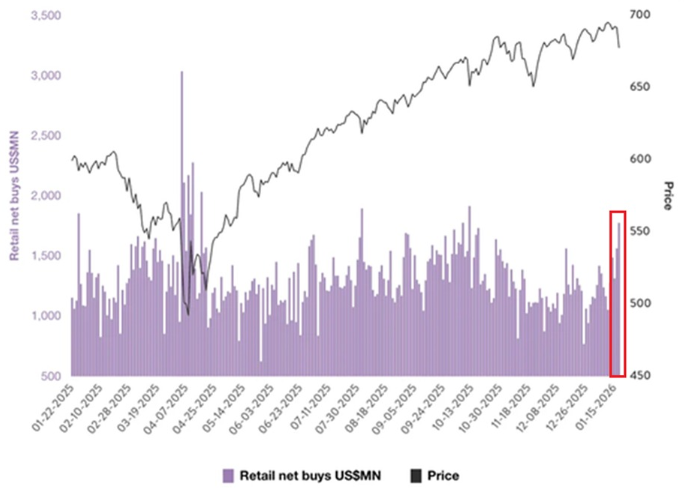

However, from the current data, retail investors are still frantically buying the S&P 500. It is evident that during the week when the S&P 500 fell, retail investors showed significant signs of bottom-fishing, with the amount of funds being invested increasing almost daily.

We can even see that retail investors' buying sentiment has been very high over the past year. During the sharp decline in April, retail investors unleashed an unprecedented amount of capital to bottom-fish. Of course, this group of retail investors is currently making substantial profits. Additionally, regardless of price fluctuations, there is a significant amount of capital flowing from retail investors into the market.

This indicates that retail investors have transitioned from being marginal capital to becoming the dominant incremental force. Retail investors are no longer just chasing prices in the latter half of the market; instead, they are treating the index as a long-term savings vehicle. It increasingly resembles a scenario where "retail investors + passive funds" are providing continuous buying pressure, while institutions manage risks and adjust positions at higher levels.

As long as this sustained net inflow from retail investors continues, it will be difficult for the index to experience a complete and uncontrollable one-sided collapse, because every pullback will naturally trigger buying support, keeping prices propped up.

Therefore, when looking at the strong buying pressure from retail investors alongside the historically low cash levels of fund managers, the market's upward structure relies on retail investors continuing to buy, external incremental capital continuing to flow in, and avoiding any sudden negative events.

The risk points for a downturn do not lie in whether retail investors are still buying, but rather in whether an event will occur that makes retail investors hesitant to enter the market due to a historically significant negative sentiment, such as an economic recession. If such a situation arises, institutions, due to low cash levels and tight risk budgets, may be unwilling to hold firm, leading to a rapid and significant pullback.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。