Original Author: David, Deep Tide TechFlow

2026 Will Be a Big Year for IPOs. This judgment was validated in January.

January isn't over yet, and crypto custodian BitGo rang the bell on the New York Stock Exchange, while Chinese AI companies Zhizhu and MiniMax successively landed on the Hong Kong Stock Exchange. Three companies, different tracks, all chose January.

Zhizhu's public offering was oversubscribed by 1164 times, and MiniMax rose 109% on its first day. Money is indeed flowing in.

But these few companies in January are just the beginning; the expected queue for IPOs this year is much longer. Foreign super unicorns are getting bigger, and there are a number of Chinese tech companies in the process on the Hong Kong and A-share markets…

Which ones might land this year, what are their valuations, and when will there be opportunities to participate?

We have compiled a list of IPOs worth watching in 2026, broken down by track.

The $100 Billion Club in the US Stock Market

Data Source: Bloomberg, organized by AI

If 2025 was the year of collective listings for crypto companies, 2026 may be the year when tech giants reopen the IPO door.

The most attention in this round is not on startups, but on those super unicorns that have been nurtured in the private equity market for many years.

Their commonality is that their valuations have reached the limits of the private equity market, and there are only a few institutions capable of taking over; continuing to raise funds is not very meaningful.

Some missed the window due to unfavorable market conditions, while others were kept private by their founders.

In 2026, these conditions are maturing simultaneously.

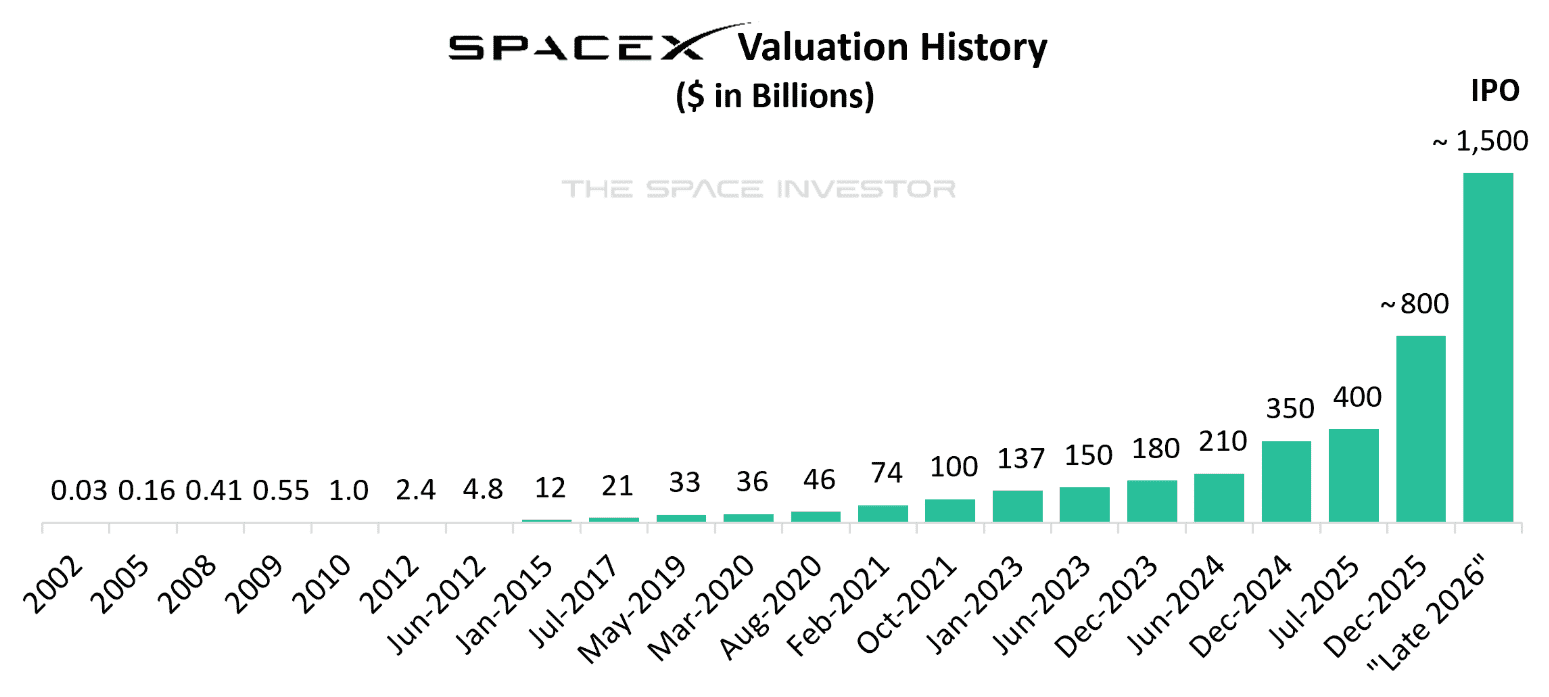

1. SpaceX, Valuing the Stars and the Sea

Estimated Valuation: $1.5 Trillion

Estimated Time: Q3/Q4 2026

On December 10, Musk confirmed on Twitter:

SpaceX plans to IPO in 2026.

According to Bloomberg, the target is to raise over $30 billion, with an estimated valuation of about $1.5 trillion. If realized, this would surpass Saudi Aramco's record of $29 billion in 2019, becoming the largest IPO in human history.

SpaceX currently has two core businesses. The first is rocket launches, with over 160 Falcon 9 launches in 2025, accounting for more than half of the global total. The second is Starlink satellite internet, with over 10,000 satellites in orbit and more than 8 million users in 2025, expecting annual revenue of $15.5 billion.

According to internal documents from SpaceX, when Starlink users reach scale, the company's annual revenue could reach $36 billion, with an operating profit margin of 60%.

If achieved, a $1.5 trillion valuation implies about a 70x sales multiple. This ratio is already high, but for a company with over 50% growth, the market may be willing to pay.

Additionally, a small data point you might overlook is that while SpaceX appears to be a space company, 70% of its revenue comes from Starlink.

Investors are not buying the dream of "Mars colonization," but rather a global leader in satellite internet services, a network service provider cloaked in a space guise.

Why is Musk willing to go public now?

According to Ars Technica, it is mainly to raise funds for building space data centers, such as using modified Starlink satellites as orbital AI computing nodes.

It sounds like science fiction, but what SpaceX has done over the past 20 years, which of it doesn't sound like science fiction?

Valuing the stars and the sea is enticing enough.

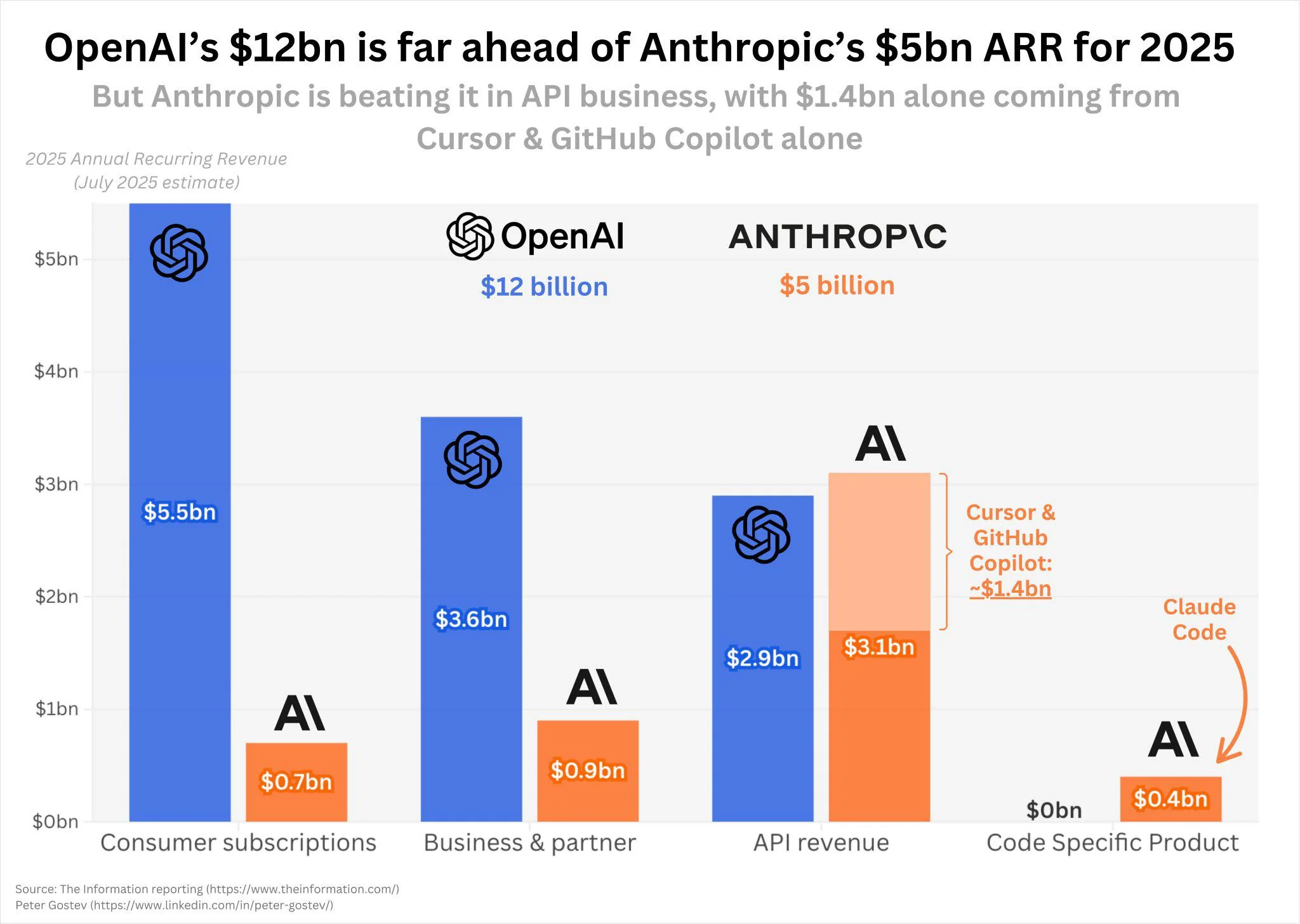

2. OpenAI vs Anthropic, The AI Duopoly IPO Race

Estimated Valuation: $830 Billion - $1 Trillion (OpenAI), $230 Billion - $300 Billion (Anthropic)

Estimated Time: Late 2026 - Early 2027 (OpenAI), Second Half of 2026 (Anthropic)

These two are often mentioned together, as ChatGPT and Claude are frequently used together.

OpenAI is currently valued at about $500 billion, with an annual revenue exceeding $13 billion (Sam Altman has even claimed that revenue far exceeds this figure), aiming for a $1 trillion valuation at IPO.

The company's CFO, Sarah Friar, has stated that they are targeting an IPO in 2027, but some advisors believe it could happen as early as the second half of 2026.

Sam Altman candidly expressed on a podcast, "I have 0% excitement about being a public company CEO."

But he also acknowledged, "We need a lot of capital, and sooner or later we will exceed the limit on the number of shareholders." OpenAI has just completed a restructuring from a non-profit to a for-profit model, with Microsoft's stake reduced to 27%, clearing the way for an IPO.

Anthropic is moving faster.

According to the Financial Times, the company has hired Wilson Sonsini (the law firm that helped Google and LinkedIn with their IPOs) to prepare for an IPO, possibly as early as 2026.

Currently valued at $183 billion, it is undergoing a new round of financing, targeting a valuation exceeding $300 billion; meanwhile, Microsoft and Nvidia may jointly invest $15 billion.

In terms of revenue, Anthropic looks more promising:

Annual revenue is about $9 billion, expected to reach $20-26 billion in 2026, and could hit $70 billion by 2028. Claude's subscription revenue growth is seven times that of ChatGPT, although from a smaller base.

It's hard to say who will win in the competition between the two companies.

OpenAI dominates the consumer side, with 800 million weekly active users for ChatGPT; but Anthropic is growing faster in the enterprise market.

Who will go public first? Currently, it seems Anthropic is better prepared. But OpenAI is larger, and once it decides to act, market attention will be completely different.

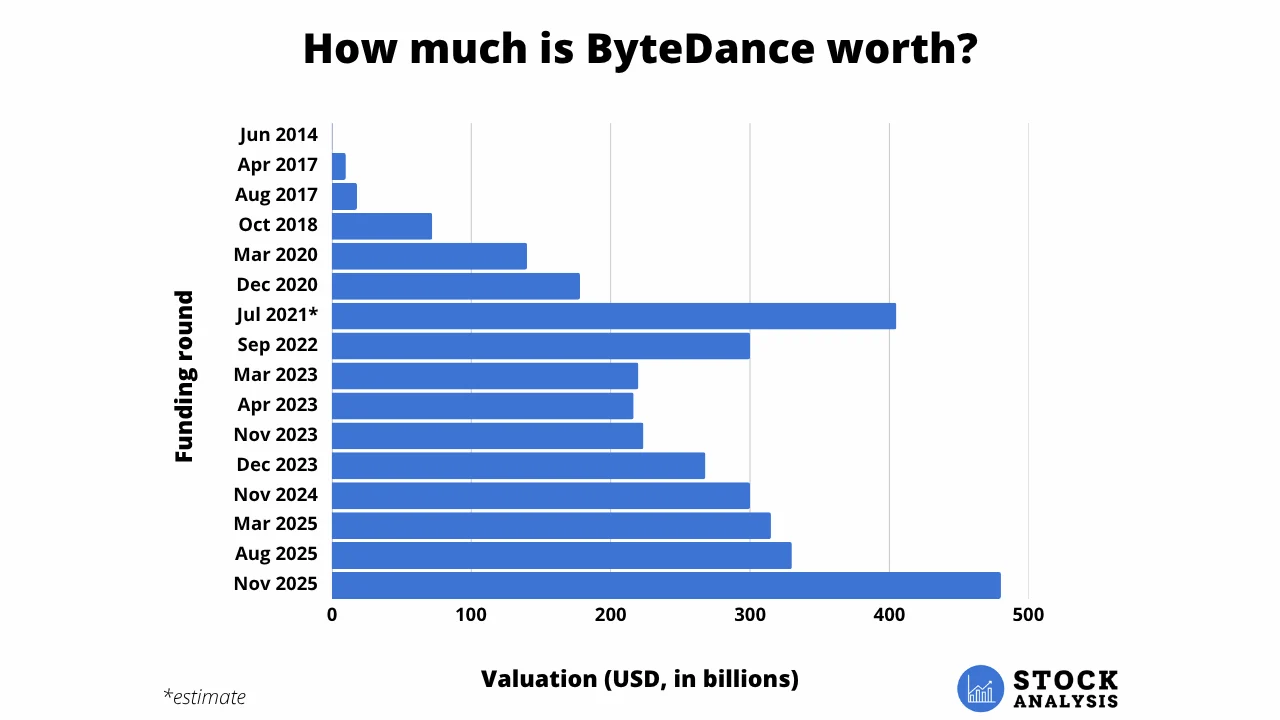

3. ByteDance Not Going Public, Can TikTok?

Estimated Valuation: $480 Billion - $500 Billion

Estimated Time: Under consideration, uncertain

ByteDance is the second-highest valued private company in the world, second only to OpenAI.

In a secondary share transaction in November 2025, Today Capital acquired shares for nearly $300 million, corresponding to a valuation of $480 billion.

The company expects global revenue of $110 billion in 2024, a 30% year-on-year increase. Douyin's dominance in the Chinese market is well-known, and the Doubao chatbot has surpassed DeepSeek to become the number one in the country.

In 2026, it plans capital expenditures of 160 billion yuan, with 85 billion yuan allocated for AI chip procurement.

However, ByteDance has previously made it clear: there are no IPO plans.

Nevertheless, the variable may lie with TikTok. If the US split ultimately materializes, market rumors suggest that TikTok's separate valuation in the US could rise from the current $400 billion to $500 billion.

A split TikTok in the US could potentially become one of the largest tech IPOs in 2026.

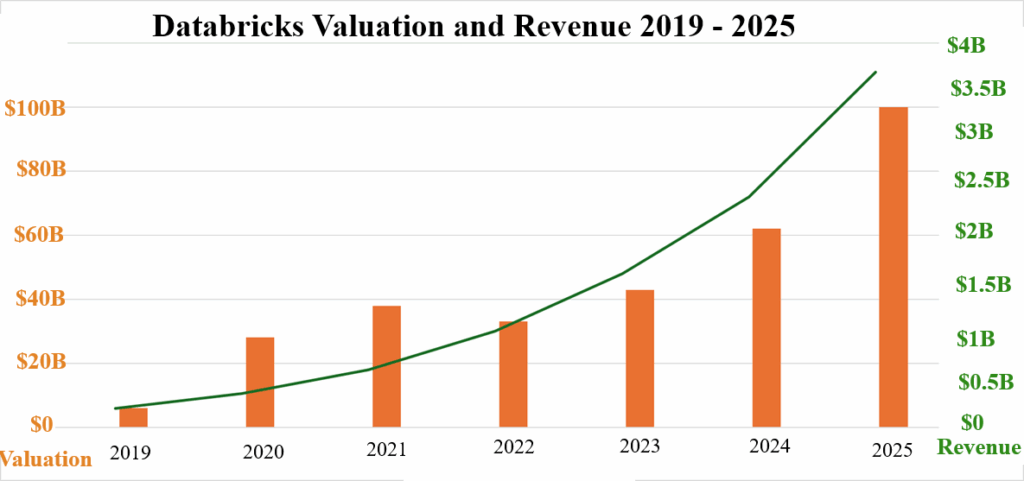

4. Databricks, You've Never Heard of It, But Everyone Uses It

Estimated Valuation: $134 Billion - $160 Billion

Estimated Time: Q1-Q2 2026

Databricks is a company that most ordinary people have never heard of, but almost all major companies use it.

It provides a unified platform for data lakes and data warehouses, allowing enterprises to store, process, and analyze massive amounts of data, and train AI models on it.

In December 2025, Databricks completed a $4 billion Series L financing, with a valuation of $134 billion.

In comparison, its valuation was $100 billion three months ago and $62 billion a year ago. Such growth rates are extremely rare in the private equity market.

In terms of financial data, the company has an annual revenue exceeding $4.8 billion, with a year-on-year growth of 55%;

of which AI product revenue exceeds $1 billion. Over 20,000 customers include OpenAI, Block, Siemens, Toyota, and Shell. Most importantly, the company has already achieved positive cash flow.

Analysts generally expect Databricks to go public in early 2026.

If it does IPO, it will directly compete with Snowflake. When Snowflake went public in 2020, it was valued at $70 billion, and its stock price doubled on the first day.

Databricks is larger and growing faster, and market expectations will only be higher.

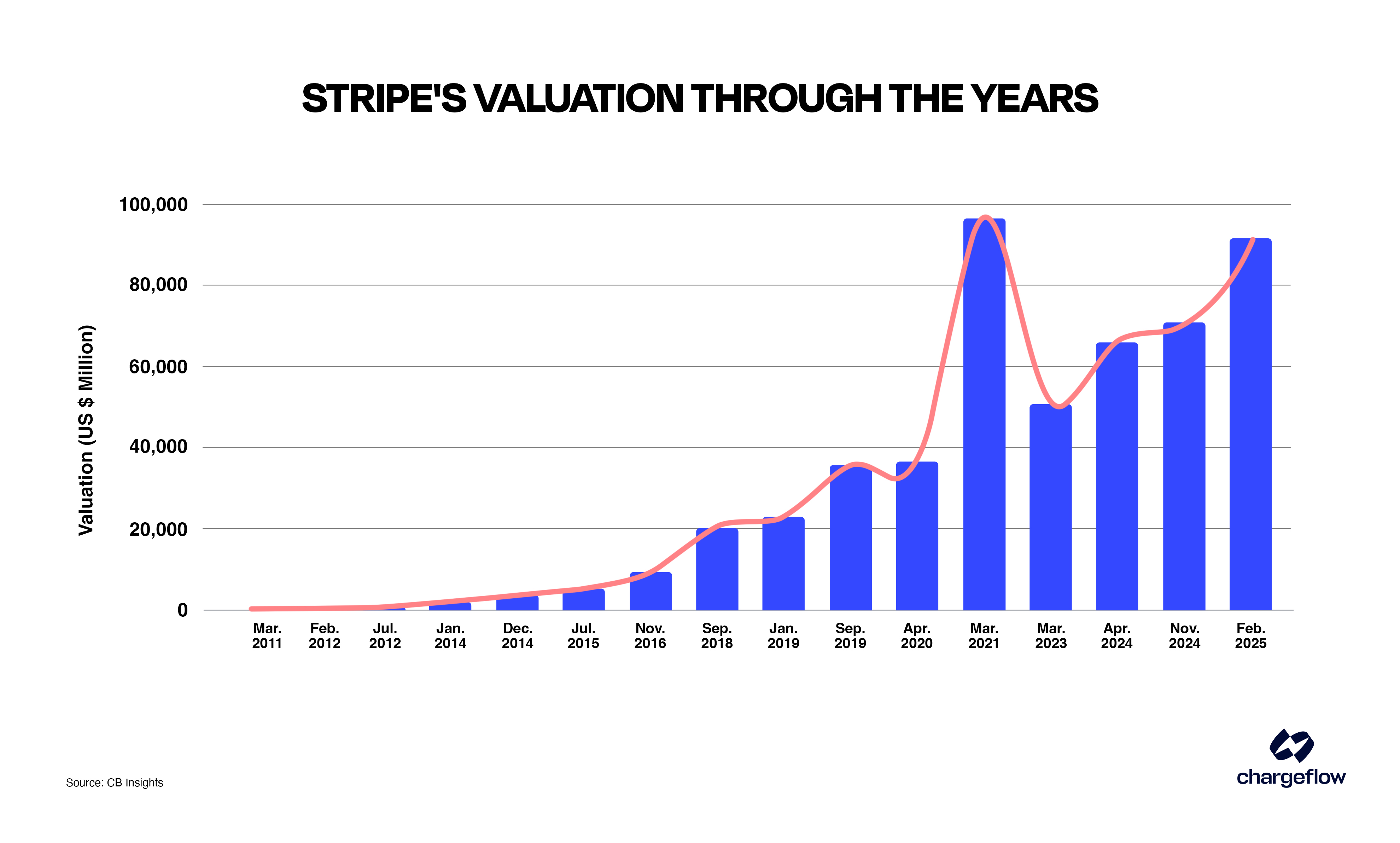

5. Stripe, The Least Urgent One

Estimated Valuation: $91.5 Billion - $120 Billion

Estimated Time: Signals in the first half of 2026, but may be delayed

Stripe may be the most unique among this group: the most qualified to go public, but the least eager to do so.

Valued at $91.5 billion, with revenue exceeding $18 billion, it is already profitable. It has processed $14 trillion in payments globally, with clients including OpenAI, Anthropic, Shopify, and Amazon. Financially, it is the cleanest among these companies.

However, founders the Collison brothers have consistently avoided the IPO question. In February 2025, they explained on the All In podcast:

Stripe is profitable and does not need to raise funds through an IPO; many financial service companies like Fidelity have not gone public for decades; shareholders can gain liquidity through regular employee stock buybacks without necessarily needing the public market.

How long can this logic hold up?

Sequoia has already started finding ways to allocate Stripe shares to LPs, which is usually a signal for VCs to push companies towards an IPO. Employees' 10-year options are also gradually expiring, increasing the pressure to cash out.

If the IPO market remains hot in 2026, the probability of Stripe going public is quite high. However, if the market cools down, the Collison brothers have the capital to wait. Unlike other companies in this batch, they have the choice in their hands.

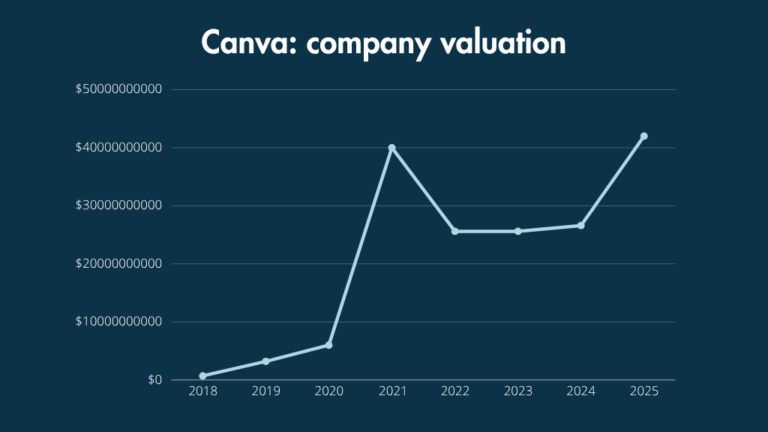

6. Canva, Possibly the Least Risky in This Batch

Estimated Valuation: $50 Billion - $56 Billion

Estimated Time: Second Half of 2026

Source: https://www.stylefactoryproductions.com/blog/canva-statistics

Compared to the previous $100 billion giants, Canva appears much quieter. The Australian design tool company is valued at $4.2 billion, with revenue exceeding $3 billion and is profitable.

There are no geopolitical risks, no pressure from an AI arms race, and the business model is simple: sell subscriptions and create design tools.

Blackbird Ventures informed investors last November that Canva would be ready for an IPO in the second half of 2026. CEO Melanie Perkins has previously resisted going public, but the need for employee liquidity may push her to change her mind.

If you're looking for a "stable" option among this batch of IPOs, Canva might be the closest. It may not be as sexy as SpaceX, but it also has fewer variables.

In summary, the clustering of these companies preparing for an IPO in 2026 is not a coincidence.

For instance, the AI arms race requires ammunition. OpenAI plans to invest $1.4 trillion over the next five years, Anthropic has committed $50 billion to build data centers, and ByteDance is spending heavily on chip purchases each year. The private equity market cannot fill these financial needs.

However, for ordinary investors, the significance of these IPOs may differ from before.

These companies have grown large and mature enough in the private equity market, and by the time they are available for purchase, it is no longer "early stage." The juiciest growth has already been consumed by the private equity market.

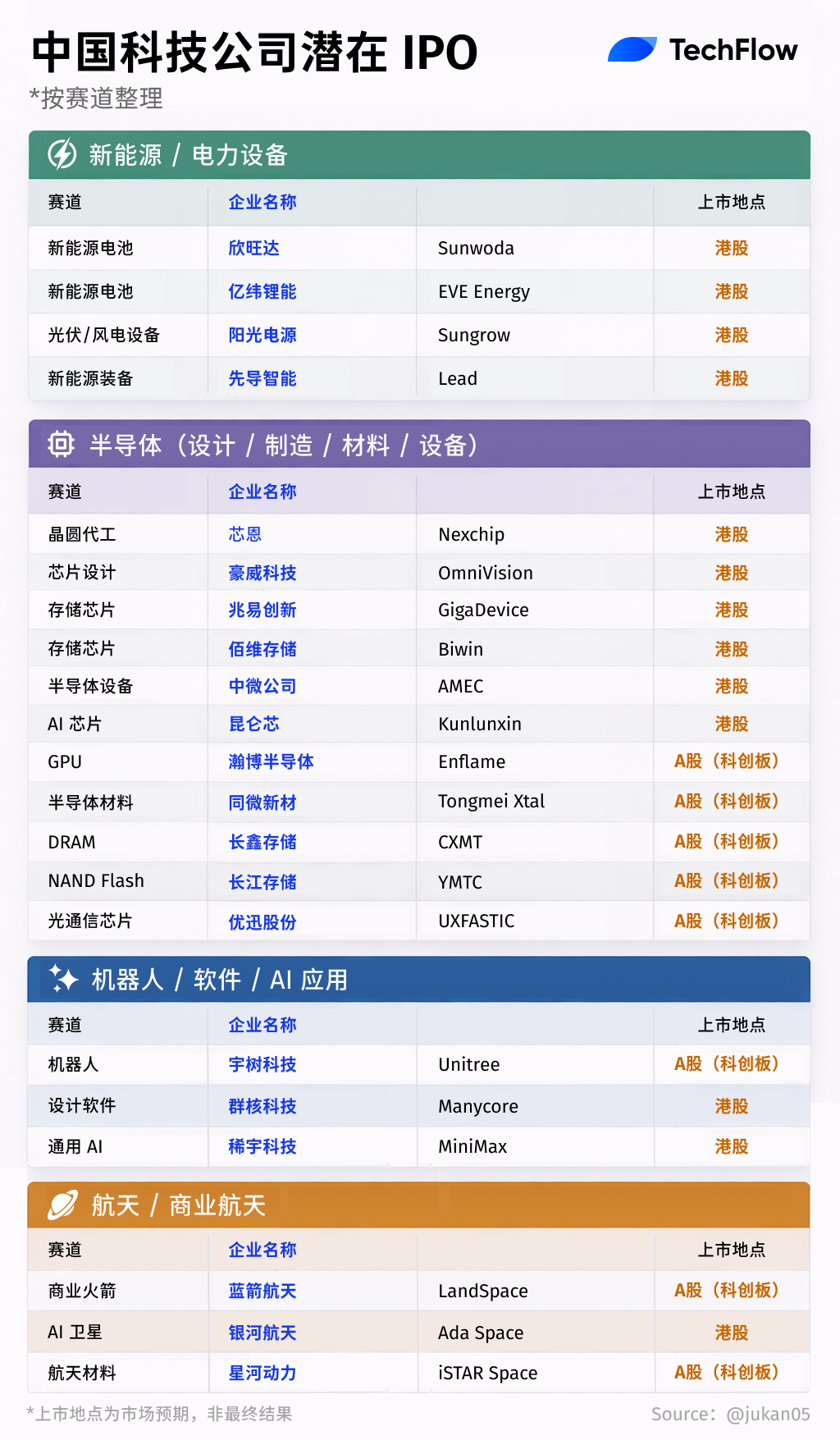

Chinese Tech IPOs: Two Lines in Hong Kong and A-Shares

Zhizhu and MiniMax jumped the gun in January on the Hong Kong Stock Exchange, but the IPO drama for Chinese tech companies has just begun.

In 2026, commercial aerospace and robotics are the two hottest main lines, targeting the A-share Sci-Tech Innovation Board and the Hong Kong Stock Exchange.

Source: X user @jukan05

Compiled by: Deep Tide TechFlow

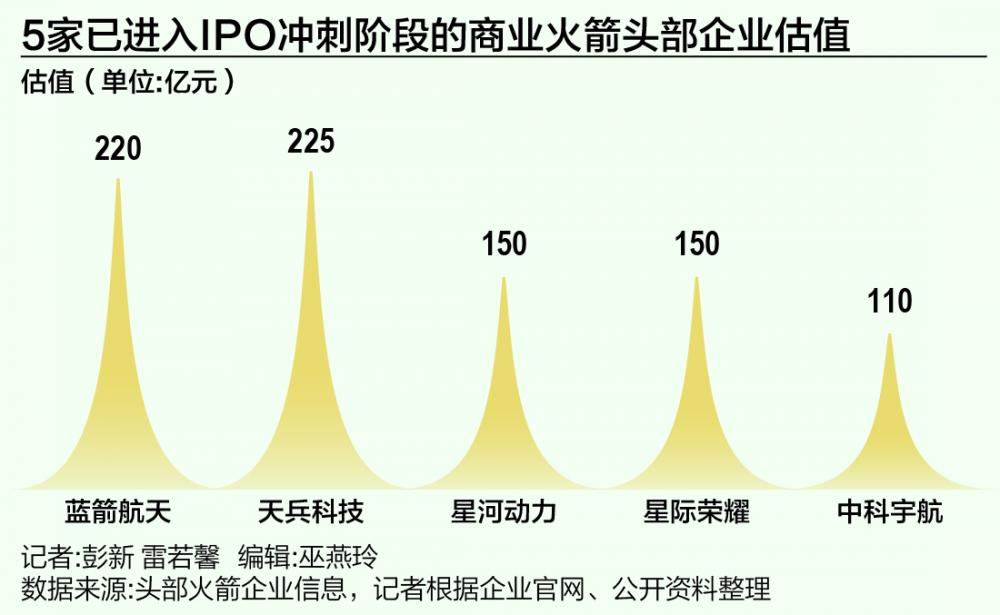

1. Landspace, Sprinting for "The First Commercial Rocket Stock"

Estimated Valuation: 20-22 Billion RMB

Estimated Time: 2026

Listing Location: Sci-Tech Innovation Board

On December 31, 2025, Landspace's IPO on the Sci-Tech Innovation Board was accepted, planning to raise 7.5 billion RMB. It took only five months from the start of guidance to acceptance, a rocket-like speed.

Landspace is a leading player in China's commercial aerospace sector, focusing on liquid oxygen-methane engines and launch vehicles.

Founder Zhang Changwu has a financial background and started the company in 2015, raising funds through 17 rounds with the backing of 85 funds. The latest valuation is about 22 billion RMB, with early investors including Sequoia, Matrix Partners, and Country Garden Venture Capital, which also entered last year.

Landspace chose the fifth set of standards for the Sci-Tech Innovation Board, which was originally only for biomedicine but was expanded last year to include commercial aerospace.

The requirement is to "successfully launch a medium to large reusable launch vehicle payload into orbit for the first time." In December last year, Landspace's Zhuque-3 conducted a recovery test; the first-stage rocket did not land softly, but the orbital mission was successful, barely meeting the line.

However, on January 5, Landspace was selected for an on-site inspection, one of the first batches this year. The subsequent progress will depend on the inspection results.

2. CAS Space, The Second Fastest Rocket Company

Estimated Valuation: Over 10 Billion RMB

Estimated Time: 2026

Listing Location: Sci-Tech Innovation Board

CAS Space just completed its IPO guidance in January, making it the fastest commercial aerospace company to go public after Landspace.

This company was incubated by the Institute of Mechanics of the Chinese Academy of Sciences and focuses on medium to large solid rockets. The Lijian-1 has been launched eight times, maintaining the record for continuous launches of private rockets in China.

On January 12, the Lihong-1 completed a suborbital flight test, reaching a maximum altitude of 120 kilometers, successfully crossing the Kármán line into space, with the payload capsule parachuting back for recovery.

Unlike Landspace's liquid rocket approach, CAS Space is pursuing a solid rocket route, which is cheaper and faster to respond, but has a lower capacity ceiling. The two companies are targeting different markets.

Founder Yang Yiqiang, 58, comes from the First Academy of Aerospace and was the first commander of the Long March 11. This "national team" background is a rare resource in the commercial aerospace sector.

3. Yushu Technology, The Unmissable Star of the Spring Festival Gala

Estimated Valuation: Over 12 Billion RMB

Estimated Time: 2026

Listing Location: Sci-Tech Innovation Board (Highly Likely)

During the 2025 Spring Festival Gala, 16 humanoid robots dressed in Northeast floral coats danced to "Yang BOT," and the company behind this performance is Yushu Technology. This segment made Yushu famous overnight and attracted a frenzy of capital.

Yushu focuses on quadruped and humanoid robots, with the core selling point being vertical integration. Motors, reducers, controllers, laser radars, and motion control algorithms are all self-developed. Founder Wang Xingxing holds 34.76% of the shares and is the actual controller. The company was established in 2016, now has over a thousand employees, with annual revenue around 1 billion RMB and net profits already in the tens of millions.

On July 18, Yushu appeared on the IPO guidance list of the Securities Regulatory Commission, with CITIC Securities as the sponsor. Insiders say it is highly likely to go for the Sci-Tech Innovation Board. With a valuation of 12 billion RMB, it would become a new leader in the robotics sector on the Sci-Tech Innovation Board after going public.

Robotics companies usually choose the Hong Kong Stock Exchange due to high cash burn and refinancing needs. Yushu's choice of A-shares indicates that its financial situation is healthier than its peers.

4. The "18C" Channel in Hong Kong, A Batch of Sci-Tech Companies on the Way

In March 2023, the Hong Kong Stock Exchange launched the "18C Chapter," specifically opening a green light for "specialized technology companies" to go public. The core logic is:

You can be unprofitable, or even have little revenue, as long as your technology is solid, R&D investment is substantial, and your market capitalization is high, you can list on the Hong Kong Stock Exchange.

There are two tiers of thresholds. "Commercialized companies" require a market cap of at least 6 billion HKD and at least 250 million HKD in revenue in the past year. "Non-commercialized companies" must have a market cap starting at 10 billion HKD, but there are no strict revenue requirements.

Zhizhu and MiniMax rang the bell in January, also taking this route. The advantage of the Hong Kong Stock Exchange is its flexible thresholds, which are friendly to loss-making companies. The downside is that liquidity is not as good as A-shares, and valuations are generally lower.

In 2026, there are still a number of companies queued for the Hong Kong Stock Exchange. When viewed alongside the domestic Sci-Tech Innovation Board, the following tracks may be worth paying attention to:

1) Semiconductors are the most crowded track.

Changxin Storage (CXMT) and Yangtze Memory Technologies (YMTC) are two of the three giants in "red memory," focusing on DRAM and NAND Flash, both aiming for the Sci-Tech Innovation Board.

Suiyuan Technology is one of the "four little dragons" of domestic GPUs and is also queued for the Sci-Tech Innovation Board. On the Hong Kong side, Kunlun Chip (AI chip company under Baidu), OmniVision (image sensors), and Zhaoyi Innovation (storage chips, listed on the Hong Kong Stock Exchange on January 13) are all making moves. Zhongwei Company (leader in etching equipment) is also planning a secondary listing on the Hong Kong Stock Exchange.

2) New energy equipment is clustered in the Hong Kong Stock Exchange.

Xingwangda and Yiwei Lithium Energy are leading global battery suppliers, while Sungrow Power does photovoltaic and wind power inverters, and Liyuanheng manufactures lithium battery equipment. These companies are all targeting the Hong Kong Stock Exchange.

3) The aerospace track is not just about rockets.

Shikong Daoyu (under Geely) is working on AI satellite internet and has submitted an application for the Hong Kong Stock Exchange. Aistar Aerospace is focused on rocket composite material fairings and is aiming for the Sci-Tech Innovation Board.

Due to space limitations, we won't elaborate on each of these companies, but a trend can be observed:

In 2026, the main battleground for Chinese tech IPOs will see the Sci-Tech Innovation Board focusing on hard tech (semiconductors, aerospace, robotics), while the Hong Kong Stock Exchange will focus on new energy and AI companies that already have revenue.

Finally, against the backdrop of soaring precious metals like gold and silver, whether you are optimistic about US stocks or domestic assets, I wish everyone the opportunity to seize their own big opportunities in the capital market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。