional investment, corporate treasury diversification, and its positioning as a digital alternative to gold. Smart contract networks are expected to capture significant value through decentralized finance, tokenized real-world assets, stablecoin settlement, and application-driven revenue, even as activity concentrates among a limited number of leading platforms.

The report also highlights scalability improvements, declining transaction costs, and expanding regulatory clarity as critical assumptions behind the forecast. While Ark emphasizes that long-term projections carry uncertainty, the data presented positions digital assets as a multi-tens-of-trillions-of-dollars market by 2030, suggesting the sector could rival major traditional asset classes in scale.

- How large does Ark project the digital asset market will be by 2030?

Ark forecasts total digital asset market capitalization could reach approximately $28 trillion by 2030. - What annual growth rate does Ark estimate for digital assets?

The report projects an estimated compound annual growth rate of about 61% through 2030. - How much of the digital asset market could bitcoin represent?

Ark believes bitcoin could account for roughly 70% of total digital asset market value. - Which platforms are expected to dominate smart contract networks?

Leading smart contract platforms like Ethereum and Solana are expected to capture most of the segment’s value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。