1. Delayed Data and Distorted Signals

● The recently released U.S. Personal Consumption Expenditures (PCE) price index data reveals a unique economic observation window. This data, which should have been published earlier, was delayed due to the longest government shutdown in U.S. history, and now reflects the economic conditions of November 2024.

● The Federal Reserve's preferred inflation indicator emerges in this special context, with its authority directly challenged. Core PCE rose 0.2% month-on-month and 2.8% year-on-year; overall PCE also rose 0.2% month-on-month and 2.8% year-on-year, completely in line with market expectations but lacking timeliness.

● Behind this data lag is the interruption of economic monitoring mechanisms caused by the government shutdown. The U.S. Bureau of Economic Analysis even had to employ technical methods to handle missing data, using the average of the September and November consumer price index data to fill in the gap for October. Although these measures barely piece together an economic picture, the reliability of the data itself has been weakened, significantly reducing its reference value for policymakers.

● Federal Reserve officials are likely to adjust the importance they place on this data. Relying on economic snapshots from several months ago when formulating globally impactful monetary policy undoubtedly increases decision-making uncertainty.

2. Economic Resilience Behind the Data

● Despite the lagging inflation data, other economic indicators show significant resilience in the U.S. economy. In November 2024, inflation-adjusted consumer spending grew for the second consecutive month by 0.3%, reflecting the sustained purchasing power of American consumers.

● This consumption resilience is particularly evident as the holiday shopping season begins. American consumers seem to have a strong immunity to concerns about the labor market and living costs, with income growth becoming the main driver supporting consumption. From a consumption structure perspective, spending on services is growing significantly faster than spending on goods, indicating a trend towards service-oriented consumption in the U.S. economy.

● At the same time, the U.S. GDP for the third quarter of last year was revised up to 4.4%, marking the highest level in two years. Personal consumption grew at the fastest pace of the year, providing sustained momentum for the economy. These data points paint a complex picture of coexistence between economic growth and inflation.

● Notably, consumer spending accounts for about two-thirds of the total U.S. economy, and its stable growth provides the Federal Reserve with room to maintain interest rate policies, even in the face of sticky inflation challenges.

3. The Federal Reserve's Policy Dilemma and Path Choices

● Faced with lagging and distorted economic data, the Federal Reserve finds itself in a typical policy dilemma. On one hand, inflation, while meeting expectations, remains sticky, with core PCE at 2.8% year-on-year still significantly above the long-term target of 2%; on the other hand, signs of weakness are emerging in the labor market, necessitating monetary policy support.

● Looking back at the Federal Reserve meeting in September 2025, the rate cut at that time was characterized as a "risk management-style rate cut," aimed at preventing a further significant slowdown in the labor market. This cautious attitude suggests that the Federal Reserve will place greater emphasis on balance in future policy adjustments.

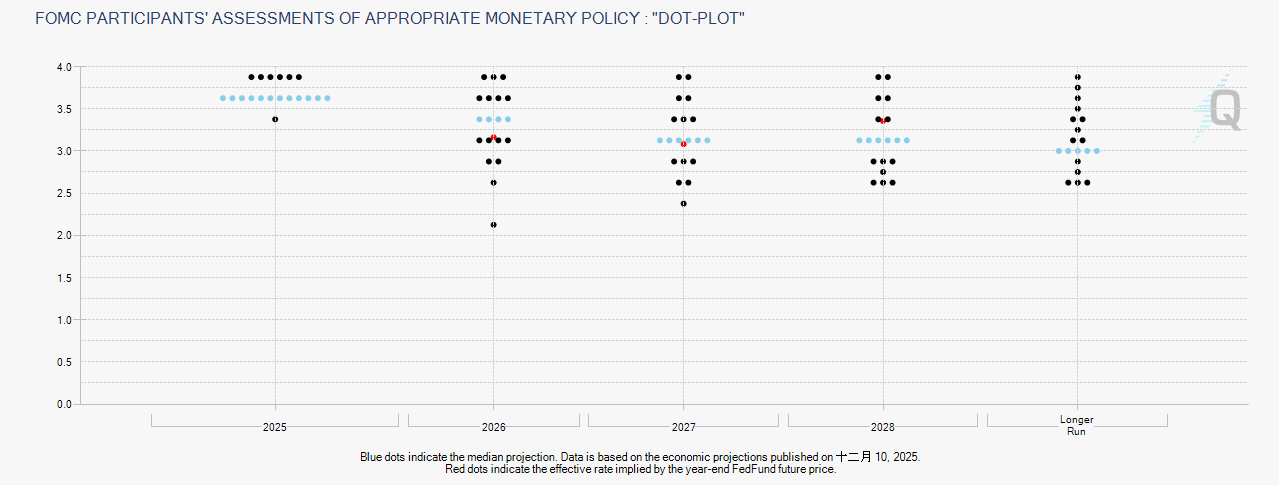

● According to the Federal Reserve's dot plot, decision-makers expect two more rate cuts by the end of 2025, each by 25 basis points, with the benchmark rate potentially falling in the range of 3.50% to 3.75% by year-end. However, regarding the interest rate direction for 2026, the Federal Reserve holds a hawkish stance, with decision-makers expecting only one more rate cut in 2026.

● This "near-dove, far-hawk" expectation structure reflects the Federal Reserve's consideration of balancing short-term risks and long-term inflation. Before more timely data is released in December and early 2026, the Federal Reserve will almost certainly maintain interest rates at the January meeting, exercising policy patience.

4. Market Reactions and Expectation Adjustments

● Following the release of the PCE data, financial markets exhibited unusual calm. Spot gold prices showed little short-term volatility, indicating that investors have fully digested this expected inflation data and found no new catalysts to change existing investment strategies.

● However, beneath this surface calm, market expectations for Federal Reserve rate cuts are quietly adjusting. Previously, the market anticipated two to three rate cuts in 2026, but this expectation is now converging towards the Federal Reserve's dot plot indicating "only one rate cut in 2026."

● Societe Generale previously pointed out that after the Federal Reserve's September meeting decision, market focus would completely shift to personal income and expenditure data and the PCE price index. While these data now meet expectations, they have not provided enough new information to alter market expectations for Federal Reserve policy.

● Meanwhile, external factors affecting inflation have also become a focal point for the market. The transmission effect of tariff policies on inflation is widely regarded as "delayed but not absent," with the Federal Reserve estimating that tariffs have a direct impact on the U.S. core PCE inflation rate ranging from 0.3 to 0.4 percentage points. This delayed effect suggests that future inflation may face greater upward pressure than currently indicated by the data.

5. Economic Outlook and Policy Insights

● In the face of data fog, the Federal Reserve's policy direction is constrained by multiple factors. From the perspective of economic growth, the International Monetary Fund forecasts that the U.S. economy will grow by 1.9% and 2% in 2025 and 2026, respectively, indicating that the rationale for supporting economic growth through rate cuts is not sufficient.

● From the inflation structure perspective, essential non-core CPI items such as food and electricity still face price pressures, contributing to the emergence of an "affordability crisis" in living costs. Additionally, the price stickiness of rents and certain service sectors remains, meaning inflation is not without concern.

● The Federal Reserve needs to find a balance in this complex environment. On one hand, it must avoid overly tightening policies that could harm economic growth and the labor market; on the other hand, it must prevent inflation from rising again. This tightrope policy balance requires more precise data support, and the current data lag issue makes this task even more challenging.

● The economic data releases in the coming months will be particularly critical. As government operations return to normal, the timeliness and accuracy of economic data will improve, providing clearer policy-making bases for the Federal Reserve.

● During this transitional period, the Federal Reserve may lean towards adopting a more gradual and transparent approach to policy adjustments, managing expectations through enhanced communication with the market to avoid policy missteps due to incomplete data. This cautious attitude, while potentially prolonging policy uncertainty, is a prudent choice in the current special environment.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。