Entering 2026, the Ethereum market did not experience the anticipated "strong start," but instead continued to fluctuate below key price levels. From the beginning of the year to now, the ETH price has reversed all gains and turned to decline, trading persistently below the psychological threshold of $3000.

However, beneath the calm price surface, a turbulent undercurrent represented by "whales" is at play, showcasing a rare polarization and fierce competition. On one side are the early holders and short-term traders distributing their chips, while on the other side, off-market funds are buying the dips and making long-term arrangements. This tug-of-war between bulls and bears is pushing Ethereum toward a critical turning point.

1. Sellers: Profit-Taking and Strategy Adjustment

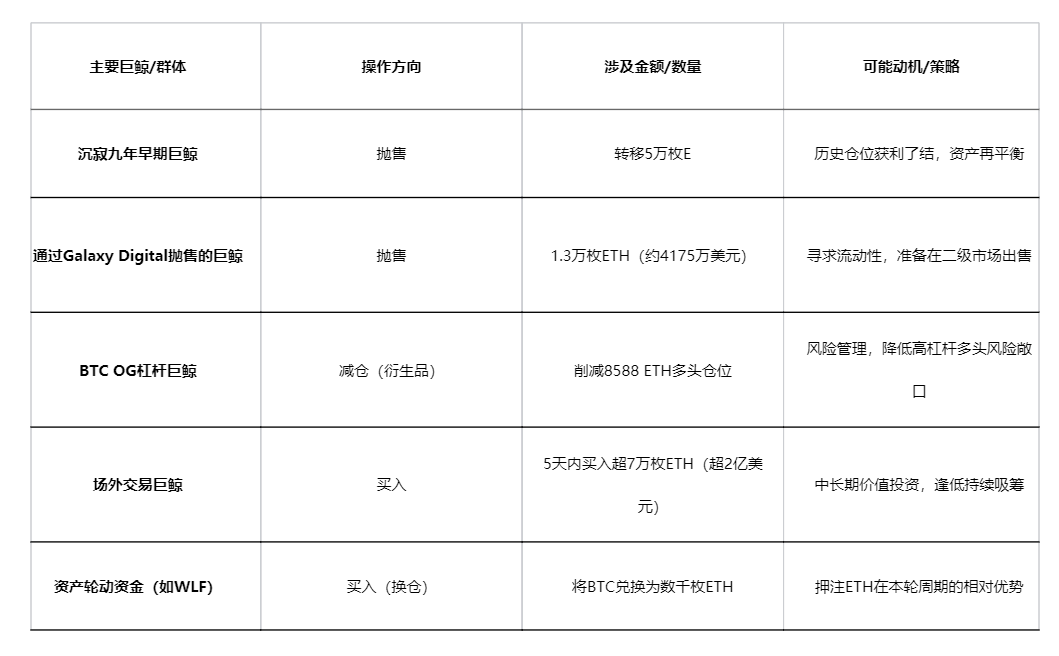

The recent market sell-off pressure mainly comes from two directions: profit-taking by early whales who have been silent for years, and tactical reductions by active whales based on market fluctuations.

● First, dormant whales awaken, historical chips enter the market. On-chain data shows that an early Ethereum holder who had been silent for nine years recently began to act, transferring 50,000 ETH to market-related addresses.

○ Such movements from "ancient" addresses are often interpreted by the market as potential profit-taking signals, as their holding costs are extremely low, and any sale at current prices could yield substantial profits. Although this address still holds a large amount of ETH, the act of initiating transfers alone is enough to influence market sentiment.

● Second, large-scale sell-offs through professional channels attract attention. On January 19, monitoring detected that a suspected whale was selling through the over-the-counter wallet of Galaxy Digital.

○ This wallet transferred out 13,000 ETH in one go, quickly depositing half of it into mainstream exchanges like Binance, Bybit, and OKX, with a total value of about $41.75 million. Conducting over-the-counter transactions through professional institutions like Galaxy Digital before transferring to exchanges often indicates that the seller is seeking more direct liquidity, preparing to sell in the secondary market.

● Additionally, leveraged whales actively reduce risk exposure. Not limited to the spot market, significant players in the derivatives market are also adjusting their positions. A whale marked as "BTC OG Insider Whale" reduced its ETH long position on Hyperliquid by 8,588 ETH in just ten minutes on January 26.

○ Despite still holding a leveraged ETH long position worth about $620 million, the act of reducing exposure indicates that even bulls are becoming cautious around this price level, beginning to manage risk.

These sell-off behaviors are not isolated events; they collectively form a significant outflow trend since the beginning of the year. Data shows that from the start of 2026 to January 23, the overall holdings of Ethereum whales have decreased from about 31 million to just above 29 million, with a cumulative sell-off of approximately 1.63 million ETH.

2. Buyers: Accumulating on Dips and Asset Rotation

In contrast to the sellers, another group of whales views the price pressure as an opportunity to accumulate chips, and their buying behavior is equally resolute and substantial.

● The strong accumulation by over-the-counter whales is particularly noteworthy. According to Lookonchain, an over-the-counter trading whale address has been continuously buying, accumulating over 70,000 ETH in the past five days, with a total value of over $200 million. This behavior of consistently making large purchases through over-the-counter channels, regardless of short-term fluctuations, typically represents a strong bullish outlook on the asset's mid-to-long-term value.

● The rotation of funds from Bitcoin to Ethereum is another trend worth noting. Some whales are adjusting their crypto asset allocations, shifting funds toward Ethereum.

○ For example, the DeFi project World Liberty Financial, supported by President Trump, recently exchanged thousands of Ethereum for Bitcoin;

○ Other large addresses have also executed similar "swap BTC for ETH" operations. This indicates that some smart money believes that, in this market cycle, Ethereum may have greater relative growth potential or resilience than Bitcoin.

● The continuous depletion of exchange supply is a direct result of whale buying behavior. CryptoQuant monitoring data shows that the reserves of Ethereum on exchanges are continuously declining.

○ This means that the force of withdrawing ETH from exchanges and transferring it to private wallets for long-term holding is stronger than the force of depositing into exchanges for sale. The contraction of exchange supply is a classic bullish on-chain signal, as it indicates that the potential selling power in the market is weakening, while the number of long-term holders, or "diamond hands," is increasing.

3. Market Structure: The Key Battleground of $2700-$3100

The tug-of-war between whales is not taking place in a vacuum but is centered around specific price ranges. On-chain data analysis clearly indicates that $2700 to $3100 has become the core battleground and key consensus area in the current ETH market.

● This range has accumulated a massive amount of chips. Statistics show that between $2700 and $3100, approximately 17.9 million ETH are densely piled up, accounting for 22.6% of the total circulating supply of ETH; at the $3100 level alone, there are 4.43 million ETH worth of chips.

These chips mainly come from two groups: one is investors who bottomed out between $2600-$2700 from May to July this year, and their continued accumulation has raised the average cost to $3100; the other is a new batch of bottom-fishing funds that entered when prices retraced to $2700-$2800 in late November.

This structure produces two important market implications:

$3100 is not a strong resistance: Since most holders around this price level are in a state of being trapped, once the price rebounds to this level, they are more inclined to break even or reduce losses slightly rather than sell off in large quantities, thus not forming a strong rebound resistance.

$2700 constitutes key consensus support: This price level is widely regarded by market participants, especially some institutions, as an important demand area. On-chain analysts point out that $2700 is currently one of the few consensus support zones; if it effectively breaks down, the price may enter a "vacuum zone" lacking clear technical anchors and chip support, leading to accelerated declines. Therefore, the competition between bulls and bears at this price level will be exceptionally fierce.

4. Divergence Signal: The Contradiction Between Weak Prices and Strong Fundamentals

The current Ethereum market presents a thought-provoking divergence phenomenon: weak price performance coexists with a continuously strengthening network fundamental. This may provide another perspective for understanding the differentiated behavior of whales.

Although the price hovers below $3000, the activity level of the Ethereum network is on the rise. According to CryptoOnchain data, the seven-day moving average of active Ethereum addresses has risen to about 718,000, setting a new historical high. Rising prices with declining on-chain activity are a dangerous signal; conversely, stable or declining prices with increasing on-chain activity are often seen as a bullish divergence, potentially indicating the accumulation of upward momentum.

Several factors are driving the increase in network activity:

● The popularity of Layer-2 scaling solutions has reduced user transaction costs and barriers.

● The activity of ecological applications such as DeFi and NFTs has seen a rebound.

● Increased retail participation complements the behavior of whales.

This divergence indicates a short-term misalignment between market trading sentiment (reflected in prices) and the practical value of the network (reflected in on-chain activity). Trading-oriented whales focused on short-term price fluctuations may choose to exit or short, while value-oriented whales focused on the long-term development prospects of the network may view this as a good opportunity to position themselves.

5. Market Direction After the Whale Showdown

Ethereum is at a crossroads shaped by the interplay of whale competition, on-chain fundamentals, and the macro environment. The fierce confrontation between bullish and bearish whales is essentially a repricing of Ethereum's short-term trends and mid-term value.

In the short term, market movements will depend on the outcome of this showdown. If selling pressure continues, especially if the price effectively breaks below the key consensus support of $2700, it could trigger broader stop-loss and panic selling. Conversely, if buying pressure can withstand the selling pressure and successfully establish a bottom at key support levels, with the continued reduction of ETH in exchanges and gradual recovery of market confidence, upward momentum will continue to accumulate.

In the medium to long term, the core factors determining Ethereum's value will still return to its network effects, ecological development, and the continuously growing real utility. Whale movements are an important window for observing market sentiment and capital flows, but they are by no means the only determining factor. For investors, while paying attention to the competition among large funds, it is more important to penetrate the short-term price fluctuations and gain insight into the intrinsic value evolution trajectory of Ethereum as a global decentralized computing platform. This tug-of-war between whales, regardless of the outcome, is merely a fierce footnote on this long evolutionary path.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。