When the price of Bitcoin fluctuates between $86,000 and $89,000, two messages flash on traders' screens: on one side, Glassnode data shows that profit-taking pressure is easing, while on the other, Titan of Crypto warns that the MACD is sending a clear bearish signal.

Bitcoin fell below $87,000 on January 26, 2026, accumulating a decline of over 10% since January 14. Various interpretations of technical analysis have led to intense debates in the market.

Some analysts are beginning to worry that this may signal the arrival of a bear market year, with some even suggesting that Bitcoin's price could retreat to around $58,000.

1. Market Status

● The current Bitcoin market is at a delicate balance point. As of January 27, 2026, after a brief dip below $86,000, Bitcoin found support and subsequently entered a gradual upward channel, currently hovering around $88,500.

● From a daily chart perspective, the $89,000 level has formed key resistance, which is both the core resistance of the previous consolidation range and resonates with short-term moving average resistance.

● Investors need to closely monitor if the price can stabilize around $88,500 in the early session, and if volume gradually follows, there is a possibility of continuing to challenge $89,000; if it fails to break the resistance, it may return to oscillate within the $87,000-$88,000 range, or even test the support near $86,000 again.

2. Technical Analysis Dispute

● Market anxiety is mainly focused on the conflicting signals from technical indicators. Analyst Titan of Crypto warns that Bitcoin's MACD has shown a bearish crossover on a two-month cycle, which is a clear bear market signal.

● Based on historical experience, similar technical patterns often trigger a 50%-64% retracement. If calculated at this magnitude, the downside potential for Bitcoin from the current price is quite considerable.

● Glassnode's data, however, paints a different picture. Their analysis indicates that Bitcoin broke through a long-term compression around the $87,000 level in the first week of 2026, rebounding about 8.5% to reach $94,400.

This rebound was accompanied by a notable cooling of profit-taking pressure in the market, with reduced selling pressure stabilizing the market.

3. Key Support and Resistance Levels

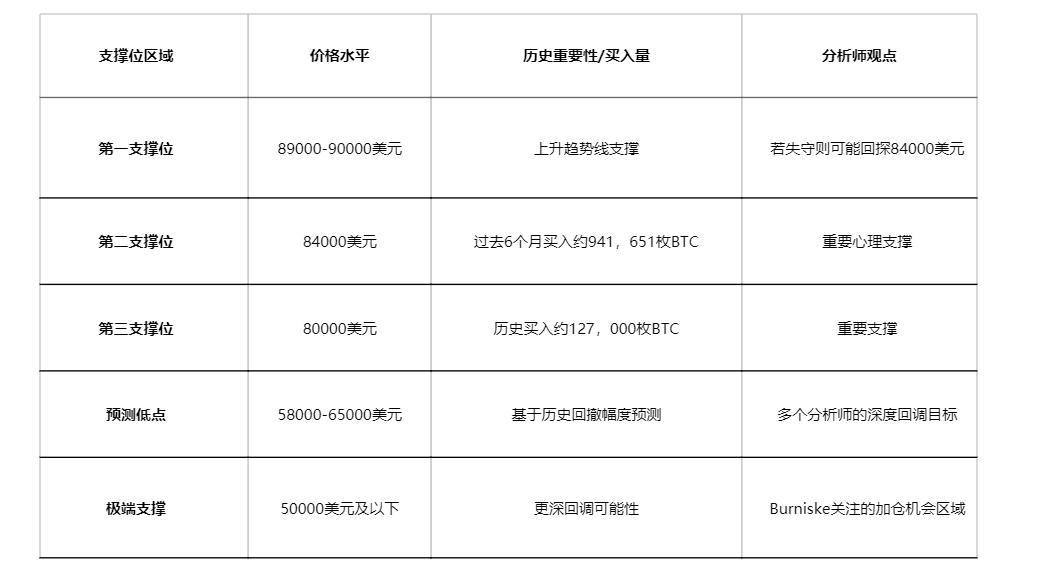

The market's direction will largely depend on the defense and attack of key price levels. According to several analysts, Bitcoin currently faces multiple important support and resistance levels.

● Short-term holder cost basis: Currently at $99,100, recovering to this level would be the first meaningful confirmation signal for a positive trend.

● Key resistance level: $89,000 is the current main resistance level, while $93,000 is the key level that needs to be reclaimed to change the seller-controlled situation.

The table below summarizes the main support levels that analysts are focusing on and their importance:

4. Institutional Viewpoint Discrepancies

● Different institutions and analysts have significant discrepancies regarding Bitcoin's trajectory in 2026. Binance founder CZ believes that considering the U.S. policy environment supporting cryptocurrencies, Bitcoin may break the traditional four-year cycle and enter a "super cycle."

● Placeholder VC partner Chris Burniske is more cautious, listing several support price levels to watch and suggesting that if the price rebounds, one should hold and gradually diversify, while a deep correction should be seen as an opportunity to accumulate Bitcoin and quality crypto assets.

● Interestingly, Fundstrat Capital has shown contradictions between public statements and internal reports. Its Chief Investment Officer Tom Lee publicly bets that Bitcoin and Ethereum will hit new highs in January, but the report given to internal clients predicts a deep correction in the first half of 2026.

5. On-Chain Data Insights

● Glassnode's on-chain analysis reveals the complex structure of the current market. The data shows that the market has transitioned from defensive deleveraging to a phase of selective risk-taking. The transfer of Bitcoin to trading platforms is increasing, which may indicate preparations for large sell-offs, while long-term holders are beginning to sell, reducing the market's bottom support.

● Data from the options market also provides valuable information. After experiencing a record maximum options open interest reset at the end of 2025, over 45% of open positions were cleared, freeing the market from structural hedging mechanisms.

● Market makers' gamma has turned bearish in the $95,000-$104,000 range, meaning that within this range, price increases will force market makers to buy spot or perpetual contracts for hedging, mechanically reinforcing the upward trend during strong periods.

6. Market Influencing Factors

● Factors pushing Bitcoin into a downward trend come from multiple directions. On one hand, the derivatives market is weakening, and funding sentiment is turning cautious; on the other hand, the bearish crossover of the MACD on the technical front is creating psychological pressure.

● The macro environment is also changing. Trader Eugene Ng Ah Sio stated: “I don’t quite understand the latest price movements this week, so I plan to wait and see for a while. From a higher time frame perspective, the pattern isn’t ideal, and my judgment is that the price is likely to go lower.”

● Former FTX community partner Benson Sun reminded: “Currently, the interest of off-exchange funds in BTC remains insufficient, making it difficult to break through $100,000; the subsequent market may oscillate widely around the $85,000 to $95,000 range.”

7. Future Market Outlook and Strategy

● Based on the current technicals and market sentiment, Bitcoin may face several different trajectory paths. If support levels are sequentially breached, Bitcoin may follow this downward path: $89,000 → $84,000 → $80,000 → $58,000.

● In the long term, there is a clear divergence in market views. Some analysts and institutions predict that Bitcoin may break the four-year cycle logic and, driven by sovereign and institutional funds, could reach $250,000.

● Glassnode believes that the market is transitioning from defensive deleveraging to selective risk-taking, entering a new phase in 2026 with a clearer structure and expanded re-selection.

● For investors, the most important thing right now is to monitor whether key support levels can hold and whether market sentiment will change further. Most analysts suggest maintaining a cautious attitude, preparing for potential volatility, and adjusting positions based on market changes.

Bitcoin's price is repeatedly oscillating below the $89,000 key resistance level, with traders constantly switching their gaze between multiple screens. A seasoned trader wrote on social media: “The market now feels like a suspense movie, where everyone is guessing the ending but no one really knows.”

Technical analysts are drawing trend lines on charts, on-chain analysts are tracking large transaction flows, and retail investors are closely watching price pushes. Similar scenes are unfolding in trading rooms in New York, London, and Hong Kong.

The Bitcoin market is at a critical moment, with the potential to either decline further due to deteriorating technicals or break through key resistance levels due to continued institutional inflows.

Which direction the market ultimately chooses will depend on how the delicate balance between these forces is disrupted.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。