Global currency markets are entering a destabilizing phase as confidence fractures and traditional defenses falter. Economist Robin J. Brooks shared a stark market analysis on Jan. 24, 2026, warning that accelerating bond stress and capital flight have placed the U.S. dollar under direct and growing threat.

Brooks, a Senior Fellow at the Brookings Institution who previously served as Chief Economist at the Institute of International Finance and Chief FX Strategist at Goldman Sachs, framed the recent moves as a decisive inflection point. He is widely recognized for expertise in global macroeconomics, particularly exchange rate valuations, capital flows into emerging markets, and the effectiveness of Western sanctions. In his assessment, he stated:

“Serious dollar depreciation has resumed.”

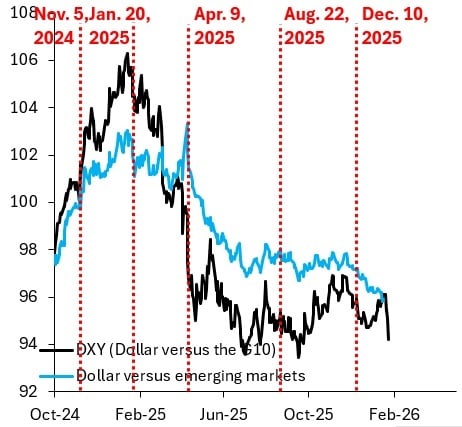

The economist grounded that assessment in a chart tracking the dollar against both G10 and emerging market currencies from October 2024 through early 2026. The G10 refers to the group of major advanced-economy currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swiss franc, Swedish krona, Norwegian krone, Australian dollar, and New Zealand dollar. Brooks emphasized that the emerging market dollar’s decisive break below its prior range acted as a leading indicator, with the G10 dollar now approaching a similar technical breakdown that historically draws in crossover investors and deepens bearish momentum.

The chart’s black line represents the DXY index, a widely used measure of the U.S. dollar versus a basket of major currencies, which peaked above 106 in early 2025 before turning sharply lower. By contrast, the blue line shows the dollar versus emerging markets, which began weakening earlier and declined more persistently. Vertical markers highlight key dates, including Nov. 5, 2024, Jan. 20, Apr. 9, Aug. 22, and Dec. 10, 2025, with the December marker aligning with the Federal Reserve’s rate cut that accelerated the move.

Read more: Ray Dalio’s 2025 ‘Biggest’ Story: The Dollar Debasement

Beyond commodities, the economist described a wider redefinition of what constitutes a safe haven. He outlined how low-debt economies such as Sweden, Norway, and Switzerland attracted significant inflows as alternatives to the dollar and the yen. Addressing Japan directly, he rejected arguments that poor liquidity caused the bond market disruption, instead linking investor retreat to fiscal credibility concerns and resistance to austerity. Rising long-term yields, he argued, still failed to compensate investors adequately for sovereign risk, leaving the yen vulnerable despite widening rate differentials. Summarizing the broader outlook, Brooks wrote:

“The bottom line is that the Dollar is under fire as is the Yen and global debt markets. The dominant markets theme in 2026 is flight to safety from debt monetization. Precious metals and safe haven currencies will rally a lot further.”

His analysis reinforced expectations that global capital will continue migrating toward tangible assets and fiscally disciplined currencies as debt burdens intensify.

- Why is the U.S. dollar under pressure in 2026?

Bond market stress, capital flight, and renewed debt monetization fears are undermining confidence in the dollar. - What triggered the latest wave of dollar weakness?

A sharp sell-off in Japan’s government bond market spilled into global debt and currency markets. - Which assets are benefiting from the debasement trade?

Gold, silver, platinum, and low-debt safe haven currencies are seeing strong inflows. - Which currencies are emerging as alternatives to the dollar and yen?

Sweden, Norway, and Switzerland are attracting capital due to stronger fiscal credibility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。