The global precious metals market has continued to heat up since the beginning of 2026, with yesterday marking a historic moment. Spot gold has broken through the psychological barrier of $5,100 per ounce, while spot silver has also reached $107 per ounce for the first time, with an intraday increase of 3.6%, and a cumulative increase of over $35 this month.

Since the beginning of 2026, global investors' pursuit of safe-haven assets has significantly intensified. Amidst multiple factors such as geopolitical tensions, expanding fiscal deficits in various countries, and the ongoing trend of de-dollarization, the role of gold and silver as traditional safe-haven assets is being redefined. However, the anticipated safe-haven Bitcoin has not participated in this wave, even recording negative returns in the new year, leading more investors to fully lean towards precious metals.

As the U.S. government faces another shutdown crisis, uncertainty has rapidly spread to the crypto market, putting pressure on risk assets. Bitcoin's price fell to around $87,000 on the 26th. Ethereum experienced a deeper decline, dropping to around $2,862. As of the time of writing, Bitcoin is quoted at $88,500, and Ethereum is quoted at $2,934.

The overall economic situation will continue to dominate the direction of cryptocurrencies. This week, the market focus will be on the U.S. Federal Reserve's interest rate decision and the U.S. Producer Price Index. Whether Bitcoin can hold its current key support will depend on whether ETF fund outflows can be halted, which will be a core indicator of whether the cryptocurrency market can stabilize in the short term.

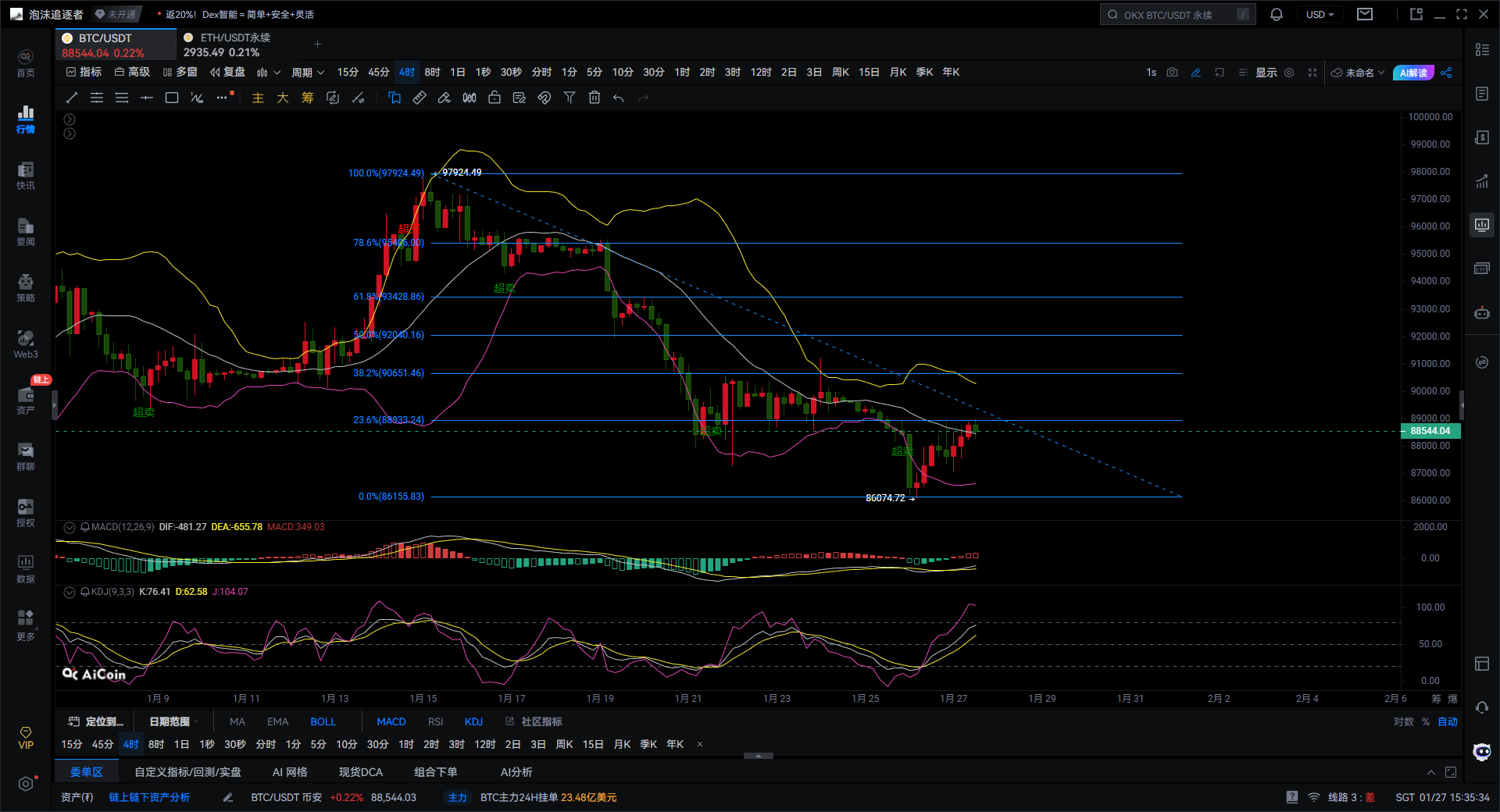

Bitcoin 4-hour chart

Fibonacci pressure analysis: The retracement lines are drawn from the downward wave of 97,924 to 86,155, with key pressure levels as follows: 0.236 at 88,933, where the current price is oscillating; 0.382 at 90,651; 0.5 at 92,040; 0.618 at 93,428. The current price is consolidating near 0.236, indicating that this position is a primary battleground for bulls and bears. If it can stabilize, a rebound may extend to around 90,600; if it cannot hold, the rebound may terminate and retest lower levels.

BOLL channel interpretation: The price is currently rebounding from the lower band and is being pressured by the middle band, while the upper band is clearly sloping downwards. This pattern represents a typical structure of weak rebounds and channel convergence, suggesting limited upward space, making it easy to experience a quick pullback after a rise, posing a high risk for chasing highs.

MACD status: The MACD indicator remains below the zero axis. Although the MACD green histogram has shortened, indicating a weakening of the downward momentum, a golden cross has not yet formed. This means that the bearish force is temporarily resting, and the bulls have not fully taken over, so the current rise can only be defined as a corrective rebound, not a trend reversal.

KDJ signal indication: In the KDJ indicator, the K and D lines have formed a golden cross, and the J value is rising rapidly and approaching high levels. This pattern often signals that the rebound is nearing its end in the short term, making it easy to experience a pullback after a rise, so chasing long positions should be approached with caution.

The price is currently operating just below the descending trend line, facing resistance and pulling back each time it approaches this line. Until a significant breakout of the trend line occurs, the possibility of a V-shaped reversal is low, and the trend still needs further confirmation.

Two paths are most likely to occur. The first is the more probable scenario: the price encounters resistance in the 88,500-89,000 range, and due to insufficient volume, it pulls back to the 87,500-87,000 area, which is a healthy but somewhat tedious consolidation. The second is a stronger scenario: the market stabilizes above 89,000 with increased volume and breaks the trend line, targeting the 0.382 position around 90,600, but this situation requires news or support from major funds, and the current probability is low.

In summary, the current market situation is a corrective rebound after a decline, not a trend reversal. The market structure shows that the price has fallen from a high of 97,924 to a stage low of 86,155, and then rebounded to the 88,500 area. Essentially, it is still a technical rebound within a downward trend, and reversal signals have not yet been confirmed. It is advisable not to rush into long positions or blindly short, and to focus on key positions.

Based on the above, the following suggestions are provided for reference.

Currently, it is advised to avoid chasing long positions. It is not advisable to rush into the market as the price rebounds to high levels; patience is needed to wait for the price to retest key support before reassessing the long and short direction. Three signals should be closely monitored: first, whether the 89,000 level can effectively hold; second, whether the MACD can cross above the zero axis; third, whether the descending trend line can be broken with increased volume. Overall, maintain caution and wait for clearer trend signals.

Giving you a 100% accurate suggestion is not as good as providing you with the right mindset and trend. Teaching someone to fish is better than giving them fish; a suggestion may earn you a moment, but learning the mindset will earn you a lifetime!

Written on: (2026-01-27, 15:15)

(Written by - Daxian Talks Coins) Disclaimer: There may be delays in online publication; the above suggestions are for reference only. Investment carries risks; proceed with caution!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。