Pre-IPO Stock in non-public companies occupies a trillion-dollar value in global asset allocation, but has long been constrained by two structural dilemmas: first, high entry barriers for participants, and second, a lack of liquidity at the exit end. In the context of real-world assets (RWA) being a focal point of financial innovation, "equity tokenization" is seen as a key mechanism to break the liquidity deadlock in the private equity market. This report focuses on the underlying equity tokenization of non-public companies (especially unicorns), aiming to clarify the evolution logic of this sector from early speculation to compliant infrastructure by analyzing the current market situation, realization paths, and key challenges. The core conclusions of the report are as follows:

1. Market Status: Despite global unicorn valuations reaching trillions of dollars, the actual scale of the tokenization market is only in the range of $100-200 million (if excluding some non-freely tradable projects, the actual transferable scale is only in the tens of millions). The market shows a strong head effect, with assets highly concentrated in a few AI tech unicorns like OpenAI and SpaceX. This indicates that the industry is still in the very early stages of transitioning from a "narrative space" to an "effective market," and has yet to form a scalable asset supply and acceptance capacity.

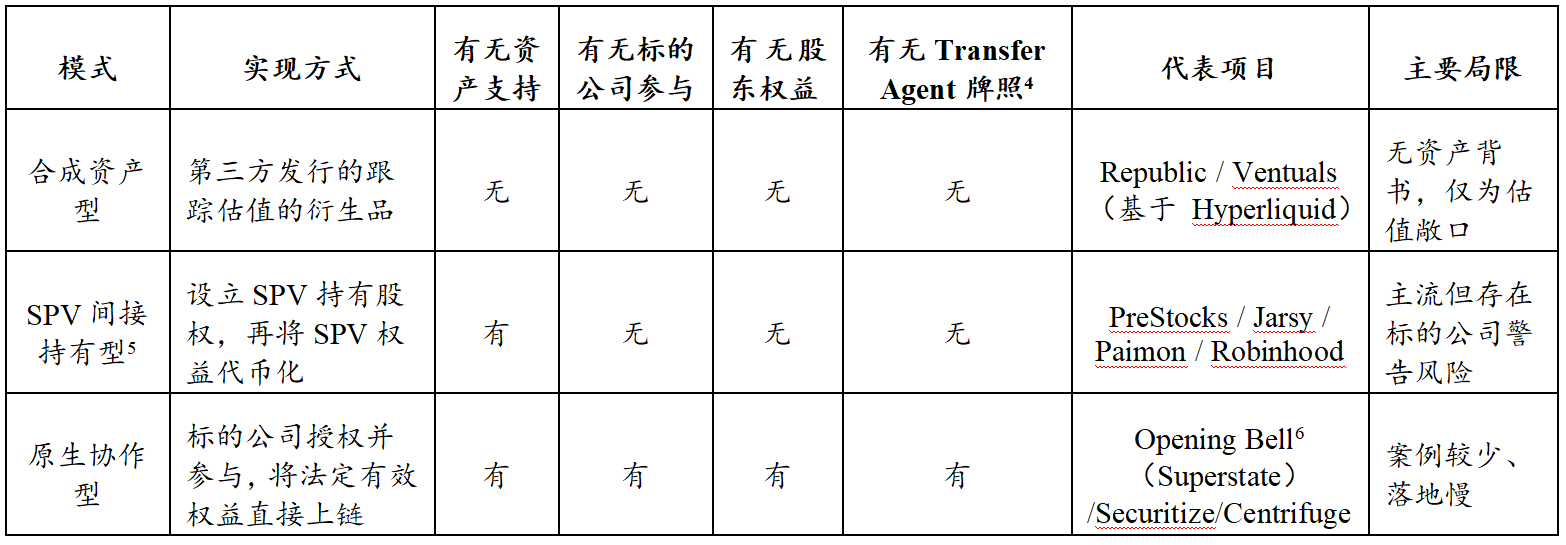

2. Path Differentiation: The industry has formed three differentiated paths, with the core differences lying in the "degree of rights confirmation" and "participation of the target company":

• Synthetic Asset Type (Republic, Ventuals): Includes Perps and debt note types, does not hold underlying equity, only provides valuation exposure, and meets speculative demand with high leverage, mainly serving as a flow introduction.

• SPV Indirect Holding Type (Jarsy, PreStocks, Paimon): Holds shares through offshore SPVs and tokenizes rights, currently the most mainstream form of implementation. However, it faces dual compliance challenges from the target company and regulatory authorities, with recent public warnings from companies like OpenAI exposing the legal vulnerabilities of this model in violating "transfer restriction clauses."

• Native Collaborative Type (Securitize, Centrifuge): Essentially provides TaaS (Tokenization as a Service) for the target company. Relying on Transfer Agent qualifications, it achieves legal mapping of on-chain tokens and shareholder registers, realizing true equity on-chain. Although the implementation cycle is long, it can solve legal finality dilemmas and provide compliant paths for IPO transitions.

3. Trend Assessment: Tokenization does not automatically create liquidity; the current market faces liquidity issues (thin markets, pricing inefficiencies). The future breakthrough point for the industry lies not in unilateral issuance, but in collaboration with the target company:

• Compliance Side: Under pressure from regulatory authorities and corporate legal departments, business models will gradually shift towards compliance collaboration, where service providers offer TaaS infrastructure for issuers.

• Asset Side: Target assets will shift from crowded head unicorns to long-tail private companies with more urgent exit demands.

• Facility Side: There is a need to build native RWA trading facilities that adapt to securities attributes (such as compliant AMMs, on-chain order books) to address the issue of insufficient depth.

• Ecological Side: The future market will move towards a multi-layered symbiotic pattern, rather than a single model of survival of the fittest. The synthetic asset model serves as a flow entry point and plays a role in user cultivation; the SPV indirect holding type has strong flexibility and can provide early validation for specific assets; the native collaborative type offers TaaS services, representing a standardized path for accommodating institutional funds and achieving large-scale asset tokenization.

Keywords: Pre-IPO Equity Tokenization, RWA, SPV Structure, TaaS (Tokenization as a Service), Transfer Agent

Table of Contents

1. Research Scope and Key Definitions

1.1. Research Object

1.2. Research Premise

2. Market Background: The "Trillion-Dollar Siege" of Non-Public Equity

2.1. Asset Lineage and Holder Structure

2.2. Scale Description: Dual Evidence of Capital Allocation and Asset Valuation

3. Core Contradictions and the Value Path of Tokenization

3.1. Dual Bottleneck: Participation Constraints and Exit Obstacles

3.2. Three Types of Gains: Circulation Channels, Price Discovery, and Financing Supplementation

4. Market Status: From Narrative Space to Measurable Scale

4.1. Scale Status: "Tens of Millions" Volume in Early Validation Period

4.2. Target Preferences: Concentration of Head Tech Unicorns and AI Assets

5. Realization Paths: Structural Differences and Rights Boundaries of Three Models

5.1. Synthetic Asset Type: Value Mapping Detached from Underlying Rights Confirmation

5.2. SPV Indirect Holding Type: Mainstream Form Validating Demand First

5.3. Native Collaborative Type: True Equity On-Chain Centered on Transfer Agent

6. Case Studies: Typical Case Dissection of Three Models

6.1. Synthetic Asset Type: Introduction of Speculative Flow

6.2. SPV Indirect Holding Type: Coexistence of Low-Threshold Implementation and High Compliance Controversy

6.3. Native Collaborative Type: Achieving TaaS Service Model through License Compliance

6.3.1. Securitize Path A: Exodus—Lifecycle Sample from ATS to NYSE

6.3.2. Securitize Path B: Curzio Research—Sample of ATS Private Circulation Unable to Go Public

6.3.3. Centrifuge Entry: Directional Signal of Native TaaS Route

7. Key Challenges: Three Types of Bottlenecks Determine Industry Limits

7.1. Compliance Squeeze: Dual Pressure from Regulation and Corporate Legal Departments

7.2. Liquidity Paradox: Tokenization Does Not Automatically Bring Depth

7.3. IPO Finality Connection: Listing Transition Issues for Non-Public Companies

8. Trend Judgment: From Early Validation to Ecological Layering

8.1. Asset Side: Shifting from Head Unicorns to Long-Tail Enterprises

8.2. Liquidity: Native RWA Infrastructure Will Become a Breakthrough Variable

8.3. Cooperation Model: Shifting from Unilateral Issuance to TaaS Service Collaboration

8.4. Ecological Finality: Misaligned Symbiosis and Ecological Layering of Three Models

9. Conclusion

1. Research Scope and Key Definitions

Non-public company equity, especially the rapidly growing unicorn equity, constitutes an important asset segment in the global economy. However, for a long time, its investment access and primary value-added returns have been dominated by professional institutions such as PE/VC and a small number of high-net-worth individuals, making it generally difficult for ordinary investors to access. As blockchain technology matures, the path of "equity tokenization" has begun to become feasible—mapping equity shares with on-chain digital tokens to improve the circulation efficiency of private assets within compliance boundaries. Boston Consulting Group (BCG) estimates that by 2030, the on-chain RWA market size is expected to reach $16 trillion. This reflects the market's high attention to the direction of tokenization: on one hand, it stems from the enormous value of leading non-public companies themselves, and on the other hand, it comes from the expectation that tokenization technology will lower the barriers and trading frictions of traditional financial markets.

Based on the above background, this article will systematically sort out the market background and development status of non-public equity tokenization, analyze the pain points of the traditional market and the mechanism advantages of tokenization, and combine major platform cases, technical and regulatory points, and key challenges to make judgments about future evolution directions.

1.1. Research Object

This report focuses on the enterprise side—non-public companies (especially unicorns)—and the tokenization of underlying rights, specifically the direct tokenization of "target company equity," rather than the tokenization of LP shares in private equity funds (PE Fund) in the traditional context.

This is mainly because discussions on "private equity fund tokenization" typically start from the investment side, using traditional financial frameworks for measurement and analysis, thus easily overlooking the larger portions of the unicorn equity structure—such as shares held by founding teams and employee stock ownership plans (ESOPs). Such omissions can lead to deviations in assessing the asset coverage and real liquidity needs of "equity tokenization," thereby underestimating the actual potential and expandable space of this market.

1.2. Research Premise

Time Node: The research time frame of this article is until December 27, 2025.

Data Standards: Non-public equity valuations inherently lack a unified official standard; therefore, some parts of market size and tokenization market value are estimated using publicly available statistics and platform data.

Equity Transferability: Non-public equity naturally has lock-up, transfer restrictions, and shareholder register management requirements, and there are difficulties in tokenization in actual implementation. Therefore, it is necessary to distinguish between "theoretical tokenization (full volume)" and "tradable tokenization (after restrictions)" as two sets of concepts.

Currency and Exchange Rate Standards: Involving multiple currency valuations, this article presents data uniformly in USD, with exchange rate conversions approximated based on the assumption of USD stablecoin anchoring, without separately discussing extreme decoupling scenarios.

Special Products: For synthetic contract products on platforms like Bybit and Hyperliquid, open interest is listed separately for measurement and is not included in the "equity token market value" calculation.

2. Market Background: The "Trillion-Dollar Siege" of Non-Public Equity

2.1 Asset Lineage and Holder Structure

Broadly, non-public company equity covers all company shares not listed on public exchanges, with highly diverse types: from early-stage startups to mature large private groups. Holders are not limited to institutional funds and commonly include: founding teams, employee shareholders (equity, option incentives), angel investors, VC/PE, strategic investors, and various secondary transferees.

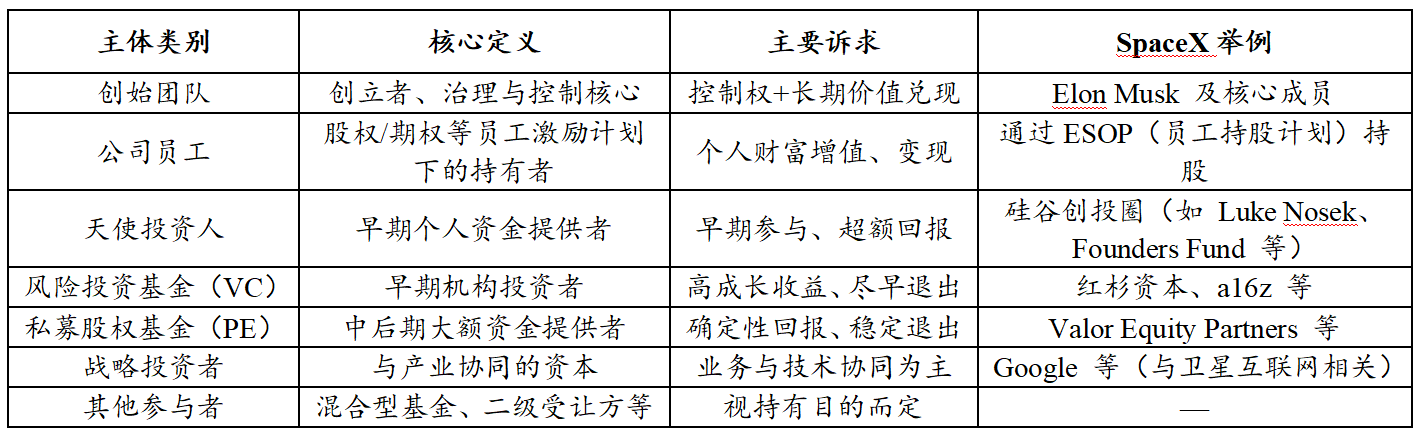

Table 1: Common Holder Structure of Non-Public Equity

Source: PKUBA Research

As shown in Table 1, except for strategic investors and some founding teams, other equity holding groups generally have varying degrees of monetization demands: institutional sides emphasize exit efficiency; employees often need liquid assets at points of departure or financial planning. However, under traditional mechanisms, aside from a few methods like share buybacks, the efficiency of equity circulation in the secondary market is low, leading to a long-standing structural dilemma of "exit difficulties."

2.2. Scale Description: Dual Evidence of Capital Allocation and Asset Valuation

It is important to emphasize that due to the lack of a unified official standard for the scale of non-public equity, this section mainly relies on statistical data from mainstream institutions to infer magnitude from two dimensions: "capital allocation capability" and "asset valuation volume."

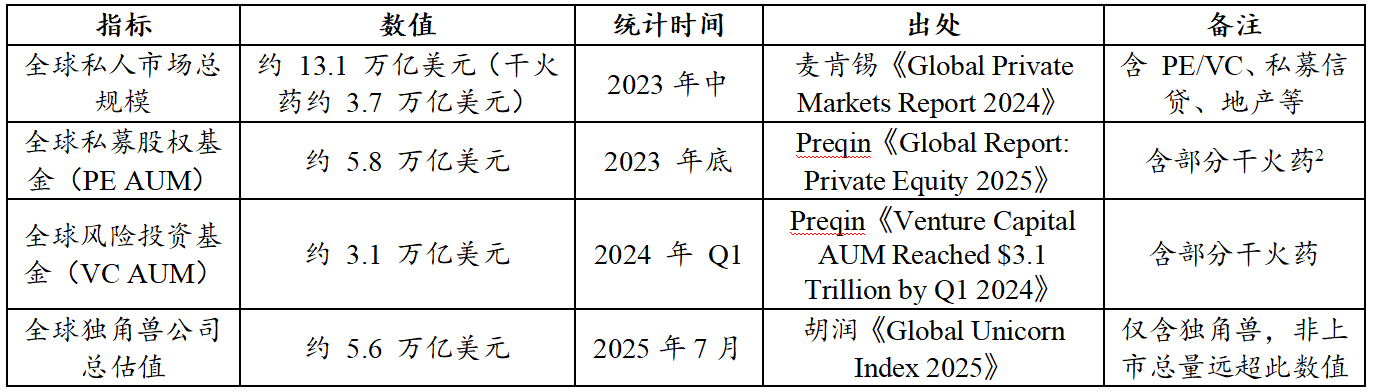

Table 2: Key Indicator Statistics of Global Private Markets and Unicorn Valuations

Source: Hurun, McKinsey, Preqin

According to the data in Table 2, from the perspective of "capital allocation capability," the total assets under management by PE and VC amount to approximately $8.9 trillion ($5.8T + $3.1T), forming an important capital base for non-public equity assets;

From the perspective of "asset valuation volume," the valuation of the unicorn group alone has reached the trillion-dollar level. According to the Hurun Research Institute[3], this figure was $5.6 trillion as of mid-2025. Additionally, CB Insights reported that as of July 2025, the cumulative valuation of 1,289 unicorns worldwide exceeded $4.8 trillion.[4] The specific valuations and industry introductions of the global Top 10 unicorn companies are shown in Table 3.

Table 3: Global Valuation Top 10 Unicorn Companies

Source: CB Insights (as of December 2025)

It is important to emphasize that whether it is $4.8 trillion or $5.6 trillion, this only represents a few thousand top companies at the tip of the pyramid; the vast value of tens of thousands of mature private enterprises and growth companies worldwide that have not reached unicorn status has yet to be accounted for.

In summary, the actual total value of the global private equity market is a vast fortress that far exceeds several trillion dollars. This astonishing scale of assets, which is impressive yet lacks liquidity, undoubtedly provides an imaginative application prospect for tokenization.

3. Core Contradictions and the Value Path of Tokenization

Non-public equity has long exhibited a coexistence of high value and low liquidity, fundamentally due to the dual constraints of institutional arrangements and market structures on both the participation and exit sides. Based on this, the potential value of equity tokenization is primarily reflected in three aspects: circulation channels, price discovery, and financing channels.

3.1 Dual Bottleneck: Participation Constraints and Exit Obstacles

Non-public equity has long presented a structural characteristic of "high value—low liquidity supply," rooted in the dual constraints of institutional arrangements and market structures on both the participation and exit sides: on one hand, entry rules and capital thresholds compress the coverage of investors; on the other hand, exit channels rely on terminal events and inefficient secondary circulation, making assets difficult to liquidate.

• Participation Side: High thresholds and small circle compliance constraints. In most jurisdictions, non-public equity transactions are typically strictly limited to qualified or institutional investors; at the same time, the minimum investment amounts often range from hundreds of thousands to millions of dollars, compounded by net asset and income qualification requirements, creating significant institutional and financial barriers, leading to a high concentration of asset dividends and limited breadth of market capital supply.

• Exit Side: Scarcity of exits and prolonged cycles. Traditional exits heavily rely on IPOs or mergers and acquisitions (M&A) as terminal events, but the trend of "unicorns delaying IPOs" significantly extends holding periods, making it difficult to realize paper wealth in a timely manner. Even when transferring through the private secondary market, transactions often depend on offline matchmaking, with common issues of information opacity, high due diligence and settlement frictions, high costs, and slow settlements, resulting in inefficient and unstable liquidity supply.

3.2 Three Types of Gains: Circulation Channels, Price Discovery, and Financing Supplementation

Compared to "tokenization of publicly listed stocks," which mainly aims to improve transaction timing and channel convenience, non-public equity tokenization resembles a redesign of the private market structure, primarily reflected in three core gains:

First, in terms of circulation channels: Tokenization reduces the "fortress" dilemma through continuous secondary liquidity, constructing a two-way channel for both participation and exit sides.

For the participation side's dilemma, the potential gain from tokenization is mainly reflected in expanding access through divisibility: by more finely splitting equity rights or economic benefits, it lowers the single participation threshold within a compliance framework, allowing more compliant investors to access growth targets that were previously difficult to allocate, thereby alleviating the structural constraints of "difficulty in participation" in the private market.

For the exit side's dilemma, the core gain of tokenization lies in supplementing liquidity exits: for employees, early investors, and institutional funds, it can provide a more continuous transfer channel beyond IPOs/M&A/buybacks, expanding liquidity options and reaching a broader range of potential acquirers, thus improving the flexibility and timing of exits without changing the terminal path.

Figure 1: Summary of Primary Market Exit Paths

Source: PKUBA Research

Second, in terms of price discovery: Tokenization introduces more continuous price discovery signals, enhancing financing pricing and market capitalization management capabilities. Traditional non-public equity valuations are primarily anchored to financing rounds, with low frequency and insufficient transparency, and valuation signals often lag behind changes in business operations and market expectations. Through equity tokenization, relatively continuous secondary trading can be formed, providing more continuous price discovery signals, helping to narrow the valuation discrepancies between primary and secondary markets, and providing reference coordinates for subsequent financing pricing and market capitalization management.

Third, in terms of financing supplementation: Tokenization opens up incremental financing channels and is expected to explore new models of STO and "digital listing." Tokenization not only serves the circulation of existing rights but may also become an incremental financing tool. Some companies can reach global compliant digital capital pools through the issuance of security tokens (STO), potentially reducing the cycle and cost of traditional IPOs, and providing new options for financing and capital structure management. Platforms like Opening Bell are also exploring similar "digital listing" paths, but cooperation and large-scale implementation at the level of non-public companies still require more case validation.

4. Market Status: From Narrative Space to Measurable Scale

4.1 Scale Status: "Tens of Millions" Volume in Early Validation Period

Due to some platforms not disclosing market values, and synthetic contracts being measured by open interest, this article mainly uses disclosures from CoinGecko and project official websites for estimation.

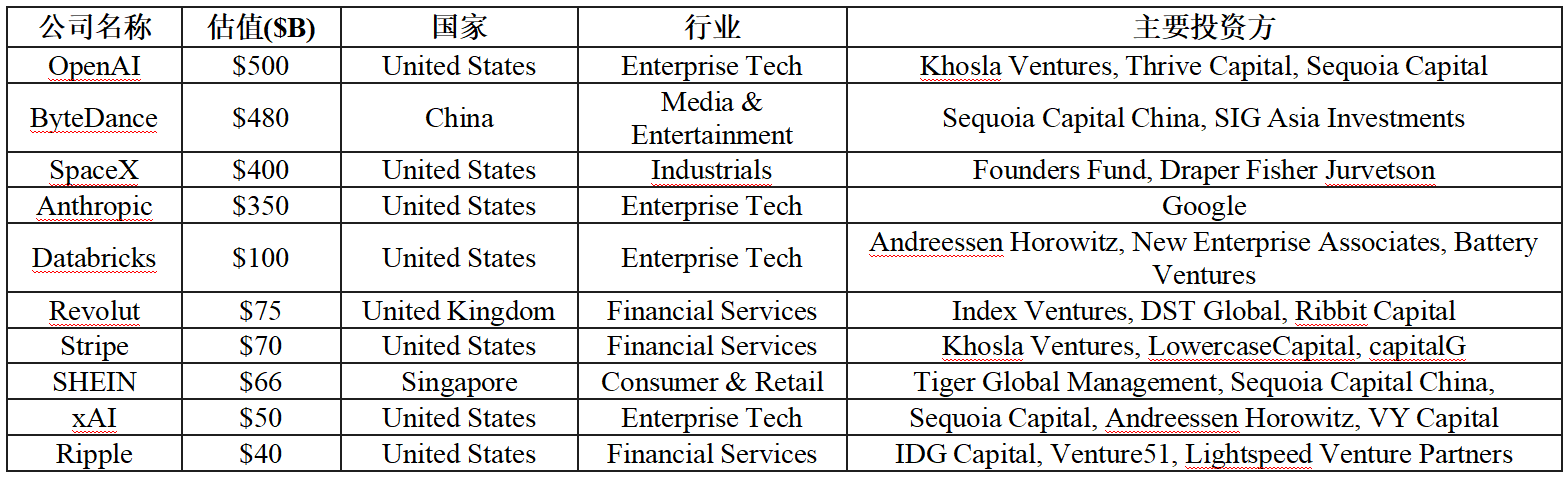

Table 4: Major Projects in Non-Public Company Equity Tokenization (Incomplete Statistics)

Source: CoinGecko project official website, as of December 27, 2025

Based on the above sample, a relatively clear judgment can be made: the non-public equity tokenization market is still in the early validation stage. From the disclosable data and estimable standards, the overall scale of the industry roughly falls within the range of $100-200 million, and excluding projects like Securitize (CURZ) and Archax (MGL) that are not freely tradable on-chain, the market's freely transferable scale is approximately in the tens of millions of dollars.

This result indicates that even though the market narrative space is vast, the current secondary liquidity, trading depth, and participation breadth remain limited, resembling a situation where only a few samples are completing market education and model validation in the short term.

4.2 Target Preferences: Concentration of Top Tech Unicorns and AI Assets

From the distribution of underlying targets, except for a few special projects, the current tokenized targets exhibit obvious characteristics of high homogeneity and concentration, primarily focusing on top tech unicorns in the United States, with AI-related assets at the core (such as OpenAI, SpaceX, xAI, etc.).

The reason for this concentrated preference is that in the early market, project parties often prioritize assets with high recognition, strong narratives, and concentrated attention, in order to gain trading heat and traffic conversion with lower educational costs, thus promoting product cold starts and market validation. Relatively speaking, although some project parties claim to have contacted or communicated with holders of Chinese background unicorns, as of now, there is still a lack of publicly verifiable landing cases, indicating that this direction has not yet formed a replicable path in terms of asset acquisition, compliance boundaries, and transaction structures.

5. Realization Paths: Structural Differences and Rights Boundaries of Three Models

Regarding "how to turn non-public equity into on-chain tradable assets," three types of solutions have basically formed in practice, with differences concentrated on: whether there is real shareholding, whether the target company participates, whether the tokens correspond to shareholder rights, and compliance licensing qualifications.

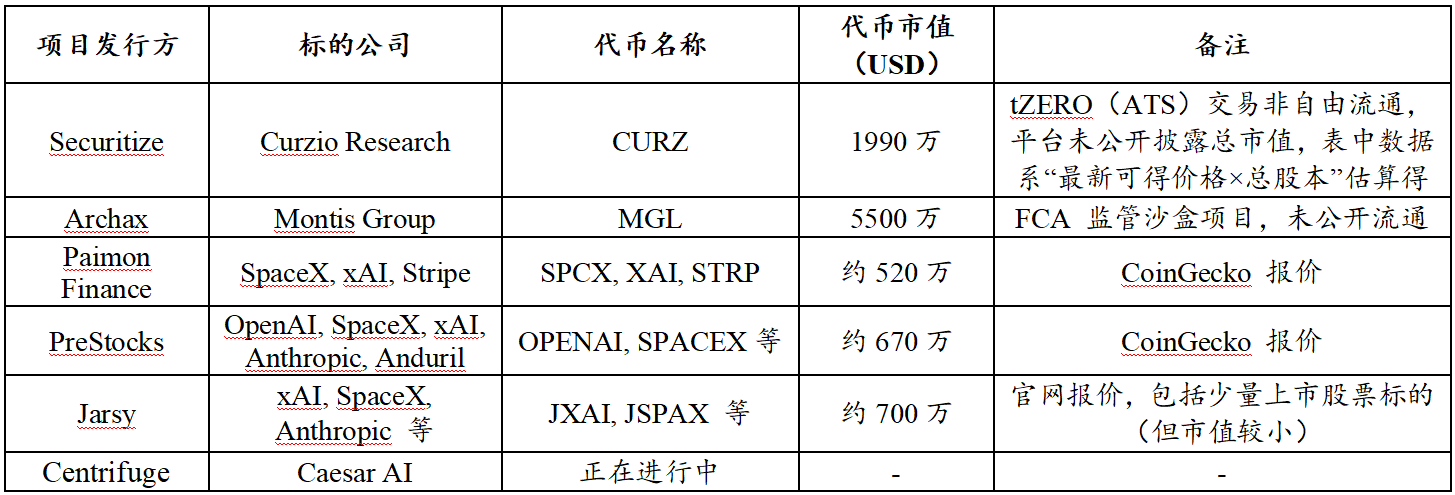

Table 5: Comparison of Non-Public Company Equity Tokenization Models

Source: Pharos Research

5.1 Synthetic Asset Type: Value Mapping Detached from Underlying Rights Confirmation

The synthetic asset type typically does not obtain permission from the target company and does not hold underlying equity, but issues contracts that track valuations, allowing investors to gain economic exposure to the target. Its key feature is that investors do not enter the shareholder register and do not enjoy governance, dividends, or other shareholder rights; returns are entirely determined by contract terms and settlement mechanisms, making the product attributes closer to synthetic derivatives.

The advantage of this model lies in its fast launch speed, flexible structure, and lower dependence on asset acquisition; however, the risks are also relatively concentrated, mainly including counterparty credit risk, tracking errors and pricing deviation risks, clearing and settlement mechanism risks, and regulatory uncertainties across jurisdictions.

This path is more aligned with the trading and speculative needs of native Web3 users for risk exposure, but it is difficult to equate it with assetization solutions in the sense of equity on-chain. Current representative practices of this model can be roughly categorized into two types: one is debt notes (such as Republic), and the other is perpetual valuation contracts (such as Ventuals, based on Hyperliquid).

Figure 2: Introduction to Equity Tokenization from Ventuals Official White Paper

Source: Ventuals Official Documentation

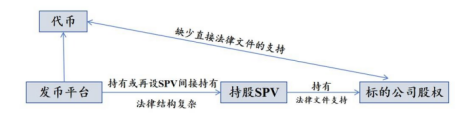

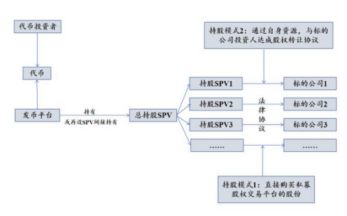

5.2 SPV Indirect Holding Type: Mainstream Form Validating Demand First

The SPV model structure is as follows: the platform establishes an SPV, which acquires and holds real equity in the traditional private secondary market; the tokens sold externally are not the equity of the target company itself, but rather the equity certificates of the SPV. Therefore, investors are usually not included in the shareholder register of the target company and do not directly possess governance voting rights.

Figure 3: Issuer Structure Diagram of SPV Indirect Holding Type

Source: Pharos Research

The advantage of this structure lies in its flexibility, but the risks are also relatively concentrated, mainly reflected in two points:

• Transparency Challenge: The offshore SPV structure is complex, and investors often can only verify asset-side proof of "whether the SPV holds shares," making it difficult to fully penetrate the operational and financial information on the liability side.

• Target Company Warning Risks: If the target company determines that there has been a violation of the shareholder agreement or transfer restrictions, it may trigger legal and compliance conflicts, which will be detailed later.

5.3 Native Collaborative Type: True Equity on Chain Centered on Transfer Agent

The premise of the native collaborative type is deep participation from the target company, which can essentially be understood as providing TaaS (Tokenization-as-a-Service) services to the target company. However, unlike the general concept of asset on-chain, this model aims to achieve a one-to-one correspondence between equity and tokens. The key is that the project party must possess Transfer Agent (TA) qualifications and establish a mapping relationship between on-chain tokens and the offline shareholder register centered on the Transfer Agent, thereby achieving the legal structuring of rights on-chain.

Transfer Agents typically refer to transfer agents registered with the SEC, responsible for maintaining and changing the shareholder register. Only when the issuance and circulation of tokens can trigger compliant updates to the shareholder register can the on-chain tokens have a substantive correspondence with the equity; correspondingly, token holders may obtain a more complete boundary of shareholder rights within the company’s articles of association and applicable legal framework, including voting, dividends, and information rights. This is also the fundamental reason why the native collaborative type has less controversy and clearer rights foundations compared to SPV and synthetic asset paths.

However, the implementation cost of this model is also significantly higher. On one hand, its transaction and transfer processes are more likely to be closely monitored by regulators; on the other hand, it often requires additional licenses and trading facilities such as Broker-Dealer (B-D) and ATS, forming a compliance closed loop from issuance, registration to secondary circulation. Therefore, its main constraints are not theoretical feasibility, but rather the completeness of compliance, implementation cycle, and the willingness of the target company to collaborate. As for the current market progress:

• Opening Bell is currently more focused on scenarios involving listed companies, while non-listed collaborations remain primarily at the official promotional level;

• Securitize has a path with strong compliance practice reference value, which will be further elaborated later;

• Centrifuge, as a leading project in the RWA field, announced in November this year its entry into equity tokenization, extending its business focus from private credit to non-listed equity, and its subsequent implementation progress is worth close attention.

Figure 4: Centrifuge's Entry into Non-Listed Equity Tokenization Promotional Image

Source: Centrifuge Official Website[5]

6. Case Studies: Typical Case Analysis of Three Models

Based on the previous path classification, the compliance strategies and trading facilities corresponding to the three types of models are significantly different. This section will further analyze specific case studies of the three models and compare their business processes and operational effectiveness.

6.1 Synthetic Asset Type: Introduction of Speculative Flow

The synthetic asset type does not acquire underlying equity but splits the target valuation into basic contract units, providing price exposure to the market through on-chain matching. Current practices mainly diverge into two paths: one is synthetic assets based on perpetual contract platforms (Perps DEX), and the other is debt instruments that achieve exposure in the form of notes.

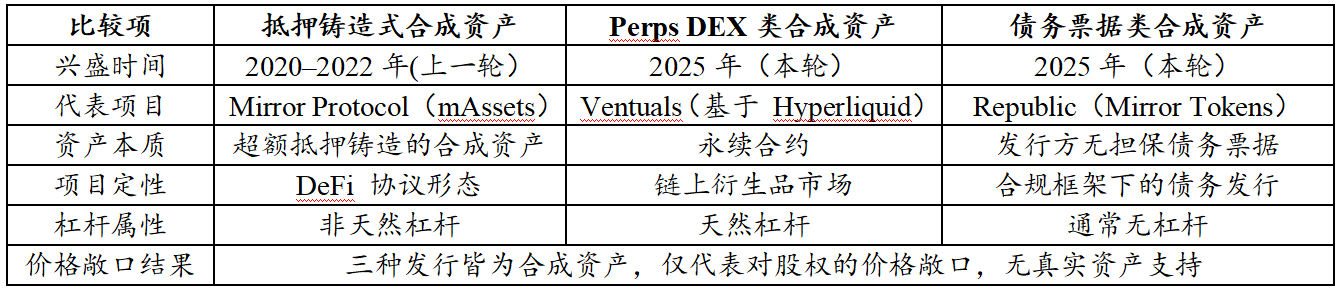

Both share the commonality of not corresponding to real equity and not generating shareholder rights; the differences are concentrated in compliance boundaries, trading mechanisms, and funding attributes, distinguishing them from the previous round of synthetic asset narratives primarily based on collateralized minting (such as Mirror Protocol). Specifically:

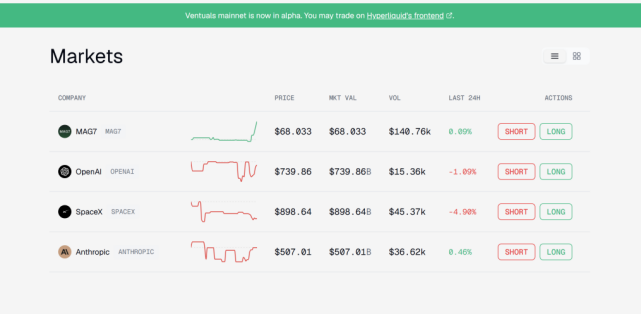

• Perps DEX Type Synthetic Assets: Essentially perpetual contracts that enhance trading efficiency and capital turnover through leverage and funding rate mechanisms, with representative projects like Ventuals (based on Hyperliquid).

• Debt Note Type Synthetic Assets: Essentially tokenized notes issued by the platform, classified as debt instruments, linked to the performance of the target through contractual terms, with representative projects like Republic's Mirror Tokens.

Table 6: Comparison of Three Types of Equity Synthetic Assets

Source: PKUBA Research

From the perspective of product positioning and funding structure, the market shows clear differentiation: the Republic route leans more towards compliance and traditional financial frameworks, holding Broker-Dealer licenses and disclosing and issuing under U.S. securities law, with a relatively clear range of investors; the Perps DEX route is closer to the logic of native trading markets, where its core competitiveness lies not in legal confirmation but in the trading attributes themselves, including leverage tools, continuous liquidity supply, and lower trading friction.

Figure 5: Ventuals Platform Pre-IPO Contract Product Display

Source: Ventuals Official Website

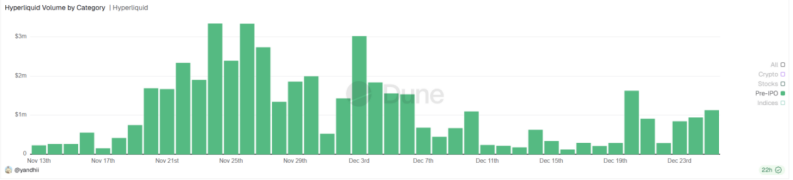

In terms of liquidity performance, the Perps route based on Hyperliquid has a more pronounced stage advantage. According to Dune data, the daily trading volume of Pre-IPO related assets on Hyperliquid has reached millions of dollars (see Figure 6), contrasting with the performance of SPV indirect holding types in secondary transactions and depth (comparison standards will be discussed in Figure 13 later). The reason lies in that synthetic assets, especially Perps, align more closely with the funding preferences of the crypto market: high-frequency trading combined with high leverage mechanisms more easily attract speculative funds and trading users, thereby forming considerable transaction volumes and completing user education on the non-listed equity exposure category on the demand side.

Figure 6: Daily Trading Volume of Pre-IPO Related Assets on Hyperliquid (USD)

Source: Dune

Further analysis indicates that synthetic assets may not necessarily constitute a substitute for true equity on-chain but may instead play a role in early demand cultivation and liquidity warming: by first gathering users and funds on the trading side, they can provide a potential market foundation and demand traction for subsequent more compliant and rights-confirmed equity tokenization paths.

6.2 SPV Indirect Holding Type: Coexistence of Low Barriers to Entry and High Compliance Controversies

The core logic of the SPV indirect holding type is to have a special purpose entity (SPV) typically located in an offshore jurisdiction hold the equity of the target company, and then tokenize the SPV's beneficial certificates, thereby providing economic exposure to non-listed equity without directly touching the target company's shareholder register.

Figure 7: SPV Indirect Holding Type Token Issuance Structure Diagram

Source: Pharos Research

This model has become the most common practice in the current non-listed equity tokenization field due to its flexible structure and relatively lower barriers to entry, but it has also concentratedly exposed compliance and governance controversies. In terms of asset acquisition, SPVs typically complete the acquisition of target equity through two paths:

• Path One: Purchase through Private Secondary Platforms. Typical platforms include EquityZen, Forge Global, Hiive, etc. This path has a relatively standardized process and stronger replicability but often comes with higher structural setup costs and compliance review requirements.

• Path Two: Acquisition through the Issuer's PE/VC Resources. The issuer utilizes its resources in the traditional private equity circle to acquire shares from private equity or venture capital funds holding the target equity. In this structure, SPVs often indirectly hold shares as new LPs (limited partners), effectively transforming the transaction into a transfer at the fund share level.

The reason this model can expand rapidly lies in its attempt to structurally bypass the transfer restriction clauses in the shareholder agreement. Since the transferred shares are often small and may be viewed as internal LP share transfers within the fund, some transactions do not need to be reported to the target company on a case-by-case basis, thus providing the platform with limited structural space and time windows.

However, accompanying the "easy implementation" is "high controversy." The transparency of the SPV model typically presents a one-sided characteristic: investors can often only verify whether the SPV holds the target equity on the asset side, while the platform's own funding arrangements, fee structures, risk isolation, and operational robustness still possess certain black-box attributes. This is particularly evident in the issuance rhythm, where two common operational methods are observed in the market:

• Buy First, Issue Later: The project party first purchases equity with its own funds and then issues tokens to recoup funds, locking in the assets and reducing performance uncertainty.

• Issue First, Buy Later: Tokens are issued to raise funds first, with a commitment to purchase equity; if fundraising is insufficient or price fluctuations prevent transactions, investors will face higher execution and delivery risks.

Compared to completely unsupported synthetic assets, the SPV model at least has equity asset backing, thus providing more certainty regarding "whether the asset exists"—but its core risks are not limited to internal operations but rather external legal and compliance challenges: when the tokenization actions are deemed by the target company to violate shareholder agreements or transfer restrictions, it may simultaneously trigger compliance pressures from government regulators and rights claims from the target company's legal side. Recently, some target companies (such as OpenAI) have publicly expressed opposition to related arrangements, further highlighting the external uncertainties of this model. The related risk transmission and impact mechanisms will be further discussed below.

6.3 Native Collaborative Type: Achieving TaaS Service Model through License Compliance

The key to the implementation of the native collaborative type lies in the uniformity of the compliance framework: it requires the target company to directly connect to the government regulatory system, achieving compliant digitalization of assets by mapping company rights to digital securities on-chain. In industry practice, this model is gradually evolving from a single on-chain tool to a full-stack solution for TaaS (Tokenization-as-a-Service) aimed at target companies. Service providers are no longer limited to technical delivery but provide a full-process closed loop covering issuance, registration, holder management, and even secondary market circulation.

In the currently observable market samples, the most representative paths of the native collaborative type are concentrated in two infrastructure-type institutions: one is Securitize, which has formed a relatively complete compliance path and has verifiable cases; the other is Centrifuge, which recently proposed a reference framework for compliant on-chain equity, but actual issuance case studies are still in the advancement stage.

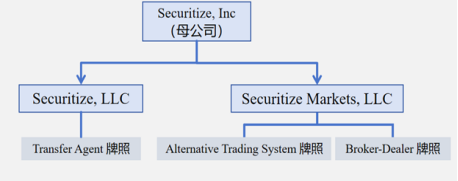

Figure 8: Securitize Compliance License and Structure Overview

Source: Securitize Official Website

Therefore, this section focuses on the architectural direction of Centrifuge and the case studies of Securitize, with the Securitize part mainly consisting of two paths:

(1) Securitize Path A: The Lifecycle of Tokenized IPO (Exodus)

(2) Securitize Path B: The Normal Form of Long-term Private Placement Circulation (Curzio Research)

6.3.1 Securitize Path A: Exodus—Lifecycle Sample from ATS to NYSE

As of the end of December 2025, the project’s token market capitalization is approximately $200 million, making it an important component of the tokenized stock market. Its evolution path reflects different stages of liquidity transition:

• 2021: Exodus, as a non-listed company, collaborates with Securitize to mint Class A common stock into equity tokens on the Algorand chain through the DS protocol; Securitize acts as the Transfer Agent, responsible for token creation, maintenance, and destruction; subsequently, the peer-to-peer transfer from whitelisted wallets gradually expands to compliant trading on Securitize Markets and tZERO (ATS, Alternative Trading System);

• December 2024: Exodus is listed on NYSE American (ticker: EXOD), completing the transition from non-listed tokenized equity to publicly traded securities;

• 2025: Exodus announces a partnership with Superstate's Opening Bell to extend stock tokens to networks such as Solana and Ethereum, while Securitize's core role as Transfer Agent remains unchanged.

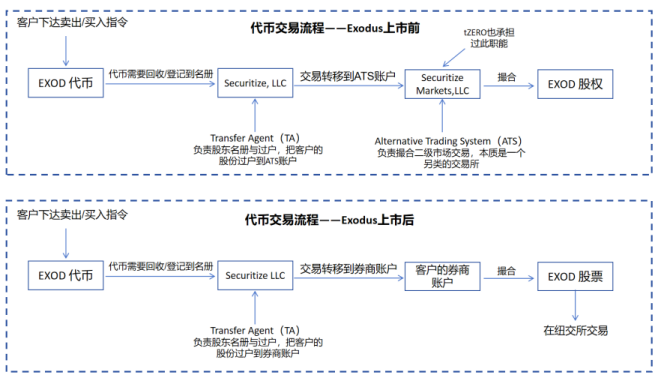

Figure 9: Token Trading Process Before and After Exodus Listing

Source: Paramita Venture

The above figure illustrates the liquidity mechanisms at different stages before and after the listing, showing that the core of token liquidity in Exodus is managed through the Transfer Agent (TA) both before and after the listing, but after the listing, tokens and stocks can be mutually converted.

(1) Pre-listing (2021–2024): Primarily ATS. Investors first deposit tokens with the Transfer Agent to update the register, then the Transfer Agent transfers the holding records to the ATS broker, where transactions are matched and settled by ATS.

(2) Post-listing (December 2024–present): Transition to public market stock trading. Investors, with the assistance of the Transfer Agent, convert tokens into traditional registered shares (street name holding) in the broker's account, conducting regular trading based on EXOD tokens.

In addition, there exists an underlying permanent liquidity path: compliant OTC transfers. Both parties' wallet addresses must be verified through a whitelist, prices are negotiated offline, and consideration is arranged separately, with token transfers completed on-chain. Notably, during the transition period from ATS delisting to NYSE listing, this path became the primary liquidity method.

6.3.2 Securitize Path B: Curzio Research—Sample of ATS Private Placement Circulation Unable to Go Public

Exodus demonstrates an ideal lifecycle, but for most non-listed companies, circulation within ATS may not be a transitional form but could become a long-term "end state."

Figure 10: Curzio Research Token Market Capitalization Trend Chart

Source: MarketCapWatch, as of December 27, 2025

The case of Curzio Research (CURZ) illustrates that after equity tokenization, trading occurs in ATS for qualified investors, providing a compliant but limited secondary market for companies that are not preparing to go public or cannot go public, alleviating shareholder exit pressure. Its trading performance also reflects the thin market characteristics of ATS: a long-term decline after issuance, bottoming out in early 2024, followed by high volatility, exhibiting characteristics such as large price spreads, sparse transactions, and low price discovery efficiency (significantly different from the depth of the public market).

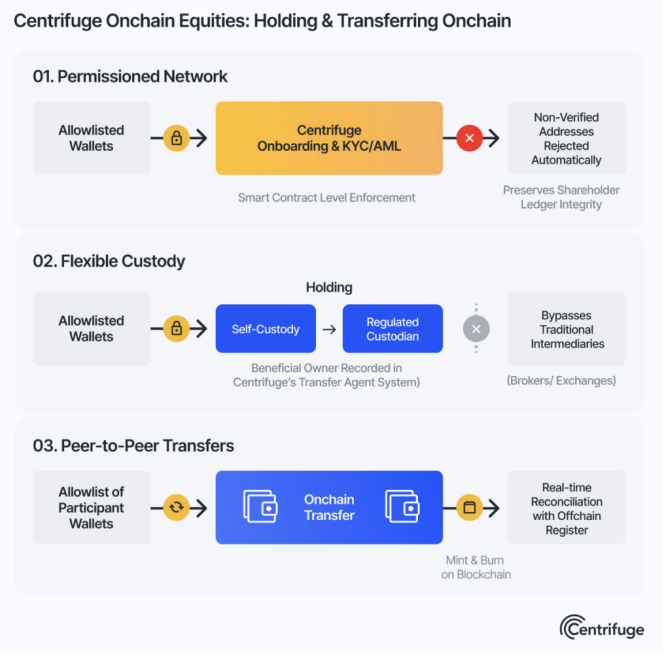

6.3.3 Centrifuge's Entry: Directional Signal of Native TaaS Route

From the perspective of industry evolution, Centrifuge's entry serves as a directional signal: the native collaborative type is moving from case-driven to standardized architecture.

On December 5, 2025, Centrifuge released "Centrifuge Tokenized Equities: A Reference Architecture for Regulated Onchain Equity," systematically providing a reference implementation framework for compliant on-chain equity. Its core idea aligns with the logic already validated by the market: a regulated Transfer Agent uniformly manages the shareholder register, achieving transparency in restricted transfer processes and ensuring that on-chain tokens have the same legal effect as physical equity.

Figure 11: Centrifuge Equity Tokenization Architecture Diagram

Source: Centrifuge Official Website

Notably, the first case disclosed on Centrifuge's official website is a collaboration with Caesar AI. This partnership positions Centrifuge strategically towards a broad range of issuers (especially crypto-native startups) rather than large unicorn companies. If this model develops into a replicable implementation template, it will significantly advance the maturity of TaaS supply aimed at Web2 companies, providing a rich infrastructure for the scalable expansion of the native collaborative model.

7. Key Challenges: Three Bottlenecks Determine Industry Limits

Although non-listed equity tokenization has a clear narrative space and potential incremental value, from the perspective of feasibility and scalability, this sector still faces several rigid constraints. The key bottlenecks currently determining the upper limits of industry expansion can be summarized into three categories: compliance pressure, insufficient liquidity depth, and uncertainty in the IPO endgame connection.

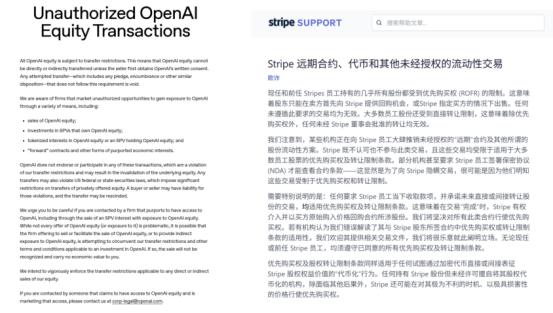

7.1 Compliance Pressure: Dual Pressure from Regulation and Target Company Legalities

Compared to tokenization of listed stocks, the compliance complexity of non-listed equity tokenization is significantly higher due to the simultaneous influence of government compliance regulation (SEC) and legal constraints from the target company.

On one hand, the product issuance and trading phases may touch upon securities laws and licensing systems (such as the SEC regulatory framework); on the other hand, more decisive constraints often come from the target company's equity management restrictions, particularly the transfer restriction clauses in shareholder agreements. Under structures like SPV indirect holdings, the issuing platform attempts to achieve "indirect transfer of equity" at the LP level through structural design, but this approach may violate transfer agreements and trigger company-side measures.

Figure 12: OpenAI and Stripe Warning Announcement on Equity Tokenization

Source: OpenAI and Stripe Official Websites

Recently, companies like OpenAI and Stripe have issued warnings regarding related SPV tokenization arrangements, emphasizing that token holders do not constitute company shareholders and that the related structures violate transfer agreements. This risk has also manifested in other real events: after Robinhood launched the OpenAI token in June 2025, it received a public warning from OpenAI in July and subsequently faced an investigation by Lithuanian regulators, reflecting the compounded uncertainty of "company legalities + government regulation."

However, it should be noted that there are two risk mitigation mechanisms for this dual pressure:

(1) First, complex SPV structures may exploit gray areas of transfer restriction clauses, and whether the target company can effectively block "indirect transfers" remains uncertain; furthermore, litigation costs are high and lengthy, and it is not guaranteed that the company will enter a complete legal process;

(2) Secondly, publicly opposing target companies are still in the minority, with some leading enterprises (like SpaceX) remaining silent, interpreted by the market as "tacit approval," and even Elon Musk himself has shown great favor towards the crypto market, further deepening market expectations for SpaceX.

Most importantly, the attitude of companies towards tokenization is not static. As crypto assets become mainstream and on-chain treasury strategies spread, it is not unimaginable for a shift from resistance to cooperation in the future. Therefore, a more realistic direction may be to promote the integration of the SPV model into a collaborative model.

7.2 Liquidity Paradox: Tokenization Does Not Automatically Bring Depth

The aforementioned risks at the "regulatory and compliance" level have certain certainty mitigation channels—however, regarding the current stage of industry development: the insufficient liquidity of equity tokens themselves remains the most direct and constraining bottleneck. In simple terms, tokenization is often viewed as a tool to "release liquidity," but reality shows that going on-chain does not equate to forming effective market depth.

From observable data, most freely circulating equity tokens currently have market capitalizations still at the million-dollar level, and trading is dispersed across multiple DEXs, exhibiting typical thin market characteristics: widening bid-ask spreads, significant slippage, prices easily impacted by small funds, insufficient transaction continuity, and the lack of structural depth leading to two direct consequences:

• For large sellers such as institutions and employees, the market struggles to effectively accommodate exit demands, and when the impact costs are too high, there may even be a situation of having a price but no market;

• For ordinary investors, trading costs and volatility risks are significantly amplified, thereby weakening their willingness to participate.

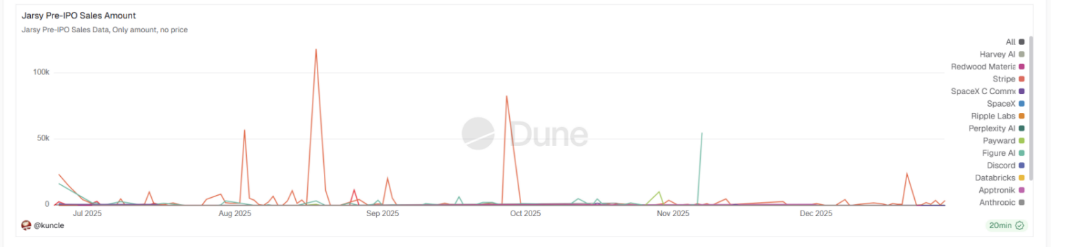

Thus, a liquidity paradox ultimately forms: tokenized assets theoretically facilitate trading, but actual liquidity does not match exit demand, making it difficult to support scalable expansion. Figure 13 shows the current trading situation on the relatively mainstream Jarsy platform, where it is clear that daily trading volume is low except for key promotional nodes.

Figure 13: Jarsy Platform Main Token Trading Volume (Non-Price) Display

Source: Dune

More importantly, insufficient liquidity weakens the expectations of tokenization in price discovery and fair value characterization, leading to secondary issues such as "lack of pricing anchors + difficulty in stabilizing fair value." In other words, tokenization once emphasized providing more continuous pricing signals for private equity, but in the absence of depth, price signals are more easily disturbed by short-term trading structures and emotional fluctuations, making it difficult for fair value to form reliably.

After introducing 24/7 trading, the prices of equity tokens become more susceptible to emotional and liquidity structure-driven influences, making it difficult for investors to determine whether prices reflect financing valuations or speculative premiums, thereby amplifying valuation discrepancies. In extreme market conditions, the price discovery mechanism is more likely to fail, and risks may spread through paths such as slippage amplification, forced liquidations (if leverage exists), or insufficient secondary market absorption, which in turn weakens the market's long-term willingness to allocate to such assets.

In summary, insufficient liquidity depth is one of the key bottlenecks that have long plagued industry development. Its improvement relies on the implementation of trading mechanisms and liquidity infrastructure more suited to security-type tokens, which will also become a core variable in whether the industry can transition from narrative validation to scalable absorption in the next phase.

7.3 IPO Endgame Connection: The Listing Transition Issue for Non-Listed Companies

Currently, the mainstream SPV indirect holding model has significant endgame realization risks: when the target company initiates an IPO, if the SPV's shareholding is deemed to violate transfer restriction clauses, it may face obstacles in the registration and conversion stages, making it more difficult to protect the rights of token holders through indirect equity via SPV. This risk is particularly relevant in the 2026 time window, considering that several unicorns like SpaceX and Anthropic are expected to go public, and the endgame connection issue will quickly shift from "structural concerns" to "operational tests."

From currently verifiable cases, Exodus is a typical successful connection sample, but its path also exposes significant friction: during the nearly one-year transition period from ATS delisting to NYSE listing preparation, trading almost stagnated (mainly relying on compliant OTC), and liquidity experienced a cliff-like decline, reflecting an objective liquidity vacuum and insufficient absorption during the migration phase.

In response to the uncertainty of endgame conversion, the market is also exploring alternative paths:

One approach is for platforms to simultaneously develop tokenization services for listed stocks to enhance subsequent absorption and conversion capabilities (such as Jarsy's exploratory direction).

Another more direct approach is to liquidate stocks after listing (after the lock-up period is lifted) and distribute the realized profits to token holders as agreed, thereby avoiding the exchange process between tokens and stocks. However, this plan still lacks sufficient validation in terms of feasibility, execution constraints, and credit risk, and remains in a trial phase, requiring more landing cases for verification.

8. Trend Judgment: From Early Validation to Ecological Layering

Non-listed equity tokenization is moving beyond the simple concept validation stage. With the evolution of compliance pressure and market demand, the industry will exhibit the following four structural trends in the future:

8.1 Asset Side: From Leading Unicorns to Long-Tail Enterprises

The current market is highly concentrated on super unicorns like OpenAI and SpaceX, which is essentially a traffic logic: project parties leverage the high visibility of target companies to reduce user education costs and achieve a cold start. However, the real trillion-dollar market lies within a broader range of long-tail private companies.

In the future, the core value of tokenization will shift from merely "riding the wave" to addressing actual pain points—providing liquidity solutions for tens of thousands of mid-sized tech companies, family businesses, and employee stock ownership plans (ESOPs). Although these assets lack top-tier traffic, they have a more urgent need for shareholder exit and market capitalization management. Asset supply will shift from merely chasing hot topics to providing substantial liquidity solutions for a wider range of real enterprises.

8.2 Liquidity: Native RWA Infrastructure Will Become a Breakthrough Variable

As mentioned in the earlier "liquidity paradox," simply putting assets on-chain does not automatically create depth. The current bottleneck lies in the inability of generic trading facilities to adapt to the low-frequency, large-amount trading characteristics of equity-type assets. The key to breaking through the industry lies in building native RWA liquidity infrastructure, which may include:

(1) Underlying Network Layer: Migrating to or building dedicated application chains on high-performance ecosystems like Solana and Base to meet the stringent demands for high throughput and low latency in securities trading;

(2) Trading Mechanism Layer: Introducing on-chain order books (CLOB) and institutional-level market makers, and deploying permissioned AMMs with whitelist restrictions to rebuild effective price discovery mechanisms within a compliant framework.

(3) Liquidity Aggregation Layer: Establishing cross-chain interoperability mechanisms to break liquidity fragmentation and exploring combinations with DeFi protocols to enhance capital efficiency.

8.3 Collaboration Model: Shifting from Unilateral Issuance to TaaS Service Collaboration

Existing synthetic assets and SPV models are mostly third-party "external unilateral issuances," always remaining in a gray area of compliance and legality due to the lack of authorization from underlying companies.

In the long run, business models will return to the mainstream path of "target company collaboration." Target companies are expected to actively introduce TaaS (Tokenization as a Service) solutions as a compliant infrastructure to optimize corporate governance and open liquidity channels. Only by completing this transition from "unilateral arbitrage" to "compliant symbiosis" can the industry truly solve the asset confirmation problem and open the path for scalable growth.

8.4 Ecological Endgame: Dislocated Symbiosis and Ecological Layering of Three Models

Based on differences in risk preferences, compliance costs, and user attributes, the three models described earlier will ultimately not be a single survival of the fittest but rather a clear ecological niche layering that collectively supports the multi-level demands of the market:

(1) Synthetic Asset Type: Positioned in the high-frequency trading market. It leverages leverage and low-threshold advantages to meet the speculative demands of higher risk preferences, primarily undertaking user education and early traffic introduction functions.

(2) SPV Indirect Holding Type: Positioned for the circulation of existing assets. Before comprehensive compliance arrives, it will continue to serve as the mainstream solution, utilizing structural flexibility to address the transfer needs of existing equity and playing an early validation role for the market heat of specific assets.

(3) Native Collaborative Type: Positioned for standardized infrastructure. By providing complete compliance and technical standards (TaaS services), it is responsible for solving the most fundamental confirmation issues. Although its advancement is slower, it is the standardized path for attracting institutional funds and achieving large-scale asset on-chain.

9. Conclusion

Non-listed company equity tokenization (Pre-IPO Tokenization) is at a critical stage of transitioning from concept validation to structural transformation. Through an in-depth analysis of market scale, realization paths, and typical cases, this report draws the following core conclusions:

First, Market Status: Structural mismatch between the "trillion-dollar" blue ocean and the "ten-million-dollar" reality. Although global unicorns and the private equity market hold trillions of dollars in existing value, the current scale of freely circulating equity tokens on-chain remains limited to a narrow range of tens of millions to a couple of hundred million dollars. This significant gap reflects that the current market is still in an early stage: asset supply is highly concentrated in a few leading tech unicorns (such as OpenAI and SpaceX), and a deep secondary circulation market has yet to form.

Second, Path Evolution: Three models present ecological niche layering rather than zero-sum games. The market has spontaneously evolved three clear differentiated paths, which will exhibit a pattern of dislocated symbiosis in the future:

(1) Synthetic Asset Type (Derivatives): As a "traffic entry," it captures speculative demand using high leverage and low-threshold advantages, completing early user education and liquidity introduction, but does not carry the assetization function of real equity.

(2) SPV Indirect Holding Type (Intermediate State): As an "existing stock transition," it utilizes structural flexibility to address current transfer pain points before comprehensive compliance arrives. Despite facing dual pressures from target company warnings and regulatory compliance, it will still be the mainstream landing solution within a specific time window.

(3) Native Collaborative Type (Endgame): As "standardized infrastructure," it provides TaaS (Tokenization as a Service) centered around Transfer Agents, solving the most essential legal confirmation and endgame connection issues. This is the compliant channel for attracting institutional funds and achieving large-scale asset on-chain.

Third, Industry Dilemma: Breaking through the liquidity paradox and compliance boundaries. Current compliance pressures are forcing the industry to shift from the unilateral arbitrage model of "bypassing target companies" to a collaborative model of "cooperative issuance," thereby avoiding realization risks during the IPO endgame. However, the key bottleneck in the industry lies in the "liquidity paradox," meaning that tokenization does not automatically equate to liquidity; after going on-chain, the lack of market makers and institutional participation results in characteristics of a thin market with large bid-ask spreads and ineffective price discovery. Breaking this bottleneck hinges on building native RWA liquidity infrastructure (such as permissioned AMMs and on-chain order books).

Fourth, Future Outlook: The TaaS era will shift from leading unicorns to long-tail entities. In the future, the breakout point for non-listed equity tokenization may not lie in competing for crowded super unicorn resources but in sinking towards a broader range of long-tail private companies and mid-to-late-stage enterprises. For these companies, the demand to use tokenization technology to manage employee options (ESOPs), obtain financing through STOs, and achieve market capitalization management is more urgent. As native infrastructures like Securitize and Centrifuge mature, the industry is expected to transition from mere asset speculation to truly serving as financial infrastructure that enhances the capital efficiency of the real economy.

References

[1] Lacie.Z, & Owen.C. (November 2025). "Trillion" Liquidity: Pre-IPO Equity Tokenization Opens New Channels for PE/VC Exits. Deep Tide TechFlow.

[2] Kumar, S., Suresh, R., Kronfellner, B., Kaul, A., & Liu, D. (September 12, 2022). Relevance of on-chain asset tokenization in "crypto winter." Boston Consulting Group & ADDX.

[3] Hurun Research Institute. (July 2025). "2025 Global Unicorn Index" Press Release.

[4] CB Insights. (July 2025). The Complete List of Unicorn Companies. CB Insights Official Database.

[5] Centrifuge. (December 5, 2025). Centrifuge tokenized equities: A reference architecture for regulated on-chain equity. Centrifuge. https://centrifuge.io/blog/centrifuge-tokenized-equities

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。