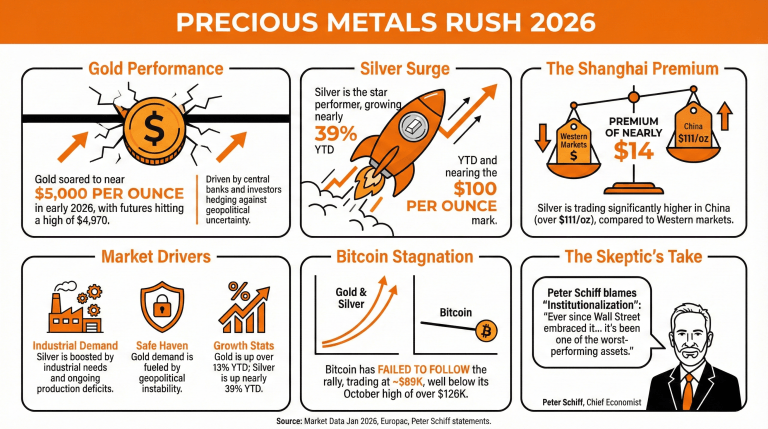

Gold and silver are becoming the stars of the investment world, boasting performances that leave any other stock or index in the dust, at least during the first days of 2026.

During early Friday, gold soared to near $5,000 per ounce levels, as COMEX futures for March reached a session high of $4,970, stabilizing over $4,900 at the time of writing. In the same way, silver futures for the same month registered a day high of $99.395 per ounce, almost reaching the three-figure ceiling.

While gold in Shanghai is trading at relatively similar prices, silver closed at over $111 per ounce in China, signaling a growing demand for the metal in the east, with a premium of nearly $14 compared to Western markets.

Gold and silver made headlines this week, scoring several record prices with forecasts explaining that, unless a black swan event happens, the precious metal bull market will continue to run. Gold has grown by over 13% in 2026, and silver has yielded earnings of nearly $39% year-to-date (YTD)

While gold demand is being fueled by central banks and investors seeking to hedge their bets against geopolitical uncertainty, silver is looking even better, as several factors, including industrial demand, ongoing deficits, and a production that is unlikely to grow significantly, push the metal to new heights.

Nonetheless, bitcoin has failed to follow, as the prime cryptocurrency has been unable to rise near its all-time high of over $126K reached in October, currently trading at nearly $89K.

Peter Schiff, Chief Economist and Global Strategist at Europac, blamed this on the institutionalization of bitcoin. On social media, he declared:

Bitcoin was the best-performing asset during a time period when hardly anyone owned it. But ever since Wall Street embraced it and most people bought it, it’s been one of the worst-performing assets.

What notable price movements have gold and silver experienced recently? Gold approached $5,000 per ounce, with COMEX futures peaking at $4,970, while silver futures hit a high of $99.39 per ounce.

How does silver’s price in China compare to Western markets? Silver closed at over $111 per ounce in China, indicating strong demand and a premium of nearly $14 compared to prices in the West.

What factors are driving the demand for gold and silver this year? Central banks and investors are turning to gold as a safe haven amid geopolitical uncertainty, while silver benefits from industrial demand and production constraints.

Why has bitcoin struggled compared to precious metals? Bitcoin has failed to approach its previous all-time high of $126K, currently trading around $89K, with Peter Schiff attributing its poor performance to increased institutional involvement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。