Written by: Lawyer Liu Honglin

Web3 is an industry skilled in storytelling, but those who are good at telling stories may not be willing to fulfill their promises.

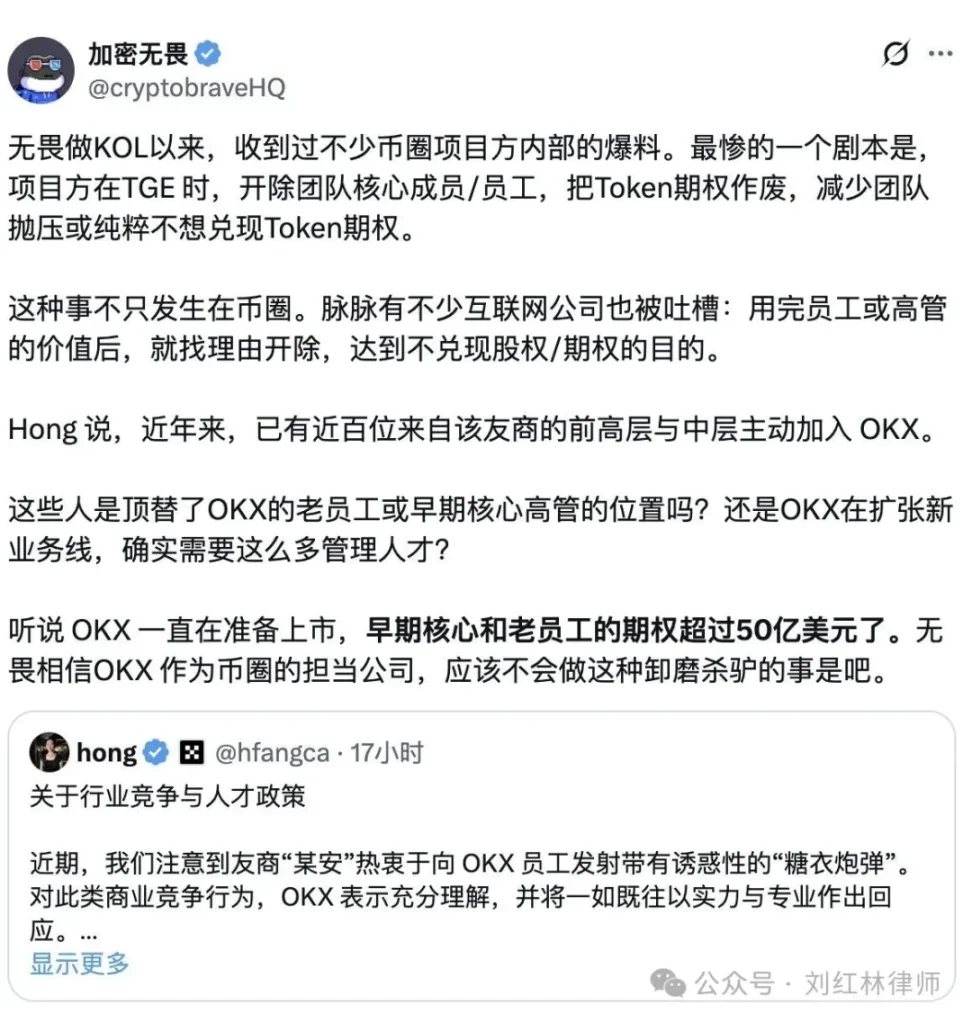

Recently, a classmate from Crypto Wuyou posted an update saying that since becoming a KOL, they have received numerous "insider tips" from various crypto projects. The most unfortunate case involved a project that directly fired core team members right before the TGE and canceled all their token options for that reason. The motivation behind such actions is not hard to guess: first, to reduce selling pressure during token circulation, and second, simply not wanting to fulfill promises. In other words, it’s about cleaning up costs before going public.

As a legal practitioner in the Web3 industry, Lawyer Honglin is not surprised by such stories. Over the past few years, we have seen too many Web3 projects undergo "organizational restructuring" at critical junctures: laying off employees before the TGE, reclaiming shares before going public, or even outright denying the existence of incentive commitments.

Even more unfortunate is that some employees do not sign labor contracts but rather so-called consulting agreements, with the project party verbally promising to distribute tokens. When the time comes to distribute, they receive nothing but the phrase "you are not on the distribution list." Even if there are emails, group chats, or recordings as evidence, a single notice stating "the plan has been terminated" can completely erase it.

In contrast, traditional Web2 companies can at least pursue labor arbitration and equity lawsuits, making efforts to protect their legal rights. However, most Web3 project entities are based in the Cayman Islands, Singapore, or BVI, and "employees" who leave wanting to sue first have to resolve the issues of "where to sue" and "who to sue." The cost of this often exceeds what the rights defenders can bear.

When Lawyer Honglin communicates with many Web3 startup teams, he finds that there is a significant misconception: they overestimate their technical capabilities while underestimating the controlling role of law.

From incentive mechanisms to corporate governance, from token distribution to control arrangements, many people are accustomed to "just getting started," even believing that technical agreements can replace legal agreements and that DAO voting can represent formal contracts.

This ambiguity and casualness provide a vast gray area for breach of contract. And before the window for realizing benefits arrives, these issues often do not manifest. Once tokens begin to circulate, market value rises, and resources come in, it becomes a tug-of-war over power and interests, rather than a continuation of joint entrepreneurship.

Such practices of tearing up incentive commitments are not limited to small projects that disappear midway through their startup journey; even some large platforms preparing to go public inevitably face similar internal employee incentive pressures.

Of course, we do not intend to speculate on individual cases, but from an industry perspective, once entering the public listing stage, internal compliance restructuring, equity reshuffling, and redefinition of options can easily become a gray area for employee rights. Without contractual protection, the hard work of early participation may be casually "optimized" away.

This phenomenon is not isolated but rather a "shortcoming" that is easy to occur in Web3 startup teams. We previously analyzed similar cases in depth in "The YesCoin Incident Revelation: 90% of Web3 Startup Teams Overlook Legal Risks and Lawyer Recommendations."

YesCoin, once a hot application in the TON ecosystem, evolved into a criminal case due to serious disagreements between two partners regarding project control, data permissions, and equity arrangements. In the case, one partner was taken away by the police for "illegally obtaining data from a computer information system" after unilaterally depriving the team of data permissions and removing system access.

Although the matter was eventually resolved peacefully, the starting point of the issue was still the lack of a clear governance structure and legal agreements in the early stages of the startup, relying solely on "personal relationships" and "trust" to support cooperation. When the project succeeded, conflicts erupted.

Decentralization does not equate to disorganization, and a DAO does not mean no contracts. Without a share agreement between partners, no fulfillment mechanism for employee incentives, and system control in the hands of individual technical personnel, when it comes time to "divide the profits," everyone starts to have different opinions, leading to disputes and turning technical conflicts into legal risks, transforming cooperation into mutual reporting.

When the project founders have not clarified their rights and responsibilities, what guarantees do the tokens in the hands of team members have?

Therefore, whether it is an extreme case like YesCoin or the practice of firing employees before the TGE, it reflects an important issue in Web3 entrepreneurship that deserves everyone's attention: in an environment lacking formal contracts and governance systems, incentive mechanisms can easily become empty promises, and entrepreneurs can easily abandon their "original intentions" at the moment of power realization.

When we lawyers intervene in such disputes, the most common scenario is: employees are in the domestic market, the project is overseas, and the tokens have been listed. At this point, pursuing accountability is almost impossible. And precisely because these legal accountability paths are extremely difficult, more and more project parties dare to "cut incentives, clear personnel, and change tokens," treating illegal breaches as a means of "organizational restructuring."

This behavior may seem to reduce costs in the short term, but in the long run, it erodes the entire industry's credit foundation. The development of Web3 already faces trust challenges from regulation, finance, and society. If even the most basic internal incentive contracts frequently fail, the industry's credibility, talent attraction, and investment stability will be greatly affected.

What we want to say is not that "entrepreneurs should have a conscience," but that Web3 projects need to have a basic contractual structure and legal framework. Founders should sign clear equity agreements and governance terms, employee incentives should have clear fulfillment arrangements and lock-up mechanisms, and token distribution should have legal binding force, not just rely on a project party's "final interpretation rights." Even if you trust your partner, let the system provide a safety net; even if you are a native of the blockchain, accept the legal realities of the off-chain world.

Entrepreneurship can share hardships, but if you did not clearly write down the rules for "sharing joys and sorrows" from the beginning, do not expect anyone to show loyalty when the windfall arrives. In the world of blockchain, what is most scarce is not technology or capital, but trust that can be fulfilled. Be a person who keeps promises and also be a team that writes promises into contracts and executes them.

Perhaps this is the most important compliance path for starting a Web3 venture.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。