On Tuesday, the market remained quite stable, with US stocks and cryptocurrencies continuing to show a slight oscillation trend. Among the three negative factors mentioned last weekend, the Canadian tariffs should be behind us, and the impact of the yen exchange rate interference is not significant. The probability of a government shutdown remains around 77%. Although it hasn't affected us yet, if a shutdown does occur next week, we will have to see whether it is a full or partial shutdown. Based on the current budget, the probability of a partial shutdown seems higher, with limited impact.

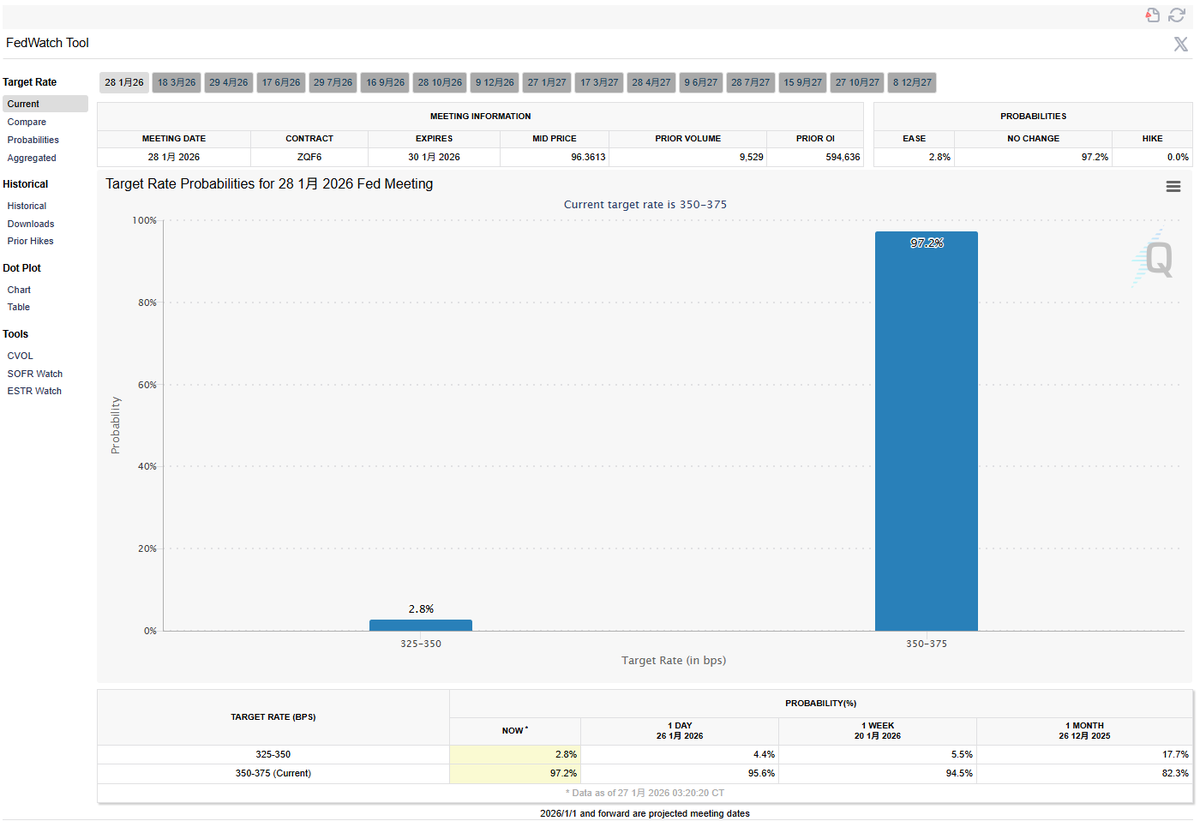

In the early hours of Thursday, the Federal Reserve's interest rate meeting will take place. Personally, I believe that the significance of the meetings until June is quite low. Even if Powell remains a board member, he will inevitably step down as chairman, which means that the next three interest rate meetings will be Powell's last moments as chairman. Therefore, Powell's stance is becoming less effective, and I even think that the dot plot for March is not very significant.

Of course, Powell is likely to stick to the three-piece set, maintaining 2% without wavering, watching the data, and not making predictions. Moreover, it is almost certain that there will be no change in interest rates in January. I even believe that if Powell shows a hawkish stance, Trump might directly announce a candidate for the Federal Reserve chairman to alleviate market anxiety.

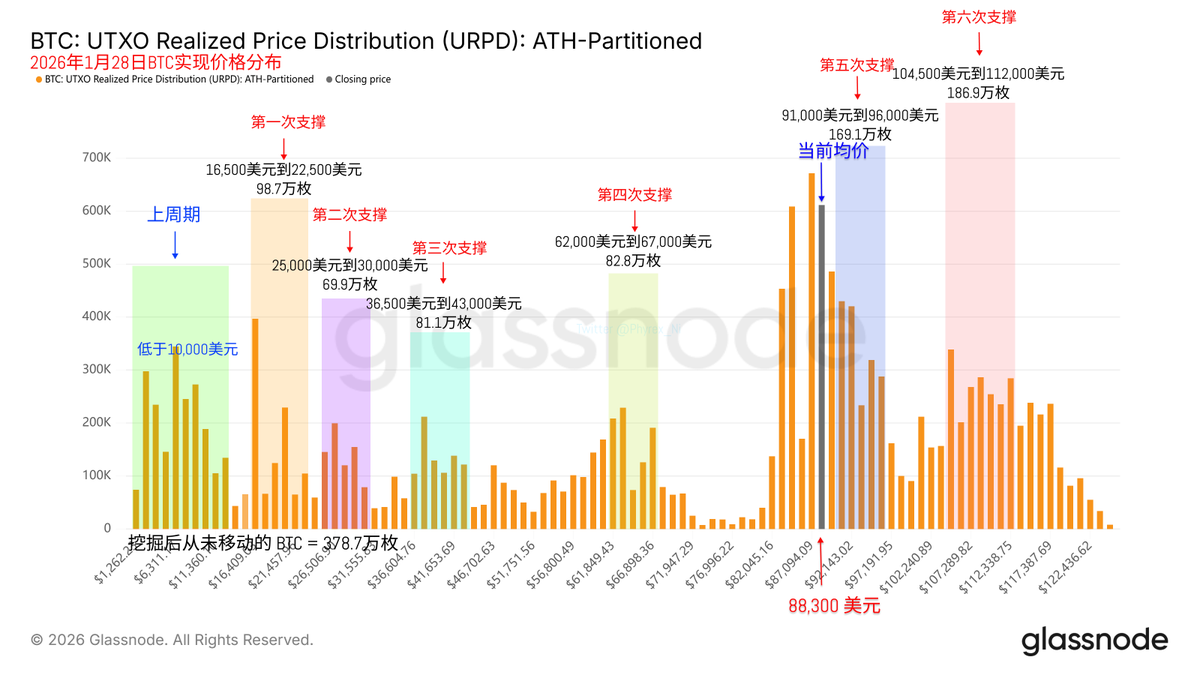

Looking at Bitcoin's data, the turnover rate is not very high, indicating that investors are still waiting for the results of the interest rate meeting and the potential government shutdown next week. However, from the performance of the US market, the S&P 500 reached a new historical high today. This has been analyzed many times recently, with a large amount of capital flowing into US stocks, so the performance of US stocks remains relatively stable. Therefore, $BTC, which has a certain correlation with US stocks, should not perform too poorly.

From the perspective of the chip structure, it remains very stable. The recent turnover rate has not been high, and there has been no significant movement from early investors for a long time. Without discussing whether we have entered a bull market, it is at least clear that we do not see a bear market state at the moment, and investor sentiment does not show panic. Even among loss-making investors, the situation remains quite healthy.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。