Original | Odaily Planet Daily (@OdailyChina)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Exchange Financial Management

The hottest financial opportunity right now is undoubtedly Binance's latest USD1 holding subsidy activity.

On January 23, Binance announced an airdrop event for qualified users holding USD1 on the platform, running from January 23 to February 20, with a total prize pool of 40 million USD equivalent WLFI. Eligible users must hold a USD1 balance in any account category on Binance (including spot accounts, fund accounts, margin accounts, and U-based contract accounts, where contract or margin accounts can enjoy a 1.2x reward bonus). During the event, WLFI rewards will be distributed weekly to users holding USD1, with the first airdrop scheduled for February 2, covering rewards from January 23, 8:00 to January 30, 8:00, and subsequent rewards will be distributed every Friday.

A simple calculation of the yield situation suggests that the results may not meet general market expectations. Overall, there are two major variables: one is the total value of the WLFI prize pool; the other is the total amount of USD1 on the Binance platform.

First, regarding the first variable, the total WLFI prize pool should be a fixed value of 40 million USD, but this morning, World Liberty Financial transferred 235 million USD1 from the treasury address to Binance, valued at approximately 40 million USD, which is expected to be the total prize pool for this airdrop event. Therefore, over the next month, the total value of this prize pool will fluctuate with the price of WLFI, considering the current downward trend in the market and the selling pressure from the airdrop rewards, I personally lean towards the total value of the prize pool shrinking to some extent.

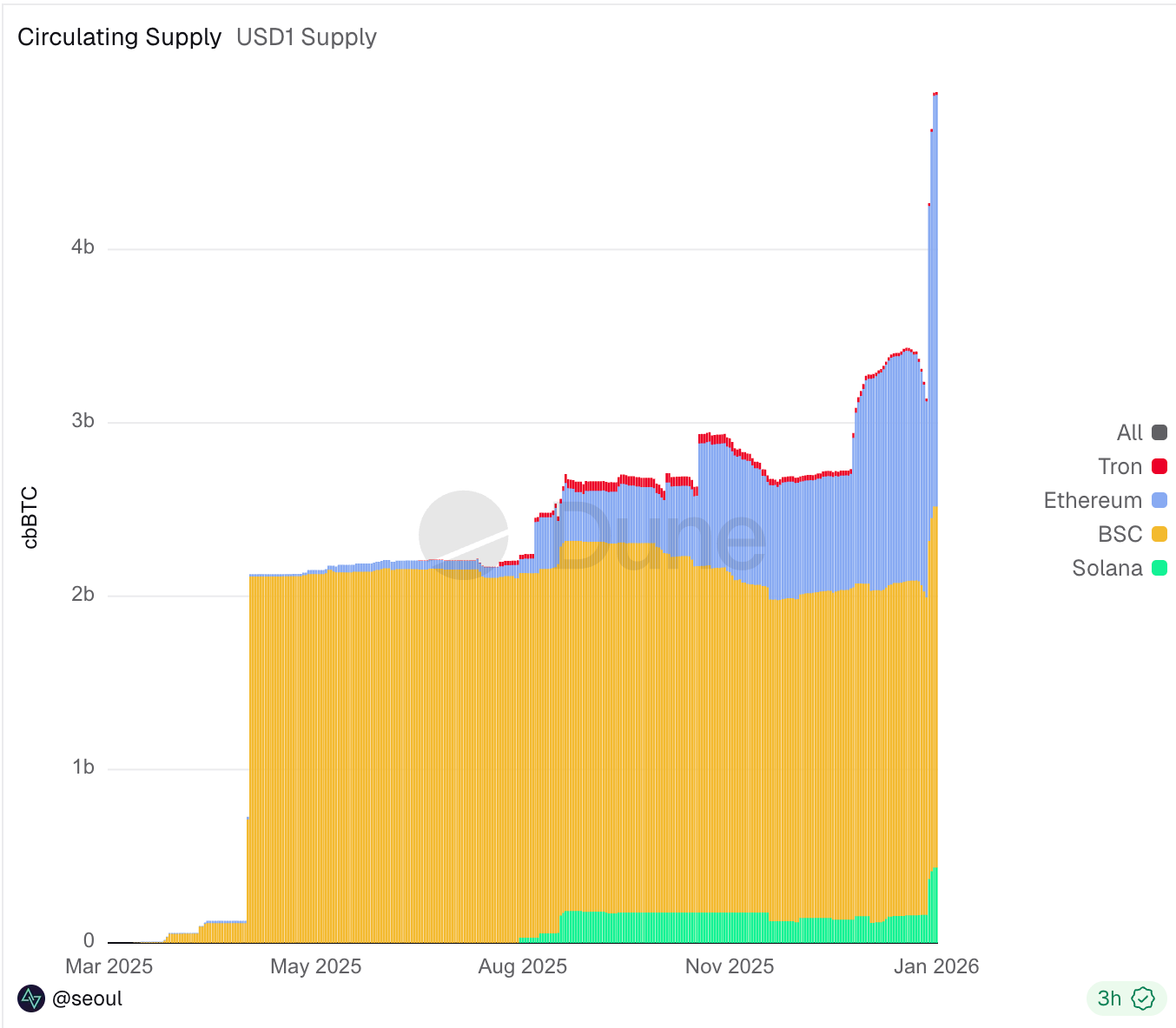

As for the total amount of USD1 on the Binance platform, the current total issuance of USD1 has reached 4.9 billion, of which about 4.22 billion is on the Binance platform. Based on this static data, the average annual yield for this event is approximately 12%. However, the problem is that since Binance launched this activity, the supply growth rate of USD1 has been quite exaggerated—since January 23, it has increased by nearly 700 million, and the newly issued USD1 will mostly flow into Binance, which will inevitably accelerate the overall dilution of the yield.

Considering the above two major variables, I personally lean towards the average yield for this event being diluted to below 10% relatively quickly, with a final expectation of around 8% being a relatively reasonable estimate. Based on this standard, unless you already hold USD1 (or stablecoins like USDC that have a higher premium than USDT), entering at a premium (for example, buying USD1 with USDT at a premium) is not very cost-effective.

On-chain Strategy 1: ListaDAO U/USDT LP Incentive (21.29% APY)

This morning, the mainstream lending protocol on BSC, ListaDAO, announced a partnership with Binance Wallet to launch an LP deposit incentive activity for stablecoin U.

Specifically, users need to participate in the activity through Binance Wallet, which runs from January 26, 8:00 to February 9, 8:00 Beijing time. The participation method is to deposit U/USDT LP (depositing both U and USDT) into ListaDAO through smart lending. ListaDAO will provide 240,000 LISTA as incentives, currently yielding approximately 21.29% annually.

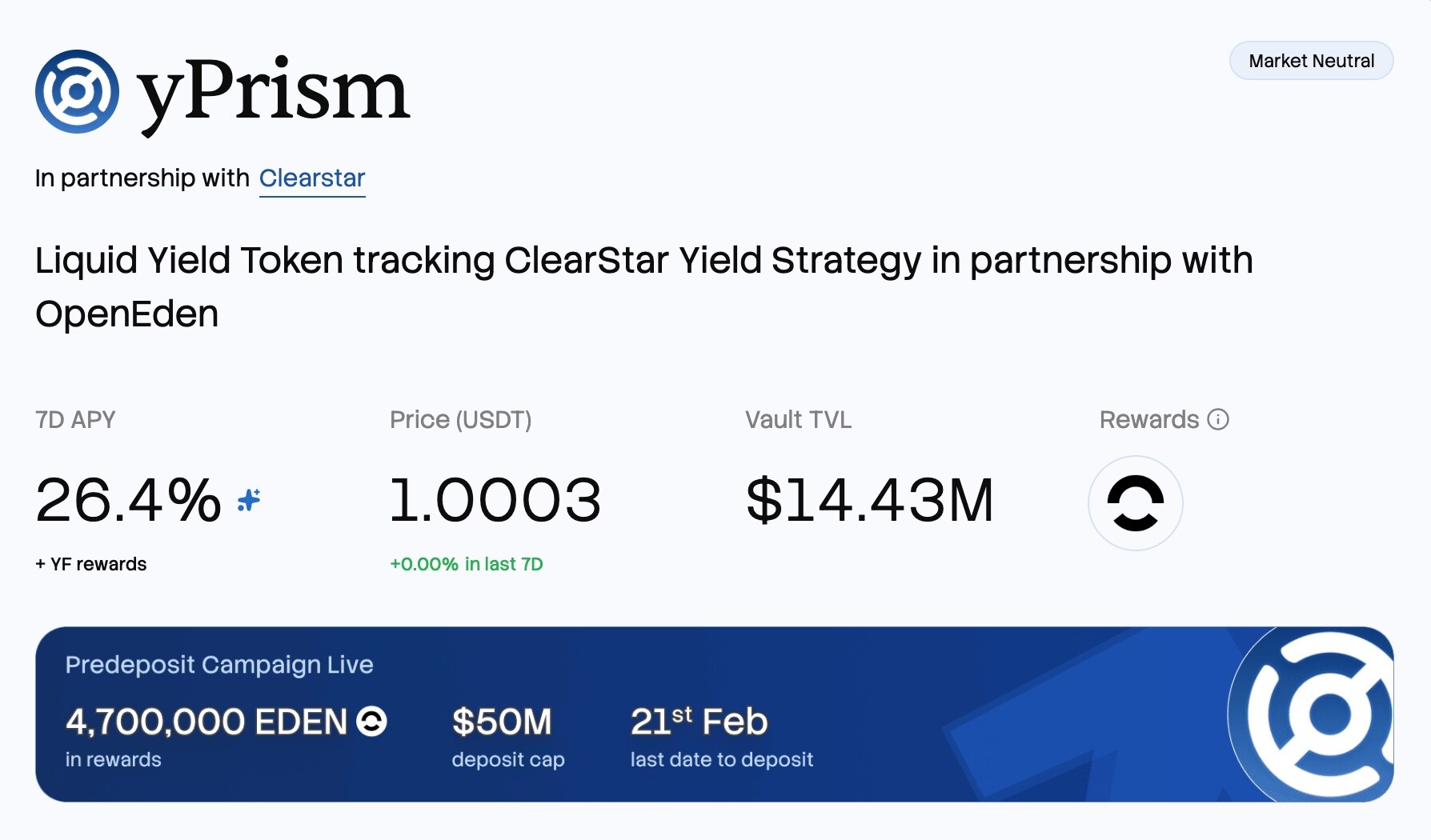

On-chain Strategy 2: OpenEden PRISM Pre-deposit (26.4% APY)

On January 23, OpenEden announced on platform X that it will soon launch a tokenized yield investment portfolio called PRISM in collaboration with FalconX and Monarq. This product aims to achieve stable returns during market cycles with low correlation to cryptocurrency prices through a multi-strategy quantitative model actively managed by Monarq.

PRISM will officially launch in February, but pre-deposits are already open, with a limit of 50 million USD for pre-deposits. Currently, 14.43 million USD has been deposited, leaving a significant amount of space. OpenEden will provide 4.7 million EDEN for pre-deposits, currently yielding approximately 26.4% annually (mainly from additional token incentives).

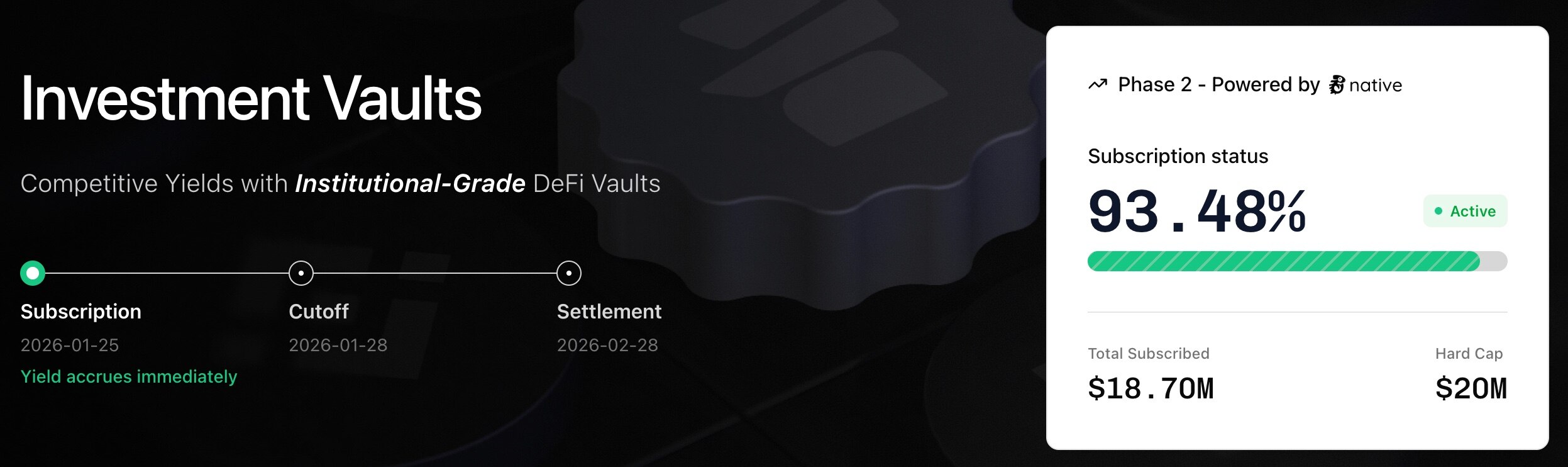

On-chain Strategy 3: Buidlpad Vault Phase 2 (8% APY)

On January 24, Buidlpad announced the launch of the DeFi fixed deposit product Buidlpad Vault Phase 2, offering an 8% fixed return. This phase of deposits opened on January 25 at 8:00 UTC, with a limit of 20 million USD, supporting ETH and USDT on Ethereum, as well as BNB and USDT on BSC, with a quota of 20 million USD.

As of the publication of this article, the pool has temporarily received 18.7 million USD, with a small amount still available for participation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。