The recent weekends have been quite difficult, and today's homework is also hard to write. I just finished the tariffs on Greenland, and I wanted to take a breather, but $BTC is dropping again, and it has dropped quite significantly over the weekend. This time, there may be three possible situations. The first is that Trump is very dissatisfied with a trade agreement with Canada and China. He mentioned it yesterday, but today he still published two articles to warn Canada.

Trump has never hesitated to use tariffs as a weapon, so the market is also worried that Canada and China might make a joint resistance on Monday. Although it is still just verbal, if it really forms a "confrontation," the market will definitely react to the potential risks, although there might also be a TACO, but the market will absolutely not remain indifferent.

In addition to tariffs, the U.S. and Japan may team up to intervene in the yen exchange rate. Although this is not as serious as tariffs, intervention could impact the arbitrage market, especially with the yen being such a sensitive borrowing asset. The third issue is that the probability of a government shutdown in the U.S. has increased again, with the budget due on January 31 facing problems.

As a result, the expected probability of a shutdown on Kalshi has surged to 78.5%. However, this shutdown may not be as comprehensive as the one in October last year. Some functional departments have already received their budgets for the year and will not enter a shutdown, so relatively speaking, even if a shutdown occurs, it should not be larger in scale compared to October.

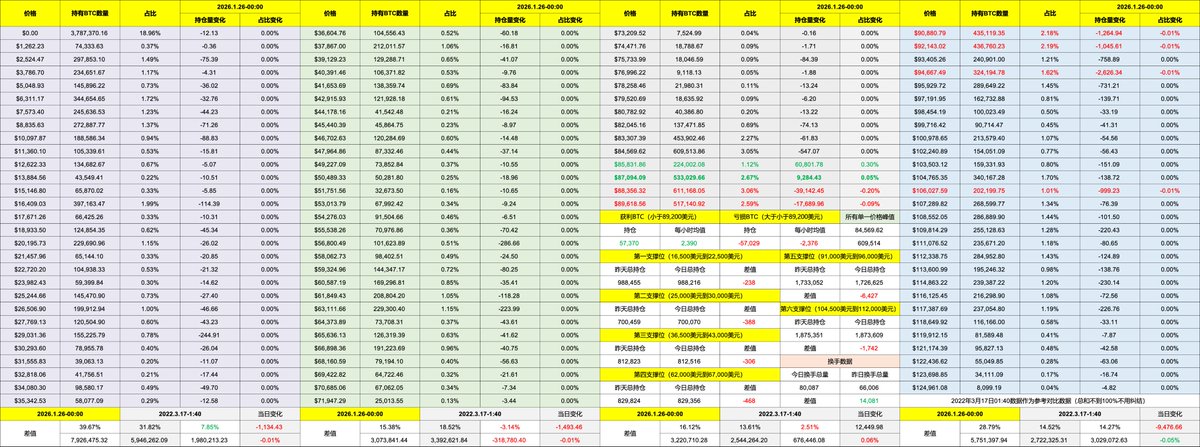

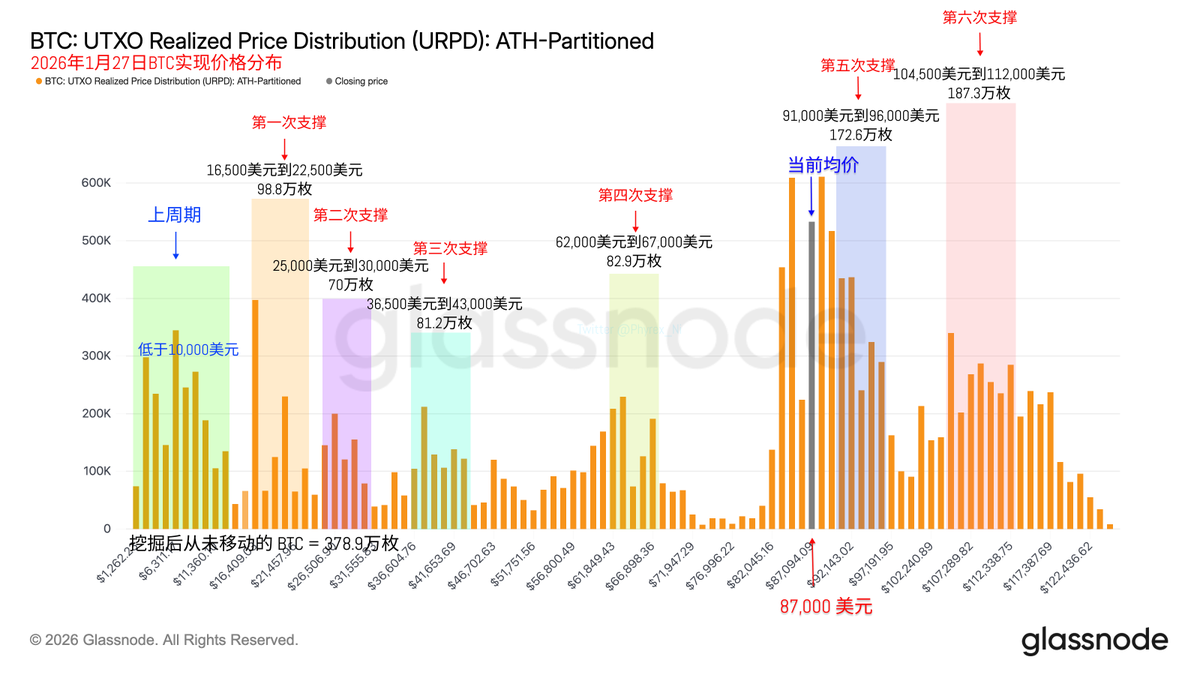

Looking back at Bitcoin's data, the turnover rate has increased. Such a high turnover rate over the weekend indicates that the market has started to panic. With three layers of negative news, investors must be feeling overwhelmed, and this is still on the weekend before the U.S. stock market opens. Similarly, in a few hours, we will know how Asian investors perform, followed by the performance of U.S. investors.

To be honest, I am quite troubled. Tariffs have repeatedly been used as a weapon by Trump, and the results have never been good. Seeing the market react poorly, Trump might resort to TACO again. Why bother?

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。