Why is it often said that European and American investors will impact the U.S. stock market?

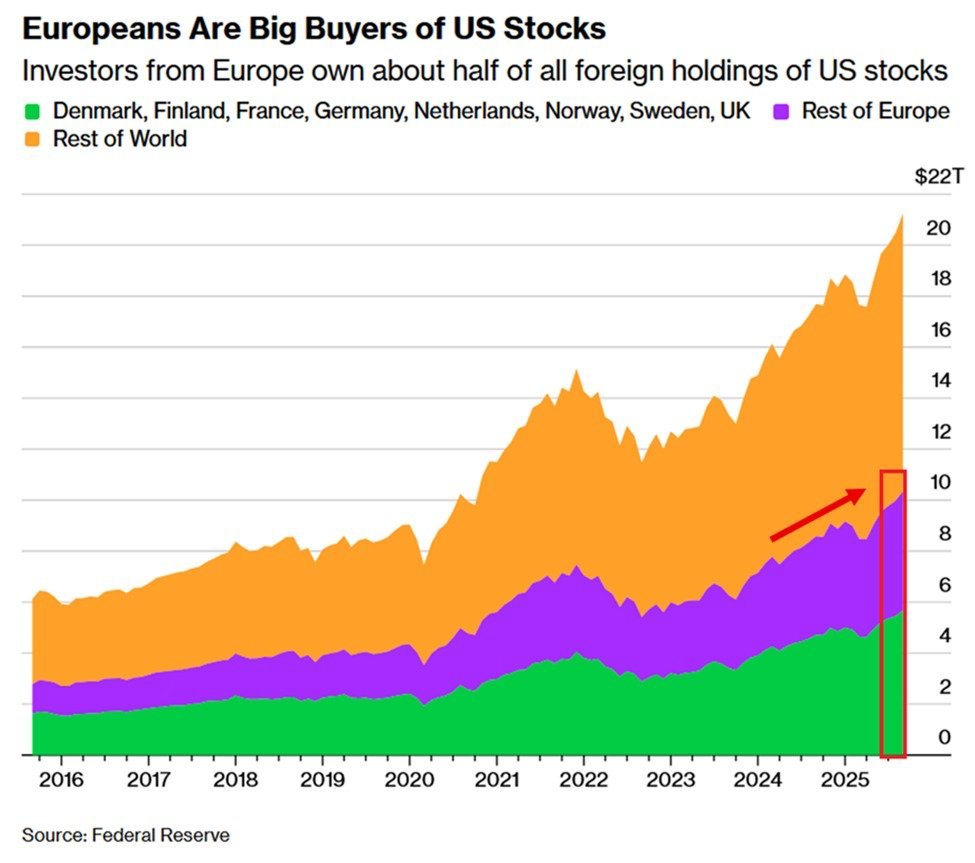

From the data, the market value of U.S. stocks held by non-American funds has continuously increased over the past 10 years, with the largest portion coming from Europe.

The green area represents U.S. stocks held by core European countries, including Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, and the United Kingdom. The purple area represents U.S. stocks held by other European countries. The orange area represents U.S. stocks held by other regions of the world.

From 2016 to 2025, the overall stacked area of the three color blocks is getting larger, indicating that global funds are increasingly allocating to U.S. stocks. In other words, the weight of U.S. stocks in global asset portfolios is rising.

Among them, Europe is one of the largest holders, with the green and purple areas combined accounting for nearly half of the total. This means that U.S. stocks are no longer just a market for Americans, but rather an asset pool priced collectively by global funds.

More critically, the marginal buyers of U.S. stocks are often not American retail investors, but rather large institutional funds, including sovereign funds, pensions, insurance, bank proprietary trading, and multinational companies' buybacks and cash management. When European funds concentrate on adjusting their positions, the impact is not limited to one or two stocks, but rather affects the price elasticity at the index level, especially for the S&P 500 and Nasdaq, which are the "default options" for global allocation.

Therefore, when we say "European and American investors will influence the U.S. stock market," it essentially means that it is not that Europeans can decide the rise and fall of U.S. stocks, but rather that when the stock of non-American funds has reached this level, U.S. stocks inherently carry a leverage of global funds. European interest rates, exchange rates, credit cycles, and even political risks will be transmitted into the pricing of U.S. stocks through asset reallocation. The U.S. stock market is increasingly resembling a settlement layer for global assets, rather than a stock market of a single country.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。