Today there isn't anything particularly new, but the overall sentiment among investors has slightly improved. The US stock market and $BTC have only seen minor fluctuations. After Trump's Greenland tariffs ended, although Europe still feels somewhat disgruntled, it seems to be more of a verbal dispute, and the actual impact should be minimal. Investor sentiment is gradually returning to stability.

Today is the last trading day before the weekend. As long as the performance of the US stock market isn't very poor, the impact on cryptocurrencies will be relatively low. It would be good if the weekend can go smoothly, but I am a bit worried that Trump might stir up some trouble again over the weekend.

Recently, there has been a winter storm in the US, and it seems that some utility stocks have been affected. However, I still believe that utility stocks in the US are very worth investing in. The issue of power shortages in the US is not new, and the world will enter a power shortage mode due to the development of AI.

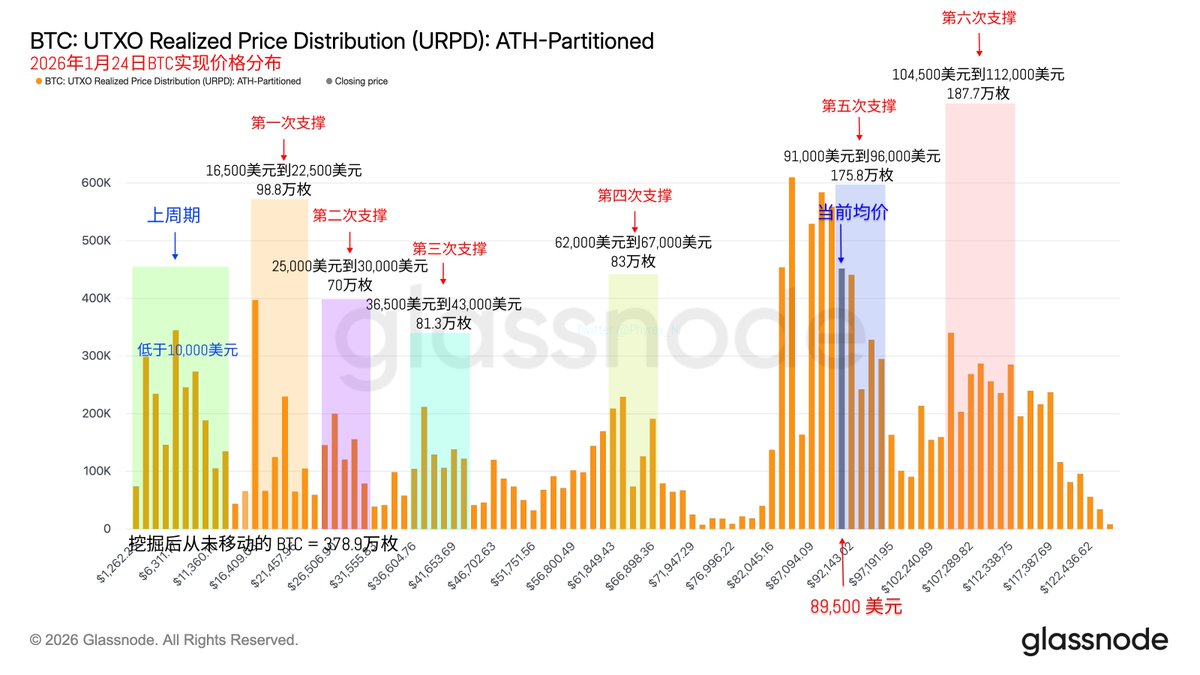

Looking back at Bitcoin's data, there has been a sudden significant increase in turnover, especially with a large amount of turnover occurring at the $112,000 level. After checking the detailed data, this is due to internal transfers within exchanges. Excluding this part, the actual turnover isn't that high, and the remaining turnover is still mainly from short-term investors. Now, I just hope there won't be any surprises over the weekend.

The current chip structure remains very stable, and we can still see a large amount of $BTC concentrated between $83,000 and $93,000, indicating that investors recognize this price range. Next, we will have to see the US monetary policy and Trump's tariffs.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。