Author: Maher, Foresight News

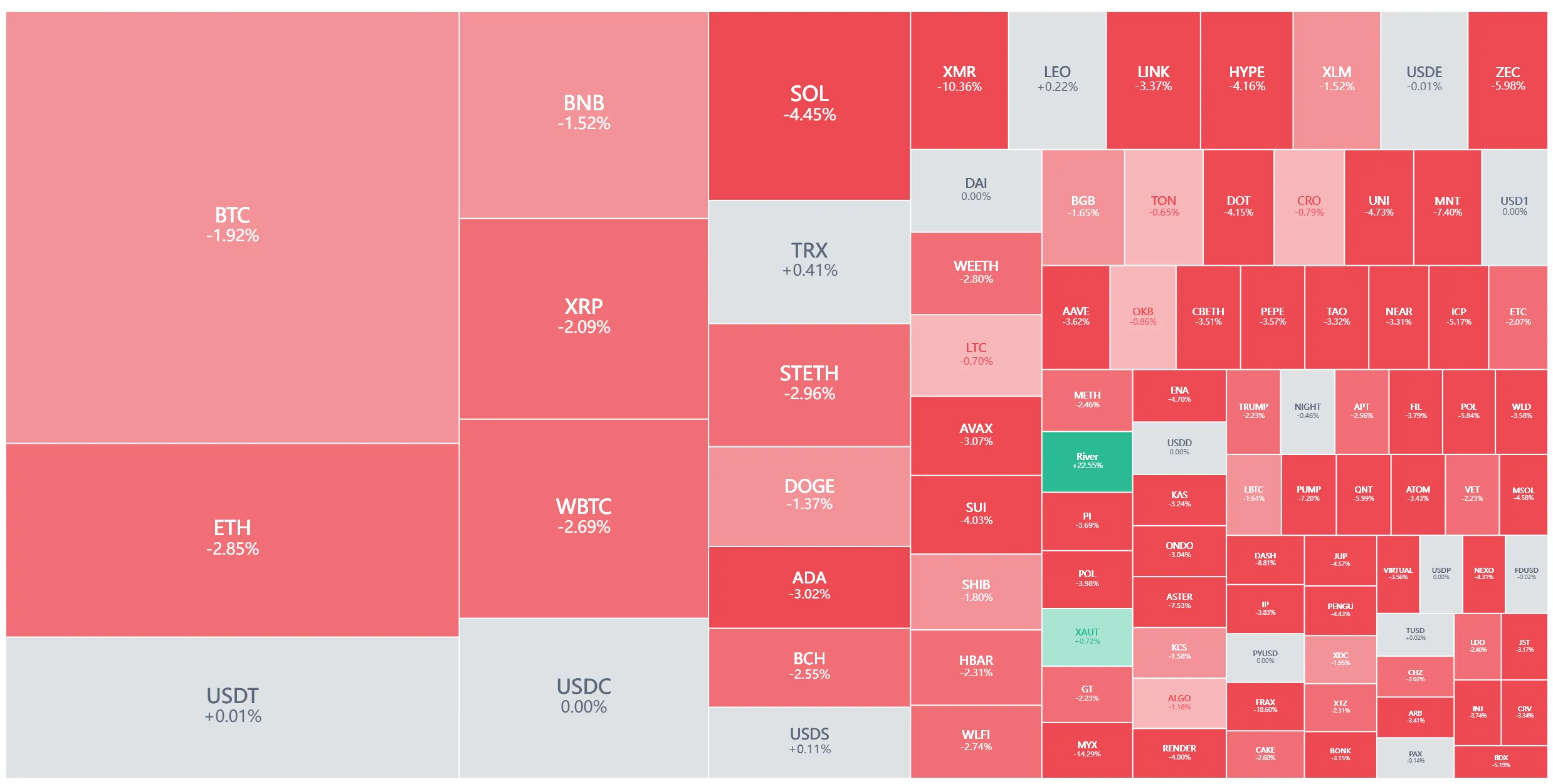

On January 26, the cryptocurrency market continued its weak trend this month, with BTC dropping from $88,000 to around $86,000, and ETH prices falling from around $3,000 to below $2,800 at one point, leading to a widespread decline in altcoins. Since reaching a high of $98,000 in early January, Bitcoin has recorded six consecutive trading days of losses, marking the longest losing streak since November 2024.

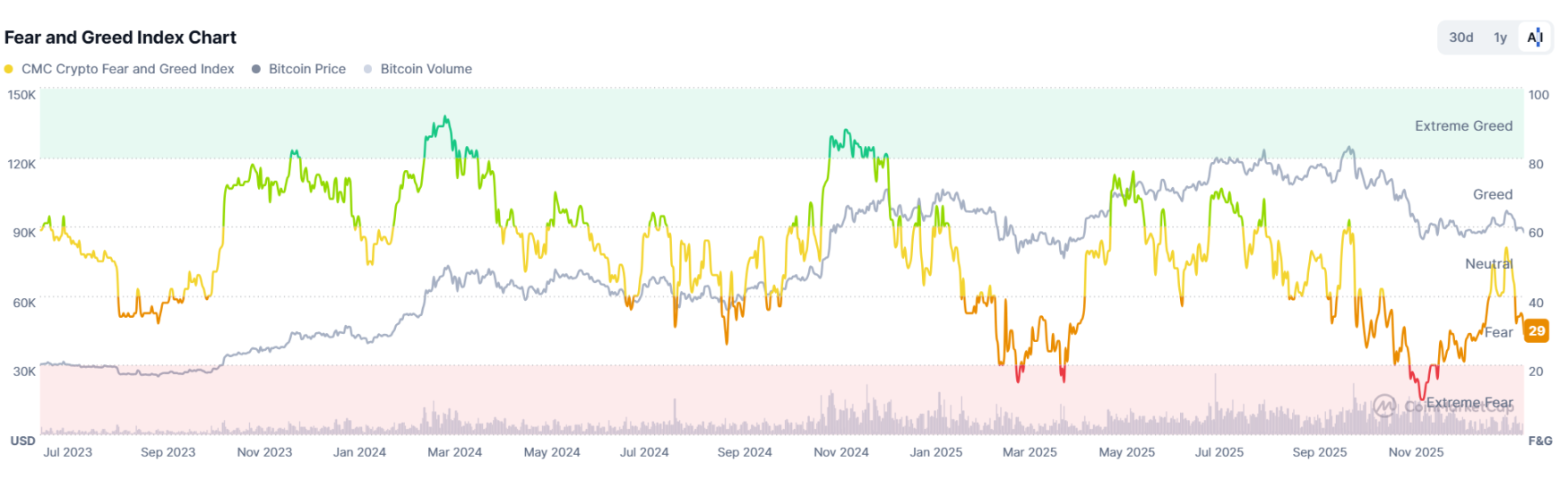

According to Coinglass data, the total liquidation amount in the crypto market over the past 12 hours reached $603 million, with long positions accounting for $553 million. The fear index currently stands at 29, indicating an "extreme fear" zone.

In the global financial markets, U.S. stocks faced pressure at the end of the week, with the futures market showing downside risks. The Dow Jones Industrial Average fell by 285.30 points, or 0.58%, to 49,098.71 points; the S&P 500 index rose slightly by 2.26 points, or 0.03%, to 6,915.61 points; and the Nasdaq index increased by 65.23 points, or 0.28%, to 23,501.24 points. Although the Nasdaq closed higher on Friday, it was not enough to prevent the three major indices from experiencing weekly declines. The S&P 500 index fell by 0.36% this week, the Dow dropped by 0.53%, and the Nasdaq declined by 0.06%. The U.S. dollar index also weakened, dropping by 0.91% on the day.

The precious metals market, on the other hand, rose against the trend, becoming the preferred choice for safe-haven funds. Gold and silver prices both reached historical highs, with gold priced at $5,041.39 per ounce, and gold ETF holdings increasing by 2.5% this week. Silver performed even stronger, currently priced at $107.8 per ounce, with industrial demand (such as for solar energy and electronics) combined with its safe-haven attributes driving its price to new highs.

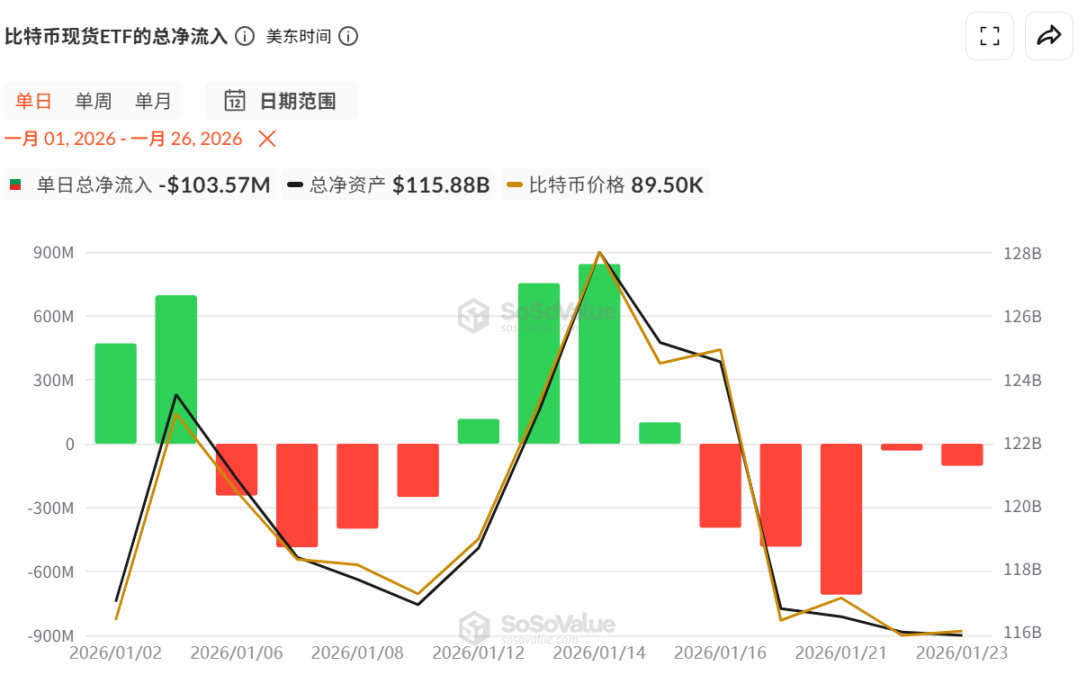

Significant Net Outflows from BTC and ETH Spot ETFs

SoSoValue data shows that Bitcoin spot ETFs have experienced a mix of net inflows and outflows since January, with five consecutive days of net outflows since January 16, including a single-day net outflow of $700 million on January 21. From January 16 to January 23, only January 22 saw a net outflow of $32.11 million, while the others exceeded $100 million.

Ethereum spot ETFs also performed poorly, with four consecutive days of net outflows since January 20, peaking at $229.95 million.

The significant net outflows from ETF spot data indicate that BTC and ETH are struggling to recover.

Unstable Situation in the Middle East, U.S. Tech Giants' Earnings Reports to be Released This Week

On January 23, U.S. President Trump stated during a speech on Air Force One that the U.S. government would impose a 25% tariff on all countries trading with Iran, a measure that will take effect soon. The so-called "secondary tariffs" mentioned by Trump are not a technical term but essentially a form of monetary sanctions imposed on countries that trade with nations that the U.S. does not favor.

On January 26, the U.S. Navy's USS Abraham Lincoln carrier strike group arrived in the Middle East and is conducting operations within the U.S. Central Command's jurisdiction. The U.S. Air Force announced that it would soon begin several days of readiness exercises in the Middle East, aimed at demonstrating the U.S. military's ability to deploy and maintain air combat forces in the region.

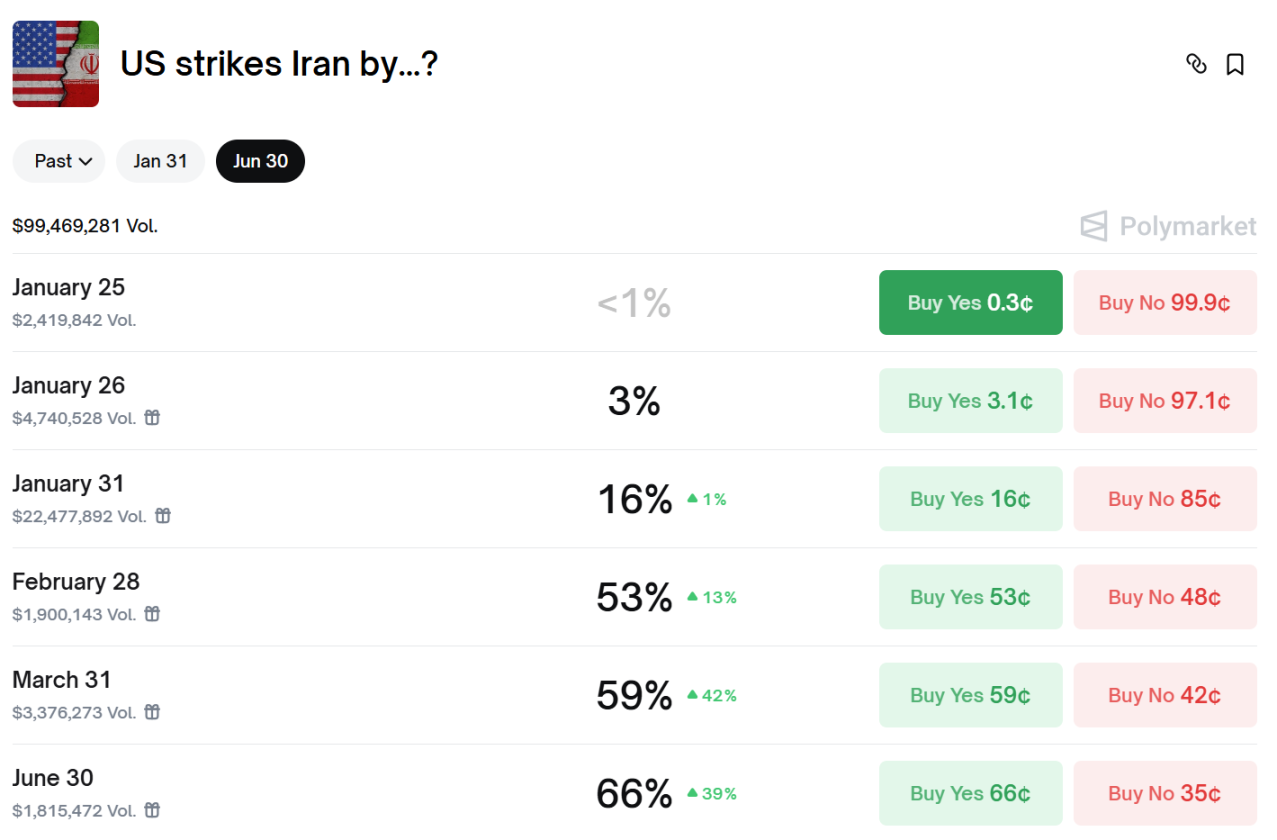

Polymarket data shows that the market's bets on the probability of the U.S. taking military action against Iran before February 28 have risen to 53%. The trading volume in this prediction market is nearly $100 million.

Iranian officials have issued a strong response, placing their military on high alert and threatening to block the Strait of Hormuz. This strait carries 20% of the world's oil, and any disruption would drive up energy prices and further amplify inflationary pressures. Geopolitical conflicts directly impact risk assets; Bitcoin, as "digital gold," should benefit, but in the short term, investors are turning to safer physical gold, leading to outflows from crypto.

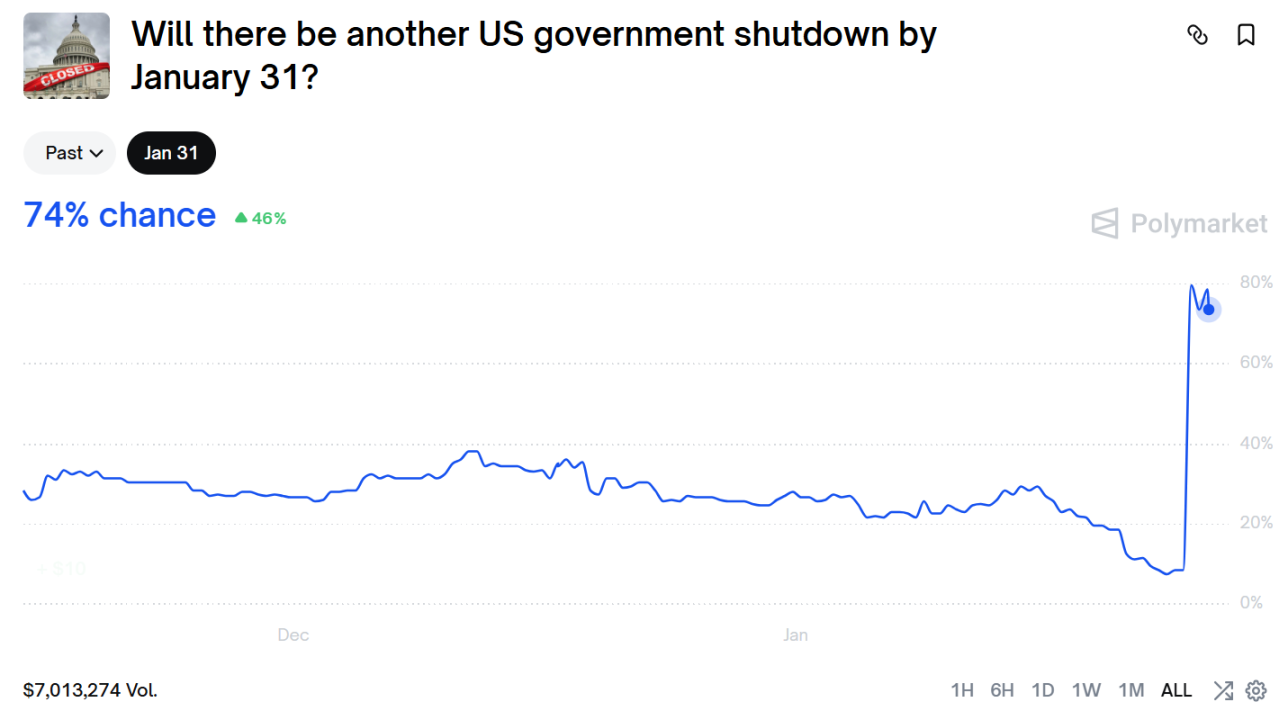

Additionally, the probability of a U.S. government shutdown has sharply increased. On January 26, Polymarket showed that the market's bets on another government shutdown rose from 8% to 80%, casting a shadow over risk assets once again.

Furthermore, the earnings season for U.S. tech stocks kicked off this week, adding another layer of uncertainty.

This week, several tech giants will announce their Q4 2025 and full-year results, including Microsoft on January 28, Meta and Tesla on January 28, and Apple on January 29.

Investors are skeptical about the return on AI spending and the growth of cloud business; for instance, Microsoft's stock price has already declined since the beginning of the year, with a focus on its Azure cloud service performance; Tesla's delivery volume has slowed, necessitating attention to the progress of new product lines. As for Apple and Meta, the market expects clear guidance on their AI and advertising businesses; otherwise, it could further drag down valuations.

These companies account for over 25% of the S&P 500's weight, and their performance directly impacts the Nasdaq index and overall market sentiment. If earnings reports fall short of expectations, it could trigger a sell-off in tech stocks, affecting the crypto market.

The correlation between crypto and tech stocks is high, and traders may be preemptively exiting to observe potential market volatility.

Future Market Trends

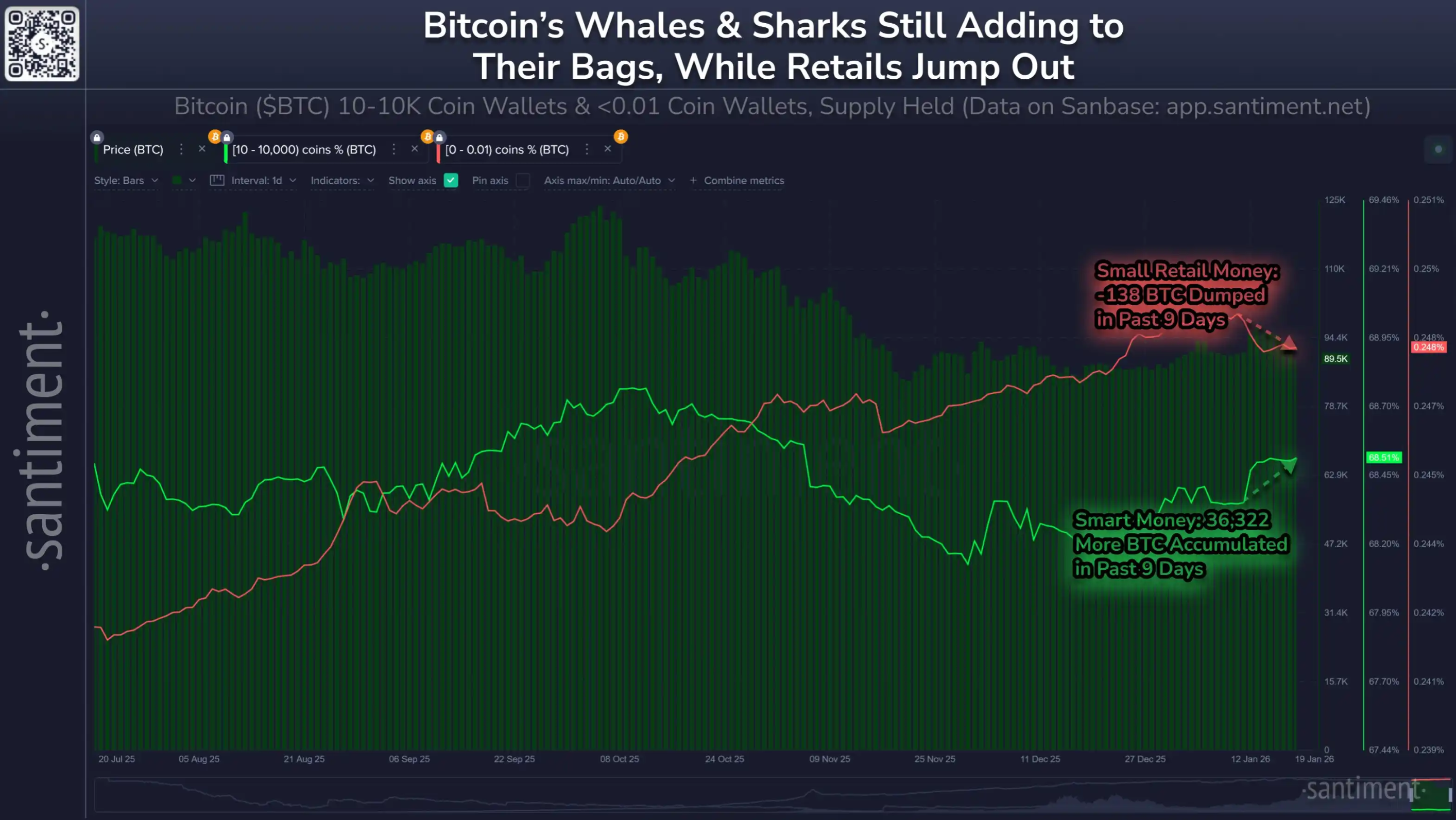

Crypto market analysis platform Santiment released data on social media indicating that while Bitcoin prices have retreated, gold and silver continue to soar. Nevertheless, Bitcoin "whales" and "sharks" are still accumulating. Addresses holding 10-100,000 BTC (whales) have increased their holdings by 36,322 BTC (+0.27%) over the past nine days. Addresses holding less than 0.01 BTC (shrimps) have reduced their holdings by 132 BTC (-0.28%) over the same period.

Santiment states that the best time for crypto assets to break out often occurs when "smart money" is accumulating while retail investors are selling. Setting aside geopolitical factors, this flow of funds is continuously building a long-term bullish technical divergence.

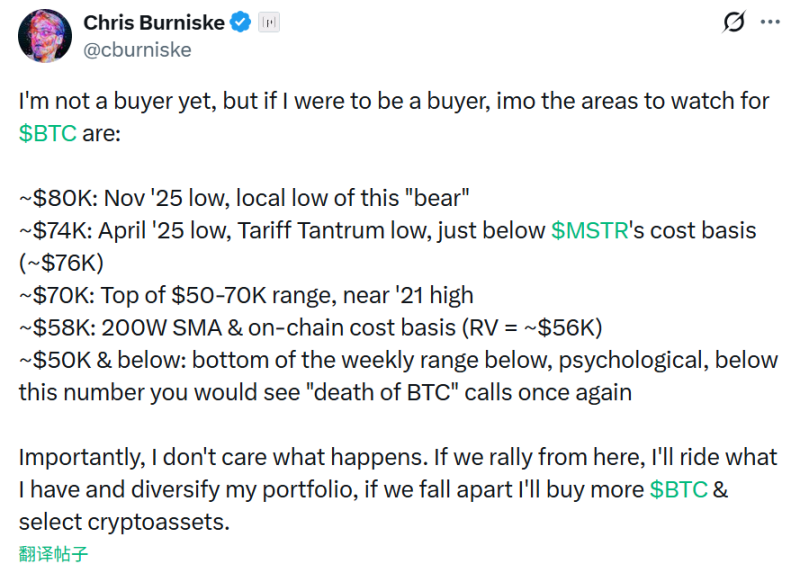

A partner at Placeholder tweeted that they will focus on several buy points, such as $80,000, $74,000, and $70,000, stating, "I don't care how it ultimately turns out. If the market rebounds from here, I will continue to hold my existing positions and diversify my portfolio; if the market crashes, I will buy more BTC and other crypto assets."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。