Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

"Black Monday" has struck again.

According to OKX market data, in the early hours of January 26, BTC dropped from $88,945 to a low of $86,090, with a maximum decline of 3.21%; ETH fell from $2,942 to $2,786, with a maximum decline of 5.3%; SOL dropped from $126.99 to $117.16, with a maximum decline of 7.74%. As of the evening of the 26th, the market slightly rebounded, with BTC reported at $88,200, ETH at $2,915, and SOL at $123.

In stark contrast to the gloomy atmosphere in the crypto market, gold and silver prices have recently hit historical highs. COMEX data shows that the international silver price reached a maximum of $109.560 per ounce within 24 hours, with a daily increase of 8.03%; international gold also strengthened, rising to $5,059.7 per ounce, with a daily increase of 1.65%. Additionally, the Japanese yen has shown strong performance in the foreign exchange market. Data shows that the USD/JPY exchange rate hit 154, marking a new low since November of last year, with a daily decline of 1.11%.

On social media, the phrase "Anything But Crypto" reflects the frustrations of crypto investors.

Trigger 1: Volatility in the Yen Exchange Rate Market

Today, the yen exchange rate experienced significant volatility in the foreign exchange market, with the yen rising sharply from 158.4 to 1 USD to 153.9 to 1 USD, an increase of over 4 yen. Behind this change, the market widely speculates that the US and Japan may have begun joint intervention in the exchange rate, or at least are conducting "exchange rate inquiries," a precursor to foreign exchange intervention.

The sharp fluctuations in the yen exchange rate did not come out of nowhere. As early as January 23, the yen to USD exchange rate in the Tokyo foreign exchange market saw a significant short-term increase.

The Federal Reserve's rare "exchange rate inquiry" is seen as a preparatory stage for foreign exchange intervention, indicating the US government's high concern over the depreciation of the yen. According to Xinhua News Agency, exchange rate inquiries typically occur in the early stages of exchange rate intervention, where financial monetary authorities ask banks about current exchange rates and market conditions through the central bank, serving as a more direct market operation signal than verbal intervention.

In fact, since 1996, the US has only intervened in the foreign exchange market on three different occasions, the last being after the 2011 Japan earthquake, when it collaborated with G7 countries to sell yen to stabilize the market. For this reason, the market views the recent sharp fluctuations in the yen exchange rate as a signal that the US and Japan may jointly intervene, likely in response to the yen's sharp decline. For the crypto market, this means that market liquidity and risk sentiment could be significantly affected, especially amid increasing global macroeconomic uncertainty.

Why Does Yen Appreciation Intensify Bitcoin's Decline?

For a long time, the low interest rate policy of the yen has led global investors to flock to borrow yen and exchange for high-yield assets in arbitrage trades. This so-called "yen carry trade" has been an important component of global market liquidity. Arbitrage traders borrow low-interest yen and convert it into dollars and other high-yield assets, investing in risk assets like Bitcoin and stocks. However, when the yen exchange rate appreciates sharply, arbitrage traders typically face increased funding costs, forcing them to close positions and sell Bitcoin to repay debts.

For example, in August 2024, the yen surged due to an unexpected interest rate hike by the Bank of Japan and market expectations of exchange rate intervention, triggering a collapse of arbitrage trades, causing Bitcoin to plummet from $65,000 to $50,000 in just a few days.

Now, with the yen exchange rate rising sharply again, similar arbitrage trades in the market may be forced to close positions once more, further exacerbating Bitcoin's price volatility.

Moreover, those familiar with global financial markets know that the yen is not just Japan's currency; it is also seen as a barometer of global economic risk. Whenever global market uncertainty increases, funds tend to flow into the yen as a "safe-haven currency." This phenomenon is particularly evident during global economic crises and financial turmoil. However, fluctuations in the yen's exchange rate reflect not only the health of the Japanese economy but also changes in global risk sentiment.

This is why frequent fluctuations in the yen exchange rate, especially during times of global macroeconomic uncertainty, directly impact the prices of risk assets like Bitcoin. When the yen exchange rate continues to fluctuate and intensify, global market risk aversion rises, leading to corrections in risk assets (including Bitcoin), while safe-haven assets like gold and silver may see price increases. Especially in the context of potential joint foreign exchange intervention by the US and Japan, a short-term correction in Bitcoin's price has become a natural market response.

It is worth noting that the negative correlation between Bitcoin and the US Dollar Index (DXY) is particularly significant. When the dollar strengthens, investors tend to shift funds to dollar-denominated assets, reducing demand for high-risk assets like Bitcoin, which faces downward pressure; conversely, when the dollar weakens, Bitcoin may have opportunities for price increases. If the US-Japan intervention is successful, leading to a significant drop in the USD/JPY exchange rate, the dollar index will be suppressed, providing upward support for Bitcoin, which is primarily priced in dollars.

However, dialectically, while exchange rate intervention may temporarily boost Bitcoin's price, if the intervention does not change the market fundamentals, price increases are often difficult to sustain. Past exchange rate intervention events indicate that government intervention is only temporary, and changes in market trends rely more on global economic fundamentals.

Trigger 2: Increased Probability of US Government Shutdown, Crypto Market Structure Bill May Stall Again

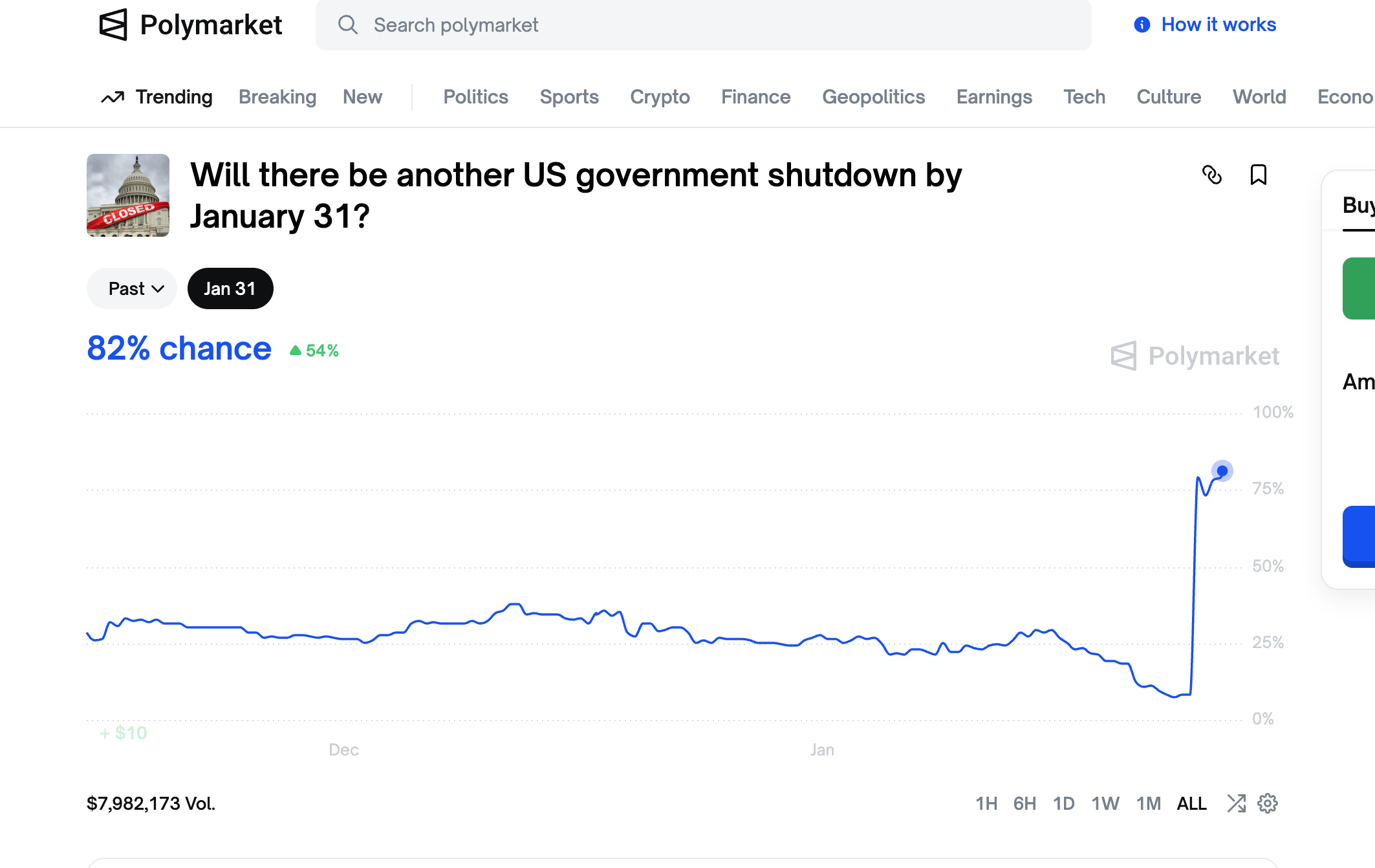

With another law enforcement incident occurring in Minnesota, the risk of a US government shutdown has sharply increased. According to the latest data from Polymarket, the market predicts the probability of a government shutdown has surged to 82%.

This situation was triggered by a fatal shooting incident in Minneapolis on January 24. 37-year-old emergency room nurse Alex Pretti lost his life during a standoff with federal law enforcement officers, and after the incident, the federal government and local law enforcement agencies provided conflicting accounts of what transpired. The shooting itself sparked widespread public outrage and quickly became a catalyst for political maneuvering.

Democratic leader Chuck Schumer has made it clear that if the Department of Homeland Security (DHS) does not resolve the disputes regarding law enforcement, the Democrats will do everything possible to block the advancement of the budget bill. Since the Senate requires 60 votes to pass a bill, this political deadlock will directly affect the government's operations. It is noteworthy that the government, after experiencing a 43-day shutdown last time, is now facing another "deadlock" just two months later.

This political impasse not only means that the US government faces the threat of a shutdown but also directly impacts the regulatory process for the crypto industry. The review meeting for the crypto market structure bill, originally scheduled for January, had to be postponed due to controversy, and the intensification of this political maneuvering may cause the bill, which should have continued to advance, to stall again.

Although there seems to be a significant consensus on the "market structure" part of the crypto market, controversies surrounding stablecoin yields, DeFi compliance, and the SEC's regulatory tools in the field of tokenized securities pose significant political obstacles to the bill's advancement.

As Galaxy Digital's research director Alex Thorn pointed out, this delay highlights the deep divisions between Congress and the crypto industry on several key issues, particularly regarding stablecoin yield mechanisms and DeFi-related provisions. Alex Thorn further mentioned that within just 48 hours, over 100 amendments were submitted, and stakeholders continued to discover new points of contention at the last minute, significantly increasing the difficulty of political coordination. For the crypto market, the uncertainty of policies has exacerbated market volatility, and a government shutdown means that regulatory policies cannot be anticipated in the short term, leaving investors filled with uncertainty and concern about the future. (Recommended reading: "CLARITY Review Postponed, Why Are Industry Divisions So Severe?")

Conclusion

In this macro game, gold has reasserted its dominance in the market with a "retro" stance. As international gold prices first broke through $5,000, the flow of safe-haven funds has become evident. Meanwhile, Bitcoin, once hailed as "digital gold," has delivered a dismal performance amid this systemic shock—since October 2023, long-term holders (LTH) have massively "cut losses" and exited for the first time. This is not just a collapse in price but a collapse of trust in Bitcoin in the face of a real financial crisis. At this moment, the market has chosen not innovation but stable safe-haven assets, and the surge in gold prices proves this point.

All of this reveals a harsh reality: in the shadow of a financial crisis, the market is more inclined to choose "stability" over "narrative." Gold, as a safe-haven asset, has solidified its position as a refuge during a sovereign credit crisis, while Bitcoin's slump exposes its still fragile credit foundation within the mainstream financial system. The million-dollar bet on Polymarket regarding "which will reach $5,000 first, gold or ETH" has been settled, and gold's decisive victory not only marks a significant price breakthrough but also symbolizes the market's "aesthetic return."

Although traditional assets have regained dominance, emerging assets are still groping in the fog for the market's true trust. However, market fluctuations are not without opportunities. The crypto market, which has broken the "four-year cycle" pattern, still harbors bottom-fishing opportunities.

As Placeholder VC partner Chris Burniske noted, from a buyer's perspective, the price ranges for BTC worth paying attention to include: around $80,000 (the low in November 2025, the current phase low); around $74,000 (the low in April 2025, formed during tariff panic); around $70,000 (close to the peak of the 2021 bull market); around $58,000 (near the 200-week moving average); and $50,000 and below (the lower bound of the weekly range, which has strong psychological significance; if breached, it may trigger discussions of "Bitcoin is dead").

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。