In a series of media appearances and official remarks on Tuesday, Scott Bessent argued that current U.S. economic conditions support the possibility of a non-inflationary expansion, driven by supply-side policy changes, rising investment, and productivity gains rather than demand stimulus alone.

Bessent’s comments came after his return from the World Economic Forum (WEF) in Davos, where he met with international leaders and prominent investors. In interviews aired on Fox News and in reporting highlighted by CBS News, he described the U.S. economy as “accelerating” and positioned the country as a preferred destination for global capital.

Central to Bessent’s argument is a fourth-quarter growth estimate of 5.4% from the Federal Reserve Bank of Atlanta’s GDPNow model. He cited the projection as evidence that current momentum is not temporary but reflective of a broader structural shift in the economy.

According to Bessent, the administration’s strategy focuses on reducing production bottlenecks rather than expanding consumption. He said inflation is caused by “friction” in supply chains and regulatory constraints, not growth itself, and argued that removing those barriers allows output to rise without pushing prices higher.

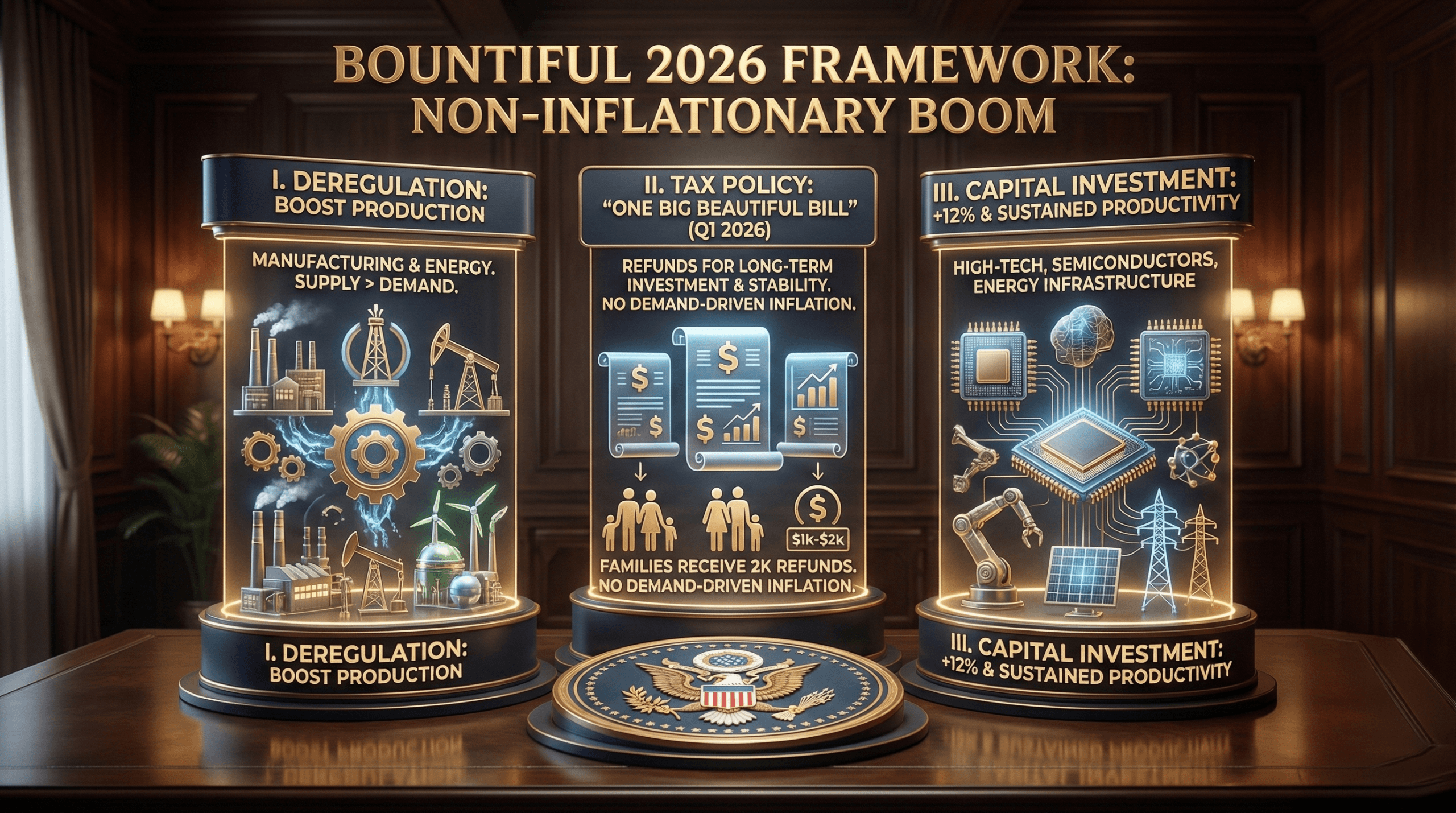

Deregulation is one of the three main pillars of the “Bountiful 2026” framework. Bessent said easing regulatory constraints across multiple sectors is intended to boost production capacity, particularly in manufacturing and energy, allowing supply to meet or exceed demand.

A second component involves tax policy. Bessent said benefits from the Working Families Tax Cut Act—referred to by administration officials as the “One Big Beautiful Bill”—are expected to begin appearing in the first quarter of 2026. He estimated that eligible households could receive tax refunds ranging from $1,000 to $2,000, increasing real income levels.

Bessent emphasized that these funds are intended to support longer-term investment and financial stability rather than short-term spending spikes. He framed the policy as a way to strengthen household balance sheets without fueling demand-driven inflation.

The third pillar is capital investment. Bessent pointed to a 12% increase in business investment over the past three quarters, with capital flowing primarily into high-tech manufacturing, semiconductor production, and energy infrastructure. He said these investments are expected to deliver sustained productivity gains.

Energy production also plays a role in the administration’s outlook. Bessent said plans to increase domestic oil output by roughly 3 million barrels per day would help reduce input costs across the economy, reinforcing downward pressure on prices even as growth accelerates.

In Treasury briefings held at the White House on Jan. 27, Bessent said policy efforts are addressing what he described as the “three I’s”: immigration, interest rates, and inflation. He argued that progress across those areas supports the conditions for a strong 2026.

Also read: Crypto ETFs Rebound as Ether Leads With $117 Million Inflow

Bessent also rejected traditional economic models that assume higher growth inevitably leads to higher inflation. Instead, he said productivity-driven expansion creates “more goods chasing the same money,” reducing price pressure while allowing output to rise.

While his remarks focused broadly on the real economy, Bessent has repeatedly described the United States as a global center for innovation, a framing he used again this week when discussing the country’s appeal to technology and finance-related capital.

- What is the “Bountiful 2026” blueprint?

It is Treasury Secretary Scott Bessent’s framework for achieving strong economic growth through supply-side expansion and productivity gains. - Why does Bessent say the boom would be non-inflationary?

He argues that higher productivity and increased supply reduce price pressure even as output rises. - What role does tax policy play in the plan?

Bessent says tax refunds from the Working Families Tax Cut Act could raise household incomes beginning in early 2026. - Which sectors are seeing increased investment?

He highlighted manufacturing, semiconductors, and energy as key areas of capital growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。