Author: Ma He, Foresight News

On January 23, gold and silver continued their significant upward trend, with spot gold prices hovering around $4,956 per ounce, and silver reaching $98.79 per ounce, approaching the $100 mark, both setting new historical highs. In contrast, Bitcoin fluctuated around $90,000.

This divergence highlights a structural shift in the global market: in an uncertain environment, traditional safe-haven assets thrive, while Bitcoin is weighed down by liquidity constraints and risk-averse sentiment.

Deep Driving Factors Behind Gold and Silver's New Highs

In January 2025, gold prices reached $2,600, and then surged dramatically, with an increase of nearly 100% as of January 23 this year.

Silver, known as "gold's volatile companion," performed even better, starting at $30 in April 2025 and setting new highs amid continuous fluctuations, with its increase now exceeding 300%.

This surge is driven by a combination of macroeconomic and geopolitical factors.

Central Bank Gold Purchases are a Key Driving Force. The People's Bank of China added 27 tons of gold reserves in 2025, while the Reserve Bank of India increased its gold holdings from 10% to 16%, benefiting from rising prices and diversification away from U.S. Treasuries. Against the backdrop of U.S. debt exceeding $36 trillion, this trend of de-dollarization positions gold as a tool to hedge against currency depreciation.

Geopolitical Tensions Intensify Demand. U.S. tariff threats against Greenland and interventions in Iran have triggered inflows of safe-haven funds, pushing gold above $4,800. The weakening dollar—evidenced by a 6% drop in the Wall Street Journal Dollar Index in 2025—further supports prices, making dollar-denominated metals more attractive to overseas buyers.

The Collapse of the Federal Reserve's Independence and Credit Crisis is Also Severe. The most pressing impetus comes from an "institutional earthquake" in Washington. With a criminal investigation into Federal Reserve Chairman Powell underway, the independence of the Fed as the last line of defense for global currency is being questioned like never before. When investors realize that the central bank may become a tool of political maneuvering, the long-term creditworthiness of the dollar is diminished.

Despite gold prices nearing the $5,000 mark, global ETF holdings and central bank purchases continue to grow. This indicates that the market is undergoing a psychological paradigm shift: the concern is no longer about prices being too high, but rather that the fiat currency held is too "cheap."

For silver, industrial demand also provides additional upward price momentum. Since 2021, structural supply shortages have continued to expand, with mine output flat while demand for solar panels, electronics, and AI infrastructure has surged. China will implement export restrictions starting January 1, 2026, exacerbating the silver shortage. Analysts expect an annual shortfall of 200-300 million ounces, with industrial consumption accounting for 50% of supply. In the later stages of a precious metals bull market, silver, due to its smaller market size and greater elasticity, often experiences extremely vigorous catch-up rallies. The current gold-silver ratio is returning to historical averages or even lower levels.

Renowned economist Hong Hao previously analyzed that as long as expectations for improved global liquidity remain unchanged, the silver upcycle is not over. Although volatility will far exceed that of gold, its attributes as an "industrial necessity" beyond being "digital gold" will provide solid support.

The Lull Behind Bitcoin

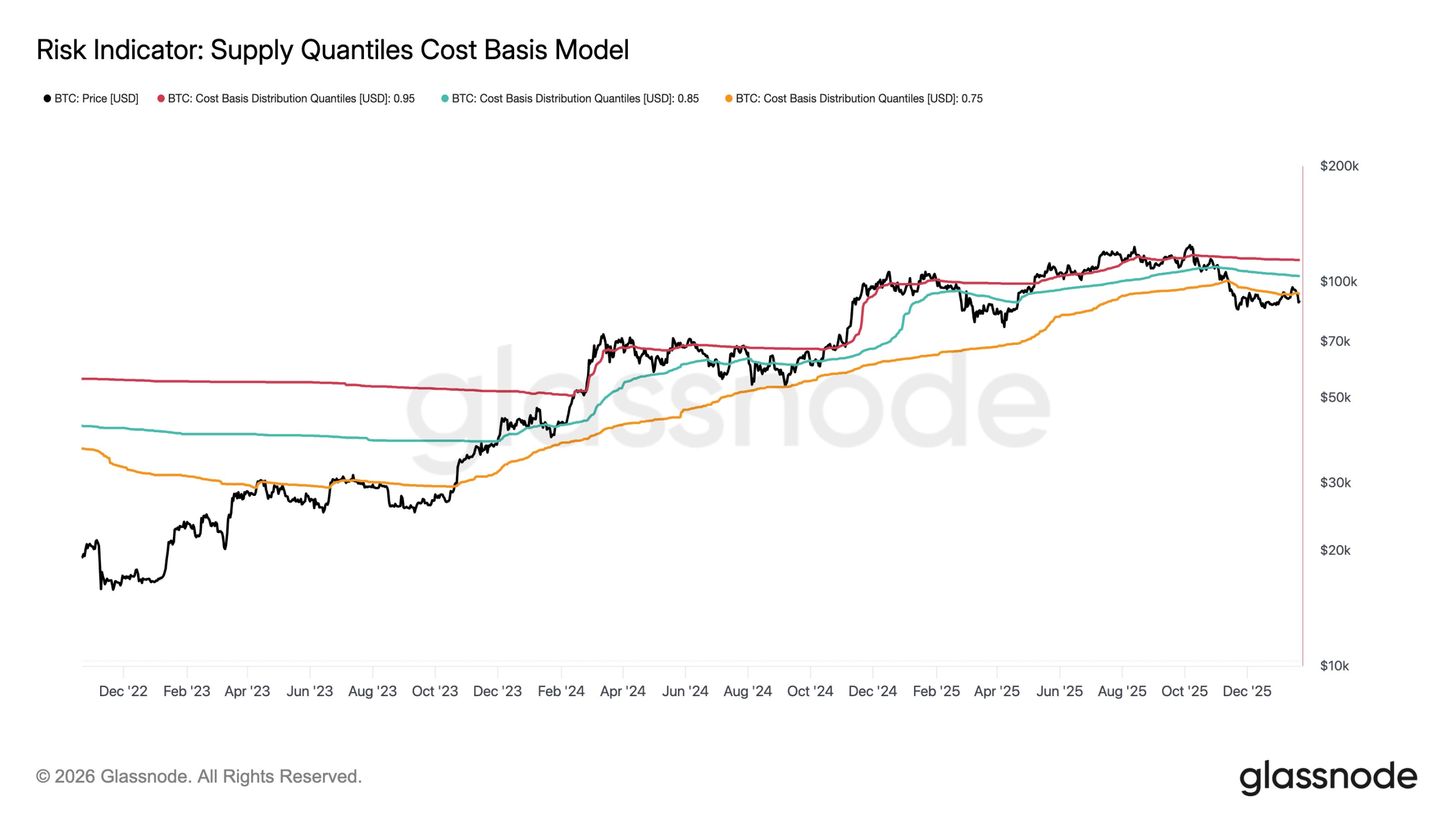

Bitcoin's trajectory forms a stark contrast. After reaching a peak of $126,000 in 2025, it has consolidated around $90,000. Glassnode reported that Bitcoin has lost the 0.75 supply cost percentile and has failed to recover. The current spot trading price is below the cost benchmark of 75% of the supply, indicating that distribution pressure is rising. Risk levels have moved upward, and unless this level can be reclaimed, the market will be dominated by a downward trend.

Liquidity contraction is the main culprit. Since 2022, the Federal Reserve has implemented quantitative tightening (QT), withdrawing $1.5 trillion in reserves, suppressing speculative inflows into risk assets like Bitcoin. The $19 billion leveraged washout in October exacerbated this issue, leading to chain liquidations. While geopolitical risks have boosted gold, they have triggered risk-averse sentiment in the crypto space.

From a cyclical perspective, although BTC has not outperformed gold and silver since last year, in terms of absolute return multiples, BTC has risen from $15,000 to a historical high of $126,000, an increase of over 800%, which is still impressive.

Wintermute stated that Bitcoin seems to be entering an upward channel after breaking out of a narrow trading range over the past 50 days. The market dynamics have changed last week. Since November, Bitcoin has broken out of the range based on real capital flows (rather than leveraged trading) for the first time. ETF demand is returning, the inflationary environment is favorable, and cryptocurrencies are beginning to catch up with the overall rise of risk assets. Although Monday's sharp drop was severe, it is a healthy adjustment. Leverage has been quickly cleared, and the market has not fallen into a vicious cycle, which is a positive signal. The current issue is whether the tariff situation is merely "bluffing" or will evolve into substantive policy. The market leans towards the former; since the beginning of the year, U.S. stocks and the dollar have still risen, and interest rates have not been repriced.

If Bitcoin can hold above the low of just over $90,000 this week, and ETF funds continue to flow in, a breakout trend is likely to continue; if it falls below $90,000 due to subsequent selling, the range since November will once again become a resistance level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。