Original Author: Sleepy.txt, Dongcha Beating

In 2017, Black Ant Capital made its first investment in Pop Mart and continued to increase its stake in the following years. In December 2020, Pop Mart went public in Hong Kong, with a market value exceeding HKD 100 billion on its first day. Black Ant Capital achieved over a hundred times return on paper, becoming a classic case in China's consumer investment field.

In 2010, Sequoia Capital China Fund invested in Meituan, and after multiple rounds of follow-up investments, it ultimately gained over 100 times return when Meituan went public. This investment made Sequoia China one of the most successful institutions in the history of internet investment in China.

In the world of venture capital, a 10x return is considered excellent, while a 100x return is legendary.

However, in Europe, a venture capital firm achieved nearly 1400 times return on a single investment.

This firm is called Balderton Capital. In 2015, they led the seed round of "Europe's Alipay," Revolut, investing £1 million. Over the next 10 years, they continued to follow up with multiple rounds, totaling an investment of about £3 million.

In 11 years, Revolut grew from a grassroots project rejected by Y Combinator to a fintech giant valued at $75 billion, hailed as Europe's most valuable fintech company. Today, Revolut has over 65 million users worldwide, with annual revenue exceeding $4 billion and annual profit over $1 billion, processing billions of dollars in transactions daily.

By 2025, Balderton Capital had cumulatively cashed out about $2 billion through the continued sale of some of its shares in Revolut. The remaining shares, based on the latest valuation, are still worth over $4 billion. This means that Balderton's total return on Revolut exceeds $6 billion, nearly 1400 times its investment.

Even more astonishing is that the fund holding Balderton's shares in Revolut—Balderton Capital Fund V, established in 2014—had a total fundraising scale of only $305 million. By 2025, this fund had already returned over 20 times the investment to its investors through the sale of some Revolut shares. This means that even if all other projects invested by this fund went to zero, its return multiple would still far exceed the average level of top industry funds, which is 3-5 times.

This story illustrates the essence of venture capital. In a business world where certainty has long disappeared, how should we face uncertainty? When everyone sees risk, where does opportunity lie?

Two Worlds of People

The starting point of this story is the encounter of two completely different individuals in early 2015.

The first person is Nikolay Storonsky, a restless Russian whose background is filled with privilege. His father is an executive at Gazprom, and he comes from a well-off family. He holds dual master's degrees in physics from the Moscow Institute of Physics and Technology and economics from the New Economic School, and he is also a sports enthusiast, having been a national swimming champion and passionate about boxing and surfing.

In 2006, he moved to London and became a derivatives trader at Lehman Brothers, dealing with billions of dollars in transactions daily. After Lehman Brothers collapsed in 2008, he switched to Credit Suisse. During frequent global business trips, he spent thousands of dollars each year on currency exchange losses. He found this unreasonable and unfair.

So, he approached Vlad Yatsenko, a software engineer who had worked for 10 years at Credit Suisse and Deutsche Bank, and decided to solve this problem himself.

In 2014, they founded Revolut at the Level39 incubator in Canary Wharf, London. Storonsky put all his savings, £300,000, on the line, betting on his future.

The second person about to meet him, Tim Bunting, came from a different world.

In 2007, at the age of 43, Bunting decided to leave Goldman Sachs.

He had worked at Goldman Sachs for 18 years, rising to become the global head of equity capital markets and an international vice chairman, one of the partners at Goldman Sachs. He stood at the pinnacle of a world of certainty, where every transaction had precise models, every decision was backed by vast amounts of data, risks were quantified, and the future was predicted.

But he chose to leave and jump into a completely different world—venture capital.

He joined Balderton Capital. The essence of venture capital is to seek possibilities amid uncertainty. There are no perfect models here, only vague foresight and judgment of people.

When they met in February 2015, Revolut was in a dire state. Their product demo was not functioning properly at that time, and they had just been rejected by Silicon Valley's most famous incubator, Y Combinator. In any normal investment decision-making process, this would be a project that would be immediately dismissed.

But Bunting saw something different.

He later recalled that in Storonsky's eyes, he saw an ambition and momentum to overturn the entire European banking industry. At the same time, he saw calmness and reliability in technical partner Yatsenko. One understood finance, one understood technology, one had drive, and one had composure—this was the perfect founder combination.

When everyone saw risk, great investors could see opportunity. Consensus often only brings mediocre returns; only non-consensus can potentially bring excess returns.

In July 2015, Balderton officially led Revolut's seed round, investing £1 million, with a post-investment valuation of £6.7 million.

However, is having excellent founders and brave investors enough? Is there a greater force driving the miracle of a 1400x return?

Timing, Location, and People

Behind Revolut's success are timing, location, and people.

First, there are the aftershocks of the 2008 financial crisis, which nearly destroyed public trust in traditional banks.

According to a Eurobarometer survey, trust in banks among Europeans fell to a historic low after the crisis. The banks themselves were also mired in difficulties, with profitability plummeting. Data shows that the average return on equity (ROE) of European banks fell from about 11% before the crisis to around 4%-5% around 2015, far below their American counterparts.

To survive, banks began massive layoffs. From 2012 to 2015, European banks closed over 10,000 branches and laid off tens of thousands of employees. This led to a sharp decline in the quality of bank services and a terrible customer experience, leaving a huge market vacuum for new challengers.

At the same time, a wave of technology was reshaping the market. In 2015, smartphone penetration in Europe began to rise significantly, and the adoption of mobile banking also grew rapidly. The shift of financial services from offline branches to mobile apps became an irreversible trend.

The regulatory tailwind also came at the right time. The European Union passed the second version of the Payment Services Directive (PSD2) at the end of 2015, which centered on "open banking." This legislation broke the banks' monopoly on customer data, allowing third-party fintech companies to access users' bank account data with their authorization to provide innovative financial services. This paved the way for the development of the entire fintech industry.

A new generation of consumers was also rapidly emerging. As digital natives, they were very frustrated with the cumbersome processes and poor experiences of traditional banks. A survey in 2015 showed that 80% of consumers under 45 believed they should be able to complete any financial transaction through a mobile app.

Moreover, the fragmented nature of the European market itself became a booster for Revolut. Europe consists of dozens of countries, languages, and currencies, and the inconvenience and high costs of cross-border transactions have always been a significant pain point.

It was against this backdrop that, around 2015, the European fintech race was in full swing. Germany's N26, the UK's Monzo and Starling, and TransferWise (now Wise), which focuses on cross-border remittances, emerged almost simultaneously. Each occupied a niche, with N26 focusing on design and Monzo emphasizing social features. The industry consensus at the time was to capture one market or product category at a time.

But Revolut was an outlier from the start.

Its core insight was that the banking industry could be built like a global software product, fully integrated and borderless from day one. While competitors were still meticulously cultivating a specific experimental field, Revolut was already expanding globally. This bold strategy, which seemed highly controversial at the time, ultimately allowed it to outpace all its rivals.

However, from a grand vision to a great company, there were many near-death experiences; Revolut did not have a smooth journey.

Running Amid Controversy

One of Revolut's company values is "Never Settle." This value is deeply ingrained in the company's DNA, driving it to run amid controversy for the past 11 years.

This relentless pursuit of more is first reflected in the speed of product expansion.

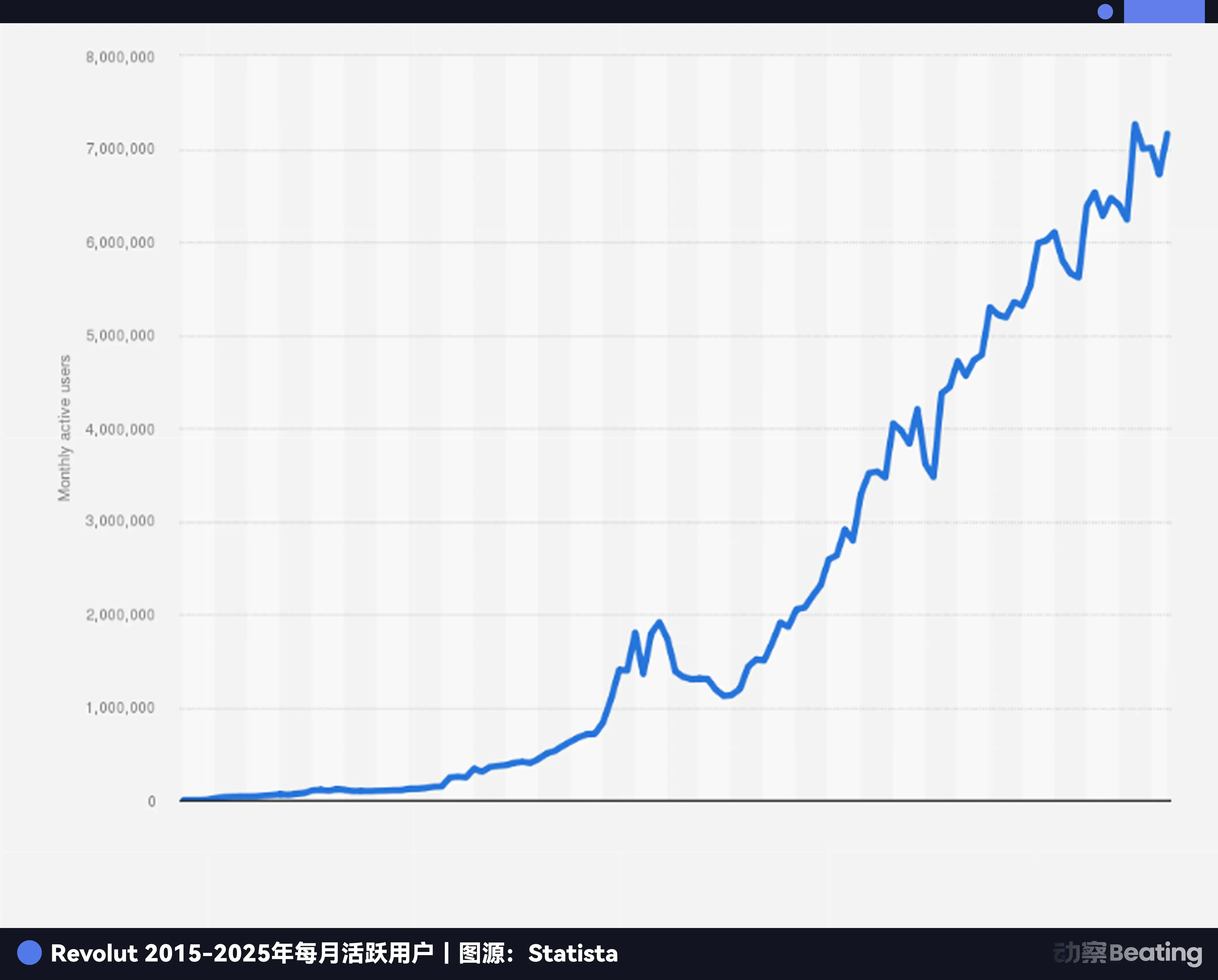

In July 2015, Revolut officially launched its product, processing over $500 million in transactions in its first year. By the end of 2016, the user base surpassed 300,000, handling nearly £1 billion in transaction volume. In November 2017, Revolut announced that its user count had exceeded 1 million, achieving this milestone in just over two years.

Storonsky's creed is "Release and iterate faster to create more winning opportunities." After launching the core product of low-fee currency exchange cards, Revolut quickly introduced many new features: cryptocurrency trading in 2017, followed by stock trading, savings vaults, budgeting tools, insurance, P2P payments, and business accounts… It positioned itself as an all-encompassing financial super app, while its competitors were still cautiously guarding their own small territories.

This aggressive expansion strategy brought astonishing growth. In 2017, Revolut's user base tripled, and revenue grew nearly fivefold. In 2018, the user count increased from 1.5 million to 3.5 million, with revenue growing by 354%. By April 2018, Revolut completed a $250 million Series C funding round, reaching a post-investment valuation of $1.7 billion, officially becoming a unicorn.

Revolut's ability to rapidly launch new features stems from its internally adopted VC-style product strategy.

They do not blindly believe in elite "top-down design"; instead, many new products and features are tested simultaneously within the company. However, only a small portion of these will ultimately "graduate" to become real business lines. Those that do not take off will be cut, while those that are successfully validated will receive doubled resource investment from the company.

Today, none of Revolut's core revenue products come from top-level strategic planning; all have emerged from this internal competition and trial-and-error culture.

However, this has come at a significant cost. Over the past 11 years, Revolut has faced at least three life-and-death tests.

The first test came from trust.

In 2016, the company needed more funds for expansion, but traditional financing channels were not smooth. Storonsky proposed a bold idea: to raise funds from the public through the crowdfunding platform Crowdcube. This was an unconventional move at the time, and many investors opposed it.

But Balderton strongly supported this decision. They believed it would not only solve the funding issue but also serve as an excellent marketing opportunity to test public trust in Revolut. Ultimately, 433 ordinary people participated in this crowdfunding, with an average investment of about £2,152 each. They believed in Revolut's vision and voted for this startup with their real money.

Now, these early supporters have received astonishing returns. The price of an iPhone at the time has turned into a down payment for a house in the suburbs of London ten years later. The initial investment of £2,152 is now worth over £380,000, yielding a return of more than 170 times.

The second test came from culture.

In February 2019, Wired UK published a major report revealing serious issues with Revolut's corporate culture. The report accused the company of resorting to unscrupulous means for growth, ruthlessly exploiting employees, leading to a very high turnover rate. The company found itself in a significant public relations crisis.

At that time, Revolut was in a period of rapid growth. In 2019, the company surpassed 10 million users and began expanding into Australia and Singapore. However, the outbreak of this crisis severely damaged the company's reputation.

As a board member, Bunting immediately engaged in deep communication with Storonsky. He shared his experience managing thousands of people at Goldman Sachs, helping Storonsky realize that as the company reached a certain stage, it needed to establish a more mature and humane management system. With Balderton's help, Revolut brought in more experienced managers and began systematically improving its corporate culture.

The third test came from compliance.

Starting in 2021, Revolut applied for a banking license from the UK's Financial Conduct Authority (FCA), but it took three years to get approved. The regulatory body raised serious questions about its anti-money laundering system and corporate governance. This was a fatal blow for a fintech company.

While waiting for the UK license, Revolut did not stop its expansion. In 2020, the company completed a $580 million Series D funding round, reaching 14.5 million users and entering the US and Japanese markets. In 2021, the company completed an $800 million Series E funding round, achieving a valuation of $33 billion. By 2022, the user count had grown to 26 million.

At this critical moment, Bunting leveraged his industry network. He personally invited Martin Gilbert, a titan of the UK investment community and chairman of Aberdeen Standard Investments, to become Revolut's chairman. This move greatly enhanced the regulatory body's trust in Revolut. In July 2024, Revolut finally obtained the coveted UK banking license.

Along with obtaining the UK license, Revolut also delivered impressive results. In 2024, the company surpassed 50 million users, with annual revenue reaching $4 billion, a 72% increase, and annual profit exceeding $1 billion for the first time, processing a total customer transaction volume of over $1 trillion. The company became the highest downloaded financial app in 19 countries.

Throughout these 11 years of ups and downs, Balderton Capital has consistently stood firmly behind Revolut. Bunting has always served as a board member of Revolut, providing indispensable support at every critical juncture in Revolut's development and continuously following up with every round of financing.

The "American Dream" of European VCs

Revolut's legendary battle has brought Balderton, which had long been in the background, into the spotlight. This London VC's ability to capture miracles is not due to random luck but stems from the bloodline of Silicon Valley's prestigious Benchmark Capital flowing through its veins.

In 1999, Benchmark's partners decided to establish a European branch, Benchmark Capital Europe, in London. They not only brought funding but also a unique organizational structure—Equal Partnership.

In traditional VC funds, a few managing partners (General Partners) typically hold most of the power and profits, while other partners occupy relatively subordinate positions. This pyramid structure can easily lead to internal competition and conflicts of interest.

In contrast, the Equal Partnership structure is entirely different. At Balderton, all partners equally own the company, have equal say in any decision, and share returns. Regardless of who finds or leads a deal, everyone enjoys the same economic returns. This system ensures that all partners' interests are highly aligned, allowing them to work together like a pack of wolves.

The advantages of this system were vividly demonstrated during the investment in Revolut.

First, there was better due diligence. When Bunting first met Storonsky, he was well-versed in financial markets but did not fully understand the underlying technology. So, he immediately brought in partner Suranga Chandratillake, who had an engineering background, to assess the situation. There were no concerns about taking credit among partners; there was only a shared goal of investing in the best companies.

Second, because all partners' interests are completely tied together, they can genuinely make the most beneficial decisions from the company's perspective. In Revolut's multiple funding rounds, Balderton provided steadfast support and never hesitated due to internal conflicts of interest.

Finally, there was more comprehensive post-investment support. Startups encounter different issues at various stages. The Equal Partnership structure means that entrepreneurs can tap into the entire partner team's resources at any time.

In 2007, the European team spun off from Benchmark and officially renamed itself Balderton Capital, named after the street where their first office was located. The core system of Equal Partnership was fully retained and became the key to Balderton's emergence in the European VC jungle.

However, a good system does not guarantee the success of every investment. In the world of venture capital, what ultimately determines victory or defeat?

The Power Law

This law, in simple terms, is an extreme version of the 80/20 rule.

In the world of venture capital, it means that a small portion of investments will contribute the vast majority of returns for the entire fund. The vast majority of investments will ultimately be mediocre or even result in total loss.

According to PitchBook data, the top 10% of investments in the venture capital industry contribute 60% to 80% of the returns across the industry. The daily work of VCs is to find that 1% possibility among countless seemingly unreliable projects. They need to cast a wide net but also need to place heavy bets on the very few projects that have the potential to become super winners at critical moments.

In Balderton Capital's 25-year history, it has invested in over 275 companies, producing a number of star enterprises like Darktrace, Depop, and GoCardless. Without Revolut, Balderton might still be an excellent European VC, but it would not be the legend it is today.

This also determines that the essence of venture capital is a game of non-consensus. If the prospects of a project have already become a consensus among everyone, its valuation will inevitably rise, and the future return potential will be extremely limited. Only those early-stage projects that are not well-regarded and are filled with controversy have the potential to bring about disruptive excess returns.

For venture capital, success is not a matter of hit rate but a matter of return magnitude. It doesn't matter if you invest in nine wrong projects; as long as you hit one that can return 1000 times, you can achieve great success. This may sound like gambling, but top VCs use a rigorous philosophy and discipline to increase the odds of winning.

So, is there a replicable formula behind this miracle of 1400 times return?

The Formula for a Thousandfold Return

Excess Return = (Non-consensus Founders x Structural Era Opportunities) ^ Patience Across Cycles

First, there are non-consensus founders.

In the world of venture capital, judgment of people is always the top priority. Especially in the seed round stage, when products, markets, and data do not yet exist, the founder is almost the only judgment indicator. A top-tier founder must be a paranoid optimist, someone who has unrealistic fantasies about the future while being able to pragmatically solve current problems.

Second, there are structural era opportunities. Revolut's success is inseparable from the unique historical window in Europe in 2015. The aftereffects of the financial crisis, the proliferation of mobile internet, the opening of regulatory policies, and the generational shift of consumers. Great companies are products of their times. They can keenly capture structural changes and use their products and services to become synonymous with that change.

Finally, and most importantly, is the patience to endure through cycles. From 2015 to 2026, Revolut faced numerous tests, including cultural crises, regulatory dilemmas, and market competition. Throughout these 11 years, Balderton has always been a steadfast supporter, not only continuously following up with investments but also providing valuable advice and resources at critical moments. This long-term holding and patience to weather challenges alongside the founders is a necessary condition for achieving excess returns.

In the world of capital, time is the best friend and the worst enemy. Only those investors who can resist short-term temptations and adhere to long-term value can ultimately reap the benefits of time's compounding.

£1 million turning into $6 billion is not just a wealth myth; it is a story about cognition, courage, and patience. It tells us that in this rapidly changing era, true opportunities are always reserved for those who can perceive the times, embrace change, and are willing to traverse cycles alongside great entrepreneurs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。