As of now, the inflow of funds into U.S. ETFs in January has significantly surpassed historical highs, with cryptocurrencies dropping out of the top ten.

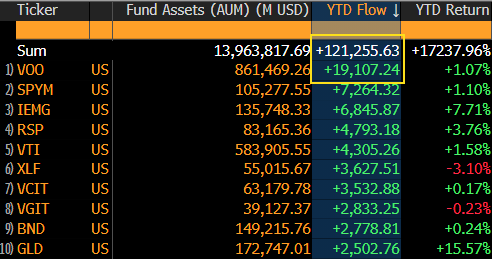

The good news is that there is still a large amount of money flowing into U.S. stock ETFs. In January, over $121.2 billion has already flowed into ETFs listed in the U.S. How alarming is this figure?

Eric from Bloomberg has calculated that the average net inflow for January historically is $40 billion, while the all-time record was set last year at $88 billion. With January still not over, we have already exceeded 40% of the historical high.

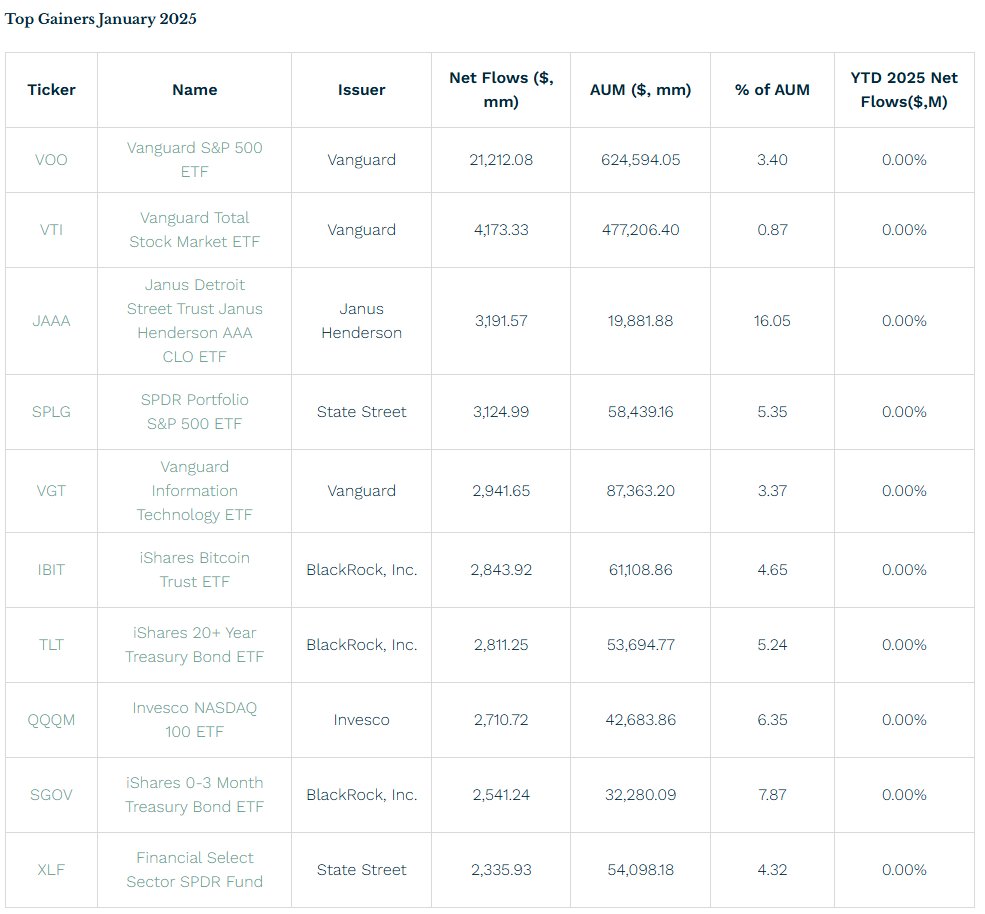

These funds are primarily entering ETFs related to the S&P 500, including $VOO, $SPY, and $RSP. The total inflow for these three assets has already surpassed $31.16 billion, accounting for about 25% of the total inflow.

From this, we can infer that although there is still a considerable amount of bearish sentiment in the market, investors in U.S. stocks are still betting with risk control, and the amount of money being bet has significantly exceeded historical highs. This indicates that investors believe 2026 will be a bull market or the beginning of a bull market. This is not speculation; it is backed by a substantial amount of real money being invested.

At the same time, it is unfortunate that in January 2025, $IBIT, which is BlackRock's $BTC spot ETF, ranked sixth in that month's fund inflow. If I remember correctly, although the $ETH spot ETF $ETHA did not make the top ten, it reached thirteenth place. However, by 2026, IBIT is no longer seen in the top ten.

This also indicates that traditional investors' interest in cryptocurrencies has significantly declined compared to the same period last year. However, at least Bitcoin still maintains a certain level of correlation with U.S. stocks, so it can still be inferred that as long as U.S. stocks are in an upward trend, the cryptocurrency industry will not perform too poorly.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。