Written by: Ben Weiss, Joyce Koh, Fortune Magazine

Translated by: Chopper, Foresight News

On a crisp Monday morning before Thanksgiving, a Secret Service convoy rolled into the small Texas town of Vega, which has a population of less than a thousand. A nationally influential figure arrived from Florida on a private jet, and local councilman Quincy Taylor revealed that news of the visit was "kept under wraps." Quincy Taylor is also the owner of Vega's only grocery store and the editor of the local newspaper; she admitted, "I shouldn't have known about this."

Hours later, the guest finally broke the silence. "Friends, I am Eric Trump." The son of President Trump said in an Instagram post, with an endless array of servers behind him, "Welcome to American Bitcoin."

Eric Trump walks through the American Bitcoin data center in Vega, Texas, alongside rows of mining machines.

Before this post, 42-year-old Eric Trump had just toured a massive data center that spans five football fields, marking his first visit since it officially began operations in late June. The data center is located on a former ranch, adjacent to fields of spinning wind turbines that provide up to 45% of the center's power. Dressed in jeans, a casual blazer, and a button-down shirt, Eric strolled between rows of servers with reporters and a video crew from Fortune magazine, stating, "I feel an extreme beauty here, completely different from the real estate projects I've been involved with."

The value of the cryptocurrency industry primarily relies on its existence on the internet, and such physical industrial layouts are rare in the sector. Over the past few years, the U.S. has quietly become the global leader in Bitcoin mining, with American Bitcoin, co-founded by Eric Trump, aiming to ride the wave of Bitcoin mining.

Recently, the cryptocurrency industry has also become deeply intertwined with the Trump business brand, which is traditionally centered around real estate. In just over a year, the Trump family has garnered at least $1 billion in pre-tax profits from various cryptocurrency-related projects, which share a consistent operational philosophy with American Bitcoin: attracting seasoned partners and completing complex transaction structures to allow the family's business entities to earn substantial profits.

American Bitcoin was established in March 2025, and its development direction aligns closely with the core industry Americanization strategy promoted by President Trump: from steel and artificial intelligence to cryptocurrency, the Trump administration has defined these industries as strategic resources that the U.S. should dominate. This concept has been integrated into the core of its brand building since the inception of the mining project. Eric proudly stated in his Instagram post that the company "is producing Bitcoin on American soil using American energy." In an interview with Fortune magazine, he expressed a shared goal with his father: to make America the "cryptocurrency capital of the world," with Bitcoin mining at the heart of the U.S. leading this emerging industry. He said, "If we don't do it, others will take advantage."

Surviving the Industry Winter

In recent months, concerns about a softening U.S. economy have led to a continuous decline in Bitcoin prices, and companies like American Bitcoin, which are considered digital asset management firms, have been hit even harder. However, Eric Trump and other insiders have shown optimism, seizing the opportunity to buy in large quantities as prices drop.

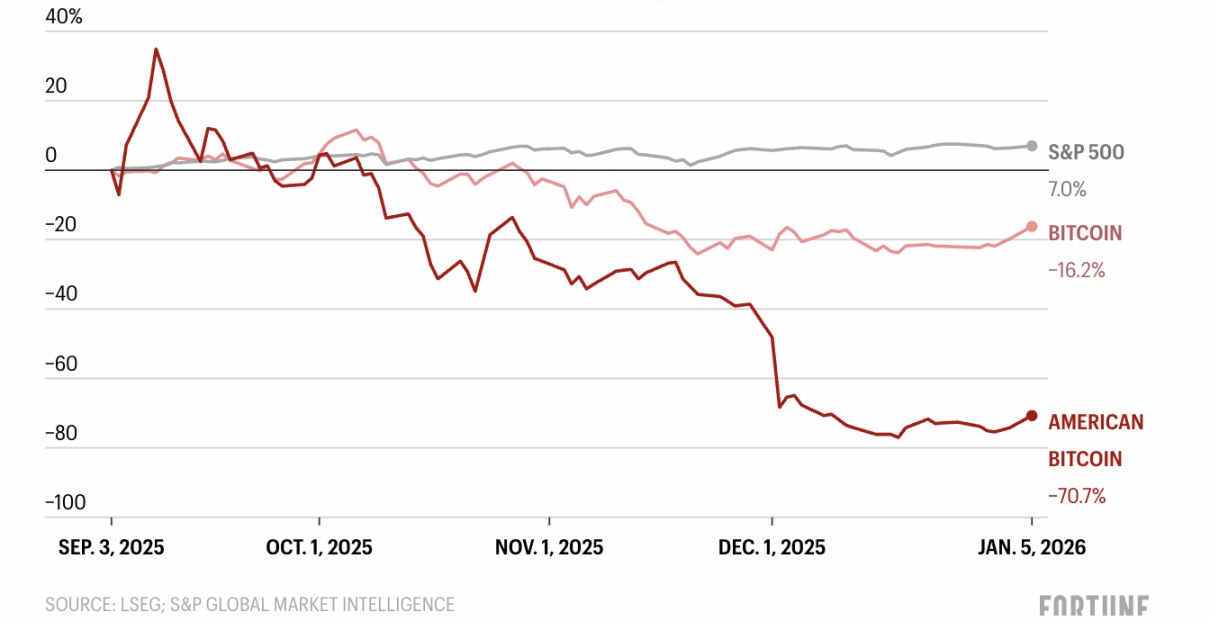

Comparison of S&P 500 index, American Bitcoin, and Bitcoin trends from September 3, 2025, to January 5, 2026.

The success of American Bitcoin is far from guaranteed. Like all cryptocurrency assets owned by the Trump family, the company faces strict scrutiny over potential conflicts of interest. Additionally, the company must prove it can withstand the extreme volatility of the cryptocurrency market: since its listing in September, its stock price has plummeted alongside Bitcoin's significant decline.

However, the co-founder told Fortune magazine that he has a long-term vision. Eric said, "Looking ahead to the next 3 years, 5 years, or even 10 years, I believe that cryptocurrency-related businesses will ultimately be the winners of this era."

Suddenly, the indicator lights on the server wall changed from their usual green to a glaring red; the equipment was overheating. Each minute of server downtime could impact the Bitcoin output of the Vega data center, directly affecting the company's revenue.

Three technicians jumped onto a white warehouse cart and raced down the central aisle to the malfunctioning mining machine panel. These mining machines, like most in the industry, were designed with the technical support of Bitmain, a Bitcoin mining chip manufacturer based in mainland China. Engineers from Amarillo methodically diagnosed the issue and found the culprit: a loose wire. One technician said, "If the wrong line is touched, the entire transmission system could fail."

This repair operation, along with the massive facility where it took place, reflects the dramatic changes that have occurred in the mining industry since Bitcoin's inception in 2009. Back then, people could mine 50 Bitcoins in one go using a home laptop, which would be worth about $4.6 million at current prices. Today, the roaring machines and scaled equipment in Eric Trump's Vega mining site signify that Bitcoin mining has entered the industrial age.

The Vega data center where American Bitcoin's mining site is located.

To understand the reasons for this change, one must look at the origins of Bitcoin. Its anonymous inventor, Satoshi Nakamoto, introduced Bitcoin as a protest against the excessive spending behaviors of central banks and governments. Unlike other currencies, Bitcoin has anti-inflation properties, with a total supply that will never exceed 21 million coins, supported by a decentralized network rather than banks or governments.

The process of Bitcoin mining not only issues new Bitcoins but also requires miners to consume energy to maintain the entire blockchain network. Miners compete to solve random mathematical problems generated approximately every 10 minutes, and the winning miner signs a "block" containing Bitcoin transactions. In return, the winner receives a Bitcoin reward, currently 3.125 Bitcoins per mined block, along with additional transaction fees.

However, as the blockchain network continues to evolve, the difficulty of winning this computational race has increased exponentially. Today, mining requires massive computational power, specialized mining chips, and enormous energy consumption. The U.S. Energy Information Administration estimates that in 2024, cryptocurrency mining could account for up to 2.3% of U.S. electricity consumption, comparable to some of the country's high-energy-consuming industries.

Currently, energy hotspots around the world are home to large numbers of mining devices, and Vega is one of them. Low energy costs, in turn, help the U.S. continuously increase its global market share in Bitcoin mining, as lower electricity costs increase the likelihood of miners profiting from mining. Data from Bitcoin mining company Luxor Technology shows that by the fourth quarter of 2025, the U.S. accounted for 38% of Bitcoin mining power, far exceeding the second-ranked Russia (16%). In practical terms, Bitcoin is now "Made in America."

Background of American Bitcoin

In March 2025, President Trump issued an executive order to establish a U.S. Bitcoin strategic reserve, positioning Bitcoin as a new battleground for economic competition between the U.S. and Russia and China. Ohio Republican Congressman Warren Davidson stated in a declaration supporting the "U.S. Bitcoin Act" last November: "This legislation will help the U.S. take the lead in the global exploration of sound currency and the future of digital innovation."

It was against the backdrop of the president's push for the U.S. to become a "Bitcoin superpower" that Eric Trump's entrepreneurial project emerged. He found a 31-year-old partner, Asher Genoot.

Asher Genoot has been deeply involved in the Bitcoin mining industry for many years, founding US Bitcoin. After the merger of the two companies in 2023, he became the CEO of Hut 8. He works in Miami and is part of the same social circle as the Trump family in South Florida, where President Trump manages his social affairs at Mar-a-Lago in Palm Beach. Eric said, "We have about 100 mutual friends."

After their initial meeting months ago, they began discussing business over pizza at a Trump golf club near Jupiter in February 2025. At that time, Eric and Donald Trump Jr. had just established a business entity called American Data Centers, which could potentially collaborate with Asher Genoot's company.

This opportunity for collaboration arose: Hut 8 already had several Bitcoin mining sites in the U.S. and Canada, with these server-filled warehouses built near low-cost energy sources. Asher Genoot said, "We have long-term plans in the energy sector while building infrastructure assets, whether it's mining data centers or computing centers supporting artificial intelligence." Eric added in a statement, "If I hadn't seen their scaled layout, I would never have considered entering the mining industry."

Subsequently, a series of dazzling financial transactions unfolded. Asher Genoot and Eric reached an agreement to spin off Hut 8's Bitcoin mining business into an independent company associated with the Trump family. Eric recalled that he insisted, "The company name must include the word 'American'." After the spin-off, Hut 8 retained 80% of the new company's shares, while the shareholders of American Data Centers held the remaining 20%; the remaining business of Hut 8 was transformed into a pure data center and power infrastructure company.

At the end of March 2025, the two partners officially announced this new project and subsequently raised $220 million in a private equity financing led by Solari Capital. AJ Scaramucci, the founder of Solari Capital, is the son of investor Anthony Scaramucci, who initially supported Trump but later became an adversary. AJ told Fortune magazine, "Bitcoin transcends politics." In September 2025, American Bitcoin officially went public, with Asher Genoot serving as executive chairman.

Asher Genoot from Hut 8 brought energy expertise and facilities like the Vega data center to American Bitcoin.

Light Asset Operations and Diverse Revenue

Like some other mining companies, American Bitcoin employs a hybrid business model, simultaneously operating a "digital asset management" business. This type of business raises funds by issuing bonds and stocks, then uses the capital to purchase cryptocurrencies, incorporating them into the company's balance sheet. This business model was pioneered by Michael Saylor, whose core assumption is that investors can profit indirectly from digital assets by purchasing shares in asset management companies without directly holding the digital assets.

Michael Saylor is now one of Bitcoin's most loyal advocates and a friend of Eric. He even suggested that Eric mortgage Mar-a-Lago to buy more Bitcoin. Eric stated that he politely declined this suggestion, saying, "But I thought at the time, 'There’s actually a second-best option, isn’t there?'"

Shortly after the company went public in September 2025, Eric was thrilled with his "second-best option." On September 9, American Bitcoin's market capitalization peaked at $8.5 billion, while Hut 8's market cap also surpassed $3 billion. In the third quarter of 2025, American Bitcoin generated $64 million in revenue, primarily from the 563 Bitcoins mined during that quarter. Asher Genoot stated that such results are quite impressive for a newly established company. By early January 2026, the new company had approximately $500 million worth of Bitcoin on its balance sheet, making it one of the top 20 Bitcoin digital asset management companies globally.

Eric sat in the courtyard next to the servers, discussing his reasons for entering the cryptocurrency industry. He said, "I became the most rejected person by financial institutions in history; First Capital Bank froze our accounts, and JPMorgan Chase and Bank of America followed suit."

President Trump, Eric Trump, and other family members have stated that after the 2020 election, Trump and many of his supporters questioned the election results, leading several banks to either terminate their business relationships with them or refuse to accept their deposits.

Due to strict limitations imposed by banking privacy laws, major banks generally do not respond to inquiries about the reasons for terminating their relationships with the Trump family, nor do they acknowledge any past business dealings. JPMorgan Chase and Bank of America declined to comment on specific customer accounts, and First Capital Bank did not respond to requests for comment. From a broader perspective, all three banks deny that they have refused to serve customers due to political positions. A lawyer for First Capital Bank wrote in response to a lawsuit filed by the Trump family, "This claim is false." The Trump family alleged in the lawsuit that the banks closed their accounts due to political positions. The lawyer also stated, "While First Capital Bank may occasionally close accounts, it does so for legitimate and regulatory-compliant reasons."

Nevertheless, the Trump family's experience closely resembles that of some cryptocurrency entrepreneurs. These entrepreneurs believe that due to regulatory scrutiny over the legality of their businesses, they and their companies have also faced rejection from financial institutions.

Eric stated that the family's confrontation with banks prompted him to turn to cryptocurrency. He said, "I realized how harsh the financial institutions in this country are, and that's why I fell in love with this new financial era." Like other staunch supporters of cryptocurrency, he believes that Bitcoin has essential advantages over traditional banking intermediaries, fees, and transaction delays. He said, "It is cheaper, faster, and more transparent than any other form of finance."

Eric is not the only one interested in cryptocurrency. Although President Trump once called Bitcoin "a scam," he later launched his own non-fungible token (NFT) series. In 2024, during his campaign to return to the White House, he announced his ambition to make the U.S. a dominant force in the cryptocurrency space. After entering the White House, he signed a bipartisan-supported stablecoin regulatory bill, issued cryptocurrency-friendly executive orders, and pardoned several individuals convicted of cryptocurrency-related crimes.

Driven by this series of political initiatives, the Trump family's vast business empire has diversified from its original real estate empire to increasingly become a comprehensive cryptocurrency enterprise. However, the core strategy has remained unchanged: to bind the Trump brand with products and businesses developed and operated by other entities, thereby expanding commercial boundaries.

In 2017, after old Trump began his first presidential term, Eric and Donald Trump Jr. took over the family business, the Trump Organization. The company has a vast real estate investment portfolio and also charges developers and other entrepreneurs fees to license the Trump brand.

In the cryptocurrency field, the Trump family has continued this model. The publicly traded social media company Trump Media & Technology Group (TMTG) has launched several cryptocurrency-related investment products, including exchange-traded funds (ETFs), but the development and management of these products rely on the digital asset exchange Crypto.com. World Liberty Financial may be the Trump family's most profitable cryptocurrency project, closely collaborating with Binance, the world's largest cryptocurrency exchange, to launch and promote its own stablecoin.

American Bitcoin is also a light asset investment. The company claims to have only five employees, and although it owns nearly 78,000 Bitcoin mining machines, it does not own or operate the Vega data center, nor does it employ the technical staff at that center; the same applies to its other three data centers. In fact, American Bitcoin pays Hut 8, led by Asher Genoot, to operate its mining business.

"This operational approach is clear: leverage the influence of the Trump brand to attract significant attention, raise funds, and then spend money to have others do the specific work," said Austin Campbell, a part-time professor at New York University and a senior cryptocurrency executive, who primarily teaches courses related to blockchain technology.

In response to Austin Campbell's assessment, a spokesperson for American Bitcoin stated, "This description is inaccurate; the management and founding partners of American Bitcoin are actively planning for the long-term development of the company."

By most metrics, these cryptocurrency projects have been highly profitable. According to the Financial Times, as of October 2025, these projects generated over $1 billion in pre-tax profits for the year, with most of it coming from the sales of cryptocurrencies and the meme coin TRUMP issued by World Liberty Financial. Although its book valuation fluctuates with market volatility, according to analyses by Fortune magazine and cryptocurrency analytics firm Nansen, by early January 2026, the valuation of the Trump family's cryptocurrency projects had surpassed $3 billion. This valuation includes their holdings of meme coins and cryptocurrencies issued by World Liberty Financial (Fortune magazine has discounted the value of these assets due to their limited liquidity) and also encompasses their shares in publicly traded cryptocurrency-related companies like American Bitcoin and TMTG.

Market Volatility and Conflicts of Interest

In early January 2026, World Liberty Financial officially applied for a federal banking license. A cryptocurrency company under Trump is seeking regulatory approval from the Trump administration, which has a clear supportive stance on cryptocurrency. The intertwining of the Trump family's business interests with presidential executive power has raised alarms in Washington.

Indeed, more and more people in the tech and investment sectors believe that if policymakers and advisors can personally invest in relevant fields, they may make more informed decisions. However, the president holds supreme decision-making authority over policies. Currently, policies favorable to the cryptocurrency industry will essentially benefit the Trump family's related enterprises.

Ethics experts have stated that the Trump family's investments in the cryptocurrency field have raised unprecedented conflicts of interest. Richard Briffault, a professor at Columbia Law School who studies government ethics, questioned regarding the president's cryptocurrency policies: "Is he making these policies because he believes they are beneficial for the country? Or because he knows these policies will directly impact the family's financial situation?"

White House Press Secretary Karoline Leavitt stated in a statement, "The president and his family have never, and will never, be involved in conflicts of interest." She also added that this administration "is fulfilling the president's commitment to make America the cryptocurrency capital of the world."

Eric Trump has also repeatedly refuted insinuations of wrongdoing. He told Fortune magazine that there is a "firewall" between his business interests and his father's policymaking. He said, "My father is not involved in the operations of the Trump Organization, nor is he involved in our cryptocurrency business. This is my company, and he is doing an excellent job governing America."

In addition to the verbal disputes surrounding compliance, another question remains to be answered: for publicly traded companies in the cryptocurrency field, which is inherently closely tied to political and regulatory actions, can these companies maintain their momentum once President Trump leaves office? However, for American Bitcoin, the more significant recent threat is the recent crash in the cryptocurrency market.

As concerns about a softening U.S. economy intensified among investors, by mid-January 2026, Bitcoin prices had dropped over 25% from their peak in the fall, and American Bitcoin's stock price also plummeted, falling more than 70% from its initial public offering in early September.

Market volatility has also affected the Trump family's other cryptocurrency assets. However, by the end of November, Eric remained calm. He said, "I am more confident in cryptocurrency now than ever before. Volatility is our friend." In fact, he, Asher Genoot, and other insiders significantly increased their holdings of American Bitcoin stock from December 2025 to early January 2026, coinciding with a market rebound after the New Year, allowing them to profit.

Residents of Vega are not particularly sensitive to the ups and downs of the cryptocurrency market. Some residents stated that the American Bitcoin mining site has not significantly impacted local life. The town is best known for its proximity to the historic Route 66.

However, some residents believe that the establishment of this data center brings more benefits than drawbacks. Vega's assistant city secretary, Kari Mays, said, "This will create some jobs in this rural area, which already has few employment opportunities." Local residents are also aware of the Trump family's role in this. Grocery store owner and newspaper editor Quincy Taylor remarked about Eric's convoy passing through the Texas countryside, "The town might be happy to tell this story." Whether in Vega or in the upper echelons of the cryptocurrency industry, it is this brand appeal that has helped the Trump family leap from newcomers in the cryptocurrency field to core players.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。