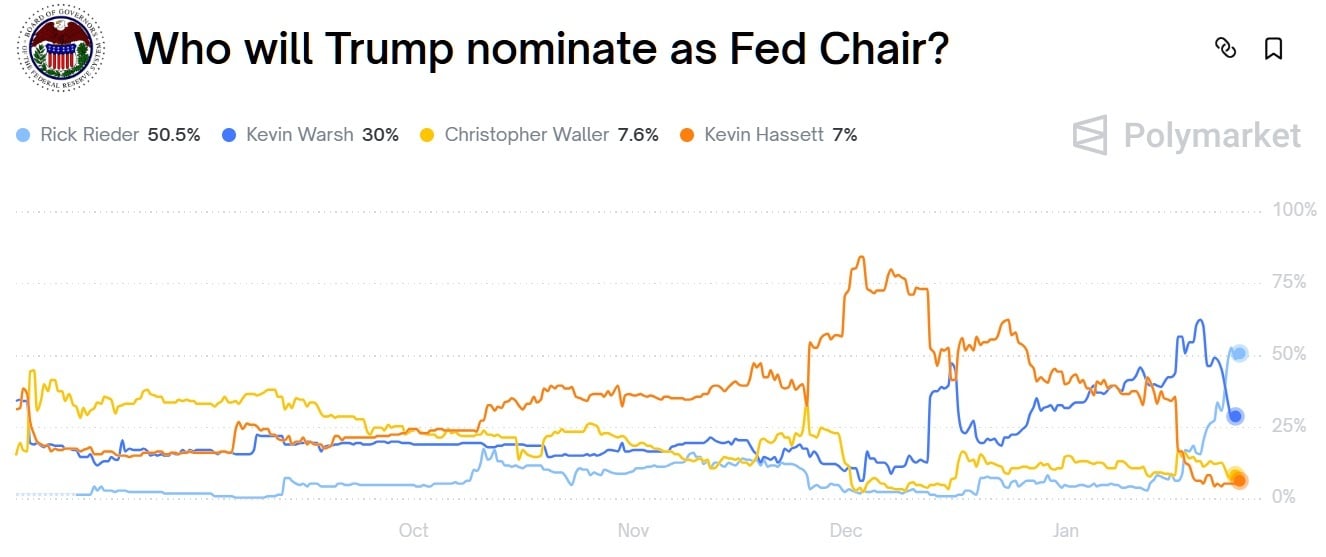

Shifts in market sentiment are sharpening focus on the Federal Reserve succession. Polymarket, a blockchain-based prediction market platform, shows on Jan. 25 that traders increasingly favor Blackrock’s Rick Rieder as President Donald Trump’s potential pick to succeed Jerome Powell, reflecting evolving expectations about future monetary leadership.

According to Polymarket, Rieder, chief investment officer of global fixed income at Blackrock, the world’s largest asset manager, commands a 50.5% implied probability, placing him ahead of former Fed Governor Kevin Warsh at 30%, current Fed Governor Christopher Waller at 7.5%, and White House National Economic Director Kevin Hassett at 7%. Aggregate trading volume surpassed $252 million, signaling sustained conviction rather than episodic wagering, while the chart illustrates Rieder’s pricing curve accelerating through December and January before separating decisively from rivals. Jerome Powell’s second term as Chair of the Federal Reserve is scheduled to end on May 15, 2026.

Rieder has consistently expressed a constructive view toward crypto assets and has made bullish comments about bitcoin’s role in modern portfolios. In public remarks, he has described bitcoin as a practical asset with real-world utility, positioning digital assets as tools rather than abstract hedges within diversified portfolios. Reflecting that view, he stated in November 2000:

“[ bitcoin] is so much more functional than passing a bar of gold around.”

Read more: Blackrock Frames Ethereum as Primary Beneficiary of Rising Stablecoin Adoption

The Blackrock executive has also offered detailed views on how bitcoin fits into portfolio construction, emphasizing both its potential and the need for moderation. He explained that hard assets now play a role in protecting against currency debasement, stating in September 2025:

“I think hard assets have to enter the equation today— gold, bitcoin—things that give you a little bit of balance in the portfolio against potential for currency depreciation.”

At the same time, he has cautioned against aggressive positioning, indicating that a 5% allocation to bitcoin appears high in his view, though he has emphasized that appropriate exposure can vary depending on an investor’s stage of life. He noted: “We’re running considerably lower than that in crypto, but I just think it’s going to go up.” The remarks outline a view of bitcoin as a long-term, asymmetric asset rather than a dominant portfolio holding, reflecting a measured but bullish stance on its role in institutional investing.

- Why is Rick Rieder leading Polymarket’s Fed chair odds?

Traders are pricing in Rieder’s market-oriented outlook and perceived political viability over other contenders. - What probability does Polymarket assign to Rick Rieder?

Polymarket shows Rieder with a 50.5% implied probability to succeed Jerome Powell. - How much trading volume backs the Fed succession market?

Aggregate Polymarket volume has exceeded $252 million, signaling strong conviction. - What is Rieder’s view on Bitcoin in portfolios?

Rieder views Bitcoin as a functional hard asset for diversification against currency risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。